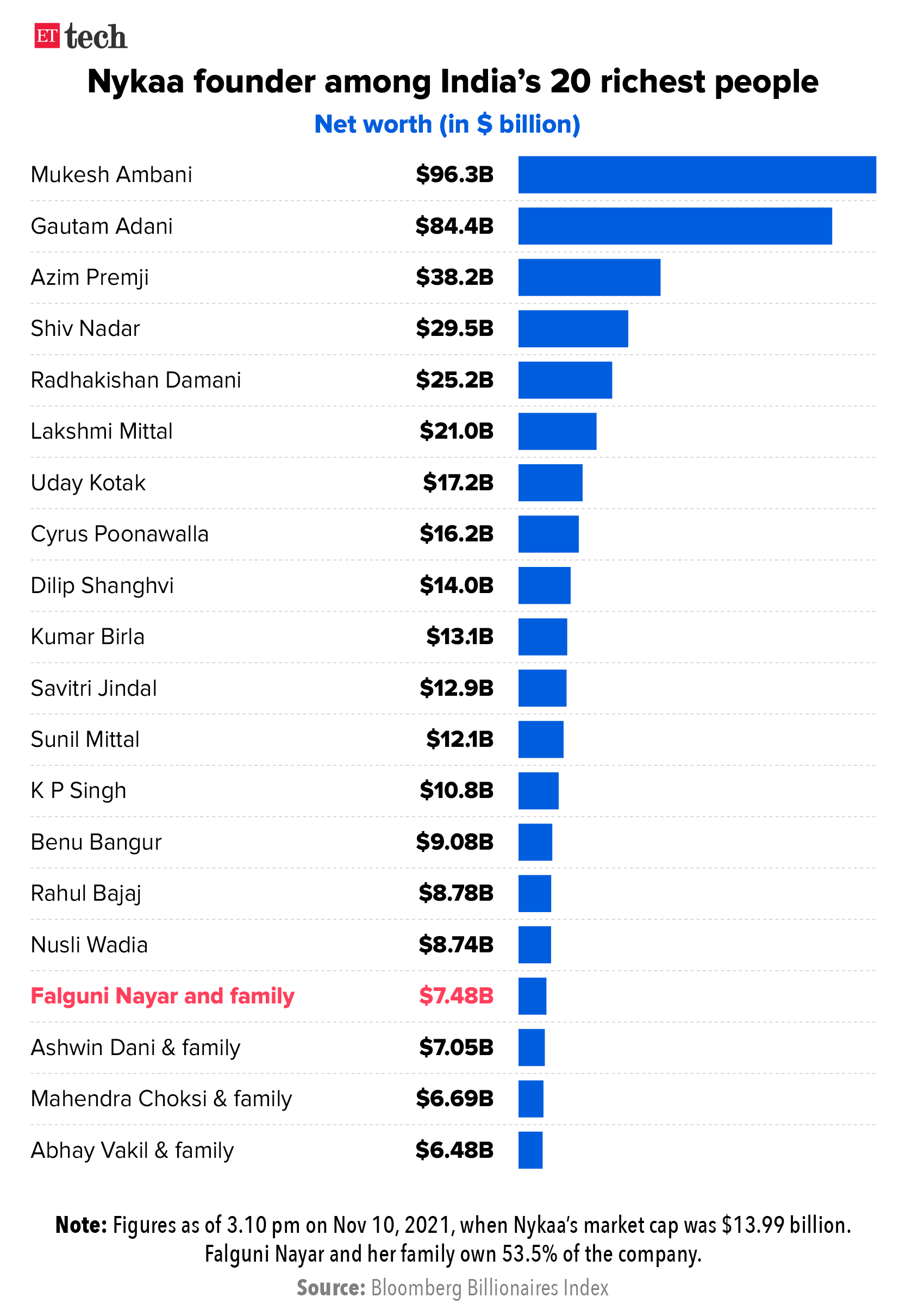

In the process, she has become the richest self-made woman in India, is among the country’s 20 richest people, and is worth more than her peers who have either listed their startups or are in the process of doing so. (All of these people are men, save for Savitri Jindal — the richest woman in India — and Mobikwik cofounder Upasana Taku.)

ETtech

ETtech

ETtech

ETtechHow did she get here? Well, on her own.

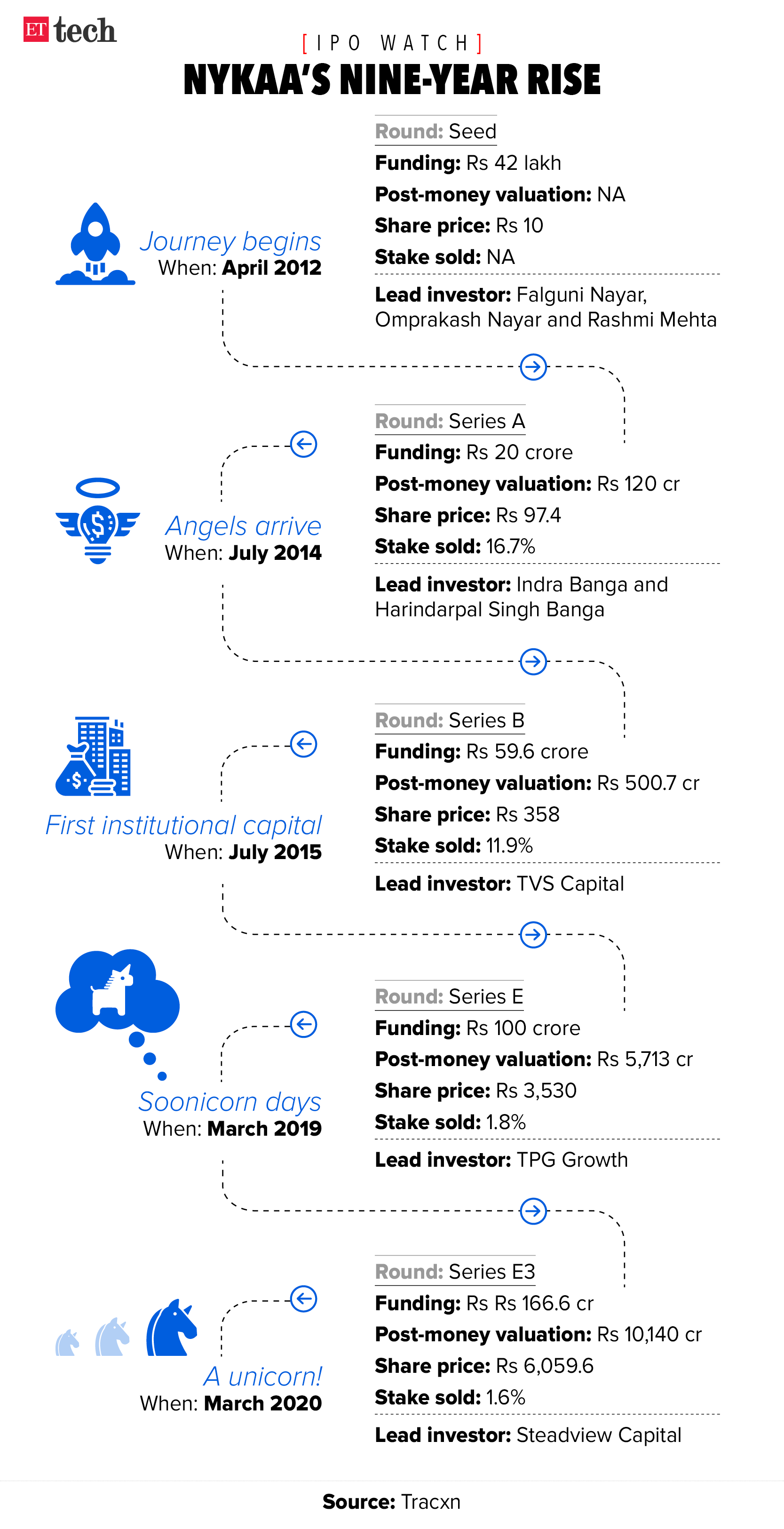

Nykaa, in its early years, was funded entirely by Falguni Nayar and her husband Sanjay Nayar, chief executive of private equity major KKR & Co in India. The focus was on building an inventory-led business, as she said

in a 2017 interview with The Economic Times.

“The company ran on family funds for two years because I didn’t want to raise money. I wanted to make the metrics happen,” Nayar had said then. “We had good momentum by the time I went to investors. We had access, since my husband and I were both bankers.”

The company turned unicorn only in March 2020, after just five rounds of funding — of which only three involved institutional investors. Nykaa is also profitable — a rarity among Indian startups.

ETtech

ETtech

Pre-Nykaa days

A graduate of the Indian Institute of Management, Ahmedabad, Nayar spent a bulk of her career at Kotak Mahindra Capital Co. When she left in 2012, she was the managing director and head of its institutional equities business.

Born and raised in a Gujarati family, her father ran a small bearings company, assisted by her mother. The household chatter revolved on investments, the stock market and trade. “Plus, I’m Gujarati,”

she said in a 2017 interview. Entrepreneurship, it seems, was in her blood.

Building Nykaa

For any business, the first year is a honeymoon period — it is easy because you are just designing. The next year, when business starts scaling up, is crucial, Nayar said in the 2017 interview. “The person heading operations couldn’t cope with 30 orders a day and quit. We had to learn how to dispatch packages and set up an enterprise resource planning system,” she said.

Today, Nykaa is among a few profitable etailers in India. It reported a net profit of Rs 61.96 crore in the fiscal ended March 31, compared to a net loss of Rs 16.34 crore in the year-ago period. Revenue grew 38% year-on-year to Rs 2,453 crore in FY21.

Tier II and III cities are driving growth in the post-pandemic era. According to a source aware of its metrics, non-metros have seen a sharper rebound in demand than metros. In its DRHP, Nykaa has said Tier II and III cities contributed 64% of revenue in FY21 compared to 59% in FY20.

To be sure, the company has diversified as well — from selling third-party beauty products to launching its own brands and entering the fashion business. Fashion is now 20% of overall sales. While its private labels are growing, they are still relatively small.

“Being an omnichannel retailer helped us during the Covid-19 crisis,”

Nayar told ET during the peak of the pandemic last year. “We now have 70 stores in 30 cities across the country. We basically pivoted our website to also do hyperlocal deliveries for essential products, but only from our stores.”

In the fiscal ended on March 31 2021, Nykaa’s gross merchandise value (GMV)—the total value of merchandise sold over a given period of time—jumped more than 50% to almost Rs 4,046 crore.

IPO and listing

FSN E-Commerce Ventures, the parent company of India’s biggest cosmetics etailer Nykaa,

launched its IPO on October 28 to raise as much as Rs 5,352 crore by offering shares in a price band of Rs 1,085-1,125 apiece. The issue was

subscribed nearly 82 times.

On Wednesday, Nykaa listed at nearly 80% premium and ended the day 96.15% higher than its issue price at Rs 2,206.70 — that translated to a market cap of Rs 1,04,360.85 crore on day one. The Nayar family’s net worth is more than half of that.

“I started Nykaa at the age of 50 with no experience. I hope the Nykaa journey can inspire each of you to be the Nykaa (heroine) of your lives,” Nayar said at the opening bell.