We also have a scoop on what’s next for Tata Neu and its post-launch strategy.

This and more in today’s packed edition ETtech Morning Dispatch.

Also in the newsletter:

■ CoinDCX raises $135m; valuation doubles to $2.15b

■ EV makers, related firms go on a hiring spree

■ Foxconn may double headcount at Chennai plant after labour unrest

Zerodha clocks 60% yearly jump in revenues, profits

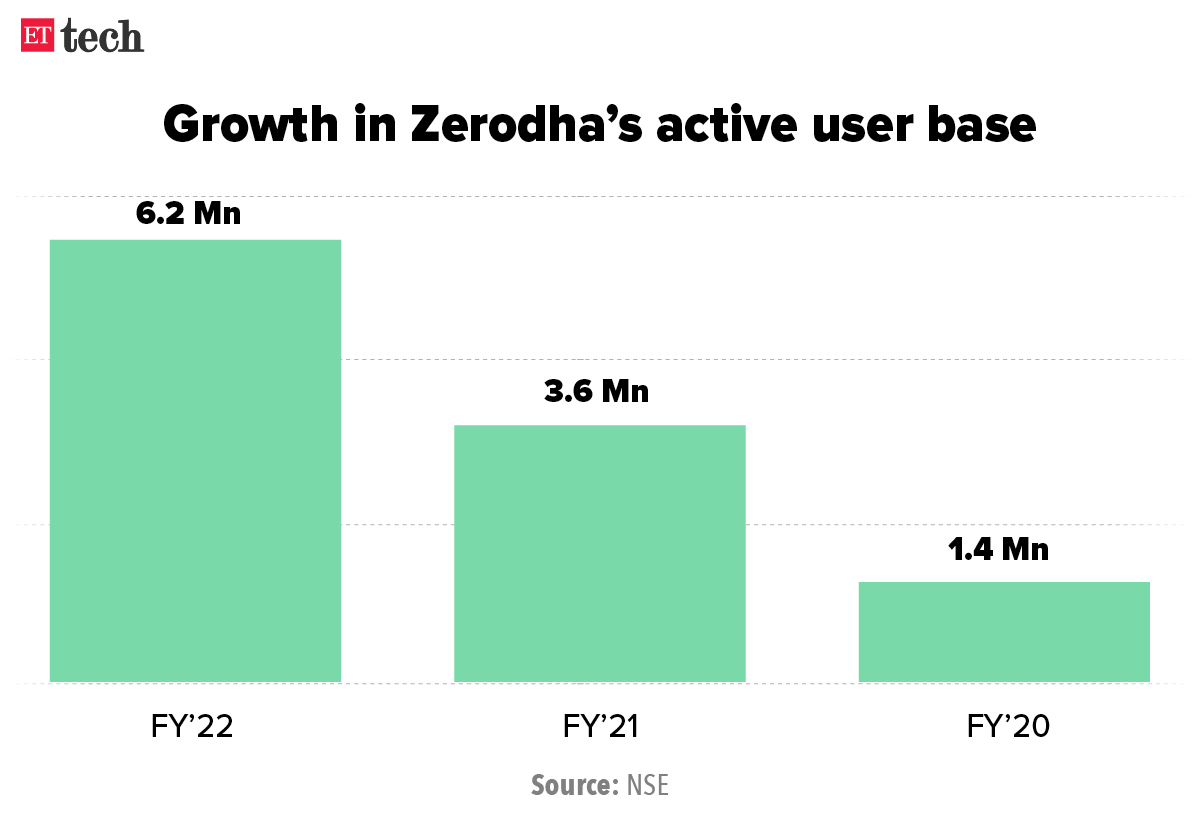

As Indian startups recover from the funding hangover and move towards ‘profitability’; Zerodha, India’s largest retail stock brokerage firm, continues its profit-making spree.

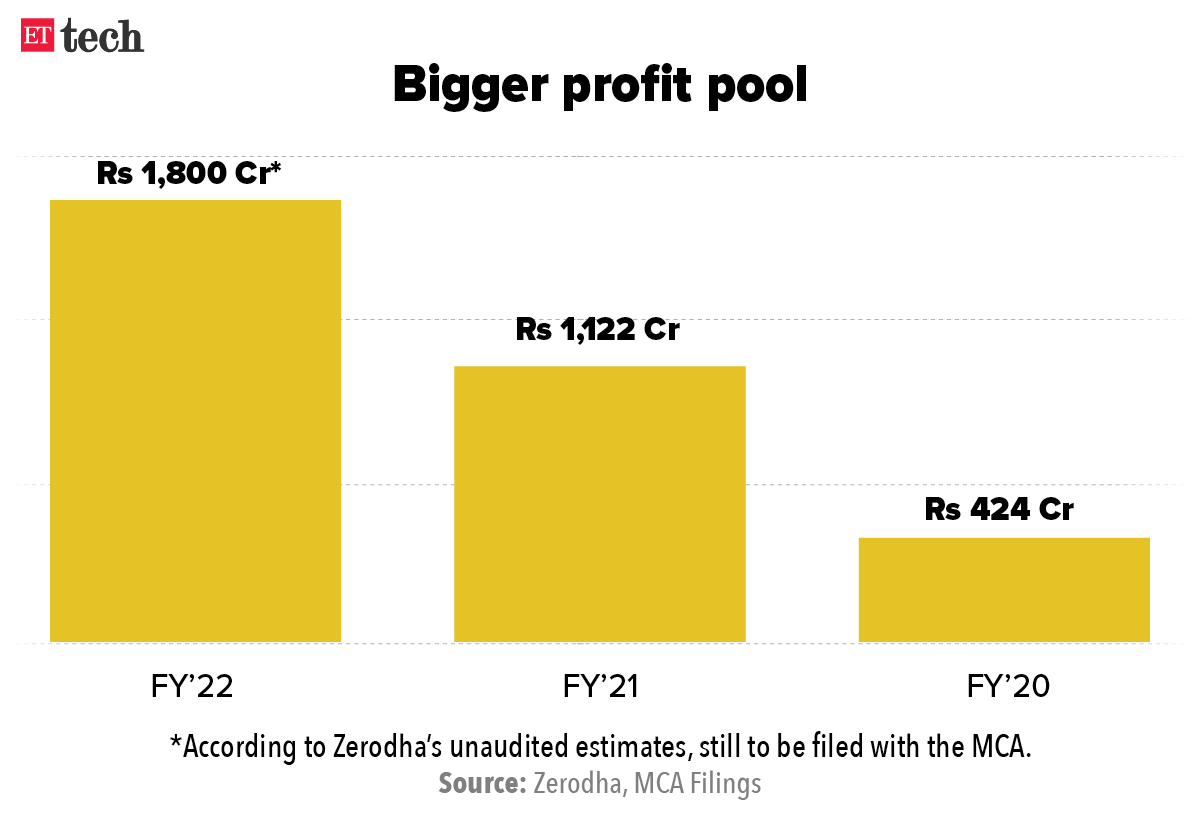

In an exclusive chat with ET, Zerodha’s founder and chief executive, Nithin Kamath, said the company has exited FY22 with revenues of roughly Rs 4,300 crore and profits of Rs 1,800 crore.

FY21 stats: Zerodha reported an overall revenue of Rs 2,729 crore in FY21, clocking a steep rise in profits at Rs 1,122 crore.

Downturn coming: Zerodha had a fabulous run last year with several initial public offerings (IPO) shoring up retail investor’s interest, Kamath said. But now the company is taking a ‘cautionary’ approach with a slowdown in public markets, and is preparing for a downturn amid a macro economic downturn.

Quote: “We might probably see degrowth in the next three-six months. I don’t see any company going for an IPO in the next few months.. apart from the LIC IPO,” Kamath said.

Tata Digital top brass takes stock of super app post-launch

You may have tried Tata Digital’s much-hyped super app Tata Neu by now. Even if you didn’t, we’ll tell you what’s in store. Last Thursday, we reported from Tata Neu’s first press conference in Mumbai, as its leadership team, helmed by top boss N Chandrasekaran, detailed the plan ahead.

The Tata Sons chairman met his top lieutenants post the event to discuss what’s next. Here’s what we found:

- A tech fix needed: Tata Neu, since its launch, has faced multiple issues but processing digital payments has been a big challenge. Chandra (as Chandrasekaran is popularly known) discussed this with his team, and the group identified it as something that’s now its priority. Some of the Tata brands, outside BigBasket and 1mg, are also relatively slower on the Neu app and the team is working to offer a native experience to users.

- Tech hiring: Tata Digital has already taken up an office space in Bengaluru’s HSR area (known for being a tech hub) and is looking to get a space in Gurugram–near 1mg’s office. Once finalised, these two centres will play an equally important role for Tata Digital’s tech talent away from Mumbai (the group’s headquarters).

- Logistics needs: Tatas are in talks with third-party logistics players for facilitating deliveries. The group wants it to be a unified approach rather than transact with individual businesses. BigBasket CEO Hari Menon is leading this project.

- Cultfit on Neu? That’s in the works, we hear. We are told Cultfit could be one such brand to come on to the Neu app. Tata group made a minority investment of $75 million in the fitness startup last year in June. Mukesh Bansal, founder of Cultfit, joined Tata Digital as its president as part of the investment.

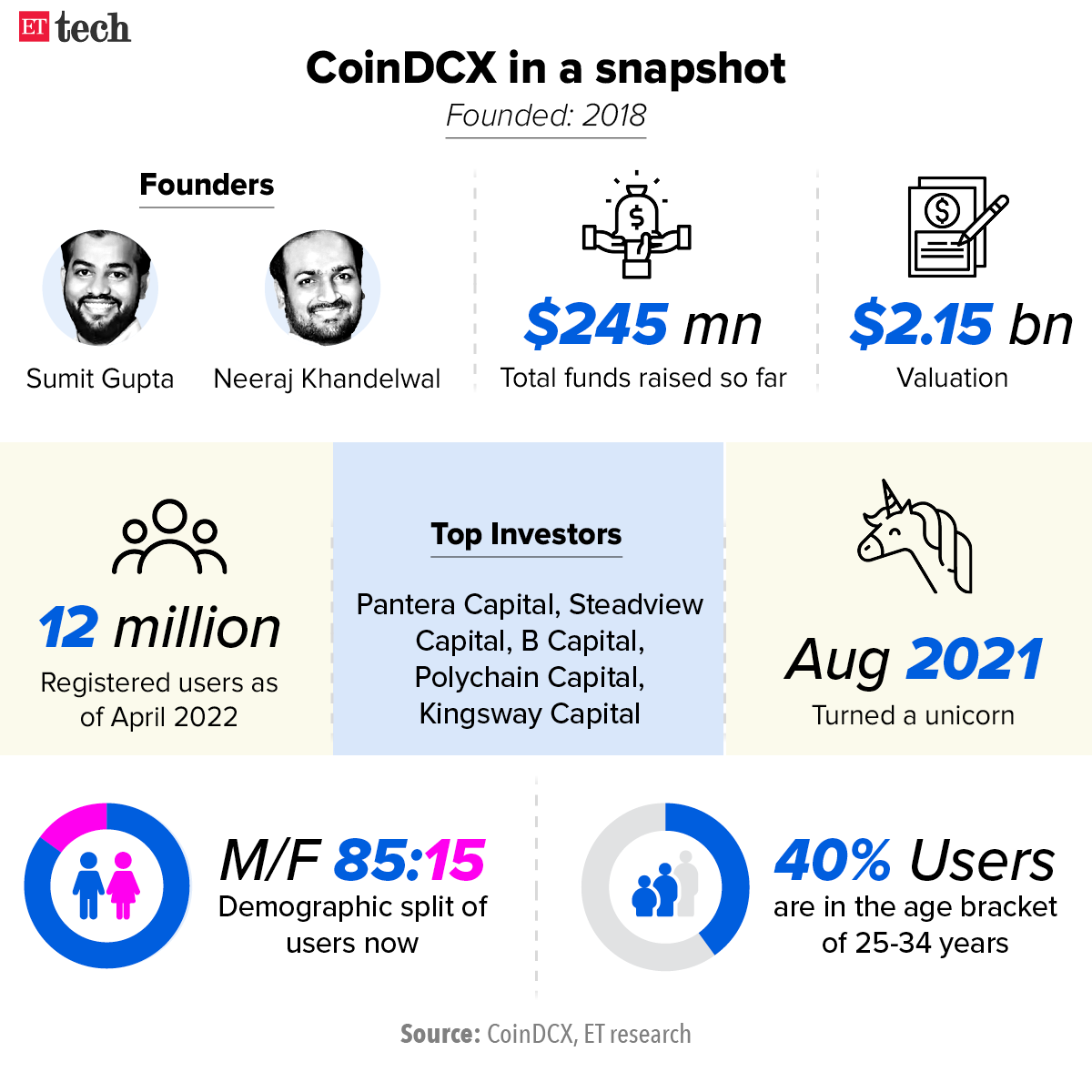

CoinDCX raises $135 million, doubles valuation to $2.15 billion

Crypto trading exchange CoinDCX has raised $135.9 million (about Rs 1,000 crore) from investors led by Pantera Capital and Steadview Capital, doubling its valuation to $2.15 billion in less than a year to become the most valued crypto trading platform in India

What will the funds be used for?

- To increase its headcount to over 1,000 by the end of next year from 400 now.

- It plans to hire across functions, including engineering, product and compliance.

- The company will invest in education and build an innovation centre to develop products in the web3 space.

- It will also invest in education initiatives, including building more vernacular content and scaling the DCXLearn platform.

Context: The funding comes against the backdrop of crypto exchanges facing newly introduced taxation rules in India. CoinDCX and its peers, like WazirX and CoinSwitch Kuber, have seen their volumes plummet to new lows this month due to restricted access to modes of depositing money for users.

EV makers, related firms on a hiring spree

Electric vehicles and related companies are on a hiring spree, ramping up their teams across domains amid rapid capacity expansion and setting up of new plants to meet rising demand for EVs.

Hiring to grow: Hiring in the sector is likely to grow by 20-25% in the next 6-12 months. The average growth in employee numbers in the EV industry stands around 110% in the last two years, 35% in the last one year and 15% in the last six months, according to data from staffing company Ciel HR Services based on a survey of 50 companies.

Quote: “We are seeing a significant uptick in hiring in the entire EV ecosystem, which includes EV manufacturers, component and battery manufacturers as well as the charging and swapping infrastructure and vehicle maintenance infrastructure,” said Aditya Narayan Mishra, chief executive officer of CIEL HR Services, which is currently running 800 such mandates.

Design challenges: The EV industry faces a range of design challenges due to its dependency on electrical components and software complexity. Design teams need to be well equipped with necessary skills as one cannot outsource embedded systems, software and power electronics that are all core to designing EVs. These complexities demand domain knowledge and advanced technical know-how, industry experts said.

Foxconn to double Tamil Nadu headcount as Apple orders rise

Foxconn, the Taiwanese contract phone maker for Apple, is looking to nearly double its headcount for its Chennai plant in the wake of higher orders from Apple, said people familiar with the development.

The rising domestic demand: The iPhone maker has received government’s clearance for denotifying 40 acres inside their plant premises near Chennai, which would allow the company to sell locally.

A little over 10,000 employees have returned to the company-provided accommodations, of the total 15,000 workers. Apple’s higher orders for Foxconn come amid the current Covid-induced lockdowns in China.

Going forward: Foxconn’s is looking to scale investments in India and is in line with other Taiwanese companies which are eyeing other Southeast Asian countries, apart from China, to expand their manufacturing footprint, foreign policy expert Sana Hashmi told ET.

Peps on the block for $130-150 million

Mattress maker Peps Industries is in talks with Rajeev Gupta-led Arpwood Capital for a complete sale of the company, valuing it between $130 million and $150 million, said three people with knowledge of the company’s plan.

Talks held: Coimbatore-based large brick-and-mortar company has also held talks with new-age sleep solutions companies such as Wakefit and The Sleep Company for a strategic partnership, but the talks did not materialise owing to the high valuation ask. Meanwhile, Peps Industries denied that it is looking for a buyer. “Peps India is a growing company and a market leader in the spring mattress category. We deny any speculation around the company buyout,” it said in response to ET’s query.

ETtech Done Deals

■ SpiceJet promoter Ajay Singh has in his personal capacity invested in healthcare startup Flebo which provides sample collection services to medical diagnostic labs, a statement said on Monday.

■ Expertia AI, deeptech virtual recruitment platform, has raised $1.2 million in a funding round led by marquee investors Chiratae Ventures and Endiya Partners with participation from Entrepreneur First and angel investor Archana Priyadarshini.

Other Top Stories By Our Reporters

India will have over 250 unicorns by 2025, says report: India is expected to birth more than 250 unicorns or privately held startups with $1 billion valuation or above, by 2025, according to the latest report from investment fund Iron Pillar. This comes on the back of a record 43 Indian startups entering the unicorn club in 2021, what stood out as a seminal year for the domestic ecosystem.

Microsoft joins Udaan’s debt funding round: Microsoft Corporation has joined Udaan’s debt financing round of over $200 million, according to a note sent to employees by Aditya Pande, CFO of the business-to-business (B2B) ecommerce company. With this, Udaan has now raised a total of $225 million through convertible notes.

Rivals Swiggy, Zomato back UrbanPiper in a $24 million funding round: UrbanPiper, a restaurant management platform, has raised $24 million in a new round of funding led by existing investors Sequoia Capital India and Tiger Global, as well as food aggregator giants Swiggy and Zomato. This is the first time that both of these food-delivery giants have together invested in a startup.

Former Twitter India head finds Musk’s takeover bid ‘attractive’: Billionaire Elon Musk’s offer to buy Twitter is not driven by possible monetary benefits but his desire to fix things at the microblogging platform, feels Manish Maheshwari, former head of Twitter India and now founder and CEO of edtech firm Invact Metaversity.

Global Picks We Are Reading

■ More Startup Layoffs Are Coming as Investors Push Founders to Conserve Cash (The Information)

■ NATO Cyber Game Tests Defenses Amid War in Ukraine (The Wall Street Journal)

■ Elon Musk wants a free speech utopia. Technologists clap back (The Washington Post)

Graphics and illustrations by Rahul Awasthi.