Credit: Giphy

Also in this letter:

■ How tech IPOs differ from those of traditional firms

■ Freshworks initiates $500 million share sale

■ Bitcoin and ether hit new all-time highs

Paytm IPO a ‘very high-risk bet’, says fund manager

Investing in Indian fintech company Paytm’s initial public offering could prove to be a “very high-risk bet” and the company’s valuation may not see a sizable jump when it lists on stock exchanges, a fund manager told Bloomberg earlier today.

Say what? “In Paytm’s case, where there is the strength of the network effects—it’s the largest digital payments from a merchant’s perspective—it has a long runway to capitalise on that and hopefully generate some profits along the way,” said Rakhi Prasad, an investment manager with Alder Capital.

“These are very high risk bets,” she added, over the medium- to long-term horizon.

“Nothing is really going to happen in the short-term. I would say demand will come through but maybe not a big listing pop that we may have been seeing in some other companies.”

Day 2 performance: Paytm’s Rs 18,300 crore offering, which opened on Monday and closes on Wednesday, is the biggest share sale ever in India. The IPO was subscribed 48% when markets closed today, the second day of bidding. Paytm has so far received bids for 2.34 crore of the 4.83 crore equity shares on offer.

- The portion set aside for retail investors was subscribed 1.23 times.

- Shares reserved for non-institutional investors were subscribed 5%.

- Qualified institutional buyers have so far bid for 46% of the shares reserved for them.

Paytm’s IPO had earlier drawn a strong response from anchor investors such as BlackRock and the Abu Dhabi Investment Authority, market investors seem less keen.

While the fintech company faces stiff competition from Google Pay and Walmart-backed PhonePe, it has the largest share of India’s merchant payments market. According to GlobalData, the Indian mobile payments market will be worth more than $2 trillion by 2024.

Year of the tech IPO: Paytm’s IPO comes at a time when India has seen a spurt of technology unicorns listing, with the stock markets rallying to record highs. Food delivery startup Zomato and beauty startup Nykaa’s initial public offerings were fully subscribed on the first day, pointing to immense retail investor interest in the space.

How tech IPOs differ from those of traditional firms

For investors, initial public offerings (IPOs) are an instrument to clock quick gains—a lottery of sorts. You invest a certain sum anticipating big returns in just seven days, assuming you get the shares you applied for. This has been substantiated by the recent record subscriptions in IPOs in India, writes Aditya Kondawar, COO at JST Investments.

What is driving so much interest in IPOs?

Think of it as a virtuous cycle. When the market sees investors making gains in IPOs, many more participants apply, leading to massive oversubscription. This in turn causes even more FOMO (fear of missing out), leading to hefty premiums on listing day.

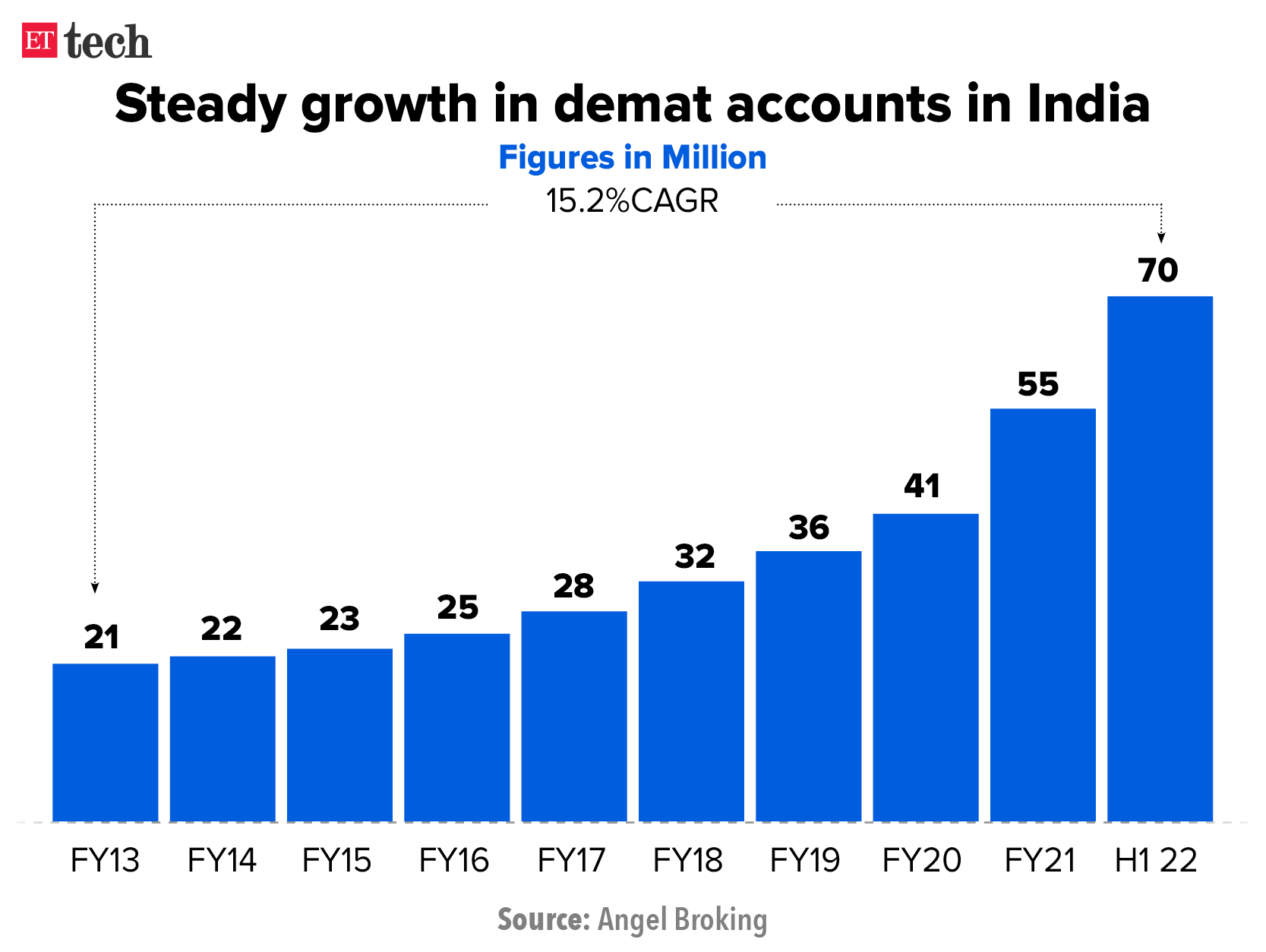

Another reason is the steady increase in the number of demat accounts. India had just 21 million demat accounts in FY13 and 41 million in FY20. Then came the pandemic and the stock market surge, and in just 18 months (as of Q2FY22) there were 70 million demat accounts in India. Around 29 million were added in the past 18 months alone, nine million more than in the seven years from FY13 to FY20!

Why the craze for new-age companies?

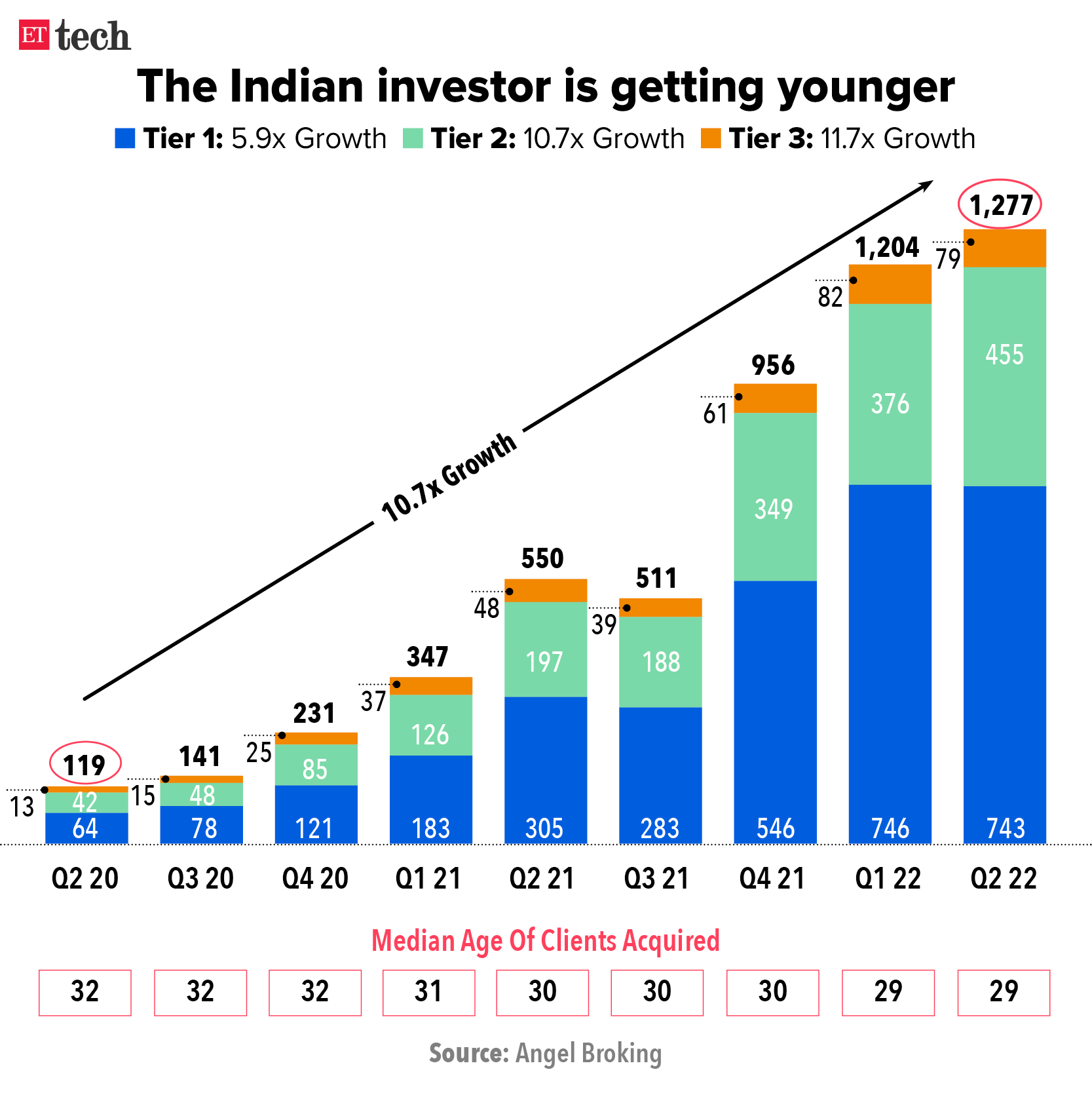

One reason for this is that these companies—Zomato, Paytm, Policybazaar, Nykaa, etc—are household names. But the main clue lies in Angel Broking’s Q2FY22 investor presentation, which states that the average age of a new demat account holder is now 29, down from 31. Younger people are more likely to invest in tech-led firms.

There has also been a tectonic shift in IPO markets – one that is not talked about.

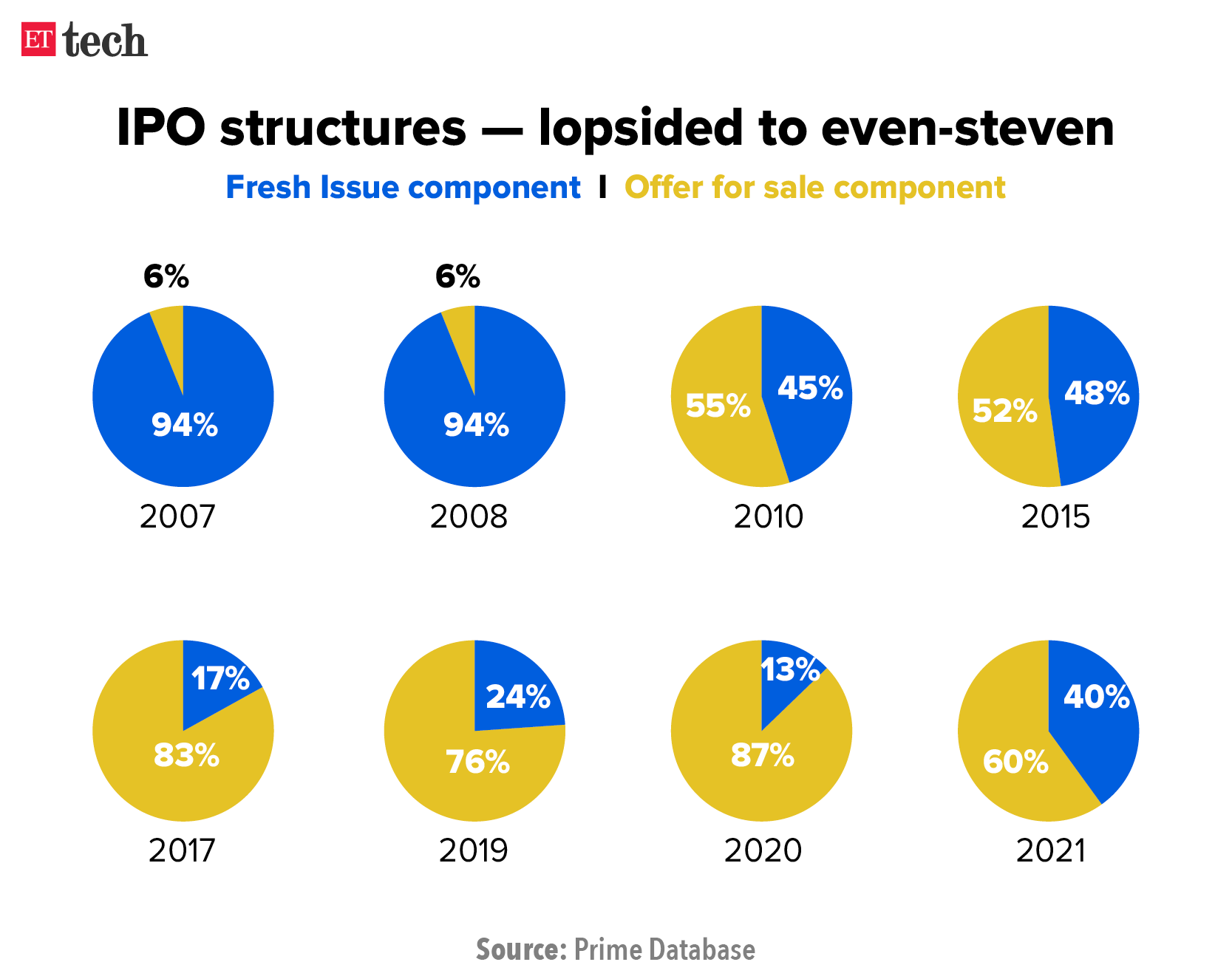

Let’s rewind to 2007 – the fresh issue component of the average IPO was 94% and the offer for sale (OFS) component was just 6%. In a fresh issue, the money goes to the company, while in the OFS, money goes to shareholders who dilute or cash out their stakes.

One of the principles of being a shareholder is: what’s the benefit of investing in a company if it doesn’t receive the funds? Of course, it can be said that the company is new-age and doesn’t need funds. In that case, you need to question why you are funding someone else’s exit at frothy valuations since IPOs always come in euphoric periods – 2007-08, 2010, 2017-18 and 2021.

This also has to do with the changing structure of India’s corporate firms. A decade or so ago, businesses were funded with their own money or debt (bank loans). But thanks to startup culture, advancements in tech, and abundant liquidity, new-age founders now have the benefit of private equity and venture capital (PE/VC) investments.

Consequently, no one is taking—or wants to take—the slow route in business. Everyone wants to scale up, and PE/VCs demand this. They typically invest well before the company is listed and usually sell some or all their shares in IPOs.

So, the typical investment lifecycle of a PE/VC-backed company going for an IPO looks like this: Promoters > Employees (stock options) > PE/VC/angel investors > Pre-IPO investors > Listed market investors and retail investors.

Click here to read the full column.

Freshworks initiates $500 million share sale to tap listing gains

Freshworks cofounder and CEO Girish Mathrubootham

Freshworks Inc. has initiated a share sale worth more than $500 million to allow top executives — including cofounder and chief executive Girish Mathrubootham — and employees to cash out post the company’s blockbuster listing on Nasdaq in September.

After IPO success: The development comes as the mandatory lock-in period after the IPO ends, allowing shareholders to sell up to 20% of their stake in the company. It is also one of the largest payouts in Indian startup history, second only to the $800 million that Walmart Inc. offered to Flipkart employees for their shares in 2018.

On November 4, Freshworks 4 notified the US Securities and Exchange Commission (SEC) of its plans to sell 13.6 million of its Class A common stock to over 3,300 shareholders, adding that it would not receive any proceeds from the sale of shares, whenever they are sold.

Offloading stakes

- Mathrubootham will cut his stake in Freshworks to 5.1% from 6%, offering up 2.4 million shares in the company.

- CFO Tyler Sloat will offer around 450,000 shares.

- CPO Srinivasagopalan Ramamurthy and CRO Jose Morales will offer around 300,000 shares each.

The offering follows Freshworks’ Q3 earnings announcement, its first since listing.

By the numbers: Revenue grew to $96.6 million in the three months ended September 30, 46% up from the year-ago period, though loss came in at 4 cents a share. Still, the company beat analyst estimates by a large margin.

According to analyst estimates compiled by Refinitiv, Freshworks’ revenue was expected to be $90.8 million and loss at 10 cents per share.

- “Except for the management team or the affiliated parties like board members, everybody else is unlocked to 20% of their vested holdings,” Mathrubootham had told us last week. “But not everything is going to probably come to the market, because a lot of our investors are going to hold.”

The silver lining: The San Mateo- and Chennai-based SaaS firm has raised revenue forecasts for the fourth quarter and for the full year. It expects Q4 revenue to be in the range of $99 million to $101 million and $364.5 million to $366.5 million for the entire year.

SoftBank’s mega buyback: Meanwhile, SoftBank Group shares jumped 10% on Tuesday, the first trading session after the Japanese conglomerate said it would spend up to 1 trillion yen ($8.8 billion) buying back almost 15% of its shares.

The company announced the buyback after it revealed its quarterly earnings crashed to a loss amid a decline in the share prices of its portfolio companies and a regulatory crackdown in China.

Street impact: The move puts SoftBank’s shares on track for the biggest daily jump in 11 months.

The buyback is SoftBank’s second-largest after a record 2.5 trillion yen buyback it launched during the height of the Covid-19 pandemic last year. Shares of the company quadrupled during that buyback, but have since fallen 40% from a peak in May.

Expert speak: “Our analysis of buyback history indicates that SBG stock performs (and outperforms indices or BABA) during buybacks,” wrote Jefferies analysts Atul Goyal in a note, referring to Alibaba, the group’s largest asset.

The repurchase period for the latest buyback runs to November 8 next year, with the group signalling the programme could take longer than the fast-paced purchases last year.

Tweet of the day

Nykaa advances listing by a day: here’s what to expect

FSN E-commerce Ventures — the parent company of beauty and lifestyle retailer Nykaa — will list on the stock exchanges tomorrow (Nov 10), a day earlier than it had planned to.

The counter is commanding a strong premium in the grey market, signalling a blockbuster listing for the startup. Shares of FSN E-commerce Ventures are available at a hefty premium of Rs 760-780 each, or about 70% higher than its IPO price range of Rs 1,085-1,125 a share.

Aayush Agrawal, senior research analyst at Swastika Investmart, said Nykaa would be listed in the range of Rs 1,600-1,700, considering its current grey market premium. “Eyeing the recently listed new-age business and Nykaa’s growth plan, we expect the company to perform much better,” he added. “We recommend investors to stay invested in the IPO as it can be a wealth creator in the next 2-3 years.”

Abhay Doshi, co-founder, UnlistedArena, said investors who get allotments are likely to gain from a strong listing pop. “Nykaa boasts efficient and quality management, robust cash flows and strong prospects for future growth,” the avid grey market tracker added. “However, it is not a buy-and-forget story. Investors should review it periodically.”

Nykaa held it IPO between October 28 and November 1 and raised Rs 5,352 crore from its primary stake sale.

It received bids for over 216.59 crore shares against an issue size of 2.64 crore shares, data from the National Stock Exchange (NSE) showed. The issue was subscribed 82 times, with the portion for qualified institutions bidders subscribed over 91 times, the non-institutional buyers’ quota subscribed 112 times, and that of retail investors subscribed 12.24 times.

Bitcoin and ether scale new peaks

Bitcoin and ether hit record highs in Asia trade on Tuesday, with enthusiasm for cryptocurrency adoption and worries about inflation driving momentum and flows into the asset class.

Crypto rally: Bitcoin rose as high as $68,564 in Asian afternoon trade and ether, the second-biggest cryptocurrency by market value, earlier hit $4,825. Both have more than doubled in value since June and added nearly 70% against the dollar since the start of October.

- “We’re getting the feeling that the market has shifted,” said Matthew Dibb, chief operating officer at Singapore-based crypto asset manager Stack Funds, pointing to a sharp pick up in demand from large investors and even pension funds.

Market momentum has been gathering since last month’s launch of a futures-based bitcoin exchange-traded fund in the United States raised expectations of flow-driven gains.

Read our explainer on crypto ETFs here.

Bumper year: Inflows into bitcoin products and funds have hit a record $6.4 billion so far this year, data from digital asset manager CoinShares showed, and totalled $95 million last week. The rally has helped lift the total market capitalisation of cryptocurrencies above $3 trillion, according to crypto price and data aggregator CoinGecko.

Today’s ETtech Top 5 newsletter was curated by Arun Padmanabhan in New Delhi and Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.