Also in this letter:

- KKR is set to make Livspace a unicorn

- Ola Electric’s troubles land at FADA’s door

- Ashneer Grover “caught” on tape

Reliance invests $200 million in Dunzo for 25.8% stake

Dunzo CEO Kabeer Biswas (left) and RIL Chairman Mukesh Ambani.

Hi, it’s Digbijay. And finally it’s a ‘Dun’ deal. 🙂

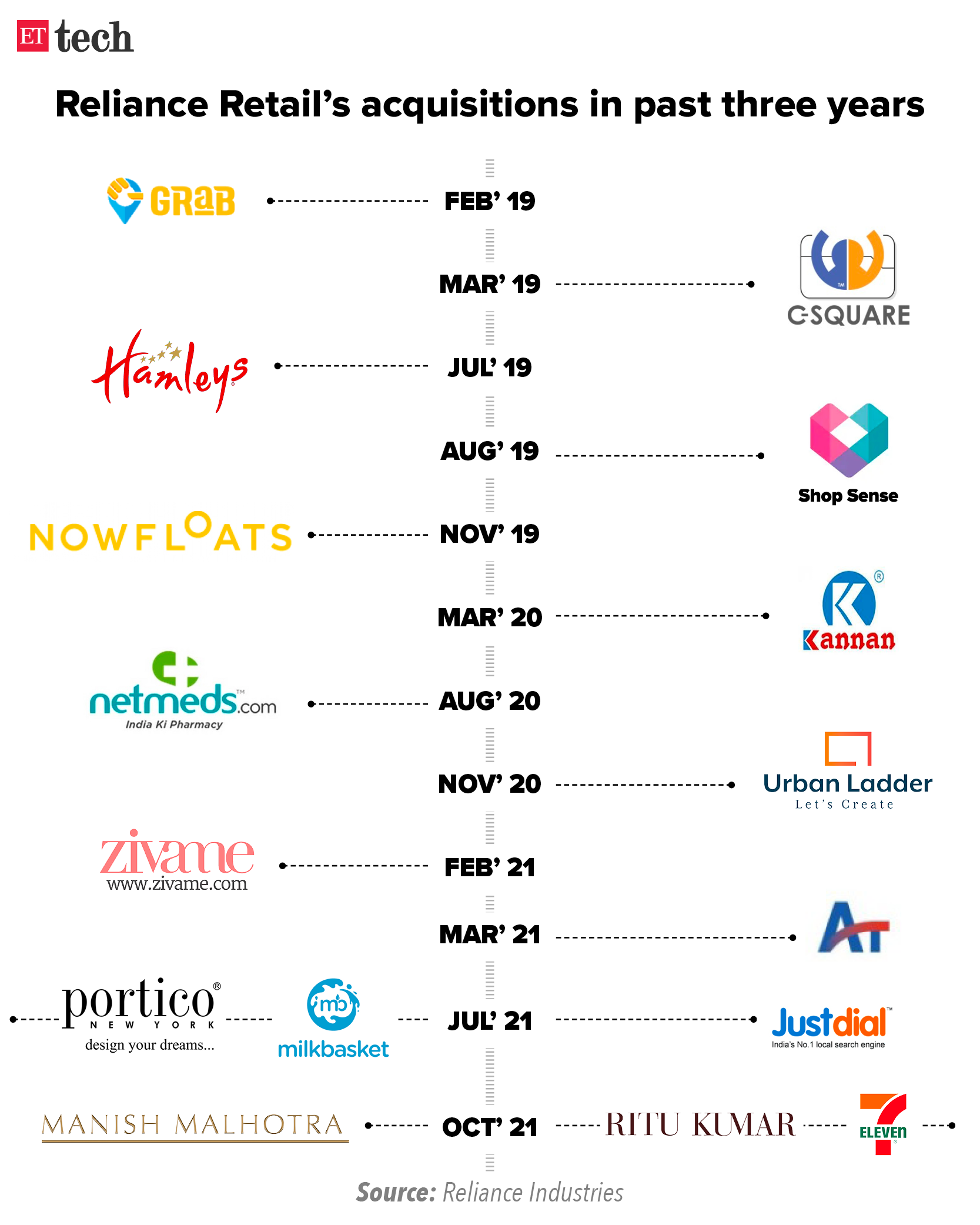

Reliance Retail has kicked off 2022 with a bang. On Thursday, the Mukesh Ambani-led firm announced that it is investing $200 million in Dunzo for nearly 26% stake, making it the single largest shareholder in the quick commerce startup.

- This is significant as it marks the Mumbai-based oil-to-telecom major’s entry into the so-called ‘quick commerce’ space, which is busier than ever.

But there’s more to it. As reported by ETtech, Dunzo was in stake sale talks with multiple suitors, including Tata Group, which is aggressively expanding its ecommerce footprint. The talks fell through as the hyperlocal startup was unwilling to cede control to the conglomerate.

Now, RIL has stepped in. Why Reliance, we asked Dunzo’s founder Kabeer Biswas, and what this deal means. Independence and a long-term partnership, he answered.

- “The idea was to be able to work with a long-term partner on the business. We want to stay as an independent entity and be able to find a way to go public,” Biswas told ET, adding that the Reliance team was very “supportive” of these ideas.

IPO plans: According to Biswas, Dunzo is planning an initial public offering in the next three years. Both new and existing investors are aligned with the thought process.

More money?: He said that while the Reliance deal has closed, Dunzo is still looking for more cash. The current deal more than doubled the startup’s valuation to $775 million, up from $300 million previously. Existing investors Lightbox, Lightrock, 3L Capital and Alteria Capital also participated in this funding round, which saw Reliance bring in the bulk of the cash.

What’s next: Both Dunzo and Reliance Retail will extensively collaborate, tapping into each other’s expertise. “Our merchants will get access to the hyperlocal delivery network of Dunzo to support their growth as they move their business online through JioMart,” Isha Ambani, director at Reliance Retail Ventures Ltd., said in a statement.

Expansion plans: Biswas said Dunzo will use the new capital to take its quick commerce business, Dunzo Daily, to 15 cities this year and power the operations through dark stores. It will run two core businesses: the consumer delivery service for grocery and essentials and a business-to-business vertical where it offers its delivery fleet to businesses.

“Dunzo Daily should be in 15 cities and the B2B business would be in 50 cities,” he said. The B2B vertical would look to service Reliance Retail as well as other merchants. Dunzo Daily, which is operational in Bengaluru, promises to deliver essentials in 19 minutes.

The number of dark stores will also increase—from 60 now to 200 in the next 6-9 months. Its current monthly delivery fleet is about 40,000 people and it would be looking to add more as it expands across the country. About 15,000 local merchants use the platform every month.

Crowded arena: “We will see competition but it’s a big consumer behaviour that’s getting digitised in the country. It’s significantly bigger than food delivery,” Biswas said on the state of play in the quick commerce segment. Eventually, Dunzo will look to deliver goods beyond groceries and essentials.

Yes, but: Not everyone is convinced about the ultra-fast delivery model and how sustainable it can be. Flipkart Group CEO Kalyan Krishnamurthy told us in an interview earlier this week that the 15-minute delivery is not the right long-term customer model.

“We would look at a more sustainable business which offers it in 30-45 minutes with good value and selection,” he said. “That’s the way we look at the convenience business rather than force-fitting a consumer need which is actually not there in the market.”

KKR & Co. set to make Livspace a unicorn

KKR & Co. is in advanced talks to lead a $200 million funding round in Livspace in what would be the biggest fundraise by the home-interior solutions firm since inception.

Deal details: While $175-$180 million is likely to come from the New York-based private equity major, existing investors are also looking to pitch in. After the investment, KKR and TPG Growth will be the two largest investors in the company.

- Once the deal is approved, the company’s valuation would double over what it is currently to $1.3 billion—making the Bengaluru-based startup the latest entrant into India’ coveted unicorn club.

A formal announcement is likely in the coming days.

For KKR & Co., known primarily as a buyout fund, this will be its second tech investment in India after Lenskart. For Livspace, the cash is a means for organic growth as well as a fund for scouting acquisition opportunities.

About Livspace: Born out of its founders’ need and difficulty to design their dream homes— the home interiors industry is highly fragmented in India with a stifling lack of professionals— Livspace provides complete home interior design and renovation for homeowners. It now has operations in two countries—India and Singapore—and 21 cities.

Tweet of the day

Ola Electric’s starting troubles land at FADA’s doors

The purported mismatch in the sales figures of Ola Electric scooters has the president of a national automobile dealers’ lobby concerned. And a bunch of customer complaints that have landed at his doorstep are simply adding to the EV startup’s teething troubles.

- According to Vinkesh Gulati, president of the Federation of Automobile Dealers Association (FADA), Ola Electric has claimed 10 million capacity at its Tamil Nadu plant and 4,000 dispatches of its electric scooters, but as of Wednesday, only 500 vehicles have been actually sold to customers.

According to MoRTH’s VAHAN dashboard, which maintains real-time vehicle registration data, a total of 439 Ola Electric scooters were registered as of Thursday morning. That compares with the 4,000 dispatches the company claimed it had made in December.

Varun Dubey, the chief marketing officer of Ola Electric, said that vehicle registration figures take time to reflect on the portal. “VAHAN doesn’t consider temporary registration. Most states require temporary registration for a month, so there is a four-week lag,” he said.

Dubey declined to comment on the final delivery figures.

Teething troubles: Ola Electric has been drawing flak on social media for its scooters not matching the claimed ARAI range of 180 km. Many users report a range of 135 km on full charge. But Dubey said that Ola’s scooters have the lowest variation from the ARAI figures compared to industry standards, which he said is at 24%.

- “Everyone markets the ARAI range and everyone has variation in their mileage from their ARAI certification. This can be as high as 40%,” Dubey said. “My variation with ARAI is the lowest in the industry at just 24%. Everyone else’s is 35-40%.”

Fake dealerships: Ola Electric is the first automobile company in India to sell directly to customers bypassing the intermediary—a dealership network. This has resulted in fake dealership forms being circulated online and Gulati said that he knows at least five dealers who have lost money to imposters.

“We clearly mention on the front page of our website that we do not have any dealerships. Still, in addition to this, as part of brand protection, whenever somebody has flagged this to us, we file a police complaint,” Dubey said.

BharatPe’s Ashneer Grover and a ‘fake’ audio clip

BharatPe cofounder and MD Ashneer Grover.

BharatPe cofounder and managing director Ashneer Grover on Thursday tweeted saying an audio clip circulating on social media, which allegedly has him talking to a bank executive, is fake.

He claimed “some scamster” is trying to extort $240,000 in Bitcoins from him using this clip.

On Wednesday evening, an anonymous handle on Twitter—‘bongo babu’—had put up a SoundCloud link to an audio clip that was allegedly an argument between Grover, his wife, and an employee of Kotak Mahindra Bank where the BharatPe cofounder allegedly hurled expletives for missing out on share allotment during Nykaa’s initial public offering.

The audio-clip has not been independently verified by ET.

“Folks. Chill! It’s a FAKE audio by some scamster trying to extort funds (US$ 240K in bitcoins). I refused to buckle. I’ve got more character. And Internet has got enough scamsters :),” Grover tweeted on Thursday morning. Grover also shared screenshots of emails seeking money.

ETtech Deals Digest

■ Courseplay, an employee growth enablement platform, has raised Rs 3 crore in a seed funding round led by Inflection Point Ventures. The funds raised will be used for customer acquisition and bringing new AI-powered capabilities to the market.

■ WEGoT Utility Services, which makes smart water meters, has raised $1.5 million in a funding round led by Gruhas Proptech, a company backed by Zerodha’s Nikhil Kamath. The Chennai-based company aims to get 10 lakh devices on the ground in 2022.

■ KPIT Technologies has partnered with dSPACE to offer a comprehensive solutions test suite for smart charging of electric vehicles. The deal brings together their hardware and software competencies to offer comprehensive testing options for the mobility ecosystem.

Other Top Stories By Our Reporters

AWS India head sees SMEs driving cloud business in 2022: The new normal requires enterprises to have the agility to scale up or down rapidly, which is where cloud will play an important role, AWS India President Puneet Chandok says. (read more)

Delhi Police arrests ‘Bulli Bai’ creator from Assam: An engineering student believed to be the “mastermind” and creator of the ‘Bulli Bai’ app was arrested from Jorhat in Assam. He was brought to the national capital where he confessed his role, Delhi Police officials said. (read more)

Fitelo expects to grow revenues to Rs250 crore: Founded in 2019 by Mehakdeep Singh and Sahil Bansal, Fitelo’s wellness plans are customised and personalised based on its users’ routines, goals, medical conditions and preferences, among other parameters. (read more)

Global Picks We Are Reading

■ Social media, a year after the Capitol riots (Bloomberg)

■ NYT to buy The Athletic for $550 million (NYT)

■ Zuckerberg sold Facebook stock nearly every weekday last year (Forbes)

Today’s ETtech Morning Dispatch was curated by Tushar Deep Singh in Mumbai. Graphics and illustrations by Rahul Awasthi.