Also in this letter:

■ After Cloudtail, Amazon to close seller firm Appario in a year

■ ‘Seek forgiveness’ if layoffs ‘not as smooth as intended’: Byju’s CEO

■ Govt sets up panels to evaluate semiconductor proposals

Snap looks to India for a boost amid US tech meltdown

In April 2017, news broke that social media company Snap’s cofounder Evan Spiegel had once said in a meeting that its photo-sharing app “was only for rich people” and wasn’t meant for “poor countries like India”.

The report, published in Variety magazine, cited claims in a lawsuit filed by a former employee. The company dismissed the claim, noting that the photo sharing app was available to be downloaded for free worldwide. But the damage had been done — Indian social media users erupted in fury and in no time reduced the rating of the popular app to one star.

Wounds heal: Five years on, that incident has faded from the collective memory and India has become home to Snapchat’s largest user base.

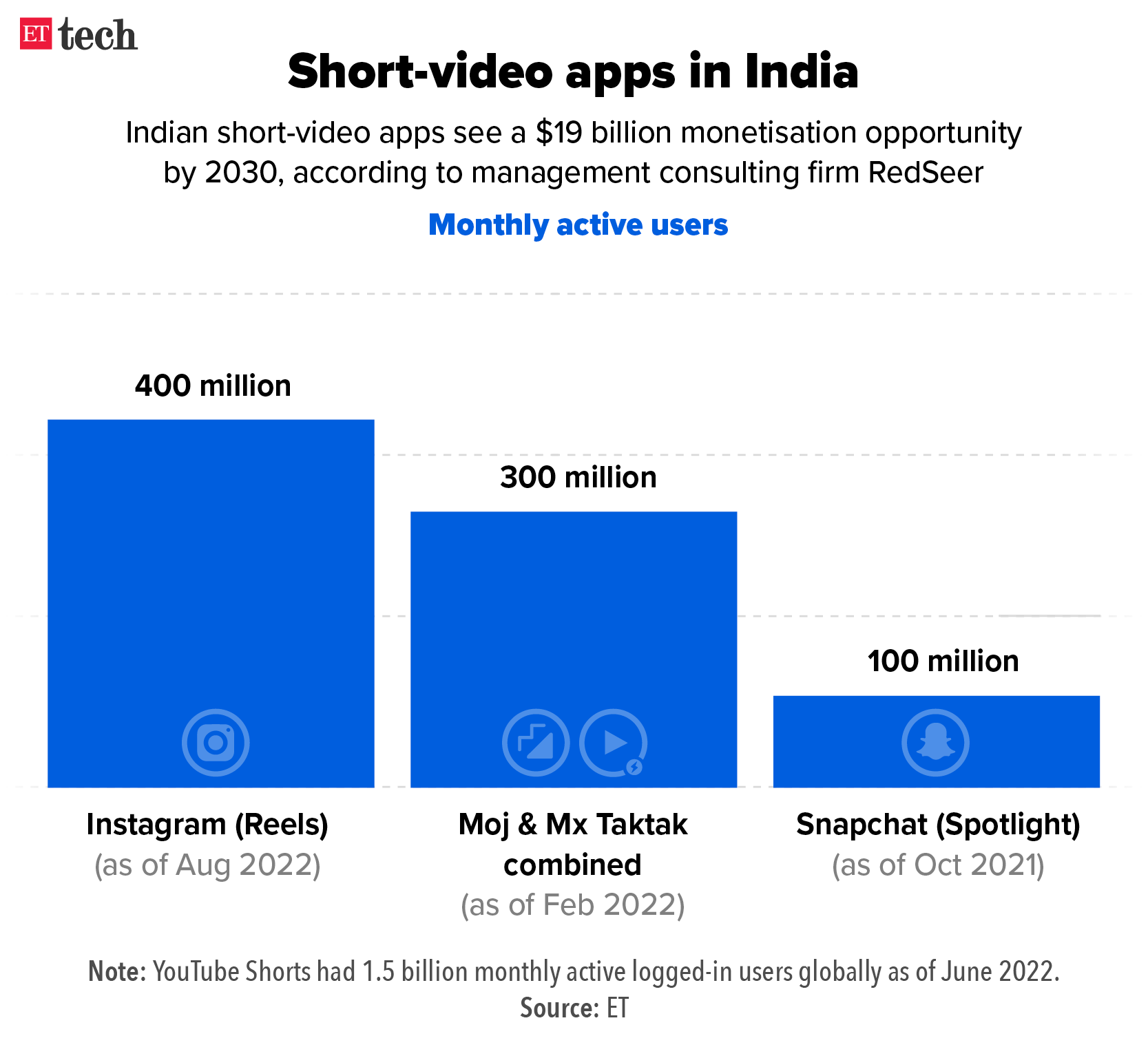

The app’s popularity is soaring, especially among Gen Z users — people born between 1997 and 2012. Spiegel himself told us in October 2021 that the app had crossed 100 million monthly users in the country. That’s almost a third of its global base of 363 million million users (as of Q3, 2022).

Tech meltdown: Globally, things are not looking great for Snap. It earned $1.13 billion in revenue during the third quarter, registering only 6% growth from a year earlier, the slowest pace since the company’s market debut in 2017.

Snap’s shares have not escaped the meltdown in tech stocks in the US, losing nearly 85% of their value on the NYSE in the past 12 months.

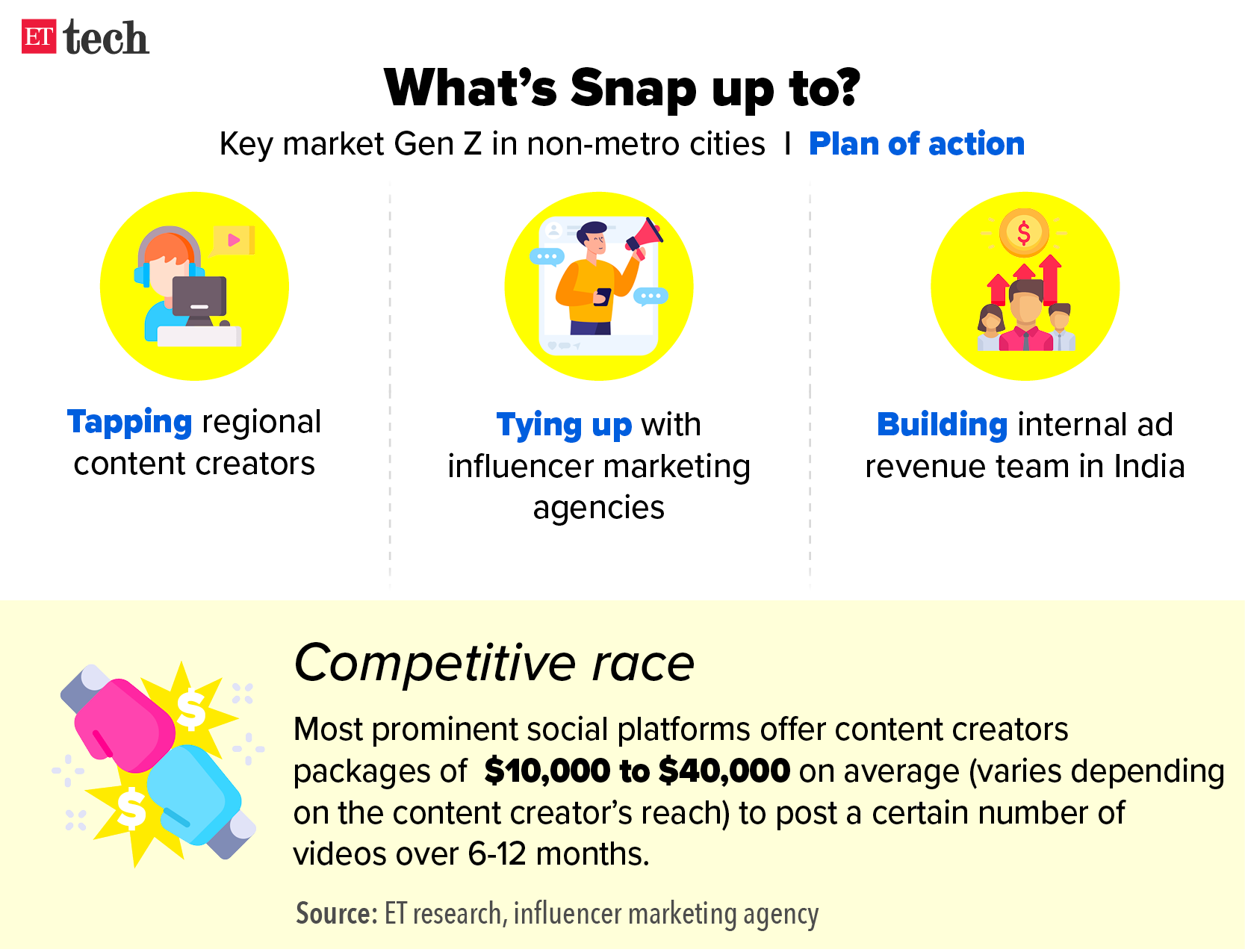

India push: Now, Snap is now looking to shore up its revenue in India. It has been onboarding creators in non-metro markets to boost app engagement and the advertising business.

These are still baby steps as it tries to catch up with Instagram and YouTube. YouTube Shorts and Instagram Reels were introduced in India around September and October 2020, respectively, after TikTok was banned following border hostilities with China.

After Cloudtail, Amazon to close seller firm Appario in a year

After shutting down giant seller Cloudtail, Amazon has now decided to close Appario Retail and delist it as a seller. Appario Retail, one of the largest sellers on the platform, is housed under Frontizo Business Services – a joint venture between Amazon and the Patni group.

Driving the news: In a joint statement, the two parties said the joint venture has been renewed but Appario will cease to be a seller on both Amazon India and Amazon India Business – the wholesale platform – within a year. The Amazon-Patni JV for Frontizo has been renewed for three years, according to people aware of the matter.

“Amazon and India’s Patni group-owned Zodiac Wealth Management LLP have agreed to renew their joint venture, Frontizo Business Services Private Limited. The partners have decided that Appario Retail Private Limited, a wholly owned subsidiary of Frontizo, will cease to be a seller on Amazon.in and Amazon.in/business within the next 12 months. The partners will continue to explore new business opportunities, including helping businesses across India to scale up their online presence,” the joint statement read.

Sources aware of the matter said it is likely to offer seller onboarding services to other businesses and that its parent Frontizo will power Amazon’s customer-service business.

Origins: Amazon set up the Frontizo JV with the Patni group in 2017. While the parent entity provided customer service for Amazon in Indian languages, Appario was scaled as a seller on the Amazon India marketplace. It emerged as one of the largest sellers, dealing in categories such as electronics and accessories and working with brands such as Xiaomi.

Amazon owns 24% in Frontizo while Patni group has a 76% stake, sources briefed on the matter said.

Cloudtail canned: This comes after Amazon was forced to reduce its stake in Cloudtail after the Indian government introduced tighter FDI rules for foreign ecommerce firms. Earlier this year, the company formally shut Cloudtail as a seller firm after acquiring a 100% stake in its parent firm Prione, which was a joint venture with NR Narayana Murthy’s Catamaran Ventures.

Appario Retail clocked revenue of Rs 14,628 crore in FY21 with a profit of Rs 54 crore. Cloudtail clocked a 15% jump in revenue to Rs 19,076 crore in FY22, while losses widened 2.8 times to Rs 522 crore.

‘Seek forgiveness’ if layoffs ‘not as smooth as intended’: Byju’s CEO

The founder and chief executive of edtech unicorn Byju’s told employees on Monday that the decision to fire 2,500 employees had been taken “to protect the health of the larger organisation and pay heed to the constraints imposed by external macroeconomic conditions.”

Monday email: Byju Raveendran also acknowledged in his internal email that the process was “not as smooth” as the company intended. We have reviewed a copy of the communication.

“I seek your forgiveness if this process is not as smooth as we had intended it to be. While we want to finish this process smoothly and efficiently, we don’t want to rush through it. So, we are informing all the affected team members individually with the dignity, empathy, and patience they deserve. I want to emphasise that the overall job cuts are not more than 5% of our total strength,” Raveendran said.

Criticism: The email follows a decision by Byju’s to cut 5% of its 50,000-strong workforce. The move came in for sharp criticism, with a Kerala-based employee union alleging that the startup was forcing employees to resign. The state government has launched an investigation into the labour practices of Byju’s.

Raveendran said the company had expanded exponentially over the past four years but was now aiming to “grow sustainably”.

ET Ecommerce Index

We’ve launched three indices – ET Ecommerce, ET Ecommerce Profitable, and ET Ecommerce Non-Profitable – to track the performance of recently listed tech firms. Here’s how they’ve fared so far.

Govt sets up panels to evaluate semiconductor proposals

The union government has set up three sub-committees to evaluate the multi-billion dollar proposals received under its ambitious India Semiconductor Mission (ISM) and aims to approve the first applications “soon”, people in the know told us.

Details: Five consortiums — including Vedanta-Foxconn, Next Orbit Ventures-Tower Semiconductor (now owned by Intel) and Rajesh Exports — that applied for incentives under ISM’s $10-billion package, are awaiting official sanction to set up semiconductor fabrication units.

Sources aware of the development said members from the Ministry of Electronics and Information Technology (MeitY) and the Industrial Finance Corporation of India (IFCI) are part of one of the sub-committees that will vet the proposals.

A second committee has been drawn from the ranks of the National Investment and Infrastructure Fund (NIIF) while the third sub-committee has been carved out from the 21-member expert group of the ISM and includes three domain experts, they added.

Clear definitions needed for games of chance and skill: Law Committee

The Law Committee under the Goods and Services Tax Council is of the view that clear definitions of “games of chance” and “games of skill” are a must before deciding how to tax online gaming and betting.

Driving the news: The absence of clear definitions will lead to more confusion and open the gate for litigation, it has informed a group of ministers (GoM) that sought its views on the legal aspect of GST on the sector, people aware of the discussions said.

The GoM, headed by Meghalaya chief minister Conrad Sangma, is looking into the GST on online gaming, horse racing and casinos, including the possibility of differential treatment between games of skill and games of chance.

Suggestion: The committee has suggested that the GoM either wait for the Centre’s detailed framework on the classification or rework its interim report with a clear classification before submitting the final report to the GST Council.

TWEET OF THE DAY

SaaS startup Icertis raises $150 million from Silicon Valley Bank

Software-as-a-service (SaaS) startup Icertis has raised $150 million through a revolving credit facility and convertible financing from US-based Silicon Valley Bank.

The company said on Monday that it would use the funds to further accelerate the adoption of technologies such as artificial intelligence (AI), machine learning, and blockchain.

Icertis’s latest funding round comes after it raised an undisclosed sum from German enterprise software maker SAP in exchange for a minority stake in January.

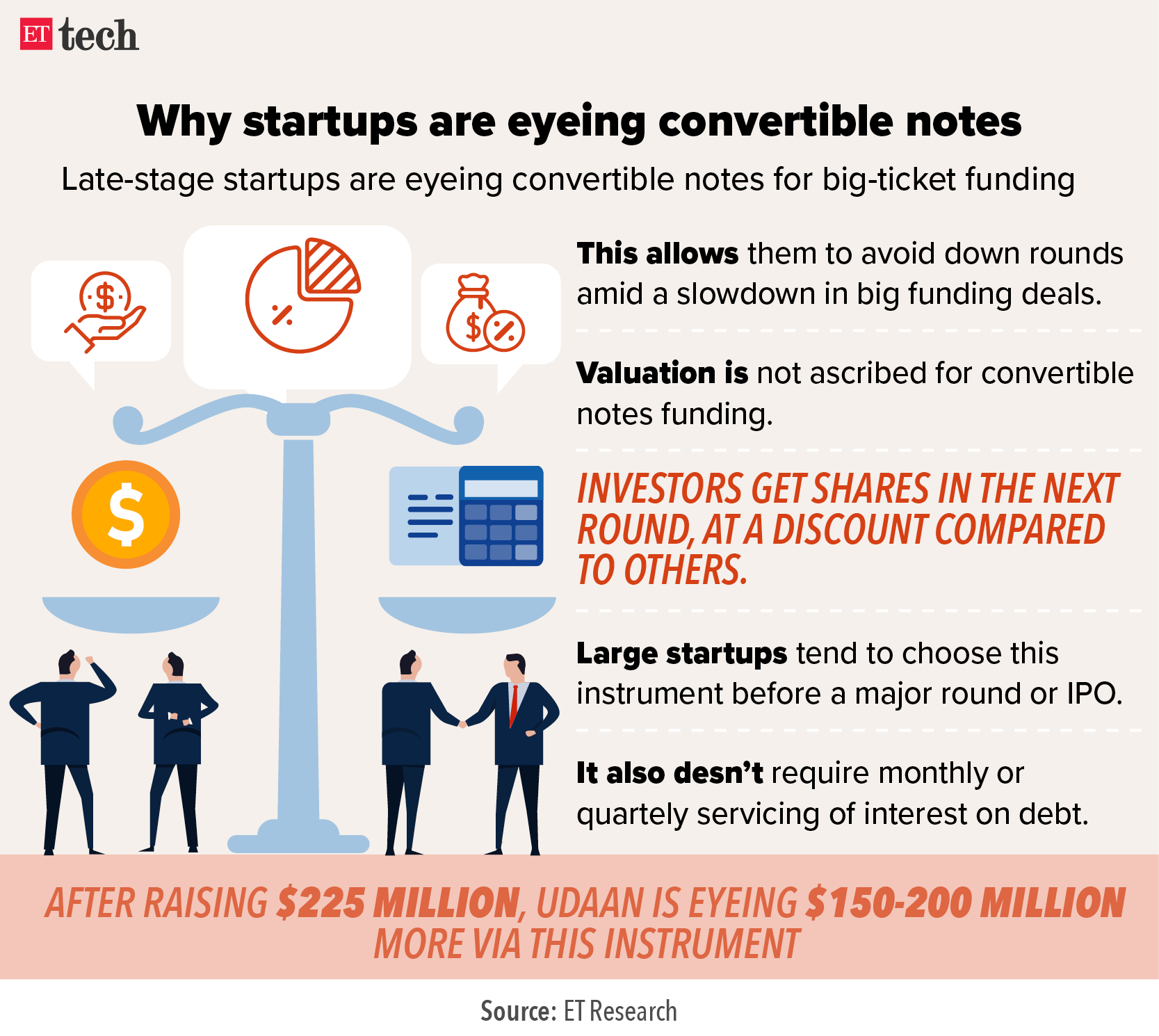

Funding is scarce: The funding round comes at a time when several late-stage startups are in talks to raise fresh capital through convertible notes amid a softening of valuations, as global macroeconomic headwinds continue to buffet global technology stocks.

We reported on October 12 that late-stage startups Udaan and PharmEasy were looking to raise $150-200 million and $100 million, respectively, through convertible notes.

Other Top Stories By Our Reporters

A16z’s Sriram Krishnan helping Elon Musk with Twitter rejig: After firing multiple top-level executives, new Twitter boss Elon Musk has roped in Sriram Krishnan, a general partner at the top VC firm Andreessen Horowitz (a16z), to help restructure the microblogging platform. The Indian-origin Krishnan had previously led the product and engineering teams at Twitter, Meta and Snap. At Twitter, he led the core consumer product team from 2017 to 2019.

Musk takeover likely to attract Gen Z users to Twitter: Elon Musk’s $44 billion takeover of Twitter is likely to attract a new set of users, primarily GenZ ones, to the microblogging platform, brand marketers said. Musk is pretty much the poster child of Web3 and the new decentralised world, which resonates with Gen Z – people born between the mid- to late-1990s and early 2010s.

Global Picks We Are Reading

■ Google case before high court could reshape internet economy (WSJ)

■ Brazilian authorities step in to catch fake news faster than Facebook (Rest of World)

■ Senator calls for investigation into Saudi stake in Elon’s Twitter buyout (The Verge)