Credit: Giphy

Also in this letter:

■ Honor pulls its India team over rising tensions

■ Shein private bids show $30B valuation drop since April: report

■ HCL Tech’s C Vijayakumar is India’s highest-paid IT CEO

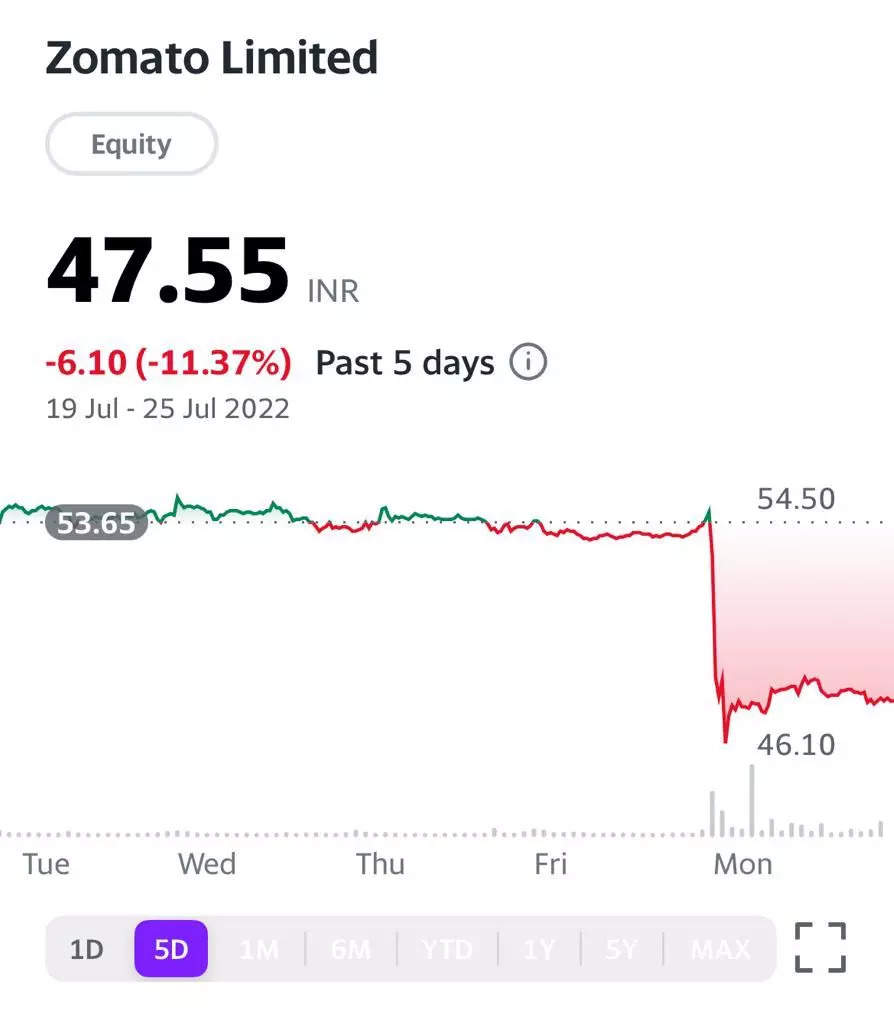

Zomato’s market cap falls below last private valuation as lock-in expires

Online food-delivery platform Zomato’s stock price fell more than 14% to hit a lifetime low of Rs 46 in the early hours of trade on BSE on Monday, pushing its market cap below its last private valuation of $5.5 billion.

The stock recovered slightly to close at Rs 47.55, down 11.37% on the day.

Why? The mandatory lock-in for promoters, employees and other shareholders, who bought the stock before the IPO, ended on July 23, one year after it was listed.

Credit: Yahoo Finance

More than 613 crore shares of Zomato were under lock-in from the date of allotment, comprising about 78% of total shares.

Year-long decline: Zomato had a blockbuster listing on the Indian stock exchanges on July 23, 2021. Its shares surged by as much as 83% above the IPO price of Rs 76 at one point on the opening day after listing at Rs 115 apiece — a premium of more than 50% over the issue price.

But its share price has declined – sometimes rapidly – ever since.

Though the company has attributed this to macroeconomic factors, its recent decisions have certainly had a bearing on its stock price as well.

After Zomato announced the acquisition of the quick commerce platform Blinkit for Rs 4,447 crore ($568.16 million) in an all-stock deal in June, its stock price took a similar beating.

Honor pulls its India team over rising tensions

Chinese smartphone brand Honor has pulled its team from India over rising geopolitical tensions and intense scrutiny of Chinese smartphone makers, the company’s chief executive Zhao Ming told the South China Morning Post.

Zhao said the company’s Indian business would continue to be managed by local partners and remain operational, though it would adopt a “very safe approach”.

At its peak in 2018, Honor held a 3% market share in India. It fell out of the top five after the US government imposed crippling sanctions on its former parent Huawei.

Phone makers feel the heat: Chinese smartphone brands such as Vivo and Oppo have been facing tightening regulatory pressure from India’s central agencies for alleged fraudulent practices and tax evasion.

The Directorate of Revenue Intelligence (DRI) detected alleged customs duty evasion of nearly Rs 4,389 crores by Oppo’s Indian arm on July 13.

And last month, the Enforcement Directorate (ED) raided the offices of Vivo and its associated companies and froze their bank accounts on suspicion of money laundering.

ED accuses Vivo: On Monday, the ED accused Vivo of trying to destabilise India’s financial system and threaten its sovereignty.

The agency alleged that Vivo’s bank accounts were “clearly involved in money laundering” and this “has been carried out as an attempt to destabilise the financial system of the country and also to threaten the integrity and sovereignty of the nation”.

Shein private bids show $30 billion valuation drop since April: report

Investors in Chinese fast-fashion startup Shein are looking to sell their stakes in the company at a 30% discount to its last known valuation of $100 billion, amid concerns of slowing growth ahead of its plans to go public in the US, reports Bloomberg.

Investors are also wary about Shein’s poor environmental, social and governance record and the recent global rout in technology stocks, which they feel could affect demand for its IPO. Shein is seeking to list in the US by 2024.

Fiery growth: Founded in 2008 by Chris Xu, Shein has become the world’s third-most valuable startup, with annual sales of $16 billion. It has also become the posterboy of fast fashion – ahead of giants like H&M, Zara and Uniqlo – thanks to the pandemic’s boost to ecommerce sales.

Yes, but: It has also courted controversy, particularly related to environmental damage, worker exploitation and copyright theft. A drop in its valuation could further sour the mood of global investors, already reeling from a 25% fall in the private valuation of Bytedance, the world’s second-most valuable startup.

Tweet of the day

HCL Tech’s C Vijayakumar is India’s highest-paid IT CEO

HCL Technologies chief executive, C Vijayakumar, is the highest-paid CEO among India’s top IT services firms, with an annual salary topping $16 billion courtesy of a two-year incentive worth $12.5 billion, the company’s annual report revealed.

Vijayakumar also received 900,060 restricted stock units during FY22. HCL Technologies’ chief financial officer Prateek Aggarwal saw a 36% rise in his remuneration for FY22.

Interestingly, Vijayakumar didn’t get a pay hike in FY22, in contrast to the 20% and 43% hikes that Wipro’s Thierry Delaporte and Infosys’ Salil Parekh received, respectively. Delaporte and Parekh are the second- and third-highest paid IT CEOs, while TCS’ Rajesh Gopinathan is fourth.

ETtech Done Deals

■ Better Opinions, a Y Combinator-backed, events-based trading startup, raised $2.5 million in a seed round from Metaplanet VC, Goldwater Capital and a few other investors. Founded in 2021, Better Opinions is an app that allows users to make predictions across various categories such as cricket, cryptocurrency, politics, and entertainment and win real money if their predictions come true. The platform currently caters to over 600,000 users and plans to use the funds to expand its product and technology team.

■ Gurugram-based at-home cooking services platform ChefKart raised $2 million in funding led by Pravega Ventures and Blume Ventures. Zomato cofounder Deepinder Goyal, Titan Capital, and Cred founder Kunal Shah also participated in the round. ChefKart offers qualified and vetted home chefs who prepare hygienic meals based on customers’ preferences. It plans to use the funds to expand to new regions.

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant in Mumbai and Ruchir Vyas in New Delhi. Graphics and illustrations by Rahul Awasthi.