The total size of the IPO is expected to be about Rs 5,000 crore, two people aware of the discussions told ET, requesting anonymity.

In July last year, Digit, one of the first unicorns of 2021, had raised $200 million from existing as well as new investors Faering Capital, Sequoia Capital India and IIFL Alternate Asset Managers, at a valuation of $3.5 billion.

ICICI Securities, Morgan Stanley India Co, , , and are the book managers for the IPO, according to the draft prospectus.

Digit may also consider taking a pre-IPO placement for a cash consideration of Rs 250 crore before filing for its red-herring prospectus. If the pre-IPO placement goes through, the company will reduce the offer size, it said.

The proceeds from the fresh issue will help the company augment its capital base and maintain solvency levels. It will also use the capital for business expansion, it said.

Discover the stories of your interest

ETtech

ETtechAccording to the draft prospectus, shareholders selling as part of the OFS include promoters – Go Digit Infoworks Services, Nikita Mihir Vakharia, jointly with Mihir Atul Vakharia, Nikunj Hirendra Shah, jointly with Sohag Hirendra Shah, and Subramaniam Vasudevan, jointly with Shanti Subramaniam.

The company, which is backed by Canadian billionaire Prem Watsa, offers insurance across motor, health, travel, and property.

The company counts A91 Partners,

Shriram Growth Fund, and Wellington Management as its other major investors. Go Digit Infoworks holds 83.6% stake in the entity.

Digit’s IPO comes at a time when new-age businesses are taking a wait-and-watch approach on listing plans.

Companies including Oyo Hotels & Homes, Boat, PharmEasy, and Snapdeal have filed draft papers for their IPO but hit the pause button after the capital markets turned choppy.

Snapdeal and Oyo have yet to get approval from capital markets regulator, Securities and Exchange Board of India, for their draft IPO proposals.

Macroeconomic headwinds have beaten down technology stocks, with most new-age companies that listed on the exchanges last year currently trading below their IPO price.

Logistics player Delhivery, whose IPO received a muted response, had also delayed listing plans and reduced the size of the final offering.

ETtech

ETtechFor the fiscal year 2021-2022 (FY22), Digit said it had 25.77 million customers, up from the 14.27 million total customers it reported in FY21.

It had sold close to 7.76 million policies in FY22, from the 5.56 million policies in the year-ago period.

Total assets under management shot up by almost 68% annually, at Rs 9,393.87 crore in FY22.

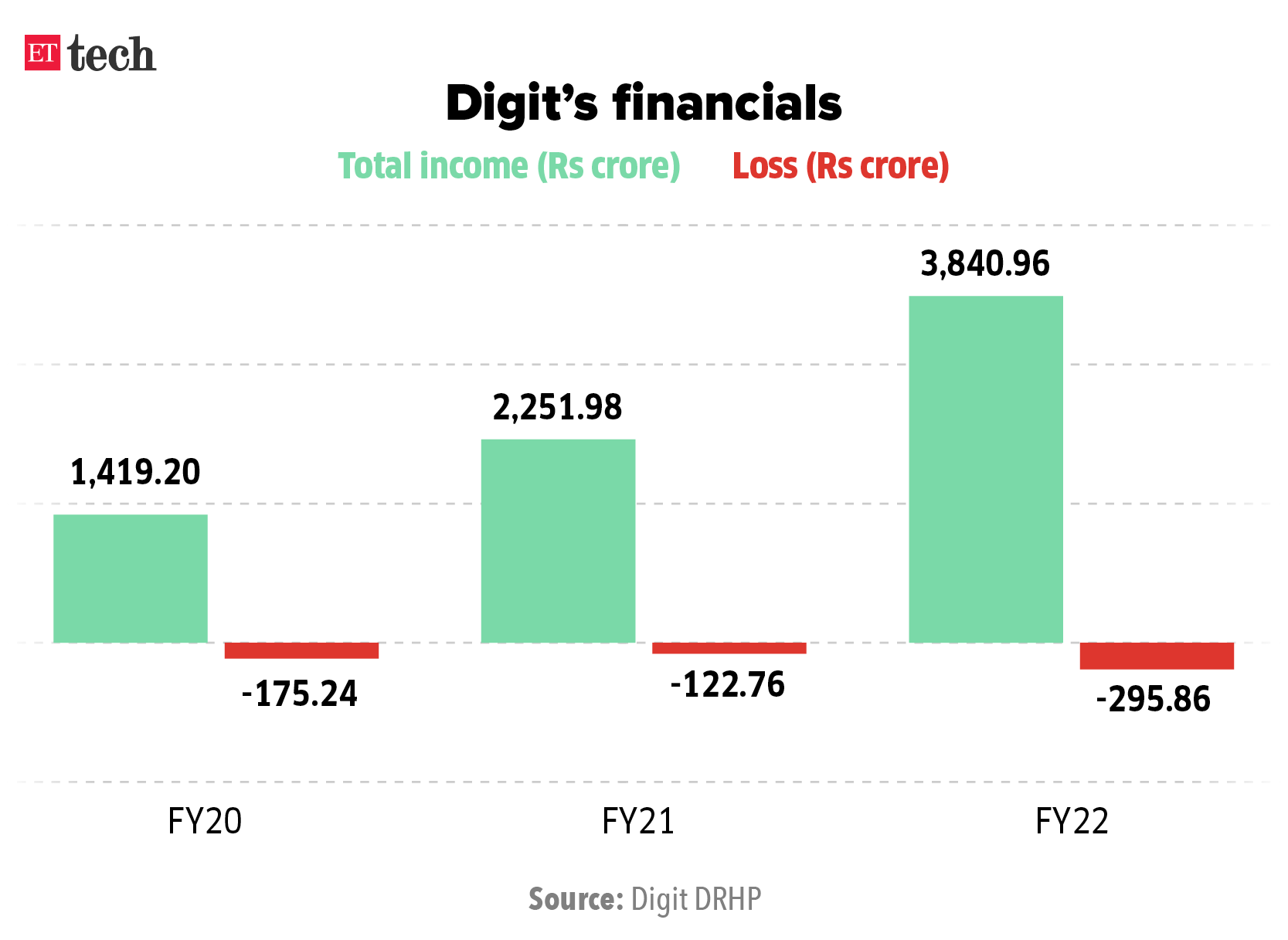

It reported total revenues of Rs 3,840.9 crore in FY22, up from Rs 2,251.9 crore the year before.

Net losses widened to Rs 295.86 crore in FY22, compared to the Rs 122.76 crore loss it recorded in FY21, the company said in the draft prospectus.