Also in the letter:

■ India-Canada tensions: IT Inc on standby

■ Arjun Mohan is new CEO of Byju’s India business

■ Creaegis closes maiden fund at $426 million

ETtech In-depth | Sebi’s new crackdown on finfluencers unlikely to stop fraud

Sebi wants to regulate the mushrooming finfluencer ecosystem. It has instructed all regulated entities to stop working with any influencer who is not registered with Sebi. Recently at a fintech event, its chairperson invited all finfluencers to come and get registered.

Missing the target: However, industry insiders believe that the regulator’s move, though a much-needed one, might actually miss a large chunk of the influencer community, given they are not dependent on Sebi-regulated institutions for their revenue.

Many people have taken to social media channels to show fake P&L statements to their followers, and promise to teach them trading tricks in lieu of expensive teaching courses.

But Sebi might not be able to reign in this category of tricksters, say founders of wealth tech startups, given they don’t work with regulated entities.

Also read | ETtech Explainer: Decoding the buzz around Sebi’s finfluencer guidelines

Large industry: New-generation founders in the wealth tech space believe that influencers have played an important role in expanding the market. During the 2020-21 boom, influencers made crores through their engagements with brands. Influencers can charge as much as Rs 10 lakh for a single engagement video, a senior marketing executive told ET. On top of that, brands can pay as much as 70% of their brokerage fees to their partners who source those customers for them.

Impact: Sebi floated a discussion paper on the topic in August and has asked industry participants to send in suggestions. It has also invited influencers to get registered with Sebi and continue offering these services to their customers.

But industry insiders believe that Sebi’s stringent norms may put off many influencers. It’s not that all finfluencers are fraudsters but just the thought of the hassles that could be involved can be a big disincentive, said a founder.

ETSA 2023 | Founders must know when to pivot when things are off: String Bio founder

Vinod Kumar, chief executive officer and cofounder of String Bio, winner of Top Innovator at the recently concluded jury meeting of The Economic Times Startup Awards 2023, said that a critical pivot at the right time is key in an entrepreneur’s journey. And that’s what has worked wonders for the startup.

The String Bio founder-couple Kumar and Ezhil Subbian learned this lesson when their initial ideas like building biodegradable plastics didn’t find any takers in the market.

“We had a small team then and we sat with them and told them the problems we were facing and asked for suggestions. That is when we realised that the nutraceuticals market was opening up and we quickly pivoted to creating ingredients for that industry,” Kumar told ET.

The latest pivot: Kumar is now trying out different options to take his biomass, produced from gases like methane, to the market. While his initial idea was to partner with large brands to let them manage distribution, now he is trying out if he can brand his own products.

Policy push: Building a hardware product company in India is tough. Kumar pointed out that they would take four to five days to source basic ingredients in India, which would take a couple of hours in the US. But now, there’s a shift in policy which could make things easier for them.

Up and up: Having raised $20 million last year and stitching a partnership with Australia’s Woodside Energy Group, String Bio has a strong runway in place and might only need growth funding from here on.

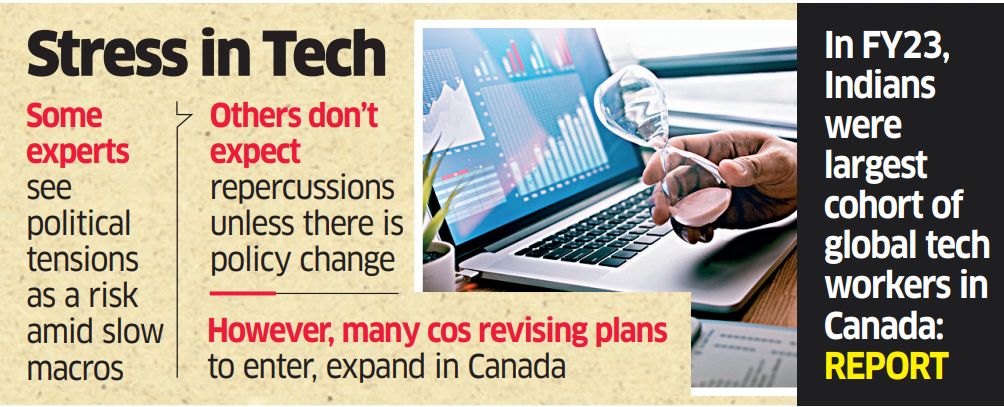

India-Canada tensions: IT Inc on standby; Nasscom says no immediate concern

The heightened political tensions between India and Canada has put several Indian firms, especially the IT services, with business relations in the foreign country on a ‘wait-and-watch’ mode.

Details: Industry body Nasscom has started an informal reach out to member companies to understand evolving scenarios even as it said that there is “no immediate concern”. The local market in Canada is small but there are a lot of delivery centres (in Canada) of Indian IT companies which service customers in the US.

Key concerns: Concerns include delay in decision making for ongoing business deals and movement of professionals since Indian IT firms have significant operations in Canada, industry experts say.

Plans on hold: Some companies which had planned expansion or new operations in the country are putting their plans on hold. Gagan Sabharwal, chief growth officer at Zeta-V Technology Solutions told ET that their start-up was planning to start an operation in Canada, but the company is now “rethinking this strategy”.

Also read | Indo-Canada row: McCain, Tim Hortons and other brands face the heat; experts advise cos to lie low

Delivery centres: Several large firms have also set up large delivery centres in Canada which serve as near-shore centers for their US operations. Tata Consultancy Services has been servicing the Canadian marketplace for more than 25 years, with offices in Toronto, Montreal, Calgary and Vancouver. Infosys has centres in Toronto, Calgary and Vancouver.

Byju’s appoints Arjun Mohan as India CEO, Mrinal Mohit quits

The Byju’s rejig isn’t over by any means yet. The troubled edtech company has appointed Arjun Mohan as its India chief executive, replacing Mrinal Mohit. Internally, the decision was announced on Wednesday. Mohit, a close lieutenant of founder Byju Raveendran, will leave after nearly 10 years at the company.

Bringing Mohan back: ET reported on July 13 that Byju’s had brought back Mohan as the chief executive of its international business unit. Mohan had worked with the edtech firm for 11 years in a senior role earlier before joining UpGrad in 2020.

Timing of elevation: The appointment comes at a time when Byju’s is in the middle of reorganising its businesses in India and abroad. ET reported on September 11 that the edtech company is planning to sell its subsidiaries Great Learning and Epic as part of a plan to clear a $1.2 billion term loan B it had raised in 2021.

A MESSAGE FROM OUR PARTNER

Accel Atoms 3.0 AI cohort: Fostering early-stage AI startups

The Accel Atoms 3.0 AI-focused cohort is committed to support and foster early-stage startups building the emerging AI stack and looking to build the future of AI. Accel Atoms — an Accel initiative that is aimed at fostering and supporting early-stage startups — is now in its third edition. As Artificial Intelligence (AI) ushers in a new era of innovation and transformation, disrupting the landscape of many industries, Accel’s AI-focused cohort is set to catalyse the rise of breakthrough AI companies of tomorrow.

Find out more about the AI Cohort

Creaegis closes maiden fund with $426 million

Homegrown private equity fund Creaegis has announced the final close of its maiden fund at about $426 million or Rs 3,500 crore, as it looks to back startups locally without a specific sector in mind.

Details: The fund was founded by former Premji Invest managing partner and chief investment officer (CIO) Prakash Parthasarathy. Its main focus is to support Indian startups in the growth stage with average ticket sizes ranging between $25 million and $40 million.

Word-for-word: “We are going to be sector-agnostic and will focus on areas of digital transformation, with use-cases involving solving inefficiencies. We will look to back solid, resilient business models and will continue our journey of investing in great founders,” said Parthasarathy in an interaction with ET.

Will Poole, managing partner, Capria Ventures and former managing partner for Unitus Ventures

Affiliate venture funds Unitus, Capria to operate under single brand: Early-stage investor Unitus Ventures, which has backed startups such as Awign, Masai School, GigForce and CueMath, said it was creating a strategic alliance with its US-based affiliate Capria Ventures to operate under a single brand.

(L-R) Incubate Fund Asia cofounder and partner Masahiko Honma, partner Rajeev Ranka, founder and general partner Nao Murakami, partner Dave Kwong

Incubate Fund Asia announces third fund, rebranding: Japan-based Incubate Fund Asia announced the first close of its third fund with a target corpus of $50 million (about Rs 416 crore). Also sector-agnostic, it has backed 27 companies so far.

Chairperson, half of governing council must be from Indian firms: IAMAI

The executive council of the Internet and Mobile Association of India (IAMAI) has proposed resolutions to ensure that the chairperson of the association is from an Indian company, according to a note circulated to members.

What does IAMAI want? The industry body has sought that the chairperson be from an Indian firm, and that 50% of seats in the governing council be reserved for local companies.

To see the light of day, these proposals will need to be approved by the 24-member governing council, which is currently dominated by Indian companies. They will come up for discussion at the body’s next general meeting.

Catch-up quick: In May, Indian firms had ousted Big Tech companies from the IAMAI governing council in elections that saw Dream11 cofounder and chief executive Harsh Jain being elected chairperson.

Other Top Stories by Our Reporters

Data Protection Board to be set up within 30 days: MoS IT Rajeev Chandrasekhar | The government will set up the Data Protection Board, a key part of the new data law, within 30 days, minister of state for IT Rajeev Chandrasekhar has said. The government on Wednesday held an industry consultation on the rules for the DPDP Act, which became effective in August. The meeting in the national capital was attended by representatives of several large tech firms such as Meta and Snap, and industry bodies like Nasscom.

Infosys expands pact with Nvidia, to train 50,000 on chipmakers’ AI tech: Infosys and Nvidia announced that they have expanded their strategic collaboration where Nvidia’s AI tools will be available on Infosys AI suite of services Topaz.

ETtech Done Deals

Kuku FM raises $25 million in funding from Fundamentum, others: Audio content platform provider Kuku FM has raised $25 million in a Series C funding round co-led by the Nandan Nilekani-founded Fundamentum Partnership and International Finance Corporation.

Eloelo raises $22 million in funding from Courtside Ventures, Griffin Gaming Partners: The funding happened at a valuation of $100-150 million, founder and chief executive Saurabh Pandey told ET in an interaction, without giving an exact figure. The entire $22 million was in primary funding.

E-visa startup Atlys raises $12 million from Elevation Capital, Peak XV: The funds raised will be used to expand the platform’s product offerings for travellers, attract customers and further strengthen its team through talent acquisition.

Semiconductor supply chains in Asia significant for Intel: CEO Pat Gelsinger | Intel, Gelsinger said, was uniquely positioned to benefit from these supply chains across the world and wanted to be in a position where the company would have semiconductor fabrication or packaging and manufacturing units in all these geographies.

Global Picks We Are Reading

■ How a ‘digital peeping Tom’ unmasked porn actors (Wired)

■ What to expect from Microsoft’s ‘special’ Surface and AI event (The Verge)

■ Why Silicon Valley’s biggest AI developers are hiring poets (Rest of World)