Also in the letter:

■ Stock broking startups eye lending, payments to expand revenue

■ Tatas line up over Rs 7,600 cr to fund electronics business

■ Krithivasan to take charge as TCS CEO

Now that WhatsApp means business, SMEs hurting

Meta-owned WhatsApp is set to implement a new pricing regime for business messaging, a move that will hit millions of small and medium enterprises that rely on the app to market their products.

Driving the news: WhatsApp’s new pricing policy for business messaging effective from June 1 is likely to trigger a sharp increase in marketing costs for small businesses. WhatsApp will now charge businesses Rs 0.3082 for every utility message while marketing messages will cost Rs 0.7265. Previously, WhatsApp charged a flat Rs 0.48 per conversation.

Why does it matter? Business owners pointed to the burden of increased costs for both customer acquisition and retention from the new pricing model. WhatsApp has grown to become one of the key channels that brands use for sales, customer support and client engagement, experts told ET. Brands like Sleepy Owl Coffee said, they will focus on Google, Instagram and Facebook while WhatsApp will be used more “cautiously and judiciously” going forward.

Quote, unquote: “We depend a lot on WhatsApp and despite the price increase, we have to factor it in because we are so used to it and our customers find it to be the easiest channel to stay in touch with us,” Sujata and Taniya Biswas, co-founders of textile and saree brand Suta, told ET.

What’s in it for Meta? WhatsApp for Business is among the most promising monetisation opportunities for Meta CEO Mark Zuckerberg. India, with nearly 500 million users, is the biggest market for the app. At the end of 2022, WhatsApp for Business downloads had crossed 300 million in India. More than 40 million users view the business catalogue in the app monthly.

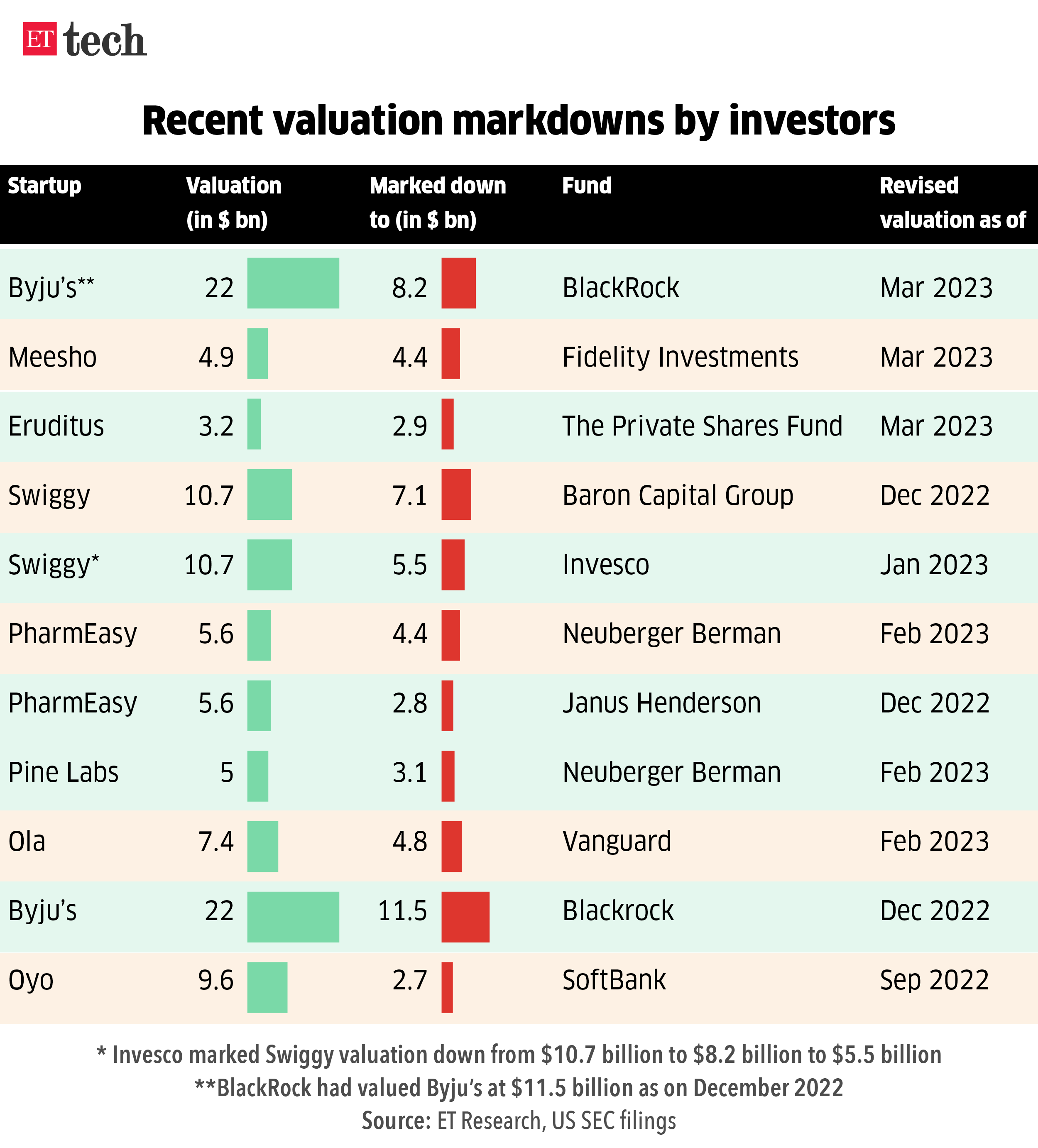

BlackRock slashes Byju’s valuation to $8.2 billion; Meesho’s valuation cut to $4.4 billion

BlackRock has again slashed edtech major Byju’s valuation, this time to $8.2 billion; down 62.7% from $22 billion when it last raised fresh capital.

Driving the news: The world’s largest asset manager, BlackRock, has further marked down the valuation of edtech firm Byju’s, three months after it first reduced the value of its holdings in the Indian company.

Details: In a regulatory filing with the US securities watchdog for the quarter ended March 31, 2023, BlackRock pegged the value of Byju’s at about $8.2 billion, which is 62.7% lower than $22 billion — the valuation ascribed to the company at the time of its last fundraise in October 2022. BlackRock owns less than 1% in the firm.

In February this year, a fund managed by BlackRock had cut the value of its investment in Byju’s by nearly 50% to $2,400 per share in its annual report for the year ended December 2022, putting the valuation at about $11 billion.

Vidit Aatrey, CEO, Meesho

Fidelity cuts Meesho’s valuation: According to regulatory filings with the US Securities and Exchange Commission (SEC), funds managed by US-based Fidelity, cut Meesho’s valuation by 10% to $4.4 billion as of March 31 from $4.9 billion in September 2021, when they had invested.

Recent markdowns: Swiggy, Eruditus, PharmEasy, Pine Labs, Ola and Oyo are among the others late-stage Indian startups which have seen their valuation being marked down by their existing investors.

Stock broking startups Groww, Upstox eye lending, payments to expand revenue base

Hi, this is Pratik Bhakta in Bengaluru. Today I have a story on how stock broking startups Groww and Upstox are entering new product areas beyond stock broking. The push to diversify their revenue streams comes as their core business has slowed down. I wrote about it here.

Driving the news: Groww and Upstox are banking on the credit business for their future growth. Groww, which already has an NBFC licence, will create products around personal loans, auto loans, consumer loans and others. Meanwhile, Upstox is looking to partner with banks and NBFCs to begin its credit journey. Eventually, it will apply for an NBFC licence, too.

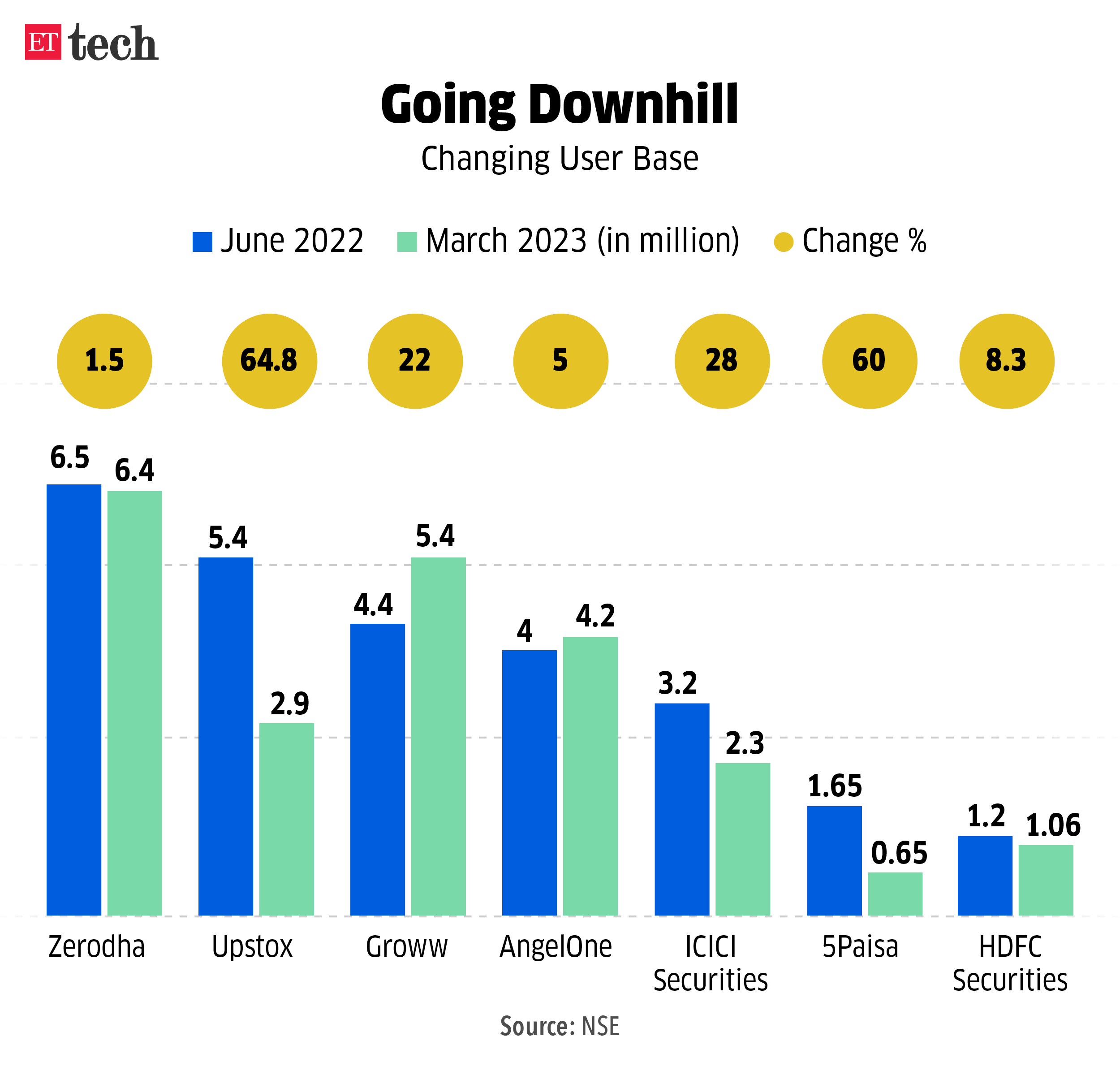

What’s the significance? While both venture-backed startups are expanding their product base, their reasons are different.

- Groww needs to expand its revenue channels, bring in more customers and eventually diversify its user base. Currently, it makes more than 80% of its revenue from F&O traders, which is a micro-segment within the larger fintech space.

- Upstox needs to hold its flock together as it has been losing clients at a faster clip than it had acquired them. To keep them engaged, Upstox is trying to create long-term investment and credit products on the app.

Quote, unquote: “With a substantial customer base exceeding 1.1 crore, Upstox perceives this as a significant opportunity to offer comprehensive money management solutions under a unified platform,” said Ravi Kumar, cofounder, Upstox.

ET Ecommerce Index

We’ve launched three indices – ET Ecommerce, ET Ecommerce Profitable, and ET Ecommerce Non-Profitable – to track the performance of recently listed tech firms. Here’s how they’ve fared so far.

Tatas line up over Rs 7,600 crore to fund electronics business

The Tata group has created a war chest for its greenfield electronic component and contract manufacturing business through Tata Electronics, having lined up funds worth over Rs 7,600 crore through a mix of capital infusion by the parent and secured loans, as per latest regulatory disclosures by the company.

Driving the news: Tata Electronics received over Rs 608 crore capital infusion in 2022-23 from its holding company Tata Sons, the highest in a single financial year, taking the total capital infusion till now to Rs 1,820 crore in the last three years since its inception. The authorised capital of the company is Rs 2,000 crore. The filings also show the company has raised secured loans of Rs 5,799 crore as of date.

What’s next: Once the Wistron deal is complete, Tatas will be the first homegrown entity to assemble Apple’s iPhones in India. The group is also reportedly looking at a larger play in electronics which may include semiconductors.

Wipro venture arm raises stake in personal care startup LetsShave

Sidharth Oberoi, founder, LetsShave

Wipro Consumer Care Ventures has picked up an additional stake in Chandigarh-based personal care company LetsShave for an undisclosed amount.

Deal details: Following the latest funding round, Wipro and South Korea-based Dorco, one of the largest razor manufacturers globally, together own a 25% stake in LetsShave. With this, the startup has now raised a total of $6 million since its inception. Founded in 2015, LetsShave started as a men’s and women’s shaving products brand. Since then, it has expanded its presence in the men’s grooming portfolio.

Tweet of the day

H World Group sells 19% of its total stake in Oyo

Oyo founder Ritesh Agarwal

H World Group Limited, formerly known as China Lodging, has sold one crore equity shares in Oyo (Oravel Stays Limited) to a clutch of UAE-based family offices and institutional investors in a series of transactions, sources told ET.

Transaction details: The transactions, which were done in multiple tranches, primarily over the course of 2022, have earned H World Group over Rs 75 crore, the people cited above said. H World Group’s partial exit translates to a return of 500% on the stake sale and values its residual stake at over Rs 300 crore. The stake sale puts Oyo’s valuation at $6.6 billion.

Gopinathan exits, Krithivasan to take charge as TCS CEO

India’s largest software services company Tata Consultancy Services (TCS) will see a change of guard this week as its chief for six years Rajesh Gopinathan steps down and K Krithivasan takes charge as chief executive and managing director on June 1.

Krithivasan to take over: Over a 33-year-long tenure at TCS, Krithivasan has held various leadership roles in delivery, customer relationship management, large program management and sales, and has successfully led TCS’ largest BFSI vertical in his most recent role.

Also read | Won’t forego margins for growth: TCS CEO-designate K Krithivasan

Quick catch up: TCS had on March 17 announced the sudden resignation of Gopinathan and named banking and financial services president Krithivasan as CEO designate.

Other Top Stories By Our Reporters

Top-level exits continue at IT major Wipro: IT major Wipro is facing a slew of senior-level exits with Mohd Haque, senior vice-president (SVP) and head of healthcare and medical devices for the Americas, and Ashish Saxena, SVP, and head of the manufacturing and hi-tech business unit, the latest to exit the company.

Unacademy launches gamified app for UPSC aspirants: Test preparation platform Unacademy Tuesday launched a self-paced learning app to create a gamified experience for those preparing for Union Public Service Commission (UPSC) tests.

Global Picks We Are Reading

Runaway AI Is an Extinction Risk, Experts Warn (Wired)

OpenAI isn’t doing enough to make ChatGPT’s limitations clear (The Verge)

It’s not (just) Ticketmaster’s fault (Rest of world)