Then the pandemic hit and governments cut colossal stimulus cheques, sending stock and crypto markets on the ride of their lives.

As bitcoin surged to new heights in 2020 and 2021, a few companies began adding bitcoin to their balance sheets as a hedge against inflation.

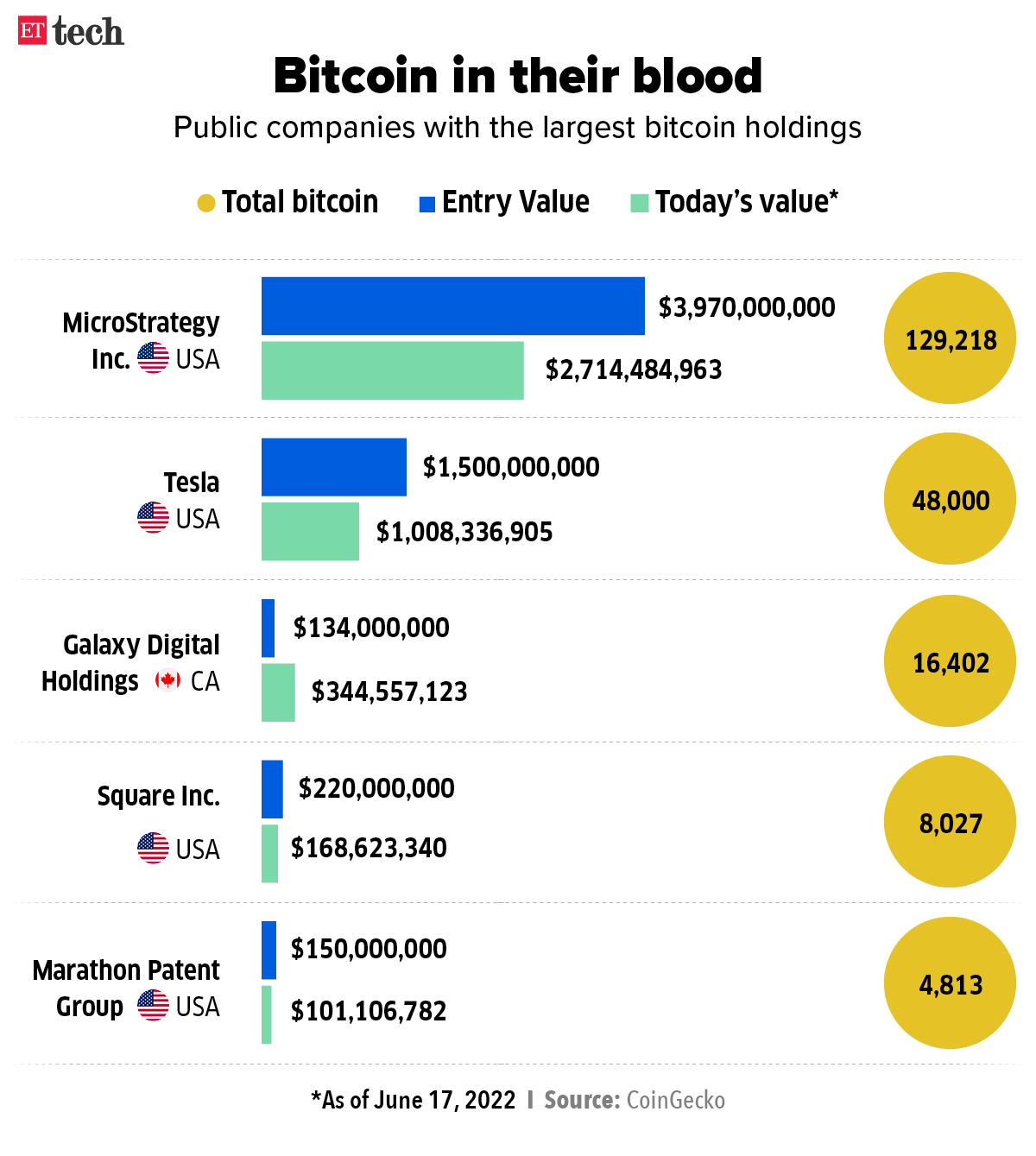

According to CoinGecko, 27 publicly traded companies own about 225,413 bitcoin, or 1.18% of the total supply. They are worth around $4.6 billion at current prices.

Public companies

The first public firm to sense the opportunity at the start of the pandemic was Galaxy Digital Holdings, a Canadian crypto-focused merchant bank founded in January 2018.

Founder Michael Novogratz said in an interview in April 2020, just after the US announced additional stimulus measures: “Bitcoin has this moment right now. Just today we had another trillion dollar stimulus — money growing on trees, and my mother taught me when I was younger that money doesn’t grow on trees.”

Because it acted quickly, Galaxy Digital is still up on its investment even though bitcoin, which was a hair’s breadth from $70,000 in late 2021, is back around $20,000.

The company paid $134 million for its 16,402 bitcoins, which are now worth around $340 million.

The second company to jump on board in 2020 was cloud software firm MicroStrategy, which bought $425 million worth of the crypto asset in August and September.

After continuing its buying spree throughout 2021, the company adopted bitcoin as its primary reserve asset, effectively turning its stock into a mock bitcoin ETF.

Microstrategy is currently the largest owner of bitcoin with 129,218, or 0.615% of the total supply. Its $4 billion investment in the crypto asset is now worth about $2.7 billion.

Earlier this week, CEO Michael Saylor denied rumours that the company would have to liquidate some of its bitcoin holdings to meet a margin call for a bitcoin-backed loan if the cryptocurrency’s price fell below $21,000.

Jack Dorsey’s payments company Square (now called Block) took the plunge in October 2020 with a $50 million purchase of bitcoin. Its Q4 2020 earnings revealed it had picked up another $170 million worth.

Dorsey, an enthusiastic advocate for bitcoin, stepped down as Twitter CEO in December 2021 to focus on the payments company. A week later he changed its name from Square to Block, a reference to the blockchain technology underpins crypto.

The 8,027 bitcoin it paid $220 million for are currently worth about $165 million.

Four months later, Elon Musk’s Tesla announced it had bought $1.5 billion worth of bitcoin, splashing a significant portion of the $19 billion cash on hand it reported at the end of 2020.

Tesla sold 10% of its Bitcoin holdings in Q1 2021. Musk said this was “to prove liquidity of bitcoin as an alternative to holding cash” on Tesla’s balance sheet.

The company now owns 48,000 bitcoin, or 0.229% of the total supply, putting it second behind MicroStrategy.

Marathon Patent Group rounds up the top five with 4,813 bitcoin. Its $150 million investment is currently worth just under $100 million.

Private companies and governments

Private firms own roughly 174,068 bitcoin, or about 0.829% of the total supply, according to River.com. Chinese firm Block.one is the largest private owner with 140,000 bitcoin, or 0.667% of the total supply – more than any public company.

Governments across the world own an estimated 259,870 bitcoin, representing 1.237% of the total supply.

Written by Zaheer Merchant

Top Stories By Our Reporters

Sequoia closes largest India and SEA startup fund at $2.85 billion

Sequoia Capital has raised $2.85 billion to deploy across startups in India and Southeast Asia, the largest dedicated corpus for the region by a risk investor. It will invest $2 billion across its India venture and growth investments, while the remaining will go to Southeast Asian companies.

The development comes after Sequoia recently told its Limited Partners (LPs), or sponsors in the fund, that it had decided to postpone the close of its latest fund amid an investigation at one of its portfolio firms, as we reported on May 18.

Earlier, Sequoia Capital had shot off a note to its portfolio companies, saying it has stopped working with law firm Algo Legal post an investigation at one of its investee firms, multiple people who have received the email told us.

Digital payments

RBI shoots down proposal on digital-only banks

The Reserve Bank of India has shot down the idea of full-stack “digital-only banks” as they pose risks to the system, governor Shaktikanta Das hinted on Friday. Das, who was speaking at an event in the financial capital, said that there was no proposal at the moment to regulate so-called neobanks.

Banks, payment aggregators press ahead with tokenisation but concerns remain: Indian banks and payment aggregators are pressing ahead with plans to tokenise cards, and are exploring ways to route digital transactions through these tokens so that card-based transactions are not affected from July 1, multiple sources told us.

RBI lifts Mastercard curbs: Meanwhile, the RBI lifted business restrictions it imposed on Mastercard almost a year ago, saying the firm had achieved “satisfactory compliance”. In July 2021, the regulator had barred Mastercard from onboarding new customers for not complying with its circular on the storage of payments data.

Extend tokenisation deadline to June 2023: former RBI panel member: Aruna Sharma, a former member of the Reserve Bank of India’s digitisation committee, has called for extending the deadline to implement the central bank’s new card storage guidelines to June 2023. The rules are set to come into effect by the end of this month.

Ecommerce corner

Amazon India bets on local stores, social commerce

Manish Tiwary

The Indian arm of US ecommerce major Amazon will increase its focus on local stores and social commerce to tap the “next 500 million consumers” in India, Manish Tiwary, country manager, India consumer business at Amazon India, said.

Ecomm policy should apply equally to Indian, foreign firms, says parliamentary panel: The Indian government should address ecommerce concerns related to antitrust, deep discounting and preferential treatment of sellers regardless of whether the platform in question is Indian or foreign-owned, a parliamentary panel on ecommerce has said.

Udaan on track to hit positive unit economics, CEO tells staff: Vaibhav Gupta, CEO of business-to-business (B2B) ecommerce firm Udaan, has told his staff in an internal note that the company was able to hit a positive contribution margin in the last quarter of FY21 and was on track to become unit economics-positive in the June quarter of 2022.

Cryptoverse

Coinbase sacks 8% of India workers after vowing to triple team

Coinbase, the largest US crypto exchange, has sacked about 8% of its India workforce just two months after announcing plans to triple its team in the country. Pankaj Gupta, the company’s vice president of engineering, said on Twitter on Wednesday,

WazirX, CoinSwitch Kuber, CoinDCX urge NPCI to restore UPI services: Top cryptocurrency exchanges including CoinSwitch Kuber, WazirX and CoinDCX have asked the National Payments Corporation of India (NPCI) to restore Unified Payments Interface (UPI) services for crypto companies.

Tech policy

India seeks global action to counter VPNs, encrypted messaging and crypto

.jpg)

India is seeking global action to counter the use of a slew of technologies including virtual private networks, end-to-end encrypted messaging services, and cryptocurrency by terrorists, sources told us, mirroring its domestic stance on these issues. In their suggestions to members of an Ad Hoc committee of the United Nations, Indian officials said, “the anonymity, scale, speed and scope offered to (terrorists) and the increasing possibility of their remaining untraceable to law enforcement agencies” by using these technologies remains one of the major challenges before the world.

Govt bans VPN for employees: The government has barred its employees from using third-party virtual private networks (VPN) services offered by companies such as Nord VPN and ExpressVPN.

Govt plans to expand Aadhaar’s ambit from birth to death: The Unique Identification Authority of India, which has enrolled nearly all of India’s adult population in Aadhaar since its launch in 2010, is now looking to expand its ambit to cover a person’s entire lifecycle from birth to death.

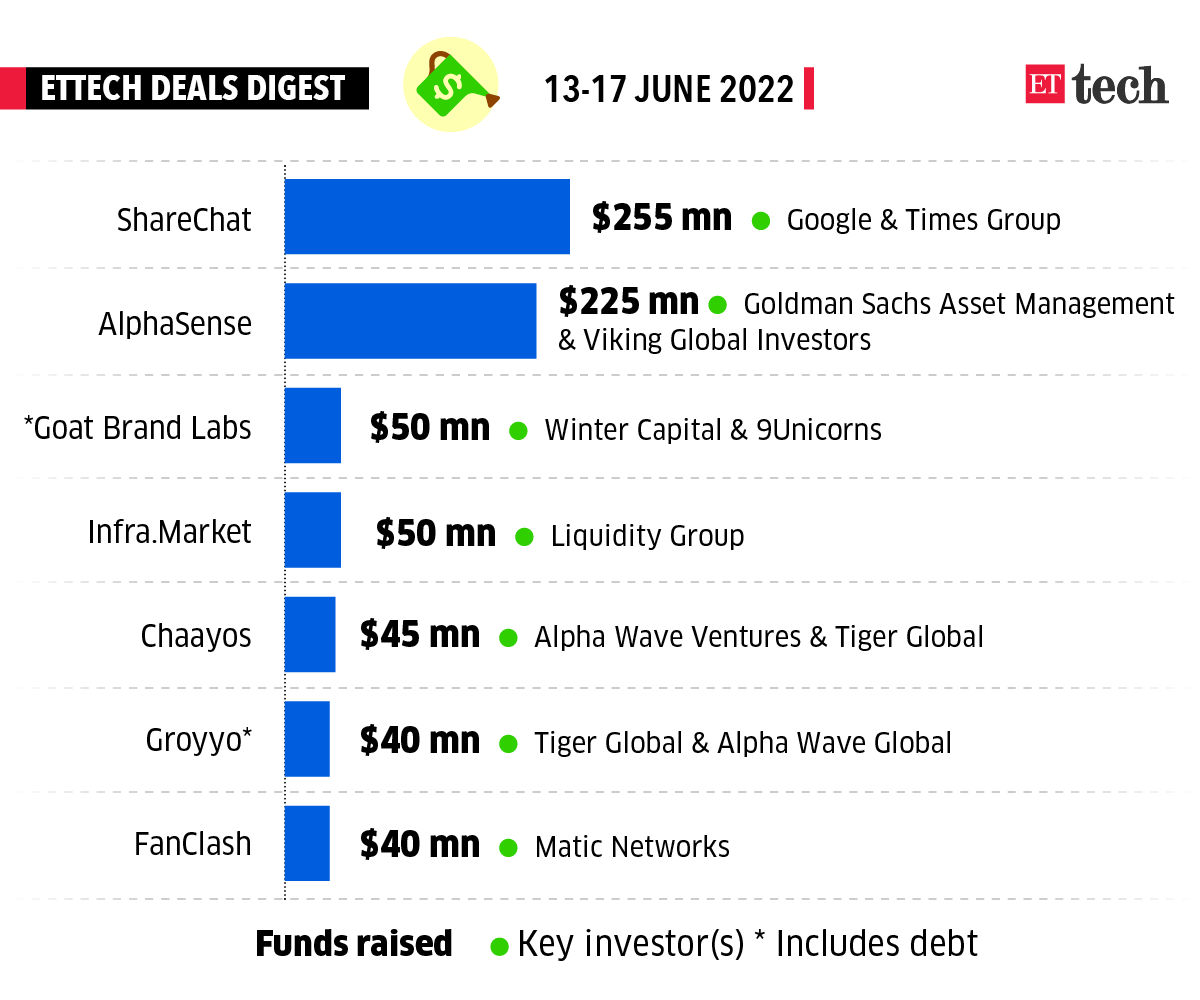

ETtech Done Deals

■ Mohalla Tech, which owns Indian-language social media network ShareChat and short-video platform Moj, has raised $255 million (Rs 1,990 crore) in a fresh round of funding from Google and the Times group.

■ South Korean game developer Krafton Inc, creator of the popular PlayersUnknown Battlegrounds (PUBG), plans to invest $100 million or more in Indian startups this year, its chief executive told us.

■ Logistics aggregator Shiprocket said it has acquired a majority stake in direct commerce-focused logistics player Pickrr in a cash-and-stock deal, valuing it at around $200 million.

■ Early-stage venture capital firm 8i Ventures said on Monday it has made a partial exit from its seed investment in financial infrastructure startup M2P Fintech for a more than 36-fold return on its investment.

The IT corner

Record US inflation to drive more business for top Indian IT firms

Top software services firms such as Tata Consultancy Services (TCS), Infosys and Wipro are expected to gain from a cost optimisation-led increase in outsourcing work to India, analysts told us, as inflation concerns loom large in the United States.

Fancy avatars and hot-desking: hybrid work is playground for modern tech: Startups developing future work models have been getting rather creative of late. Video chat platform Gather has imagined a work life where employees’ digital avatars become an extension of their identities as they sit out of a virtual cubicle in a virtual office setting.

Middle East presents next big opportunity to Indian IT firms: The Middle East is emerging as an important destination for Indian IT companies as countries in the region step up digitisation initiatives. Saudi Arabia alone presents a potential $500 billion opportunity, according to industry estimates.

Infosys setting up four new offices in tier II cities: Infosys is setting up four new offices in tier II cities to be closer to the available talent pool, Krishnamurthy Shankar, group head of human resource development, told us.

Startup Inc

Indian company boards are getting younger thanks to startups

The boards of Indian companies are getting younger as startup culture catches on. More than a third of people who got a director identification number (DIN) in the last fiscal year were aged 30 or younger, data from the Ministry of Corporate Affairs (MCA) showed.

Startups look to accelerate hiring of women in product, tech roles: Even as the war for talent continues and roles in technology and product command a premium, a host of new-age companies are prioritising moving the needle on their diversity numbers. According to Nasscom data, women constitute 35% of India’s technology industry.

Google launches accelerator for women-led Indian startups: Google has launched a cohort-based accelerator programme for women-led startups in India. Called the Google for Startups Accelerator Women Founders Programme, it aims to boost female entrepreneurship in the country.