Also in this letter:

■ Amazon will absorb Cloudtail and Prione employees

■ K’taka close to landing ISMC’s $3B semiconductor fab

■ IPO on the horizon, says Chargebee CEO

Top banks ask NPCI to clarify its stance on UPI for crypto

Leading banks have started to question India’s ‘shadow ban’ on cryptocurrencies.

Driving the news: Many top lenders have asked the National Payments Corporation of India (NPCI), which runs the Unified Payment Interface (UPI), to issue a formal directive about any curbs on its use in buying and selling crypto.

Backstory: Several banks have grudgingly blocked UPI for trading crypto based on “verbal instructions” from NPCI. Now, they want it in writing.

Also Read: Regulatory heat forces Coinbase to halt UPI payments in just three days

The banks – some of which are shareholders of NPCI – raised the issue at a recent meeting after the payments body expressed reservations a few weeks ago about the use of UPI in crypto trades, sources aware of the discussions told us.

Yes, but: A formal communique from NPCI seems unlikely any time soon. An NPCI official told ET that there are “no intentions of [issuing] any circular”.

Why is NPCI wary? Senior bankers and members of the crypto community told us NPCI’s reluctance probably stems from legal complications that could arise from an official ban.

“If there is a formal circular to ban UPI for cryptos or VDAs, whatever is the nomenclature, the crypto industry in all likelihood would legally contest it — as they did when RBI imposed a ban in April 2018,” said a banker.

Is IMPS ok? “We didn’t quite understand NPCI’s decision. While it informally restricted UPI (for crypto trades), it is silent on IMPS. This point was also raised at the meeting,” said a banker. IMPS (or, immediate payment service) is a real time payment service offered by NPCI.

“So, one wonders whether IMPS can be used to transfer money to a crypto platform. We have no clarity. [But] I have a more fundamental question. Is NPCI authorised to impose an informal ban on UPI when the payment framework is governed by the Reserve Bank of India (RBI)?” the banker asked.

Amazon will absorb Cloudtail and Prione employees, says CEO of joint venture

Around 1,000-1,200 employees of Cloudtail and its parent firm Prione Business Services will be moved to Amazon, Prione CEO Pankaj Jathar told the company’s employees at a town hall meeting on April 12, a source told us.

We have also reviewed slides of a presentation Jathar used to explain the transition.

Details: The process of shifting Prione employees to Amazon has started, said the source. “We are planning to complete the transition by the end of May 2022. Specific dates of various steps to be published in the next two weeks,” it said.

This person said Amazon is currently conducting background checks of Prione employees, for which it has hired a third-party firm, First Advantage.

Prione told its employees that its office in Langford Town, Bengaluru, will continue to function.

Significance: Cloudtail is one of the largest sellers on Amazon India and was critical to Amazon’s early success in India. In FY21, Cloudtail’s revenue increased by over 45% to Rs 16,639 crore with a profit of more than Rs 182 crore.

It is being shut down as existing norms do not allow an entity running an online marketplace and its group companies to own equity in any of the sellers on the platform or to have control over their inventory.

Wrapping up: Cloudtail has already begun transferring its inventory and business rights to other sellers on Amazon India. We reported on March 28 that VRP Telematics and Rocket Kommerce would take over a portion of Cloudtail’s business while Cocoblu Retail would take over segments such as fashion.

It had also sent out contract termination letters to its vendors, saying it was in the process of shutting down and would stop taking purchase orders from April 18, we reported on April 12.

In tight race, Karnataka close to plucking ISMC’s $3 billion semiconductor fab

The tussle between states to land a proposed multi-billion semiconductor plant is reaching a crescendo.

Driving the news: Karnataka is in advanced talks with one of the consortiums, which includes Intel, for setting up a plant in an electronics and systems design and maintenance (ESDM) cluster in water-abundant Mysuru.

ISMC Digital Fab, one of the three applicants for the Centre’s $10-billion incentive package for semiconductors, has a $3-billion commitment to build a factory in the Dholera Investment Region in Gujarat, but has been sharpening its focus on Karnataka thanks to an attractive incentive basket and the abundance of a key resource — water.

Quote: “ISMC has been shown the sites and a dialogue is underway,” said a person directly aware of the deal. “The states are aware that the first state to land the semiconductor ecosystem will benefit in the long run, which is why there is a clamour for it,” said a person aware of ISMC’s plans.

ISMC Digital is a consortium comprising investor NextOrbit Ventures and Israeli semiconductor technology company Tower, recently acquired by Intel for $5.4 billion. Two other consortiums — Vedanta-Foxconn joint venture and the Singapore-based IGSS — have bid for central incentives announced late last year.

TWEET OF THE DAY

IPO on the horizon, says Chargebee’s Krish Subramanian

Chargebee founders (from left) Krish Subramanian, Rajaraman Santaram, Thiyagarajan T and Saravana K P.

Software-as-a-service (SaaS) company Chargebee wants to go public but only after it hits key internal milestones, its CEO told us.

Quote: “Over the next 3-5 years we want to be ready with respect to becoming a public company,” Krish Subramanian, cofounder and CEO of the Tiger Global-backed company, said in an interview. “That requires a lot of internal maturity.”

Last September, San Mateo-headquartered Freshworks, founded in Chennai like Chargebee, listed on Nasdaq and ended its first day with a market cap of $13 billion.

But Chargebee is looking to follow in the footsteps of collaboration tools company Atlassian, which recorded over $2 billion in revenue in 2021.

Subramanian underscored Atlassian’s rigour in building internal stability, business acumen and commitment to data fidelity before it went public seven years ago. “Atlassian said they practised this for six to eight quarters internally before going public, and that’s what makes them stand out as a company,” he said.

Chargebee would require at least three years to build a level of “cadence and commitment” to operate as a public company, Subramanian said.

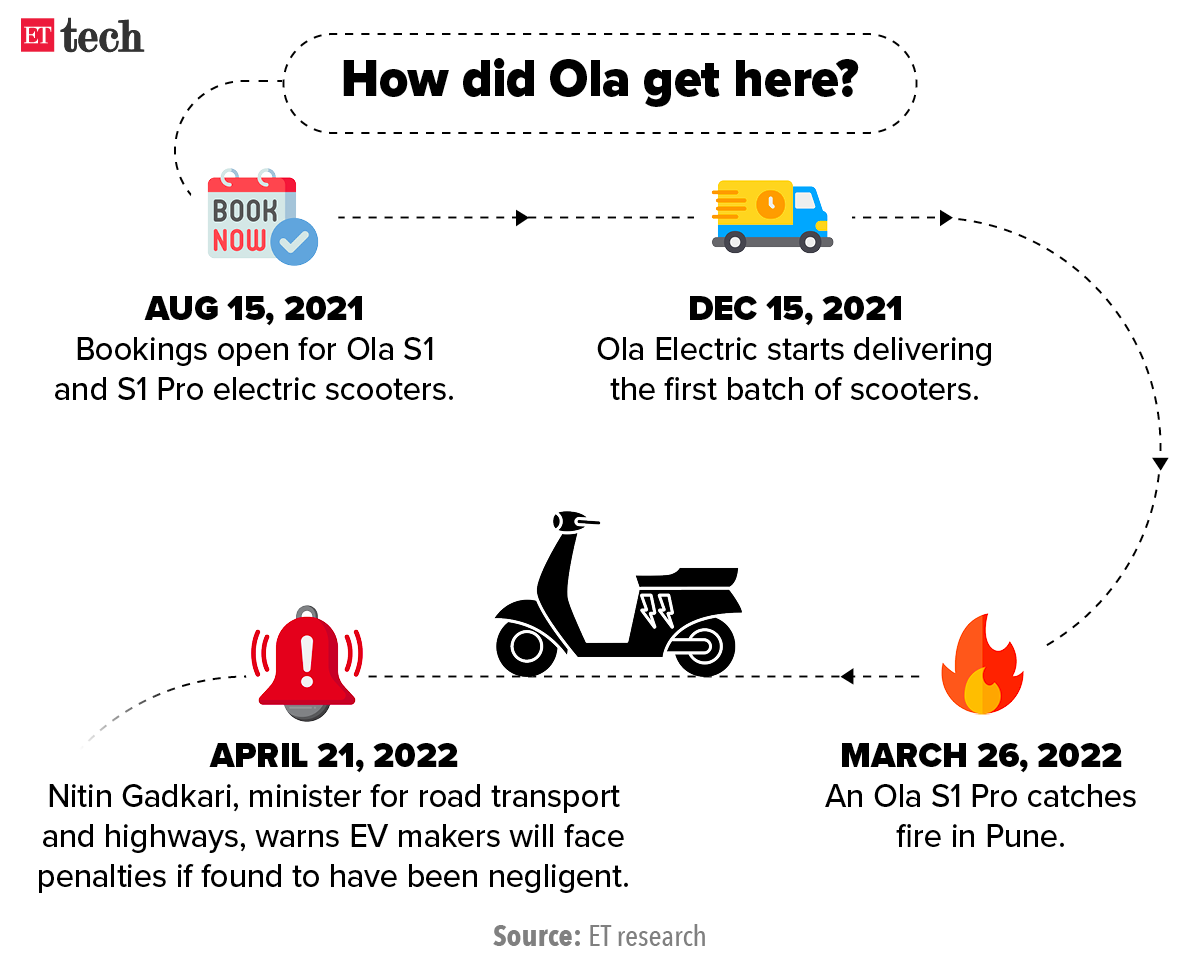

Ola Electric recalls 1,441 scooters over Pune fire

Ola Electric is recalling 1,441 electric scooters for inspection after an Ola S1 Pro caught fire in Pune last month.

This makes it the third electric vehicle maker – after Okinawa and Pure EV – to announce a recall following more than two dozen fires involving electric scooters across India in recent weeks.

These incidents have dented the confidence in the growing EV industry. Dealers have been terminating contracts and customers cancelling bookings and seeking refunds.

“Our internal investigation into the March 26 vehicle fire incident in Pune is ongoing and the preliminary assessment reveals that the thermal incident was likely an isolated one,” the company said in a press statement on Sunday.

“As a pre-emptive measure, we will be conducting a detailed diagnostics and health check of the scooters in that specific batch and therefore are issuing a voluntary recall of 1,441 vehicles,” it said.

Other Top Stories By Our Reporters

TCS CEO Rajesh Gopinathan

Tech demand cycle has good five-year visibility, says TCS chief: The tech demand cycle has good visibility on a five-year horizon, TCS chief Rajesh Gopinathan told us in an interview. “I don’t see anything that disrupts and takes away technology as the primary investment driver,” he said.

Infosys saw fastest growth in 11 years in FY22, says CEO: Infosys’s growth in FY22, 19.7% in constant currency, was the fastest in 11 years, and one of the best years the company has ever had, its CEO Salil Parekh told us in an interview. “Over the last four years, we’ve essentially had industry-leading growth as we put in place some strategic elements that translated into good execution,” he said.

Global Picks We Are Reading

■ Everything you need to know about Netflix’s big miss (Bloomberg)

■ Puzzle over Elon Musk Twitter plan after cryptic ‘moving on’ tweet (The Guardian)

■ Apple, Amazon, Microsoft headline busy earnings week (WSJ)

Today’s ETtech Morning Dispatch was curated by Zaheer Merchant in Mumbai and Judy Franko in New Delhi. Graphics and illustrations by Rahul Awasthi.