Credit: Giphy

Also in this letter:

■ RBI extends tokenisation of cards by 3 months

■ E-commerce firms eye larger pie with bigger packs

■ ETtech Deals Digest: India’s sixth SaaS unicorn of 2022

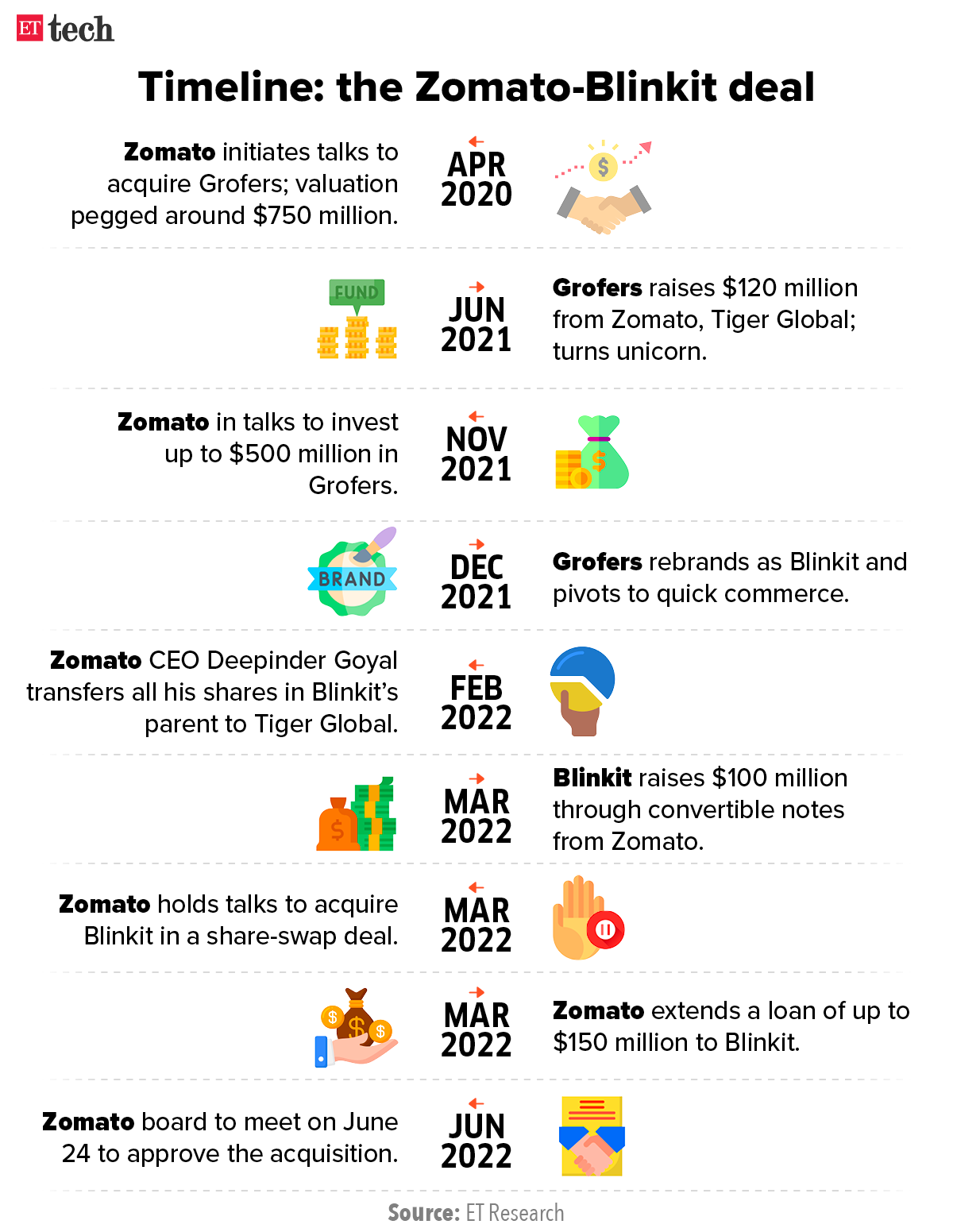

Zomato board approves Blinkit buy for Rs 4,447 crore

Zomato’s board of directors approved the acquisition of Blinkit (formerly Grofers), a quick commerce startup, in an all-stock deal at a board meeting held today, according to a BSE filing.

The deal – valued at Rs 4,447 crore or close to $570 million – is close to 43% lower than Blinkit’s last valuation of just over $1 billion. Blinkit turned into a unicorn last year following a $120- million funding from Zomato and Tiger Global.

Long-anticipated deal: The long-anticipated deal will help Zomato, which has been bullish on quick commerce, strengthen its position significantly in the buzzy, ultra-fast grocery delivery space.

While Zomato will enter into the sector at a time when it is replete with players, the sector is yet to show signs of turning profitable.

Earlier fundings: Last year, Zomato invested $100 million in the Gurugram-based quick commerce startup, acquiring a 10% share.

Earlier this year, Zomato announced that it had given Blinkit a loan of up to $150 million. Zomato Founder Deepinder Goyal claimed a portion of this money had been delivered to Blinkit during its first investor call since going public, and the rest would be released depending on whether it needed it or not.

Competitors and past plans: Zomato company will compete with well-funded players, including Swiggy’s Instamart, Zepto, Reliance Retail-backed Dunzo, and Tata-owned BigBasket.

Zomato has been trying to enter the quick commerce space and had twice dropped plans to deliver groceries online since the start of the pandemic in 2020.

Also read: Why nobody is talking about 10-minute deliveries anymore

RBI extends June 30 deadline for card tokenisation by 3 months

Citing issues related to implementation with respect to guest checkout transactions, the Reserve Bank of India has extended the deadline for tokenisation of cards by three months.

The RBI had earlier set a deadline of June 30, whereby merchants and payment aggregators had to delete all card details and replace it with tokens.

Nervous Merchants: Large online merchants are nervous about the readiness of the ecosystem to handle transaction and tokenisation volumes as they do not want payment disruptions for consumers.

Several large merchants had told ET they were unsure about the scalability of the payments network for tokenisation, as they feared disruptions in the payment experiences of consumers.

3 months to iron out issues: The RBI wants the stakeholders to use the time to get ready for handling tokenised transactions, processing transactions based on tokens and implementing alternate mechanisms to handle post-transaction activities.

It also wants them to generate adequate public awareness about creating the tokens and using them effectively during transactions.

Not many takers yet: The number of transactions processed using tokens is yet to gain traction across all categories of merchants.

Though creating tokens is voluntary for the cardholders, the central bank has encouraged cardholders to tokenise their cards for their own safety. However, those who do not wish to create a token can continue to transact by entering card details manually during the transaction.

What is tokenisation? Tokenisation entails replacing the card details by a unique code or token, allowing online purchases to go through without exposing sensitive card details. Till date, about 19.5 crore tokens have been created.

E-commerce firms eye larger packs for more returns

Online delivery platforms such as Blinkit, Swiggy Instamart and Dunzo are focusing on larger packs to drive higher returns per delivery as they say it leads to higher margins and bigger ticket sizes.

The bigger, the better: Company executives believe large packs also serve as a more convenient option for consumers.

Such a trend took off during the COVID-19-induced lockdowns and accelerated with surging in-home consumption of essentials and discretionary products.

Win-win for all: “It’s a win-win for both online platforms as well as companies,” said Mayank Shah, senior category head at biscuit maker Parle Products.

For e-commerce platforms, it leads to reduction in the number of deliveries and turns out more viable with better economics.

Firms are stepping up their efforts to make the most of the quick commerce industry that is expected to be a $5-billion market by 2025.

Piyush Goyal suggests ONDC should be made available in regional languages

In a meeting between Minister for Commerce and Industry Piyush Goyal and various industry stakeholders to review the progress of Open Network for Digital Commerce (ONDC), the minister suggested the network should be made available in regional languages.

Over 150 apps sign up: Thampy Koshy, chief executive at ONDC, told ET that over 150 entities have signed up with the network to integrate their apps, and all of them will be going live in the upcoming months.

Successful transactions: Seven companies have adopted ONDC protocols and built their own ONDC-compatible apps.

They have successfully completed cascaded transactions across the ONDC network during the pilot phase.

Robust policy needed: Goyal said the ONDC network needs to make a robust policy framework to build trust within the network.

Tweet of the day

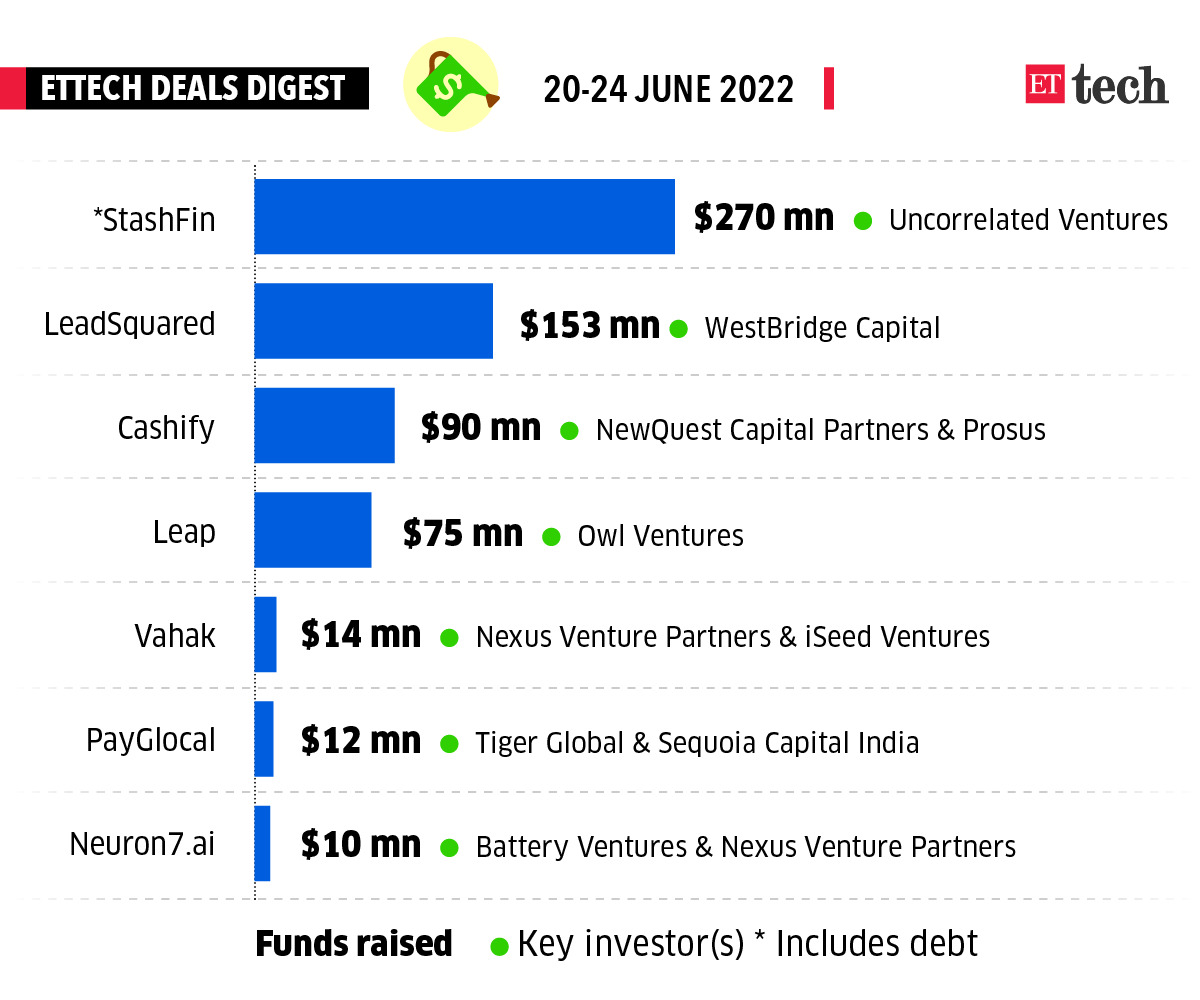

ETtech Deals Digest

SaaS startups continued their bull run this year as LeadSquared became the sixth such startup, and 16th overall, to join the unicorn club. The other startups that raised funds this week were neobank StashFin, and Cashify.

Here is a full list of all deals this week.

Today’s ETtech Top 5 newsletter was curated by Gaurab Dasgupta and Ruchir Vyas in New Delhi. Graphics and illustrations by Rahul Awasthi.