Nonetheless, there were some who believed that disciplined growth was just an aberration and that people, and things, would soon lapse to their earlier ways.

But. The April-June earnings posted in the past week by companies such as food and grocery delivery platform Zomato, software-as-a-service major Freshworks, and new-age logistics services provider Delhivery showed that steps towards frugality could lead to favourable results, even in a relatively short time.

Zomato chief executive Deepinder Goyal

While Zomato grabbed the headlines for posting its first-ever quarterly profit, Freshworks and Delhivery saw their losses narrow significantly.

Consider these points:

■ According to a report by Kotak Institutional Equities, as a percentage of its revenue, Zomato’s employee costs fell by 1,069 basis points to 14%. Similarly, its advertising expenses as a percentage of revenues declined by 664 basis points, to 13%.

■ Freshworks managed to keep its operational expenses under check, as a result of which costs cost heads such as research and development, sales and marketing, and general administrative fell marginally to $1,63,507 even as its topline jumped 19%.

■ Similarly, Delhivery’s operating revenues increased 11% to Rs 1,930 crore, while its expenses declined slightly. This was led by a decline in its largest expense head — freight, handling, and servicing costs — to Rs 1,438 crore from Rs 1,453 crore in the year-ago period.

Zomato’s chief financial officer, Akshant Goyal, said in the post-earnings call that the lift from layoffs undertaken in December kicked in during the April-June period, reducing its employee costs to Rs 338 crore from Rs 349 crore in the year prior.

Analysts questioned Freshworks about a tradeoff between growth and margins as some of the company’s underlying business metrics stabilised.

“We want to be clear when we are not producing profits at the expense of growth, and we’ll continue to invest in our go-to-market plans. But we want to make sure those are efficient investments and that we get the right returns,” Freshworks’ chief financial officer Tyler Sloat said.

A Delhi-based partner at a venture capital firm said that Zomato’s “tryst with profitability” will give the confidence to loss-making consumer-focussed startups that getting back in the black without sacrificing growth is possible. The partner, however, said that it would be prudent to wait for a few more quarters in order to rule out any aberrations.

In a research note, brokerage firm Jefferies pointed out that with only two crore monthly transacting users currently, “Zomato has a long runway for customer acquisition and revenue growth, albeit this may come at the cost of near-term profitability”.

Top Stories This Week

Left to right: Scott Shleifer, global head for private investments, Tiger Global and Chase Coleman, founder, Tiger Global

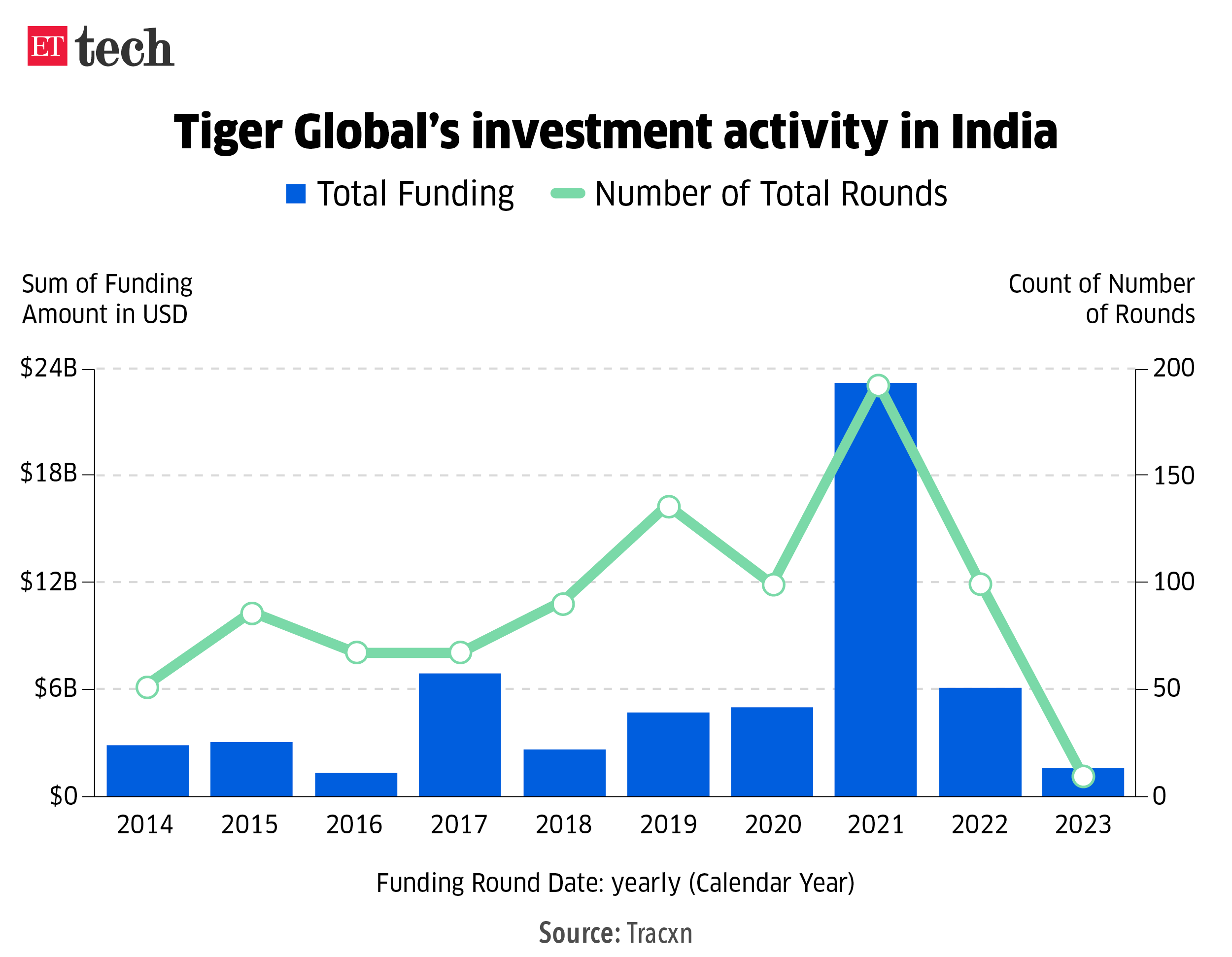

ETtech exclusive: Tiger trail at Flipkart ends with $3.5 bn in profits: New York-headquartered investment firm Tiger Global informed its limited partners (LPs) last week that it has exited from Flipkart, snagging $3.5 billion in total gains over the past few years in a phased selloff. The gains are the most it has generated from a single company globally, and also the highest profit it has managed from an Indian internet firm.

Subsequently, Walmart’s shareholding in Flipkart rose to 80.5%, strengthening its ownership of the Indian ecommerce firm, as cofounder Binny Bansal and other minority investors sold more shares to the retailer. Bansal also exited, marking the end of his association with one of the most storied Indian consumer internet startups over the past decade. In the current secondary transaction that values Flipkart at $35 billion, Bansal would have pocketed about $650 million.

Davidson Kempner begins rejig of Aakash board: The hedge fund is inducting at least four new independent and nominee directors in the test-prep subsidiary of Byju’s parent Think & Learn. The new board is expected to take charge within a fortnight. Founder and CEO Byju Raveendran will be the sole executive representative of the parent on the AESL board.

ET had reported that Davidson Kempner had issued a legal notice to Aakash over alleged covenant breaches on a Rs 2,000 crore loan sanctioned to the company. Meanwhile, in a notice to Aakash’s promoters, Byju’s has also said that it would honour the agreement to close the acquisition of the brick-and-mortar coaching centre announced two years ago.

Byju’s misses target to amend $1.2 billion loan terms: Byju’s had until August 3 to amend the terms of its $1.2 billion term loan B. However, it missed the target date set by its creditors, adding fresh challenges to its efforts to resolve disputes around the loan.

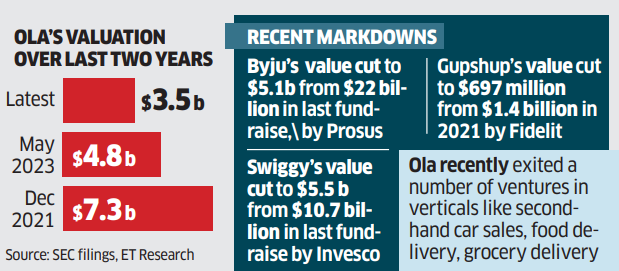

Vanguard slashes Ola’s valuation again by more than 50%: Funds operated by US-based investment major Vanguard Group have cut the value of their holdings in ANI Technologies, the parent firm of ride-hailing startup Ola, to $3.5 billion, down over 50% from a peak of $7.3 billion, regulatory filings by the investor with the US Securities and Exchange Commission (SEC) showed.

Also Read | Fidelity cuts Gupshup’s valuation by 37% to $876 million

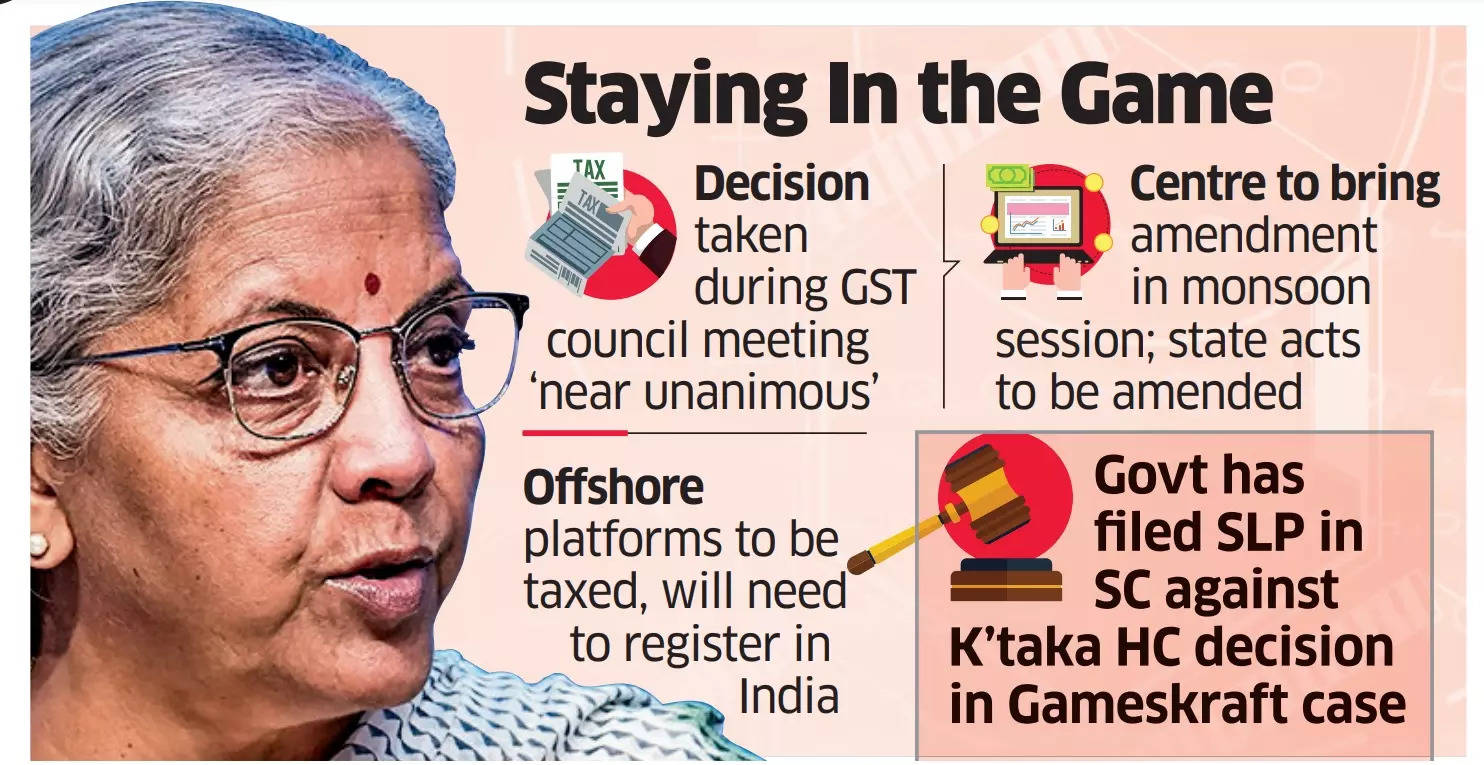

Online gaming industry relieved as GST Council clears tax haze: The online gaming industry has welcomed the GST Council’s recommendation that winnings from games won’t be taxed, but said the 28% goods and service tax on the full face value will hurt the industry.

Also read | Gaming companies differ on tax formula ahead of GST Council’s second meet

The GST Council, on August 2, decided that the tax will be applicable on the “amount paid or payable to or deposited with the supplier (of services), by or on behalf of the player (excluding the amount entered into games/bets out of winnings of previous games/bets) and not on the total value of each bet placed”, ruling out the possibility of repetitive taxation.

Foxconn to invest $600M in Karnataka: Electronics contract manufacturer Hon Hai Technology Group (Foxconn), the world’s largest contract manufacturer, will invest about $600 million (Rs 5,000 crore) to set up iPhone component and semiconductor manufacturing units in Karnataka. The proposals are part of the Taiwanese giant’s broader strategy to diversify away from China.

New Data Bill & Other Policy Stories

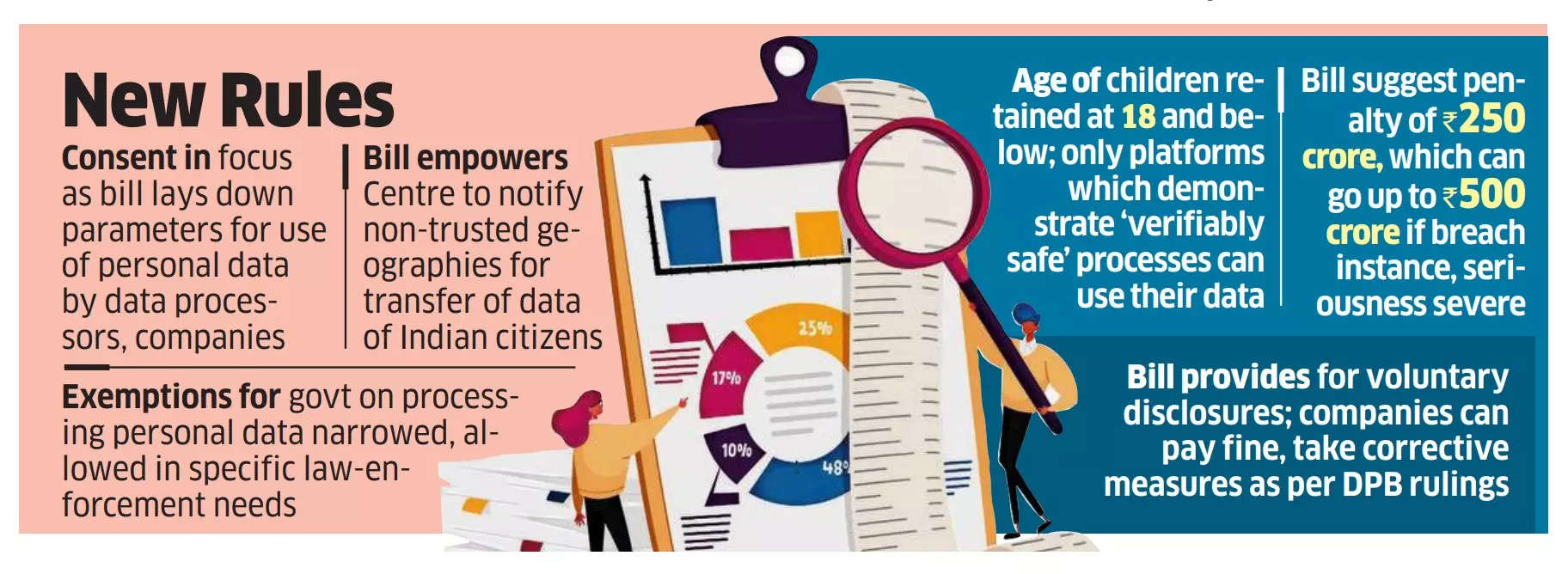

New data bill tabled in LS; govt eyes passage in current session: India, which is the world’s largest data market after China, moved a step closer to a privacy law with the union government tabling the Digital Personal Data Protection (DPDP) bill in Parliament on Thursday.

The new legislation aims to give people tighter control over the use of their personal information by businesses, as it lays down strict conditions for data sharing, processing, and storage.

Opposition, experts decry govt’s powers in exemptions spelled out in new bill: The bill details certain scenarios in which the protection to users under the provisions of the Act will not be applicable. Members of the opposition and some technology policy experts have raised concerns, as this gives wide-ranging powers to the government.

MoS IT Rajeev Chandrasekhar

Exemptions in new data bill limited to national security, public order: MoS IT Rajeev Chandrasekhar | The exemptions sought in the recently tabled data protection bill are very straightforward in terms of when the government can access personal data and (under) what circumstances, minister of state for information technology Rajeev Chandrasekhar told ET.

Also Read | Crooks blackmailing influencers using AI-made deep nudes

Government floats draft deeptech startup policy; proposes changes in nine areas: The government has floated a draft national deeptech startup policy proposing changes across nine areas including access to funding, strengthening the intellectual property regime, supporting deeptech startups, and enabling shared infrastructure and resource sharing.

Deeptech industry participants, including founders, investors, and advisors that ET spoke to, expressed confidence in the draft policy recommendations for innovation and funding in the sector, while some questioned its effectiveness.

Indian government to introduce draft ecommerce policy in a few weeks: The centre is likely to introduce the draft ecommerce policy in the next one or two weeks, according to people aware of the discussions at a meeting between top industry executives and union commerce and industry minister Piyush Goyal, on August 2.

Government restricts imports of laptops, PCs, tablets: To boost local manufacturing, India’s Directorate General of Foreign Trade has restricted the import of laptops, tablets, all-in-one PCs, ultra-small form factor computers, and servers. These items will only be allowed against valid licences.

Earnings Corner

At Rs 2 crore, Zomato turns profitable for the first time: Food and grocery delivery platform Zomato reported its first-ever consolidated net profit along with a 71% increase in operating revenue in the seasonally strong fiscal first quarter. The t company benefitted from a higher frequency of ordering by subscribers of its recently-relaunched loyalty programme.

Following this, Zomato’s market capitalisation crossed the $10 billion mark on Friday following a surge in its share price.

Sahil Barua, CEO, Delhivery

Delhivery Q1 results: Losses narrow sharply to Rs 89.5 crore, sales rise 10.5% | Logistics services provider Delhivery on Friday reported that its losses narrowed significantly in the quarter ended June 2023, both on a year-on-year basis and sequentially. The consolidated net loss dropped to Rs 89.5 crore in the quarter, from Rs 399 crore a year ago, and Rs 159 crore a quarter ago.

Freshworks reports 19% jump in revenues, expects $28 million operating profit: The Chennai and San Mateo, California, headquartered company said its net loss had halved to $35.66 million, or 12 cents per share, in the first quarter ended June 2023, from $69.75 million, or 24 cents per share, a year earlier.

Cognizant net profit down 19% YoY; company retains revenue guidance: US-based software exporter Cognizant’s net profit fell 19% on-year in the second quarter to $463 million, dragged down by costs related to its two-year ‘NextGen’ restructuring programme. Margins were also impacted by tapering discretionary spends by clients worried about the macroeconomic slowdown.

Apple net profit inches up 2% to $19.88 billion, sales continue to dip | Record revenue in India was one of the few bright spots for Apple in an otherwise disappointing quarter, as its sales slump continued in key geographies. Its net profit rose 2% to $19.88 billion in the quarter.

Fintech News

Fintech lenders see profits in FY23 after a rough couple of years: After a couple of very rough years, things seem to be looking up for the fledgling fintech lending sector. A few major venture-funded lending startups have come into profits in fiscal year 2023. Some are also scouting for fresh equity rounds to shore up their capital reserves.

PayU’s focus on India could soon culminate in a listing: Prosus-backed digital payments major PayU is looking for a public listing of its business entities in India, even as it sold off a major subsidiary, PayU Global Payments Organisation, to Israeli payment processing firm Rapyd.

PayU , which offers digital payments and credit in the local market, has begun preparations for its IPO, two sources in the know told ET.

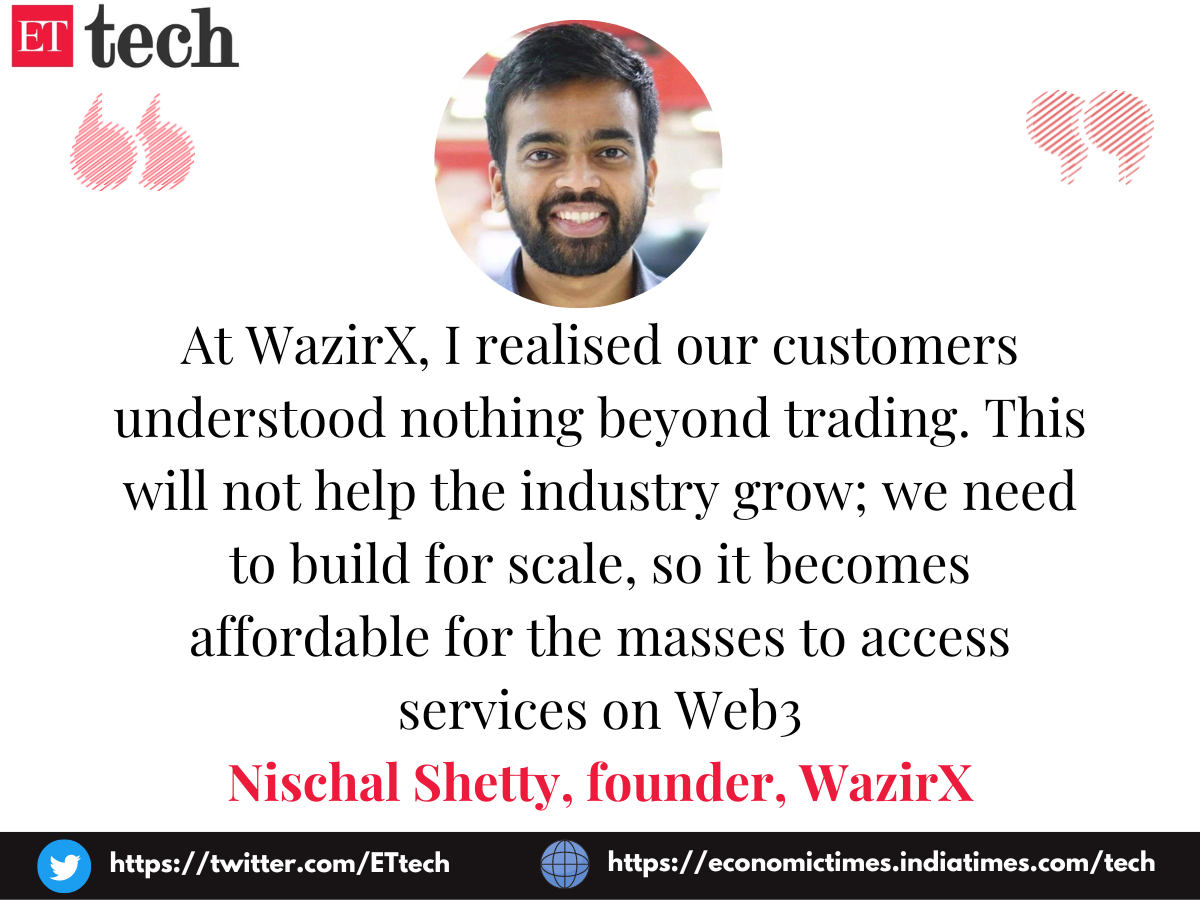

Crypto startups look to rebuild for the future: Until about a year ago, cryptocurrencies were all about trading. That is changing now, with crypto founders looking to expand the scope of their operations by offering gaming, decentralised financial services, and more.

ETtech Deal Digest

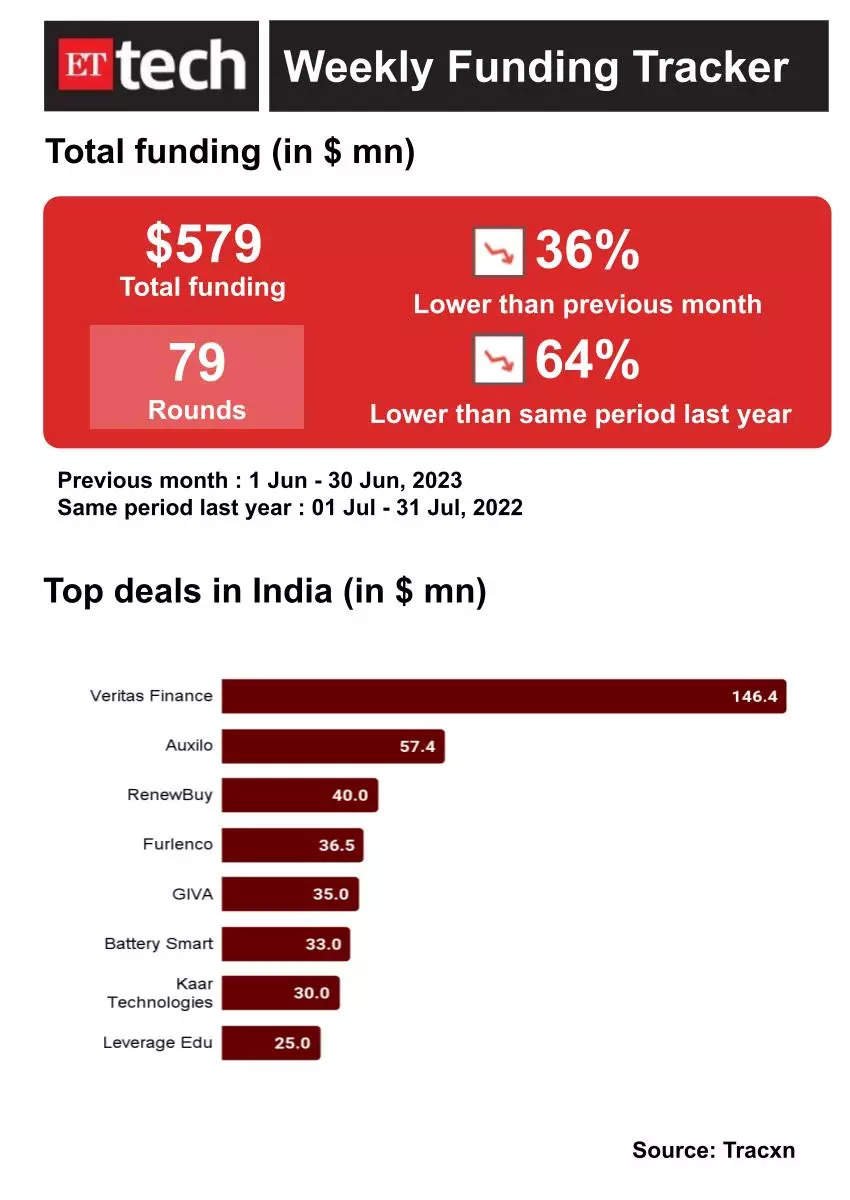

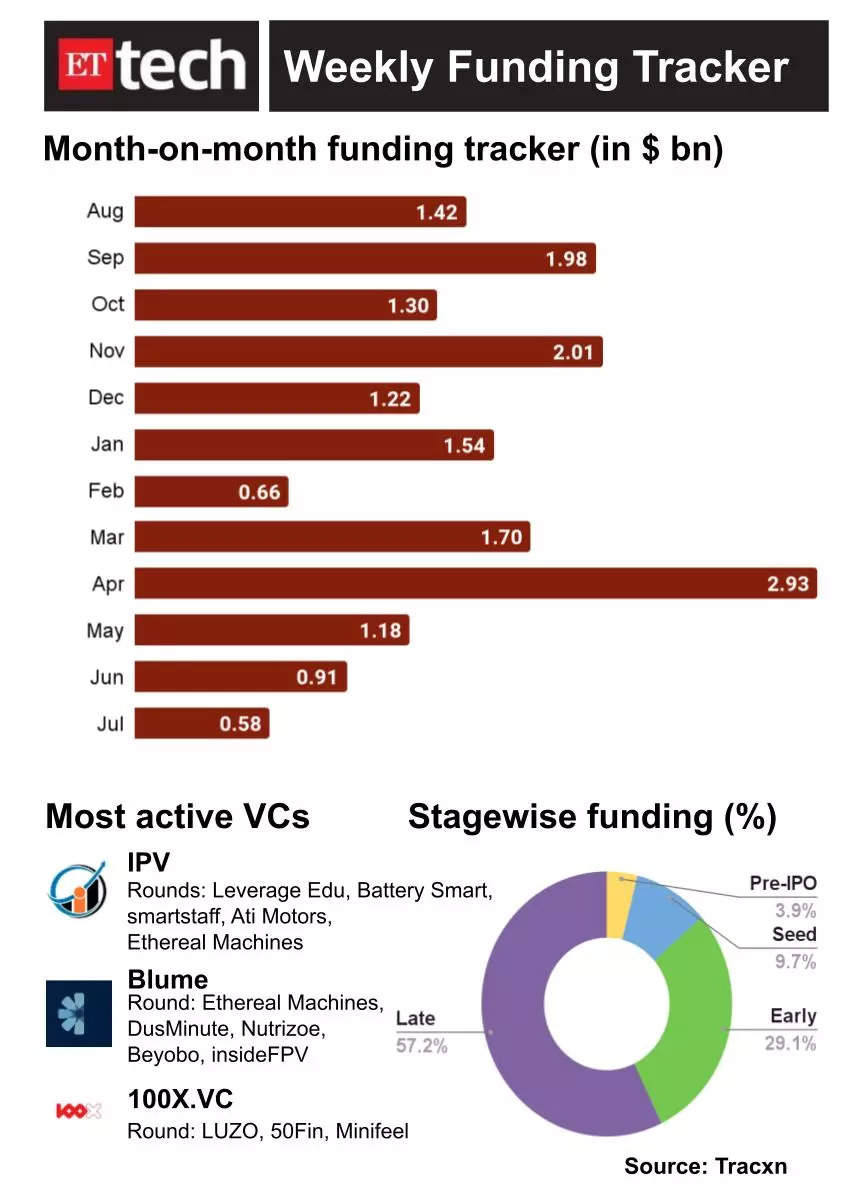

Venture capital funding in technology startups recorded the lowest monthly value in well over a year, with $579 million having been deployed across 79 funding rounds in July 2023.

This is an almost-64% plunge from the nearly $1.6 billion that venture capital firms had deployed across 270 rounds in July 2022.

Sequentially, the figure is down 36% from $909 million in June.

IT/Startup Hirings, Jobs

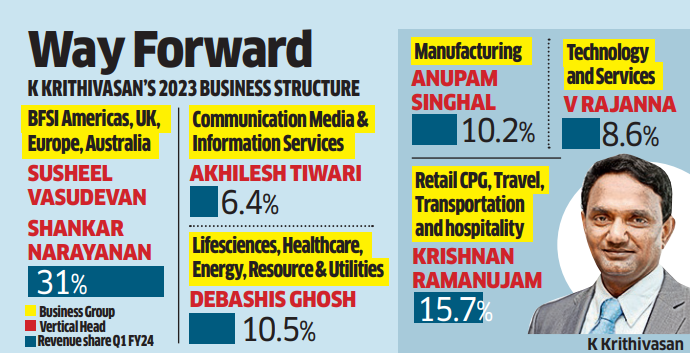

Experts applaud TCS’ return to vertical ops structure: Software giant Tata Consultancy Services’ decision to revert to its vertical-based operating structure could help it deal better with the larger macro-economic concerns the country’s information technology sector faces, according to analysts.

Used car startup Spinny lays off 300: Gurgaon-based used car startup Spinny has laid off around 5% of its workforce. This is part of a restructuring exercise that will also see its budget and luxury car offerings — Truebil and Spinny Max — being merged into the main Spinny platform.

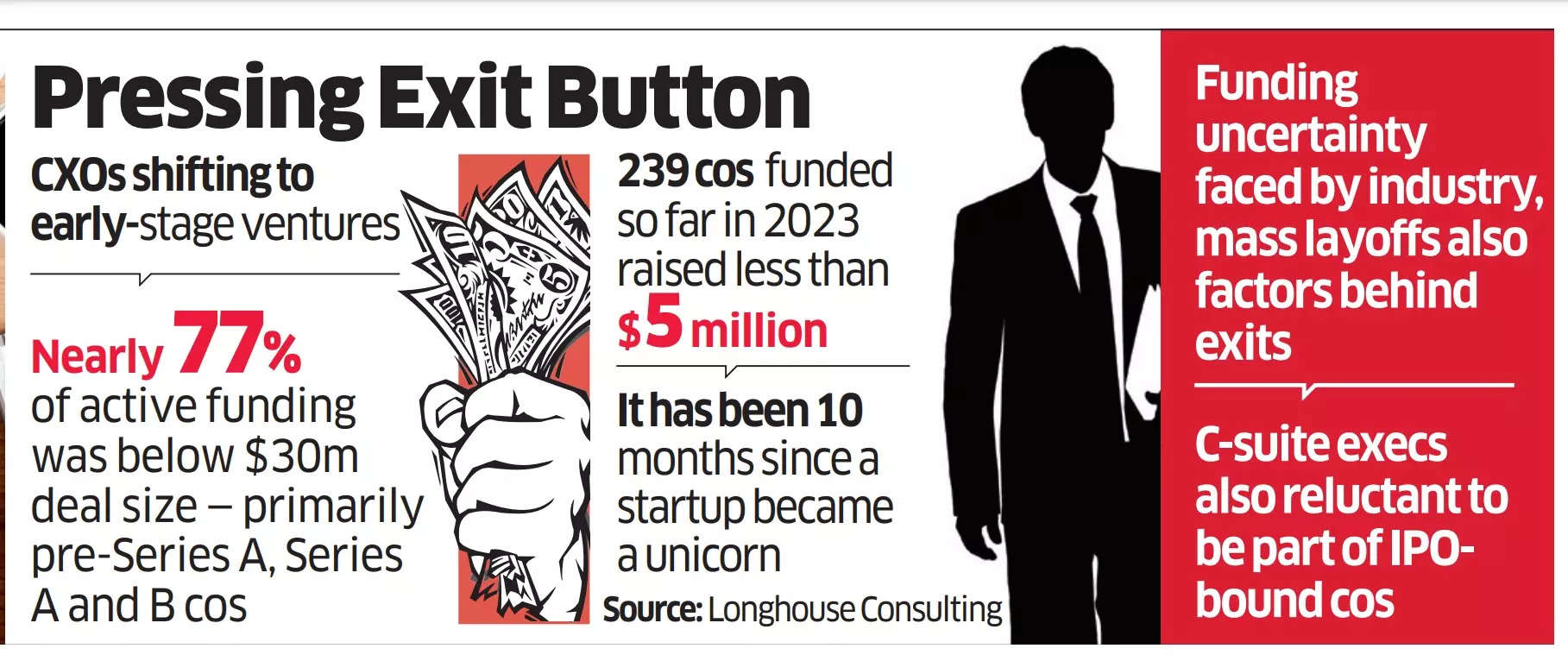

CXOs log out of unicorns to start their own ventures: The prolonged funding winter in the startup world is making several C-suite executives, who helmed trailblazing new-age companies in recent years, quit and set up their own companies, or join early-stage businesses that are attracting investments.

As funding winter bites, startup staff seek safer shores: As Indian startups cut costs and lay off staff to adjust to a harsh funding winter, headhunters say they are seeing a flood of CVs from nervous workers.