In a strategic financial maneuver, three prominent Indian banks – HDFC Bank, Axis Bank, and IndusInd Bank – have recently unveiled revised Fixed Deposit (FD) rates. These revisions come at a crucial juncture, just ahead of the Reserve Bank of India’s (RBI) much-anticipated policy meeting. These banks are positioning themselves to adapt to potential changes in the economic landscape, and the FD rate adjustments are a significant indicator of their proactive approach.

HDFC Bank Takes the Lead

Leading the charge, HDFC Bank has chosen to increase interest rates on its Fixed Deposits. The move aims to attract more investors and deposits into the bank. By offering higher returns, HDFC Bank hopes to solidify its position in the market as a reliable financial institution for both short-term and long-term investments.

IndusInd Bank Joins the Fray

IndusInd Bank, another major player in the Indian banking sector, has also announced a revision in its FD rates. The bank is offering competitive rates to entice potential investors. This strategic decision reflects the bank’s confidence in its ability to navigate the changing financial landscape effectively.

Axis Bank: A Surprise Contender

Axis Bank, not one to be left behind, has made its move as well. The bank has introduced revised Fixed Deposit rates in a bid to remain competitive in the market. By keeping pace with its peers, Axis Bank aims to retain its customer base and potentially attract new customers seeking attractive FD options.

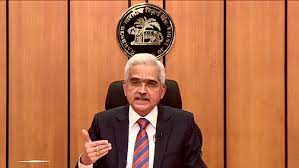

The RBI Policy Meeting Looms Large

The timing of these revisions is particularly noteworthy, given the upcoming RBI policy meeting. The Reserve Bank of India is expected to make critical decisions that will influence the nation’s economic trajectory. Banks are bracing themselves for any policy changes that might affect liquidity, interest rates, and investment opportunities.

What These Revisions Mean for Investors

For investors, these revised FD rates present a window of opportunity. With banks vying for deposits by offering better returns, customers can make informed decisions based on their financial goals. Whether it’s short-term liquidity or long-term wealth accumulation, these revised rates cater to a diverse range of investment needs.

The Bottom Line

In the ever-evolving financial landscape, adaptability is key. HDFC Bank, Axis Bank, and IndusInd Bank have demonstrated their readiness to face economic uncertainties by revising their Fixed Deposit rates. As the RBI policy meeting draws near, all eyes are on the central bank’s decisions, which will undoubtedly have a profound impact on India’s banking and financial sector.

In conclusion, the proactive stance of these banks in revising their FD rates highlights their commitment to serving their customers and staying competitive in the market. Investors now have a chance to make the most of these revised rates, aligning their investments with their financial objectives. As we await the RBI’s policy decisions, these banking giants have set the stage for a dynamic and competitive financial landscape in India.