Also in this letter:

■ Crypto has no inherent value, says RBI guv

■ Indian startups raised over $7B in Oct-Dec: report

■ Uday Shankar, Lupa Systems to raise $1.5B from Qatar fund

Zomato Q3 results: Loss narrows to Rs 67.2 crore; revenue jumps 82%

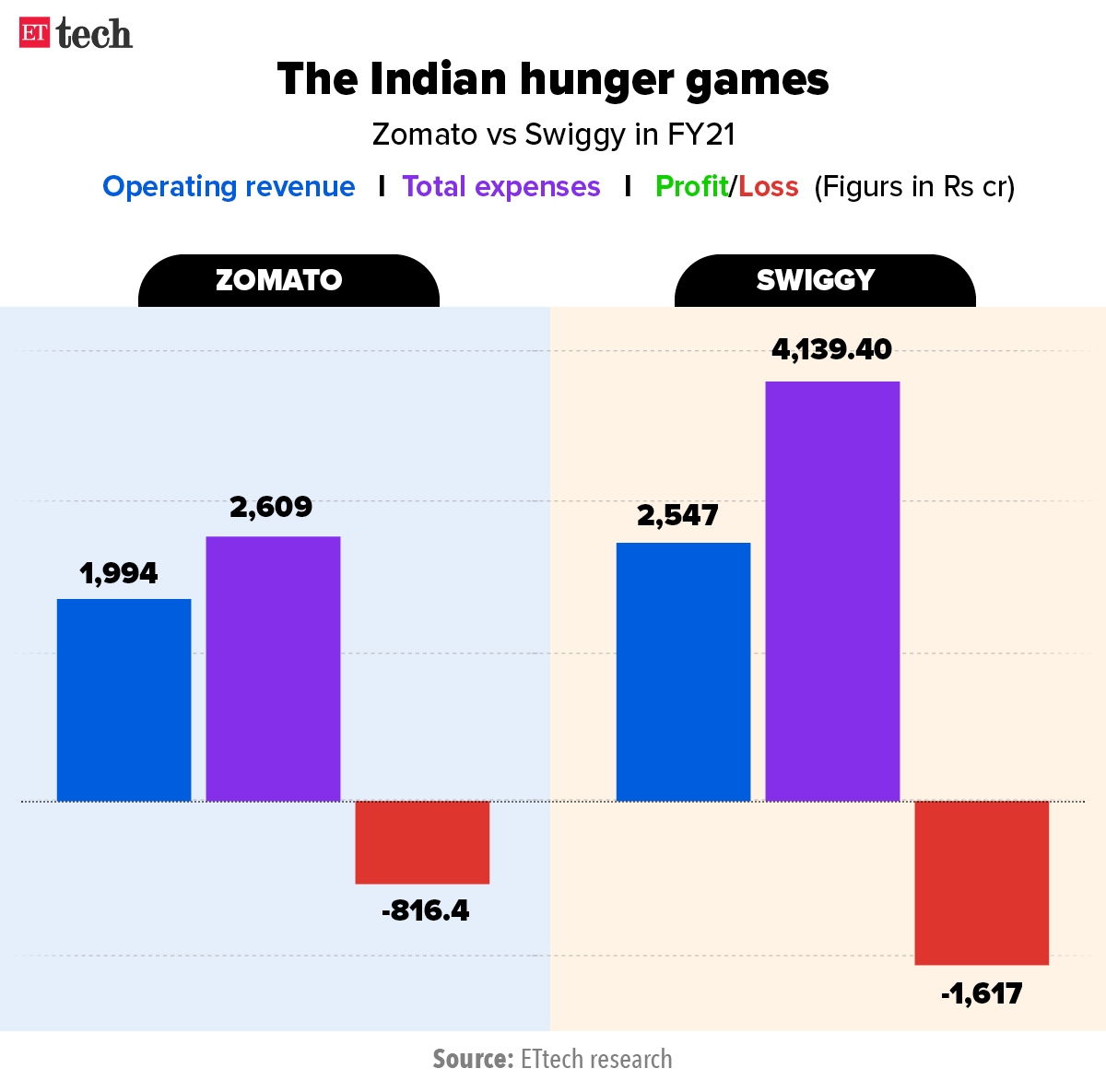

Food delivery firm Zomato has reported a consolidated net loss of Rs 67.2 crore for the December quarter, down from Rs 352.6 crore in the same quarter last year.

By the numbers: Revenue from operations came in at Rs 1,112 crore, up 9% from the previous quarter and up 82.47% from Rs 609.4 crore in the year-ago quarter.

- Gross order value (GOV) grew by 84.5% year-on-year and 1.7% quarter-on-quarter to Rs 5,500 crore. Zomato defines GOV as the total value of all food delivery orders placed online on its platform in India, including taxes, customer delivery charges, but excluding discounts and tips.

- Adjusted Ebitda (earnings before interest, tax, depreciation and amortisation) loss fell to Rs 270 crore from Rs 310 crore in the previous quarter.

- The number of orders grew 93% yoy and 5% qoq. Average order value, which includes delivery charges, shrunk by 3% qoq, mostly on account of a reduction in customer delivery charges.

Quote: “We re-distributed our growth investments more in favour of discounts on customer delivery charges vis-à-vis food coupons. Why? Because we are seeing a higher return on investment with discounted delivery charges compared to coupons. As a result, discounts per order were reduced by Rs 5 per order in the last quarter as compared to Q2FY22,” said Deepinder Goyal, CEO of Zomato.

Stock price: Zomato’s shares closed 0.42% higher before the company announced its results. But the stock has been battered of late, having shed 27.95% in the past five days and more than 33% since the start of the year amid a correction in the valuations of global and local tech firms.

Swiggy’s FY2021 results: Meanwhile, Swiggy’s consolidated revenue from operations decreased by 26.6% yoy to Rs 2,547 crore in FY2021, while net losses shrunk by almost 59% from the previous fiscal to Rs 1,616 crore, according to a regulatory filing sourced from Tofler.

Zomato’s recent moves: In late January, we reported that Zomato was investing in digital advertising company Adonmo and in food ordering system UrbanPiper. The company’s board has also approved the incorporation of a non-banking finance company (NBFC), which will be a wholly-owned subsidiary of Zomato.

The fresh investments by Zomato are a part of its larger strategy to back startups. Last year, the company said it plans to invest $1 billion in Indian startups over the next two years. It had announced investments in fitness platform, Curefit, hyperlocal discovery business, Magicpin and logistics firm Shiprocket.

Crypto has no value, not even that of a tulip, says RBI guv

Reserve Bank of India Governor Shaktikanta Das delivered a stark warning against investing in cryptocurrencies on Thursday, saying they lacked the underlying value of even a tulip — a reference to a speculative bubble that gripped the Netherlands in the 17th Century.

RBI’s reality cheque: Das gave his withering assessment of the digital currency craze just days after the government announced tax rules for cryptocurrencies, which many took as a sign that it would one day legalise these assets.

But Das’s comments show the RBI, which has always been vehemently opposed to cryptocurrencies and even tried to indirectly ban them in 2018, hasn’t changed its stance one bit.

What he said: “Private crypto currency or whatever name you call it is a big threat to our macroeconomic stability and financial stability… and these cryptocurrencies have no underlying (value) — not even a tulip.”

On digital rupee: Das said the RBI couldn’t provide a timeframe on when India’s official digital currency would be rolled out, adding, “Whatever we are doing, we are doing it very carefully and cautiously… We have to keep risks like cyber-security and counterfeiting in mind”.

In her budget speech on February 1, Finance Minister Sitharaman had said the RBI would introduce its central bank digital currency (CBDC) this year.

No one-size-fits-all model: Meanwhile, Kristalina Georgieva, head of the International Monetary Fund, has said evidence emerging from the first CBDCs around the world suggests there is no one-size-fits-all model as stability and privacy are designed into systems.

She also said financial stability and privacy considerations are paramount to the design of CBDCs. “These are still early days for CBDCs and we don’t quite know how far and how fast they will go,” Georgieva added.

Tweet of the day

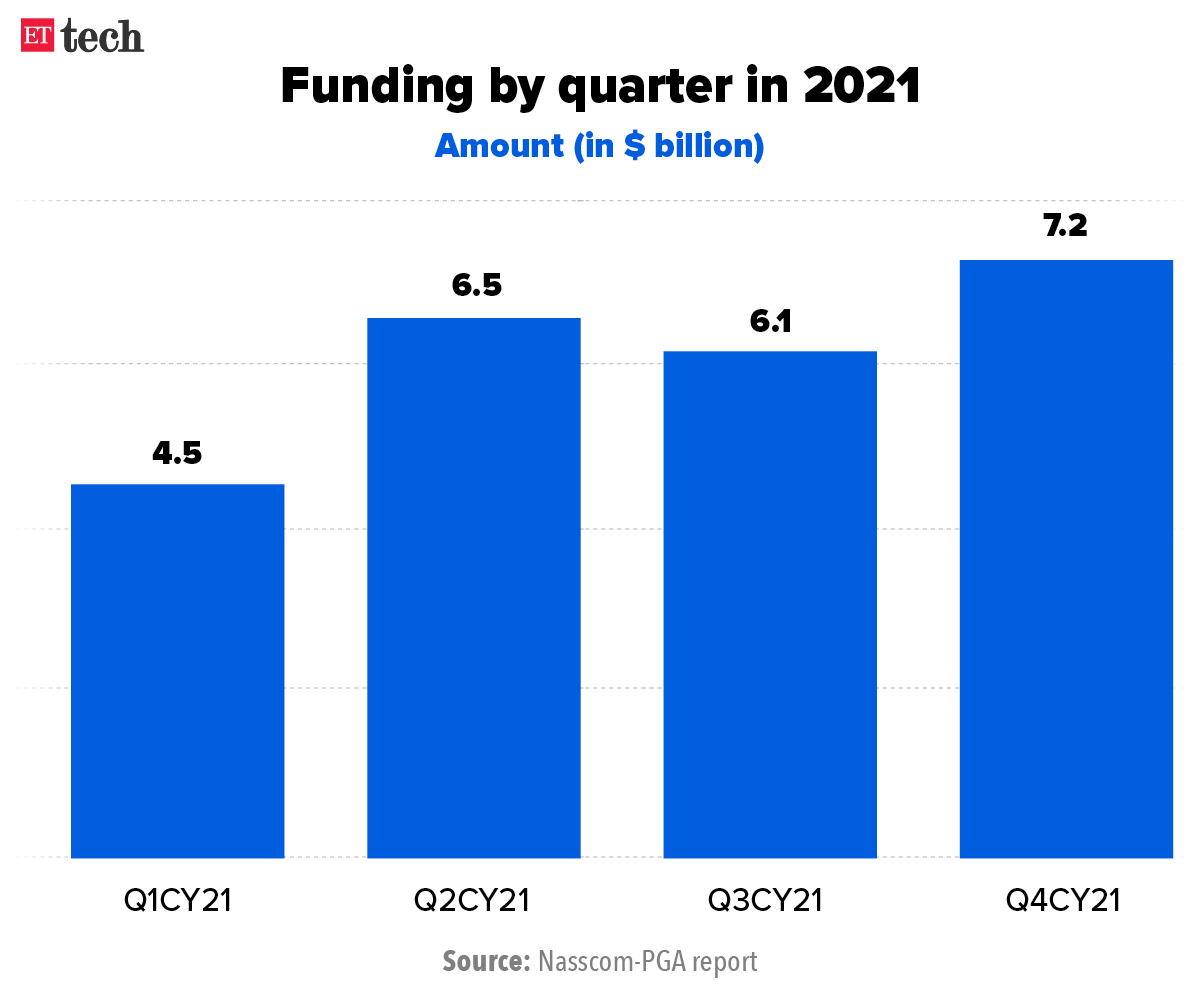

Indian startups raised over $7 billion in Oct-Dec 2021: report

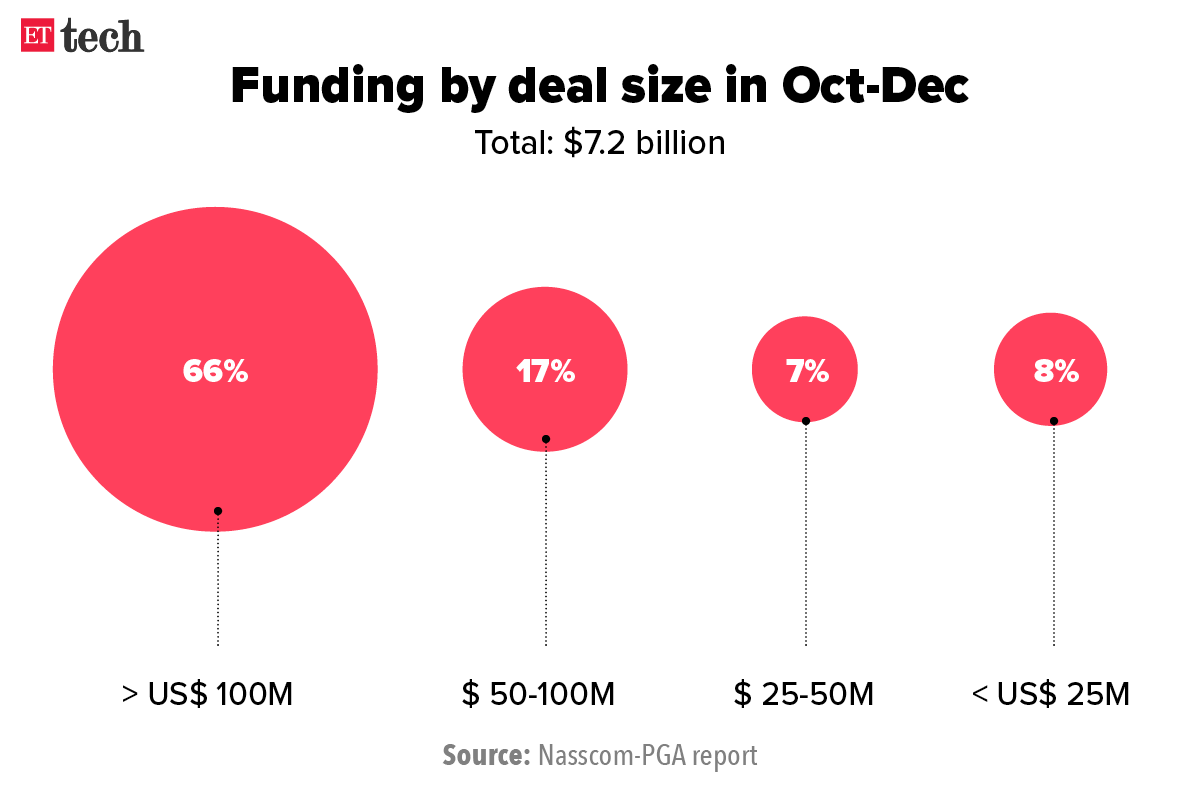

Indian startups raised more than $7 billion in funding during the fourth quarter of 2021 (October-December) up 18% from the third quarter, and 14 of these companies entered the ever-growing unicorn club, a report by Nasscom-PGA Labs said.

Also Read: 2021 Year In Review | The Year Of The Unicorn

The number of deals closed in the October-December quarter stood at 184, up by around 52% from 121 in the third quarter, the report added.

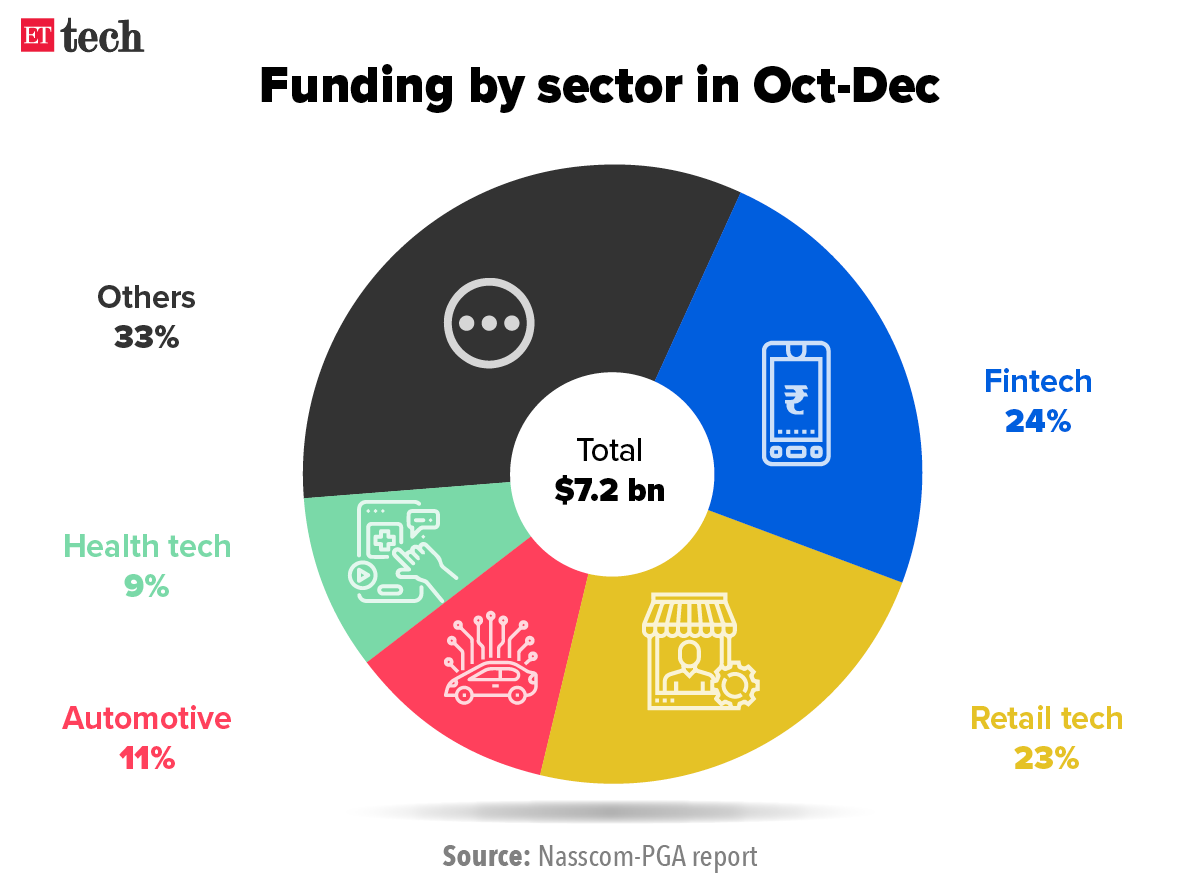

Fintech and retail tech were the most well-funded sectors, accounting for 24% and 23%, respectively, of the total deal value in the reported quarter.

Six of the 14 unicorns added in the quarter were from the retail tech and fintech sectors.

The Nasscom-PGA report also highlighted that the surge in online retail came on the back of massive digital adoption in the country due to the ongoing health crisis.

The biggest deal during the quarter was the $400 million fundraise by Cars24, an online marketplace for used cars, followed by Razorpay ($375 million), PharmEasy ($350 million), Nykaa ($300 million) and Spinny ($283 million), the report said

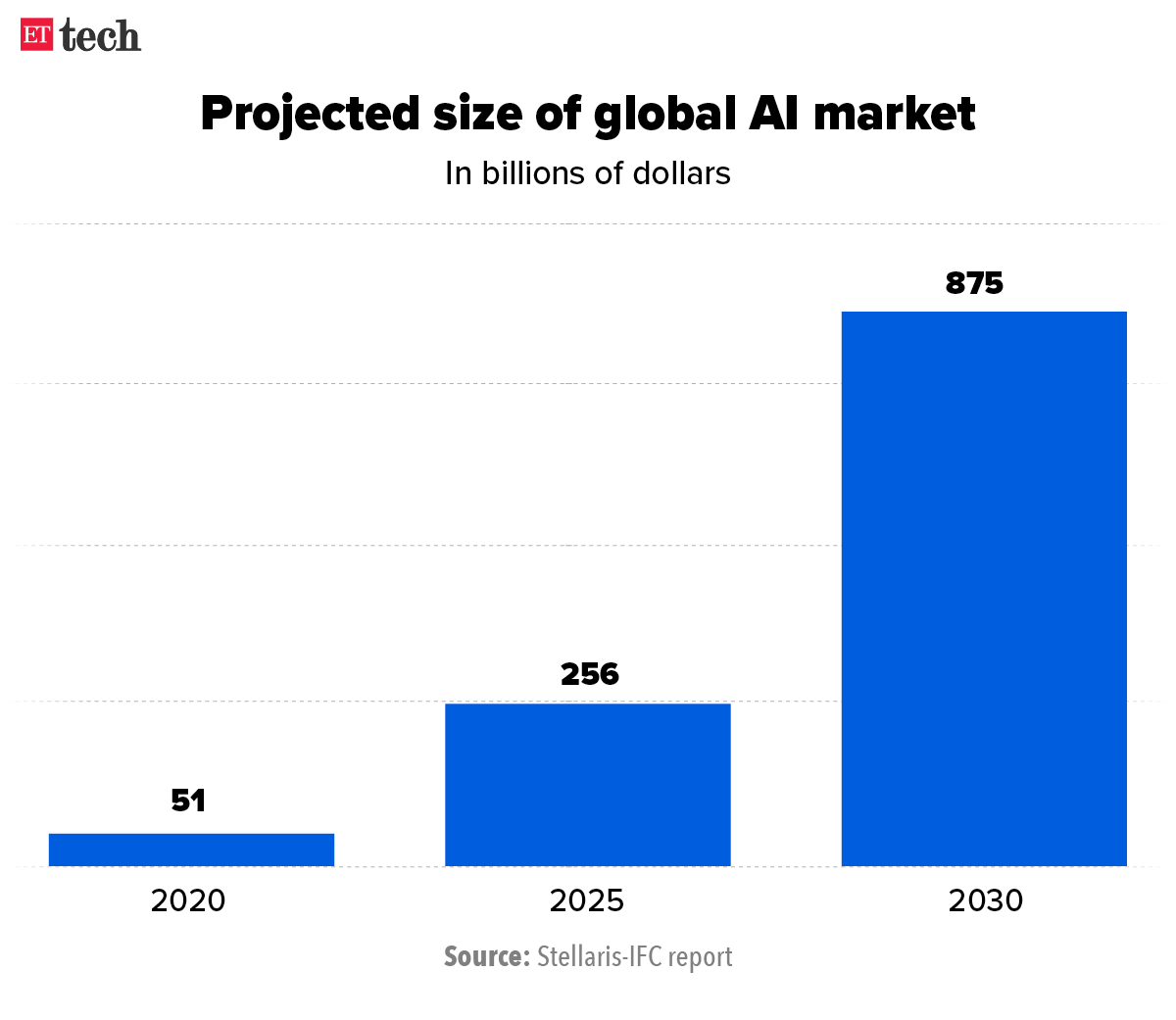

SaaS firms using AI could create $500 billion of value by 2030: Indian software-as-a-service (SaaS) startups that harness artificial intelligence (AI) could create $500 billion of market value by 2030, according to a report by early-stage venture capital firm Stellaris Venture Partners and IFC.

The big opportunity: The report said India’s AI opportunity could create more than 900,000 white-collar jobs and 3.6 million new indirect jobs by 2030. “We believe that globally, AI represents around $ 900 billion revenue opportunity by 2030 from infrastructure, applications and services,” it said.

The report was based on an industry-wide study conducted in collaboration with tech giants including Cisco, Infosys, Amazon Web Services (AWS), GitHub, and Freshworks.

Uday Shankar, James Murdoch’s Lupa to raise $1.5 billion from Qatar sovereign fund

Uday Shankar

Uday Shankar and James Murdoch’s private investment company Lupa Systems have formed a new investment platform, Bodhi Tree, and secured an investment of $1.5 billion from the sovereign fund Qatar Investment Authority (QIA).

The new venture will invest in media and consumer technology opportunities in Southeast Asia, with a particular focus on India, said a joint announcement release.

Talks with Reliance: The investment from QIA has come at a time when Shankar, former president of The Walt Disney Asia Pacific and chairman of the Star and Disney India, is in talks with Mukesh Ambani’s Reliance Industries to pick up a significant minority stake in Reliance-controlled TV18’s step-down subsidiary, Viacom18.

Murdoch and Shankar will serve as co-chairs of the newly-established venture.

The announcement said that QIA will be committing up to $1.5 billion (approx. 11,200 crore) to Bodhi Tree’s vision being pursued by the duo.

ETtech Done Deal

- Better Opinions, a Y-Combinator backed company, has raised over $1 million in a funding round from Y Combinator, Java Capital, Soma Capital, and angels including Mayank Kumar, co-founder of UpGrad, Sudhanshu Raheja, head of product and engineering at GoTo Financials (Gojek-Tokopedia), Pratyush Prasanna, SVP of Gojek, Chinmaya Sharma, chief commercial officer, Namshi and the Ranadive Family, the co-owners of Sacramento Kings.

Microsoft unveils new app store guidelines as it woos regulators on deal

Microsoft has announced a new set of principles for its app store, including open access to developers who meet privacy and security standards, as it begins a push to win approval for its blockbuster acquisition of ‘Call of Duty’ maker Activision Blizzard Inc.

The $68.7 billion purchase, announced last month, was the biggest gaming industry deal in history.

Microsoft will file for approval of the deal in 17 jurisdictions, the company’s president Brad Smith said. He said he had previewed the app store policies with US lawmakers and received “a positive reaction.”

Quote: “Our goal is to build what’s called a universal store for games,” he added. “In other words, a store that anyone can access on any device on any platform to purchase or download any game that a developer chooses.”

Today’s ETtech Top 5 newsletter was curated by Arun Padmanabhan in New Delhi and Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.