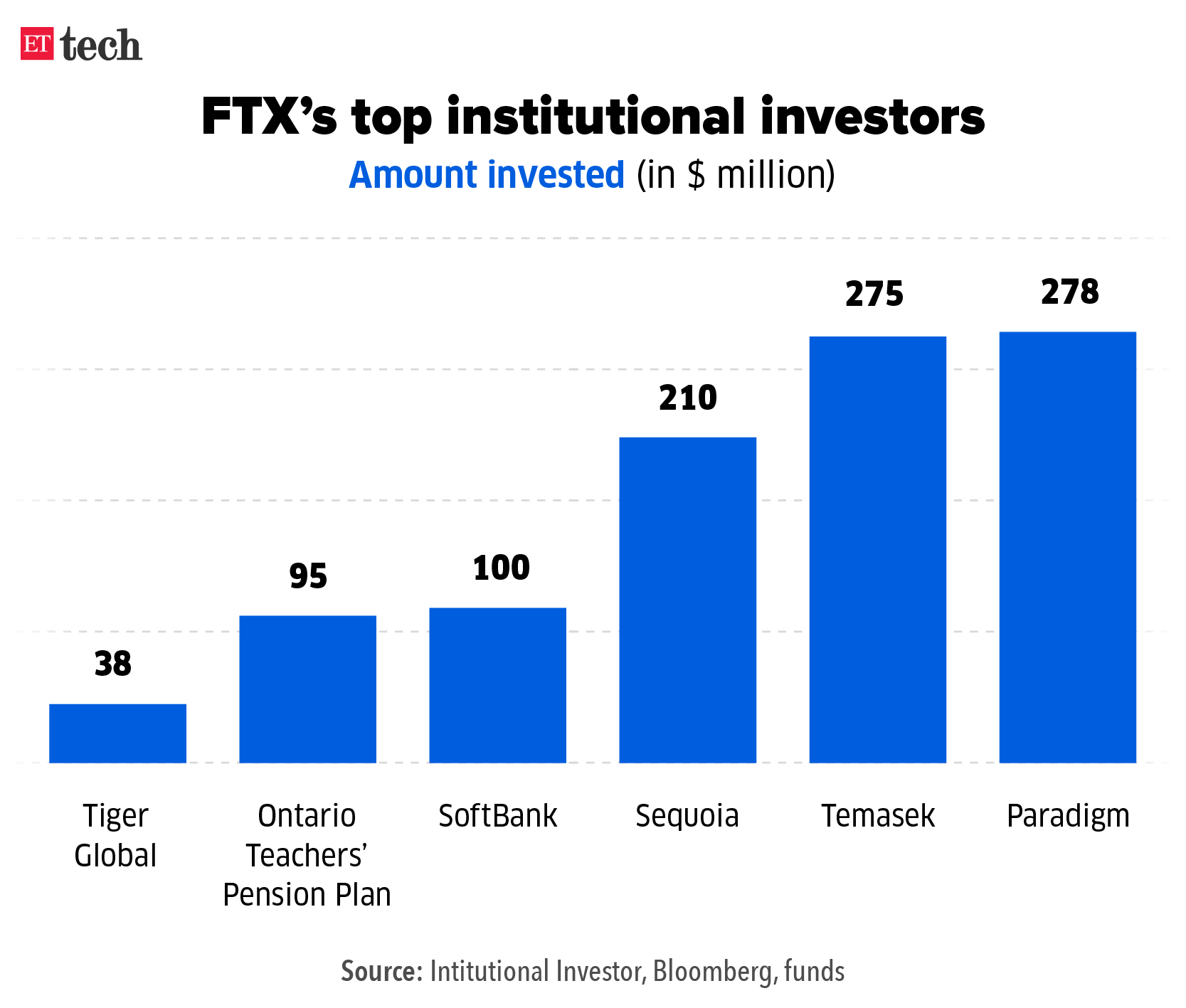

In total, FTX raised $1.9 billion from 80 investors in just two years. The now-bankrupt company’s cap table reads like a list of the world’s top venture capital, private equity and hedge funds.

Sequoia, SoftBank, Tiger Global, Temasek, Ribbit Capital and Blackrock, among others, invested in FTX and FTX US – some as recently as January 31, 2022.

The New York Times reported on November 11, citing sources, that FTX founder Sam Bankman-Fried (SBF) left little room for negotiation in meetings with potential investors over the past year. “FTX was his company, [SBF] told them, and he planned to run it with little oversight. Interested investors should ‘support him and observe’,” an investor who heard the pitch told NYT.

They responded by giving FTX $400 million early this year at a valuation of $32 billion.

Sequoia: In a 13,000-word, now-deleted article on its website, the VC fund recounted how its partners were hugely impressed not only with SBF’s ideas and vision, but the fact that he was playing the video game League of Legends while dazzling them with said vision during a Zoom meeting.

Sequoia went on to invest $210 million in FTX. Last week, it wrote down the value of its stake in the crypto exchange to zero after rival exchange Binance withdrew an offer to bail it out.

SoftBank: The Japanese powerhouse, which invested in FTX through its Vision Fund 2, revealed on November 11 that it had put just under $100 million in the company. Like Sequoia, it has since marked the investment down to zero.

Tiger Global: Billionaire Chase Coleman’s hedge fund was another blue-chip investor in FTX. It was among a clutch of investors in the crypto exchange’s Series C round in January 2022 that valued the company at $32 billion. It also participated in a Series B round that valued FTX at $25 billion.

Tiger hasn’t said how much it invested in FTX but Michelle Celarier of Institutional Investor, an international business-to-business publisher, reported, citing a source, that the hedge fund put about $38 million in the company.

OTPP: In October 2021, the Ontario Teachers’ Pension Plan, one of the world’s largest pension plans with around $242.5 billion in assets under management, invested $75 million FTX. In January 2022, it invested another $20 million. This week, it said it was writing down its $95-million investment to zero.

Paradigm: The crypto/web3-focussed investment fund pumped $278 million into FTX, according to a letter it sent to its limited partners last week, making it the single largest investor in the company. On Tuesday, cofounder Matt Huang said the firm was “shocked” by the recent revelations and deeply regretted its decision to invest in FTX.

Temasek: On Thursday, Singapore’s state-owned investor said it has written down its entire $275 million investment in FTX, “irrespective of the outcome of FTX’s bankruptcy protection filing”.

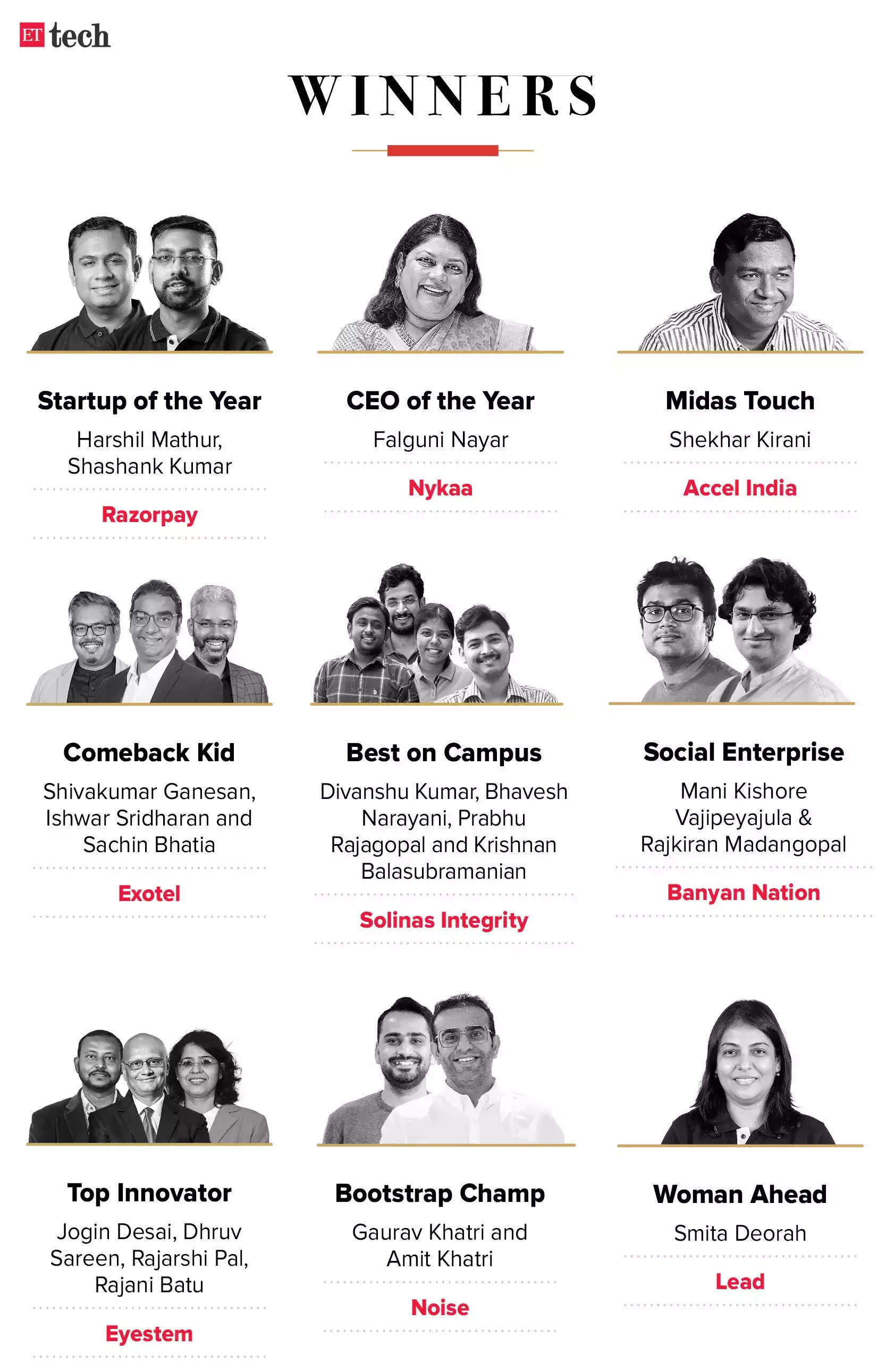

The Economic Times Startup Awards 2022

After months of anticipation, the day is finally here when the biggest and brightest stars of the Indian startup universe will be crowned in Bengaluru at the eighth edition of The Economic Times Startup Awards 2022.

Union Cabinet Ministers Piyush Goyal and Ashwini Vaishnaw, and Chief Minister of Karnataka Basavaraj Bommai will be the guests of honour at a glittering ceremony.

A high-powered panel comprising startup founders, CEOs, and investors will discuss how companies can balance profitability with growth amid the ongoing tech downturn, the biggest the world has seen since the dotcom crash of 2000.

In the run-up to the awards ceremony, we spoke to some of this year’s winners, asking them to reflect on their journey, reveal the perfect recipe for a stellar startup, and disclose their ambitions for the future.

Razorpay, the winner in the prestigious Startup of the Year category, is looking to go public over the next two to three years and doesn’t need to raise any more capital even as it continues to grow revenue at 100% annually, its founders Harshil Mathur and Shashank Kumar told us. Kumar also said Razorpay wants to go public with its payments, credit and neo-banking story, and its international and offline payments, too.

Click here to read the full interview

A year after taking her company public, Falguni Nayar, the founder and CEO of Nykaa – who was adjudged ‘CEO of the year’ at The Economic Times Startup Awards 2022 – said the next big focus for her is to hit profitability in its fashion and business-to-business (B2B) units with reasonable growth rates, even as the company’s shares have undergone a correction amid a broader rout in technology stocks globally and in India.

Click here to read the full interview

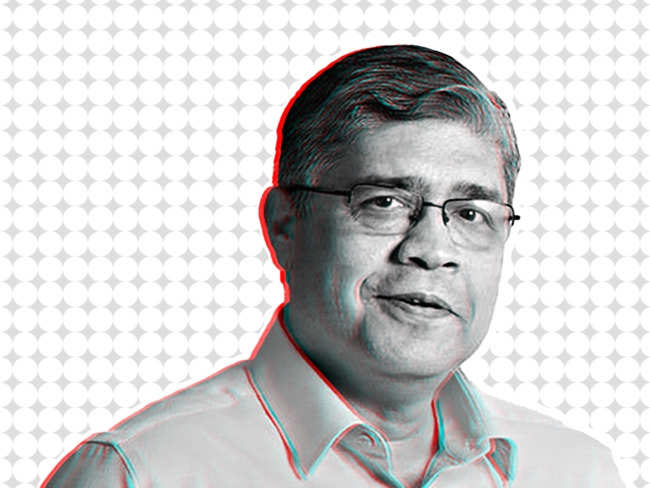

Shekhar Kirani, partner at Accel India, known for his early bet on Nasdaq-listed SaaS company Freshworks, bagged the Midas Touch award. He told us that companies must show profits for at least two quarters before they approach the public markets. Kirani said that the second half of 2023 will see some companies in India attempt to go public, while the same is still not certain for the US.

Click here to read the full interview

ET Ecommerce Index

We’ve launched three indices – ET Ecommerce, ET Ecommerce Profitable, and ET Ecommerce Non-Profitable – to track the performance of recently listed tech firms. Here’s how they’ve fared so far.

Tech policy

In August, the union government withdrew the Personal Data Protection Bill, 2021 after working on it for five years. It said it would soon replace it with “a comprehensive legal framework”, designed to address “all of the contemporary and future challenges of the digital ecosystem”.

On Friday, the government released the Digital Personal Data Protection Bill, 2022, which drops non-personal data and social media from its purview.

The draft is now open for public consultation and stakeholders can submit their views on it by December 17. However, the comments and submissions will not be made public “to enable persons submitting feedback to provide the same freely”.

On November 16 we reported the draft of the new data bill – renamed as the Digital Data Protection Bill – would have provisions seeking to regulate non-personal data and social media, and would allow the storage and transfer of data in “trusted” jurisdictions, which would be defined by the government from time to time.

Two days later we reported that the revised draft bill calls for stiff financial penalties for organisations that fail to contain data breaches or inform users and the government about such incidents.

Also read | New rules in data bill to ease Big Tech worries

Hiring and layoffs

Tech giant Amazon began laying off employees in an effort to trim costs, increase operating margins and increase profits amid the tech winter and fears of an impending recession.

On Tuesday, it said it would lay off about 260 workers at various facilities employing data scientists, software engineers, and corporate workers. The job cuts would be effective from January 17.

Amazon did not specify how many more layoffs are in the offing beyond the ones confirmed through California’s WARN Act.

We reported on November 16 that Amazon is likely to undertake layoffs in India as well, which could potentially affect at least a few hundred employees across divisions.

As sackings spread across large tech firms such as Meta and Twitter – which recently fired about 11,000 and 3,700 employees, respectively – Indian or Indian-origin executives, especially those working out of the US, are experiencing acute anxiety.

Meanwhile, Meta on Thursday announced that Sandhya Devanathan would succeed Ajit Mohan as its head in India. Mohan stepped down earlier this month and joined rival social networking company Snap.

Also read | Infosys to roll out 65% variable pay for Q2

India’s semiconductor push

The Indian government has been betting big on local semiconductor manufacturing as the diplomatic tussle between the US, China and Taiwan is nowhere close to its end. Seeing the opportunity at hand, the Centre has launched the India Semiconductor Mission to tap into the vast potential of the market dominated by China and Taiwan.

The government is planning to fund semiconductor design in India and has set aside a fund of Rs 1,000 crore to this end, said IT minister Rajeev Chandrashekhar at the 25th edition of the Bengaluru Tech Summit.

He also said that the government wants the next generation of devices and products to be designed and built in India. The minister said that by the end of 2023, three out of six devices will be used to power servers for the Indian cloud.

Mumbai-based ISMC Analog, one of the applicants under the government’s plan to set up semiconductor fabrication units in the country, is close to sealing a debt deal with a five-bank consortium led by State Bank of India (SBI) for its $3-billion project near Mysuru, multiple sources told us.

They said the lenders’ consortium has given “in-principle” approval to provide a loan of up to Rs 2,500 crore for the project.

“The consortium could be led by SBI. Other big bankers could also join it, given that the viability of the project is established, and the applicants are big names,” a source told us.

Imploding cryptoverse

The collapse of FTX, which was among the world’s biggest cryptocurrency exchanges, while unlikely to deter retail traders in India from investing in digital coins, is expected to put the spotlight on centralised exchanges, with investors seeking more information from these exchanges about their reserves and liabilities, according to several people we spoke to.

“This is the time to be very cautious. Such episodes, which have happened before as well, have an impact on how much investors can trust exchanges. There’s a saying in crypto — ‘not your keys, not your crypto’. The exchanges should make reporting of proof of reserves and liabilities a norm,” 30-year-old Abhigyan Arora, a Mumbai-based freelance music producer and crypto investor, told us.

Indian crypto exchanges, which have been seeking regulatory oversight, tended to agree.

Vikram Subburaj, cofounder and CEO of the Chennai-based Giottus, told us the exchange would start providing its customers with proof of reserves. “It is high time that all exchanges divulge proof of reserves. Regulators must also make proof of reserves mandatory as part of compliance filings,” he said.

However, there are other crypto exchanges that are losing faith in digital assets as the cascading effect of the FTX bankruptcy continues to bring in a daily barrage of negative news.

On Monday, crypto exchange AAX suspended withdrawals while users at another exchange, Bitcoke were facing withdrawal problems. Crypto lender Blockfi has suspended withdrawals, and even Crypto.com was dealing with mass withdrawals.

Also read | Former FTX CEO Sam Bankman-Fried planning escape to Dubai: report

In other news

LTIMindtree to focus on real estate, cost, revenue synergies: LTIMindtree, the entity formed through the merger of Larsen & Toubro Infotech (LTI) and Mindtree, will focus on real estate, cost and revenue synergies over the long term, its chief executive said. The company, which has become India’s fifth-largest IT service provider by market cap, may seek to rationalise real estate in case of duplication within the same cities.

India boost for Airbnb: Airbnb saw overall night bookings by Indians grow by almost 50% in the third quarter, while domestic night bookings increased by about 80% from the same period pre-Covid. “India has been one of our most important and fastest-growing major geographies,” cofounder and chief strategy officer Nathan Blecharczyk told us in an exclusive interview.