Also in this letter:

■ EV startup Exponent Energy nears $25 million

■ IT majors eye operating margin boost

■ Regulatory sandbox likely for OTT communication apps

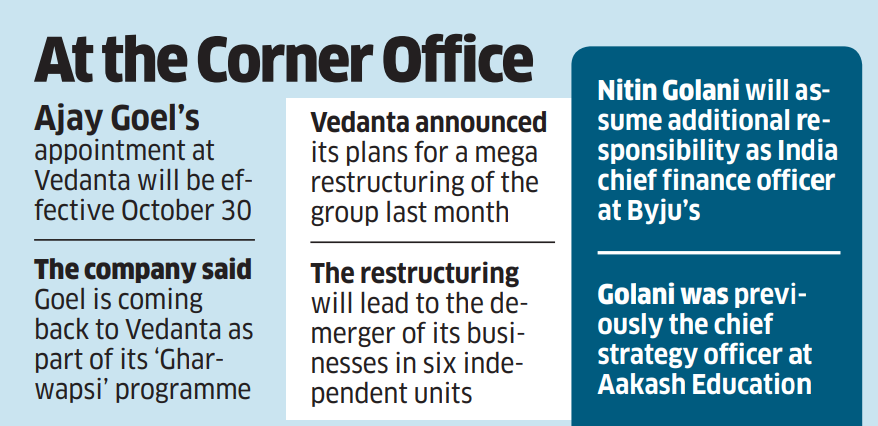

Byju’s CFO Ajay Goel quits in seven months, rejoins Vedanta

Former Byju’s CFO Ajay Goel

Seven months after joining Byju’s, chief financial officer Ajay Goel has quit, and will return to mining group Vedanta, in the latest setback for the troubled edtech.

Driving the news: Goel’s appointment at Vedanta would be effective October 30, as per a stock exchange filing. The mining company said Goel is coming back to the firm as part of its ‘Gharwapsi’ programme amid its vast restructuring plans.

Taking charge: Nitin Golani, currently the president (finance), will assume additional responsibility as India CFO following Goel’s exit. Pradip Kanakia has been appointed as a senior advisor in the finance section.

Golani was previously the chief strategy officer at Byju’s subsidiary Aakash. According to the statement, Golani played a crucial role in Byju’s acquisition of Aakash in 2021 and moved into an operating role at Aakash post-acquisition.

From the horse’s mouth: “I thank the founders and colleagues at Byju’s for helping me assemble the FY22 audit in three months. I appreciate the support received during a short but impactful stint at Byju’s,” Goel said in a statement.

Results delayed: The development comes at a critical time for the edtech, which is yet to furnish its financial results for FY22. Byju’s has said Goel will leave after “completing audit formalities”. The company had said in a statement on October 16 that it would release the numbers in that week, but that commitment was not fulfilled. Goel’s exit may have a bearing on the arrival of the audited financials, which its auditor BDO needs to certify.

Read ETtech’s recent coverage on Byju’s

Festive sales may fetch Flipkart up to Rs 36,000 crore in gross sales

Ecommerce major Flipkart is on course to clock around Rs 33,000-Rs 36,000 crore in gross merchandise value (GMV) during the ongoing festive season sale which is expected to continue until around Diwali in November lasting 40-45 days, sources told us.

GMV refers to the total value of goods sold on an online marketplace. Flipkart earns a commission on each sale for offering its marketplace, thereby connecting merchants and consumers.

Clocking growth: The numbers projected for this year’s sale will mark an increase of up to 15-20% over the GMV recorded by the company in 2022. “The start of the sale cycle, which began on October 8, has been positive, and (Flipkart) should be on track to hit GMV of around $4-4.5 billion,” one person aware of the sales trajectory so far told us.

Driving growth: According to people in the know, the growth in Flipkart’s sales can be attributed to an uptick in demand for high-value items across categories, including high-end smartphones, electronics and appliances. At least two executives from third-party logistics companies confirmed this trend.

Industry executives also point to a rising trend of “premiumisation” across both online and offline retail, which is buoying the sector after muted sales during the first half of the year.

Also read | Premium Apple, Samsung devices driving smartphone sales growth during festive season: report

Bright start: Data and comments from Flipkart and its rival Amazon India indicate that the sales are off to a good start. During the first week, GMV grew by about 18% to around $4 billion, according to market research firm Datum Intelligence. It expects the ecommerce industry to reach an overall GMV of around $9 billion by the end of this year’s festive season.

Also read | Flipkart India logs 9% revenue growth at Rs 55,823 crore; losses widen by 42%

EV startup Exponent Energy nears $25 million funding

Sanjay Byalal Jagannath (left) and Arun Vinayak, cofounders, Exponent Energy

Exponent Energy, a Bengaluru-based startup building fast electric vehicle (EV) charging solutions, is close to raising $25 million in a funding round led by Fidelity-backed global investor Eight Roads. The timing of the fundraise is significant given the sluggish environment for EV and mobility ventures.

Up round: The fundraise is happening at a valuation of $100-120 million, sources told us, higher than the $45 million valuation at which the company last raised funding—a $13 million round in August 2022. In addition to Eight Roads, Exponent’s existing investors, including Lightspeed and AdvantEdge, are also learnt to be participating in the round.

Deployment plans: A person aware of Exponent’s plans said that the company is looking to deploy the additional funds to expand its charging infrastructure into more cities, while also enhancing its battery portfolio for additional use cases.

The big picture: Several other startups in the EV and mobility space have struggled to close rounds, or have done so by raising amounts lower than they initially intended to. This includes startups such as three-wheeler EV maker Euler Motors, two-wheeler EV manufacturer Ather Energy and EV ride-hailing startup BluSmart.

Inc.5 Shoes raises $10 million: Legacy footwear brand Inc.5 Shoes raised its maiden venture funding of $10 million (about Rs 83 crore) in a round led by Mumbai-based venture firm Carpediem Capital, with participation from Param Capital and P3 Venture Fund.

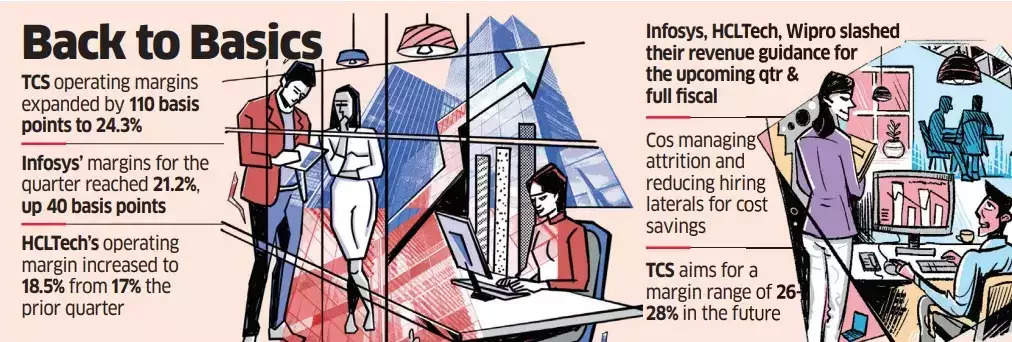

Top IT companies look to boost margins amid market struggles

India IT majors such as TCS, Infosys, HCLTech and Wipro are aiming to fatten their operating margins amid the stagnation in their topline. These companies are aiming to increase profitability as the elbowroom to expand revenues appears rather constricted.

Margin call: The top three players recorded sequential growth in their operating margin in the quarter ended September. While TCS widened its operating margin by 110 basis points to 24.3%, Infosys said its margin stood at 21.2%, up 40 basis points. HCLTech’s operating margin grew to 18.5% from 17% in the previous quarter.

Expert take: Experts said firms are using the downturn to go back to the basics on cost management and are increasing employee productivity to squeeze out better margins without growth. They added that this would aid companies to successfully manage the necessary short-term margin improvements since attrition has fallen.

No wage hike at HCLTech: ET reported on Tuesday that HCLTech is likely to not give wage hikes to its middle- and senior-level employees in the appraisal cycle starting this month. “As announced after our Q1 results, we made the difficult decision to skip the compensation review cycle for E4 and above bands in this fiscal year, and that decision will remain for now,” read an internal email from the company’s chief people officer, Ramachandran Surdararajan.

Also read | Indian IT companies likely staring at slowest growth since start

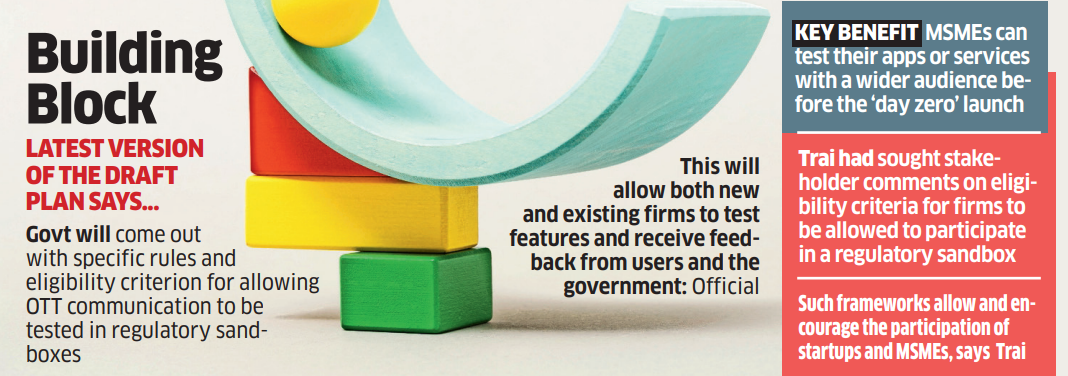

Government plans regulatory sandbox for OTT communication apps

The government is likely to provide the option of a regulatory sandbox for existing and new over-the-top (OTT) communication apps to test features in a “live but safe environment” before they are allowed to be released for all users.

Bill details: According to the latest version of the draft Indian Telecommunications Bill, 2023, the government will come out with specific administrative rules and eligibility criteria for communication apps such as WhatsApp and Signal to be tested in these regulatory sandboxes.

Quote, unquote: “One major benefit of such an environment is that MSMEs can test their apps or services with a wider audience before the ‘day zero’ launch,” a government official told ET. “We will come out with specific rules. It is an innovative concept. We want to make sure how much the government can be involved legally.”

Other Top Stories By Our Reporters

Mamaearth founders Ghazal Alagh and Varun Alagh

Mamaearth parent Honasa Consumer to launch IPO on October 31 | Mamaearth parent Honasa Consumer Ltd will launch its initial public offering (IPO) on October 31, though at a smaller size than initially planned, according to the company’s red herring prospectus filed with the markets regulator, Sebi. The Gurugram-based company plans to issue fresh shares worth Rs 365 crore along with an offer for sale (OFS) of 41.25 million shares. The omnichannel consumer brand will make a pre-IPO placement on October 30. The public issue will close on November 2

Goa going beyond beaches to become a ‘workation’ spot: The Goa government is working on attracting more ‘digital nomads’ and technology investment to the state by bolstering its electronics and accommodation infrastructure. This quarter, co-working shacks called ‘sea hubs’ will be set up along the beach, the state’s minister of tourism and IT, Rohan Khaunte, told ET.

Meta India’s gross ad revenue swells 13% to Rs 18,300 crore in FY23: Facebook India Online Services, the India arm of social media giant Meta, saw its gross ad revenue grow 13% to Rs 18,308 crore for the fiscal year ended March 31, 2023.

Global Picks We Are Reading

■ Amazon’s AI-powered van inspections give it a powerful new data feed (Wired)

■ US states accuse Meta of ‘manipulative’ practices towards young users (Financial Times)

■ The trials of gig work are inspiring a new genre of hit songs (Rest of World)