Source: Giphy

Also in this letter:

- Trifecta Capital raises $101M in first close of its third fund

- PhonePe clocked over two billion digital payments in Oct

- Volkswagen gears up to take on Tesla in EV infra battle

Grey market signals muted listing for Paytm tomorrow

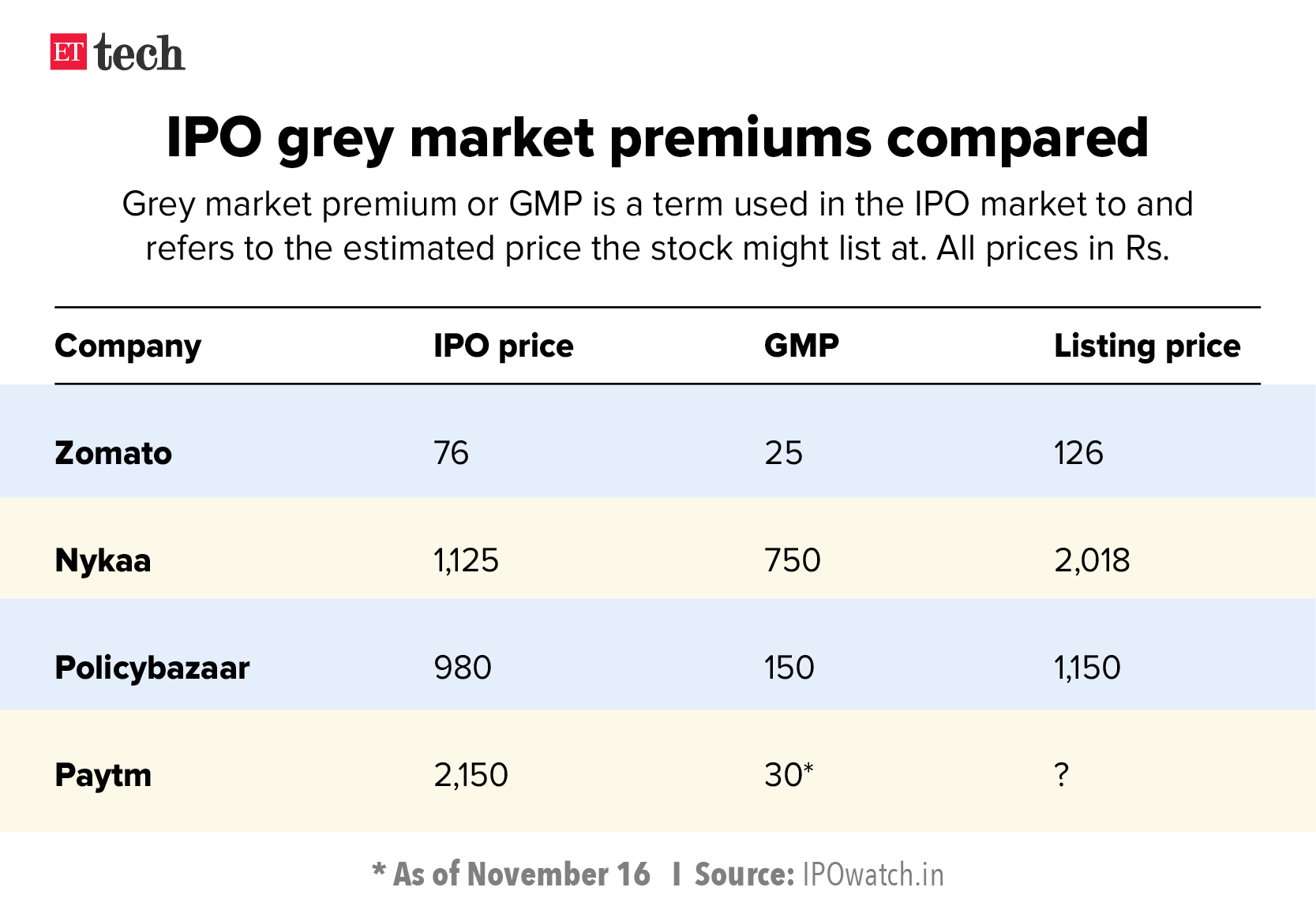

A day ahead of its listing tomorrow, shares of Paytm parent firm One97 Communications changed hands on the grey market at a premium of just Rs 20-25 over the final issue price of Rs 2,150. On Tuesday, they were trading at a premium of just Rs 30, a mere 1.4% increase over the final issue price, according to IPO Watch.

The stock was trading at Rs 2,300 a share on the grey market on November 7, a premium of Rs 150 or 7% over the issue price. This fell to Rs 80 on the first day of the IPO and by the close of the issue on November 10 it was at Rs 40.

What is the grey market premium? Grey market premium (GMP) is a term used in the IPO market and refers to the estimated price a stock might list at. The grey market is unofficial but investors use the GMP as an indicator of how the stock could perform on listing.

Yes, but: GMP, while a useful indicator, is by no means faillible. Sometimes it predicts the listing price accurately and sometimes it doesn’t.

Flat listing expected: Dealers tracking the grey market said the ultra-expensive pricing, poor financials and muted growth prospects were the key reasons for the poor listing.

Abhay Doshi, cofounder at UnlistedArena, said Paytm was likely to be a flop on debut, despite the hype it generated as India’s biggest IPO ever. “The valuations of the issue were on the expensive side. Also, the company has not shown any significant performance in the financials and it is losing market share,” he added.

Ankur Saraswat, research analyst at Trustline Securities, said the company would make a flat listing. “New investors should wait for a meaningful correction in the shares and then enter this fintech behemoth,” he added.

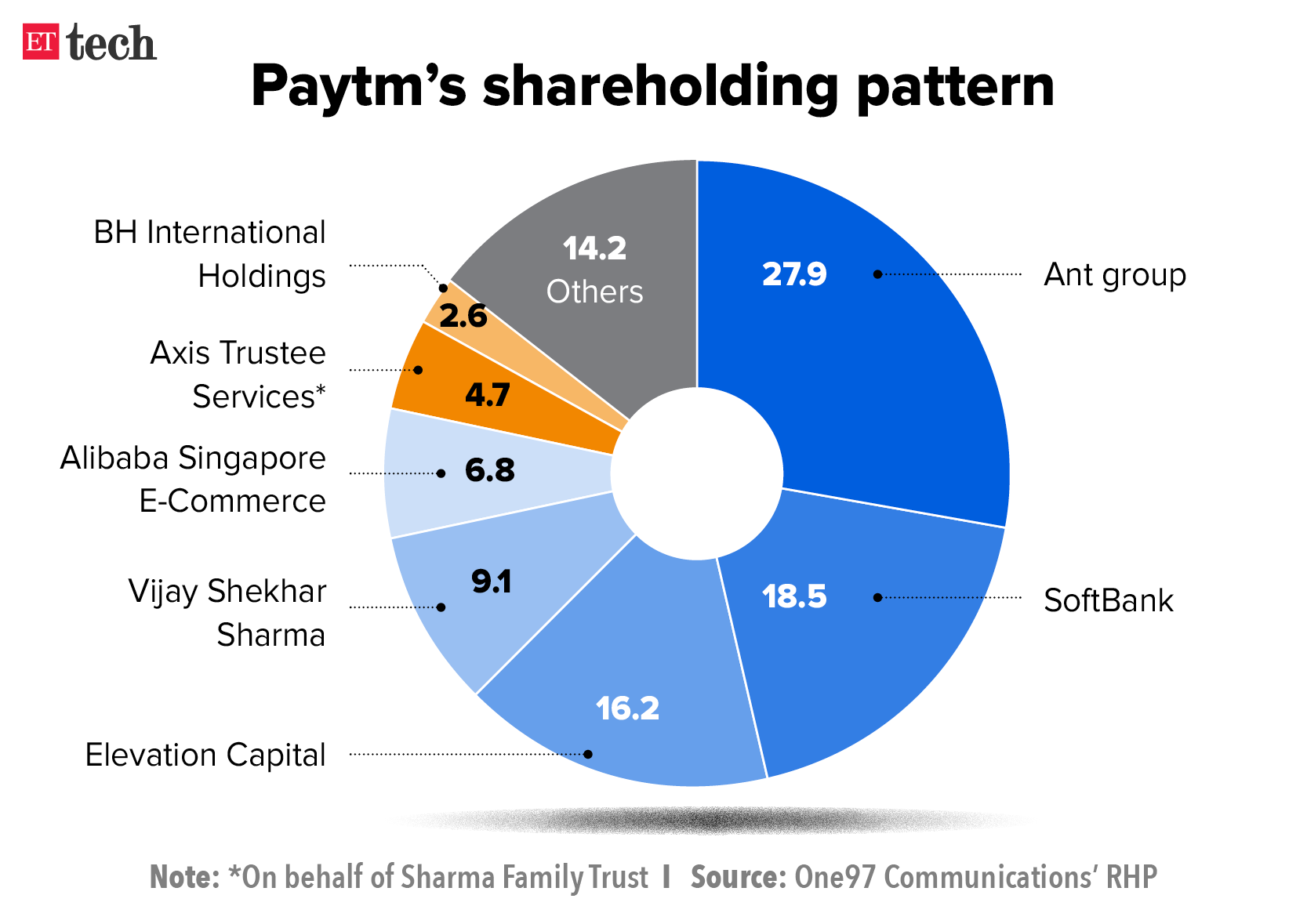

Lukewarm IPO: In its IPO, held between November 8 and 10, Paytm issued Rs 8,300-crore worth of new shares, while existing shareholders and promoters sold shares worth Rs 10,000 crore in the offer-for-sale component.

The IPO was subscribed just 18% on the first day of bidding, with the company receiving bids for 88.21 lakh of the 4.83 crore equity shares on offer. On day 2, it was subscribed 48%, with 2.34 crore bids received. India’s biggest IPO was fully subscribed on day 3 and was eventually subscribed 1.89 times.

Trifecta Capital raises $101 million in first close of its third fund

Trifecta Capital has raised Rs 750 crore (about $101 million) towards the first close of its third fund—Trifecta Venture Debt Fund—within two months of launch.

Context: With this, Trifecta joins a growing list of homegrown funds that are raising rupee capital to invest in Indian startups. Funds such as Alteria Capital, Stride, IIFL, Edelweiss, 3one4 Capital among others have recently raised larger funds to deploy in India’s startup ecosystem.

Details: The total size of the third fund is Rs 1,000 crore, with a green shoe option of Rs 500 crore, which the firm is likely to mop up by the end of the current financial year.

The fund aims to serve the fast-growing demand for growth and acquisition financing in Indian startups across sectors such as business-to-business, consumer services, consumer brands, ecommerce, mobility, ed-tech, agritech, fintech and healthcare.

As of November 15, it has raised over Rs 3,500 crore across three venture debt funds and one late-stage VC fund. Since inception, Trifecta Capital has committed Rs 3,500 crore in venture debt and equity investments across more than 85 companies.

Its portfolio companies include BigBasket, PharmEasy, Cars24, Infra.Market, ShareChat, Dailyhunt, Urban Company, Vedantu, The Good Glamm Group, CureFit and Meesho.

Next steps: “Over the next two years, we will continue to introduce more interesting products and services to solve for large gaps within this ecosystem,” said Nilesh Kothari, managing partner at Trifecta Capital.

Better Capital gets in on the act: Meanwhile, venture capital firm Better Capital, run by Silicon Valley entrepreneur Vaibhav Domkundwar, has raised its maiden fund of $15.28 million to scale its pre-seed and seed investment strategy, the company said. Domkundwar is a solo general partner at Better Capital, unlike most venture capital funds, which run as a partnership among a few executives.

The fund—Better Capital Ventures I—is backed by founders, operators and investors who are former or current leaders at Meta (Facebook), Google, Uber, LinkedIn, Tiger Global, TPG, as well as other top 10 growth venture and hedge funds, it said. The firm closed fundraising within 40 hours of launch, a record for such a fundraise.

It began investing in pre-seed stages in Indian companies in 2018 and already has a portfolio of more than 125 companies, including Open, M2P Fintech, Rupeek, Teachmint, Slice, Jupiter and Khatabook. It will invest in pre-seed and seed rounds across sectors with a median cheque size of $300,000.

Tweet of the day

PhonePe says it clocked more than two billion digital payments in Oct

PhonePe, part of the Walmart-owned Flipkart Group, clocked more than two billion transactions across payment channels in October, according to a statement. These include payments made using the Unified Payments Interface and the Bharat Bill Payment System.

Rapid growth: In February, PhonePe had recorded one billion monthly transactions. The company claims to have 145 million monthly active users (MAUs), $600 billion annualised total payments value, and digital transactions from over 19,000 pin codes covering 99% of the country.

PhonePe’s rapid growth—one billion transactions added in just eight months—is indicative of the wider adoption of digital payments in India, accelerated by the pandemic.

$100 billion milestone: The value of transactions using UPI crossed $100 billion in a month for the first time in October. As many as 4.2 billion UPI transactions amounting to Rs 7.71 lakh crore (about $103 billion) were clocked in the month, marking all-time highs on both counts for the five-year-old payments channel.

The spurt was largely on the back of increased demand for online shopping amid the festive season sales. The gradual reopening of the economy since the ebbing of the second wave also aided this growth.

ETtech Done Deals

■ GoKwik has raised Rs 112 crore ($15 million) in its Series A funding round led by Sequoia Capital India. It plans to use the funds to expand its client base to social commerce startups, scale up the product and technology teams and launch new products. It also plans to double its 75-people team.

■ SalaryBox, an employee management app for small enterprises, has raised $4 million in seed funding from Silicon Valley-based startup accelerator Y Combinator and others to further its endeavour of bringing blue-collar workers into the formal economy.

VW gears up to take on Tesla in EV infrastructure battle

Volkswagen plans to double staff numbers at its charging and energy division, roll out new payment technology next year and strike more alliances to take on Tesla in a key electric vehicle (EV) battleground: power infrastructure.

By ensuring there are enough fast-charging plugs—and enough power—for the EVs it wants to sell, Europe’s biggest carmaker hopes to convince drivers worried about battery ranges that they can ditch their fossil fuel cars for good.

Underlining its electric ambition, Volkswagen has drafted in power industry veteran Elke Temme, who spent nearly two decades at German energy companies RWE and Innogy, to help the carmaker get in better shape to take on Tesla.

In the job since January, Temme, 53, has been tasked with bundling the carmaker’s various power activities such as procuring energy, enabling customers to charge their cars at home, and on the road, and selling the electricity required.

Getting this done will require a bigger workforce and Temme plans to double the staff at Volkswagen’s European charging and energy division, known as Elli, to about 300 in 2022, having already tripled it this year, she told Reuters in an interview.

“We’re investing in huge growth areas that don’t always have to be profitable right away. We always see these investments in the overall context of our group strategy,” she said. “That’s why building up a comprehensive infrastructure is key.”

Temme declined to specify the budget she has been given but said Volkswagen, led by Tesla admirer Herbert Diess, has approved the investment requests for the division, which also sells home battery storage systems similar to Tesla’s Powerwall.

Volkswagen leads the pack worldwide by far with its investment plans for EVs and batteries through 2030, according to a Reuters analysis, and it is planning to spend €35 billion on battery EVs by 2025.

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.