Also in this letter:

- Sebi calls for more transparency in IPO ads

- Tech firms are stealing a march on rivals

- Purplle in talks for controlling stake in Faces Cosmetics

Zomato in talks to invest $500 million in Grofers for quick commerce play

Zomato, which invested $100 million in Grofers in August, is now in talks to put another $500 million in the online grocery platform, sources told us.

Context: The big bet on Grofers comes after Zomato’s on-again, off-again attempts at grocery delivery over the past year.

If the deal goes through, this will be Zomato’s single largest investment in a company. It marks an extension of Zomato’s battle with Swiggy into the quick commerce segment, which has been attracting huge investments globally.

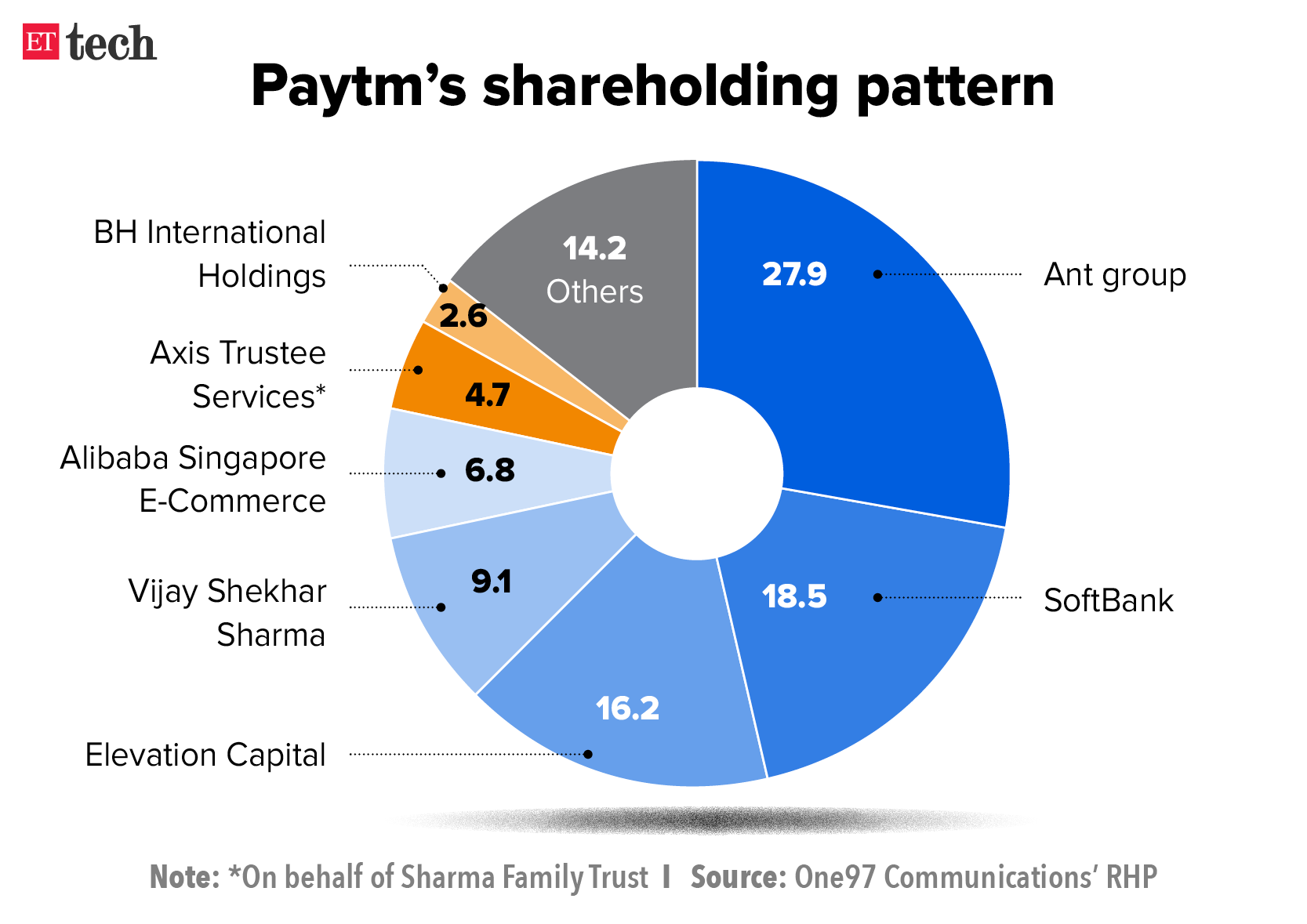

Valuation bump: The funding will likely value Grofers at around $1.5 billion, the sources said, up from $1 billion when Zomato invested $100 million. It will also raise Zomato’s holding in Grofers to about 30%. Grofers’ biggest shareholder is SoftBank Vision Fund, which holds almost 45% in the company. Tiger Global and Sequoia Capital are investors in both Zomato and Grofers.

“Talks are on between the two companies and Zomato is most likely to invest the full $500 million by itself,” said one of the people cited above. “There were some discussions with SoftBank and others, but those have not fructified yet.”

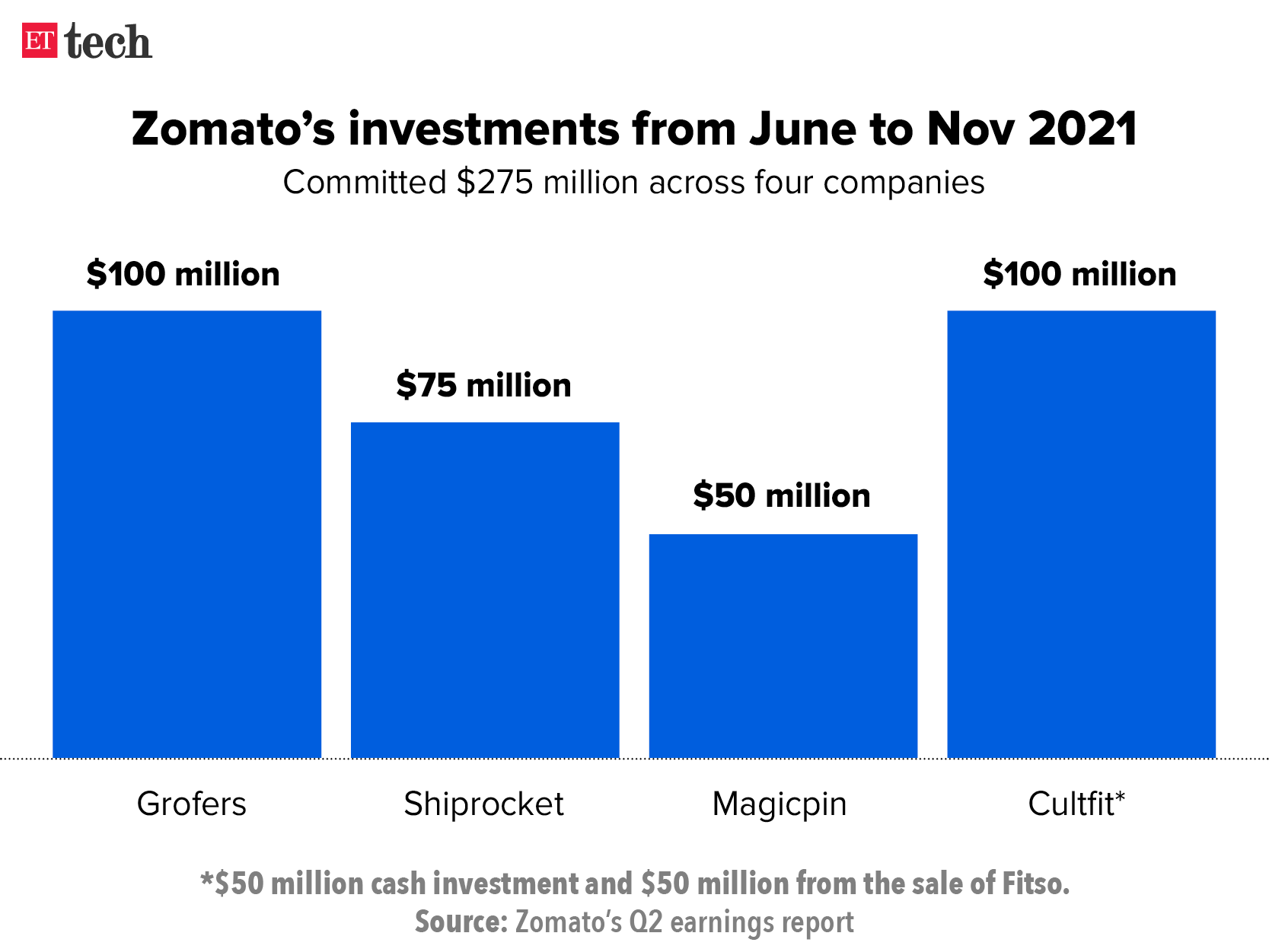

The Deepinder Goyal-led Zomato which had a bumper listing on the Indian bourses in July has been on an investment spree. It has backed startups such as logistics tech firm Shiprocket, discovery platform for offline retailers Magicpin and fitness platform Curefit, as part of its strategy to deploy $1 billion in young companies.

Quick delivery push: Zomato’s move to double down on the fast-growing quick delivery segment comes on the back of rival Swiggy prioritising Instamart, which specialises in grocery deliveries in 15-30 minutes.

Swiggy’s Sriharsha Majety told us in July that as much as 25% of the company’s revenue was coming from non-food delivery businesses, and that it planned to use $1.25 billion of new funding to invest heavily in verticals such as Instamart.

Sebi calls for more transparency in IPO ads

India’s markets regulator Sebi has taken note of the huge profits private equity (PE) investors have made by selling shares in several recent IPOs. To improve transparency in disclosures, it now wants merchant bankers to clearly state the cost of acquisition for large investors such as PEs in IPO advertisements.

Context: More than half a dozen new-age companies have launched IPOs in the past few months. Sebi observed that the institutional investors’ acquisition cost was one-third of their selling price via IPOs.

What Sebi said: In a missive to merchant bankers yesterday, Sebi said: “The risks to investors shall include weighted average cost of acquisition of all shares transacted in the last three years and one year, from the date of [filing the red herring prospectus]. The portion pertaining to ‘risk to investors’ shall constitute at least 33% of the price band advertisement space.”

What this means: Currently, such ads highlight the price band. Sebi’s move will help individual investors get a sense on the entry and exit pricing of institutional and large investors. It will also help small investors get an idea about their entry price as most of these companies are currently loss-making.

Quote: “Nobody can or should object to disclosure guidelines from the regulator, especially in the current red hot IPO market. But care needs to be taken to ensure that IPOs where a company is making a fresh issue of shares don’t appear to be less risky than IPOs where there is an OFS (offer for sale) component. There is risk in both types of IPOs — those with a fresh issue only, or a fresh issue plus OFS,” said P R Srinivasan, designated partner, Xponentia Capital Partners.

Tweet of the day

Tech firms are stealing a march on rivals

The tech and startup space has seen unprecedented hiring in recent months, prompting companies to devise new strategies to gain advantage in the talent hunt game

- These include “stealing” candidates who are serving their notice period (and are set to join a new company).

Companies are prioritising such talent on the move to reduce the offer acceptance time and the scope to continue job shopping. The offers handed out are better than the ones they already have on hand.

Quote: “Companies are seen moving away from candidates with long notice periods … there is a clear preference for immediate joiners and candidates who can join in weeks or a month,” said Kamal Karanth, cofounder, Xpheno. “Most large enterprises have two- to three-month notice periods and recruiters are hence targeting talent that is on the move already, or are at the tail-end of their notice period.”

This comes at a time when offer acceptance rates for certain tech skills are at an all-time low. In skill sets like full-stack engineers, data engineers/data analytics, frontend engineers, data scientists, SRE/DevOps and backend engineers, acceptance rates have shrunk to 40-60% from 90-95% last year, according to data from Xpheno.

Purplle in talks to buy controlling stake in Faces Cosmetics

Manish Taneja, cofounder and CEO of Purplle

Ecommerce beauty platform Purplle is in talks to buy out a controlling stake in premium cosmetics and skincare brand Faces Cosmetics, sources told us.

Purplle had last month raised Rs 555 crore ($75 million) in a funding round led by private equity fund Kedaara Capital at an enterprise valuation of Rs 4,662 crore.

Quote: “There is heightened action in the online beauty space with growth in high double digits, and big names like Reliance and Tatas also formalising their own online beauty platforms,” said one of the executives.

While announcing the fresh funding late last month, Purplle.com chief executive and cofounder Manish Taneja had said the company would explore inorganic growth and mid-to-large-ticket acquisitions. He had also said close to 30% of the funding would be for acquisitions.

A report by Avendus Capital estimated that India’s beauty and personal care market will grow to $4.4 billion by 2025, at a compounded annual growth rate of 29%.

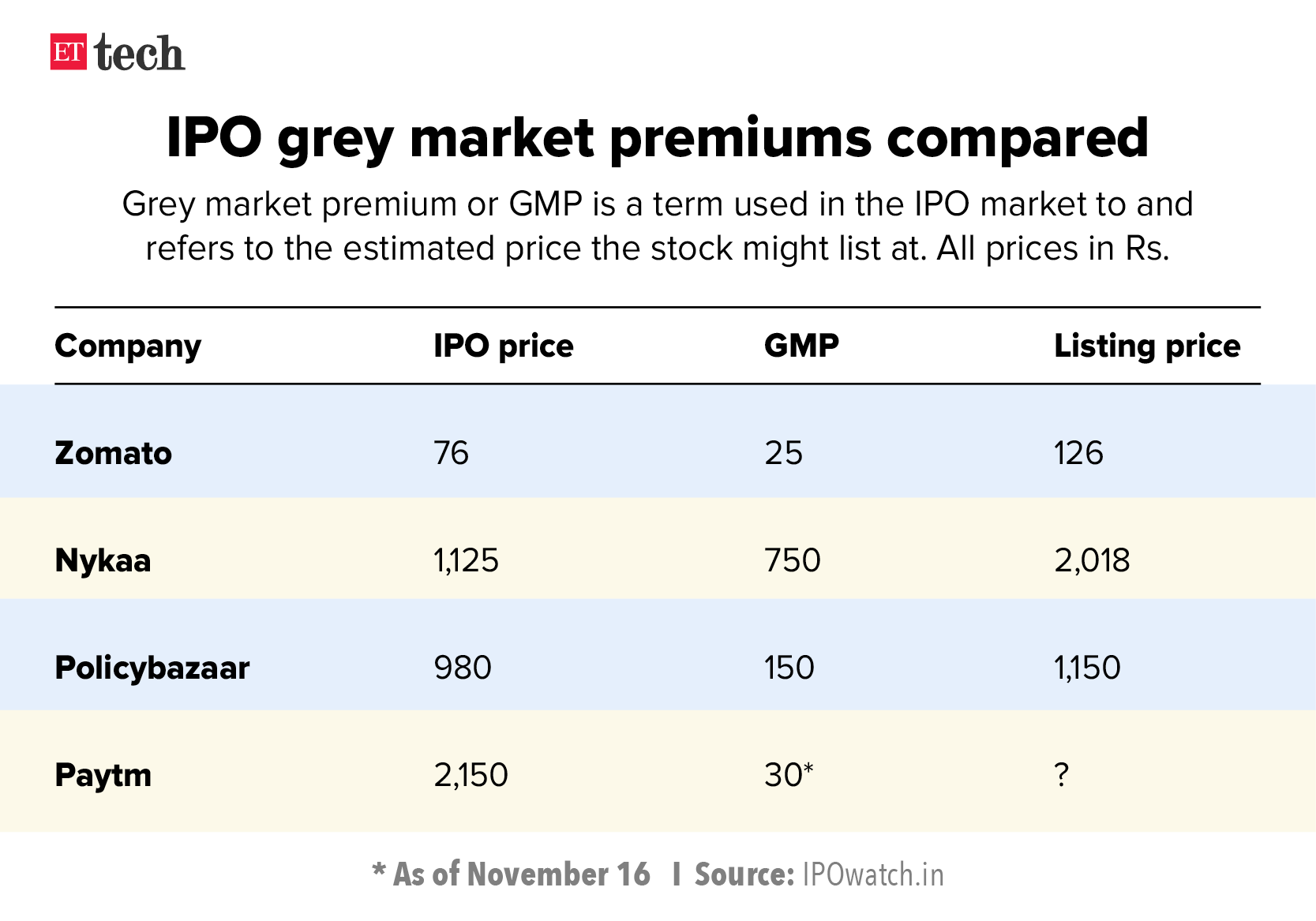

Grey market signals muted listing for Paytm

On Wednesday, a day before its listing on India’s stock markets, shares of Paytm parent firm One97 Communications changed hands on the grey market at a premium of just Rs 20-25 over the final issue price of Rs 2,150. On Tuesday, they were trading at a premium of just Rs 30, a mere 1.4% increase over the final issue price, according to IPO Watch.

The stock was trading at Rs 2,300 a share on the grey market on November 7, a premium of Rs 150 or 7% over the issue price. This fell to Rs 80 on the first day of the IPO and by the close of the issue on November 10 it was at Rs 40.

What is the grey market premium? Grey market premium (GMP) is a term used in the IPO market and refers to the estimated price a stock might list at. The grey market is unofficial but investors use the GMP as an indicator of how the stock could perform on listing.

Yes, but: GMP, while a useful indicator, is by no means infallible. Sometimes it predicts the listing price accurately and sometimes it doesn’t.

Flat listing expected: Dealers tracking the grey market said the ultra-expensive pricing, poor financials and muted growth prospects were the key reasons for the poor listing.

Abhay Doshi, cofounder at UnlistedArena, said Paytm was likely to be a flop on debut, despite the hype it generated as India’s biggest IPO ever. “The valuations of the issue were on the expensive side. Also, the company has not shown any significant performance in the financials and it is losing market share,” he added.

Ankur Saraswat, research analyst at Trustline Securities, said the company would make a flat listing. “New investors should wait for a meaningful correction in the shares and then enter this fintech behemoth,” he added.

Lukewarm IPO: In its IPO, held between November 8 and 10, Paytm issued Rs 8,300-crore worth of new shares, while existing shareholders and promoters sold shares worth Rs 10,000 crore in the offer-for-sale component.

The IPO was subscribed just 18% on the first day of bidding, with the company receiving bids for 88.21 lakh of the 4.83 crore equity shares on offer. On day 2, it was subscribed 48%, with 2.34 crore bids received. India’s biggest IPO was fully subscribed on day 3 and was eventually subscribed 1.89 times.

Trifecta Capital raises $101 million in first close of its third fund

Trifecta Capital has raised Rs 750 crore (about $101 million) towards the first close of its third fund—Trifecta Venture Debt Fund—within two months of launch.

Context: With this, Trifecta joins a growing list of homegrown funds that are raising rupee capital to invest in Indian startups. Funds such as Alteria Capital, Stride, IIFL, Edelweiss, 3one4 Capital among others have recently raised larger funds to deploy in India’s startup ecosystem.

Details: The total size of the third fund is Rs 1,000 crore, with a green shoe option of Rs 500 crore, which the firm is likely to mop up by the end of the current financial year.

The fund aims to serve the fast-growing demand for growth and acquisition financing in Indian startups across sectors such as business-to-business, consumer services, consumer brands, ecommerce, mobility, ed-tech, agritech, fintech and healthcare.

As of November 15, it has raised over Rs 3,500 crore across three venture debt funds and one late-stage VC fund. Since inception, Trifecta Capital has committed Rs 3,500 crore in venture debt and equity investments across more than 85 companies.

Its portfolio companies include BigBasket, PharmEasy, Cars24, Infra.Market, ShareChat, Dailyhunt, Urban Company, Vedantu, The Good Glamm Group, CureFit and Meesho.

Next steps: “Over the next two years, we will continue to introduce more interesting products and services to solve for large gaps within this ecosystem,” said Nilesh Kothari, managing partner at Trifecta Capital.

Better Capital gets in on the act: Meanwhile, venture capital firm Better Capital, run by Silicon Valley entrepreneur Vaibhav Domkundwar, has raised its maiden fund of $15.28 million to scale its pre-seed and seed investment strategy, the company said. Domkundwar is a solo general partner at Better Capital, unlike most venture capital funds, which run as a partnership among a few executives.

The fund—Better Capital Ventures I—is backed by founders, operators and investors who are former or current leaders at Meta (Facebook), Google, Uber, LinkedIn, Tiger Global, TPG, as well as other top 10 growth venture and hedge funds, it said. The firm closed fundraising within 40 hours of launch, a record for such a fundraise.

It began investing in pre-seed stages in Indian companies in 2018 and already has a portfolio of more than 125 companies, including Open, M2P Fintech, Rupeek, Teachmint, Slice, Jupiter and Khatabook. It will invest in pre-seed and seed rounds across sectors with a median cheque size of $300,000.

Other Top Stories By Our Reporters

PhonePe says clocked record 2 billion monthly transactions in October: India’s biggest payments app by transaction volume lived up to the billing, and then some, last month. PhonePe, part of Walmart Inc.-controlled Flipkart Group, clocked more than two billion transactions across payment channels in October, according to a statement on Wednesday.

What women need is to see women succeed: Societal change, having and celebrating role models and easier access to capital are some of the key factors that need to be addressed in order to make it easier for more women to take to entrepreneurship. Speaking at a panel discussion at the Bengaluru Tech Summit, Vineeta Singh, CEO, Sugar Cosmetics, said that more than providing skills and training programmes, what women needed to see is more women succeeding and their success being celebrated to inspire others.

Kyndryl sees India as big opportunity for talent, growth: Kyndryl Inc., an IBM spinoff that recently listed on the Nasdaq, sees India as a big opportunity for talent acquisition as well as business growth, according to its chief executive. “India’s IT industry is expected to grow by about 70% within the next five years, climbing to a total annual revenue that’s somewhere between $300-350 billion, according to McKinsey,” Kyndryl’s chairman and CEO Martin Schroeter said at the opening of the Bengaluru Tech Summit 2021.

Global Picks We Are Reading