Credit: Giphy

Also in this letter:

■ Govt’s expectations unchanged after Twitter-Musk deal: Chandrasekhar

■ Tesla shouldn’t import cars from China for sale in India: Gadkari

■ CredAvenue acquires Corpository, and other done deals

Who’ll run Elon Musk’s Twitter? What we know and don’t know yet

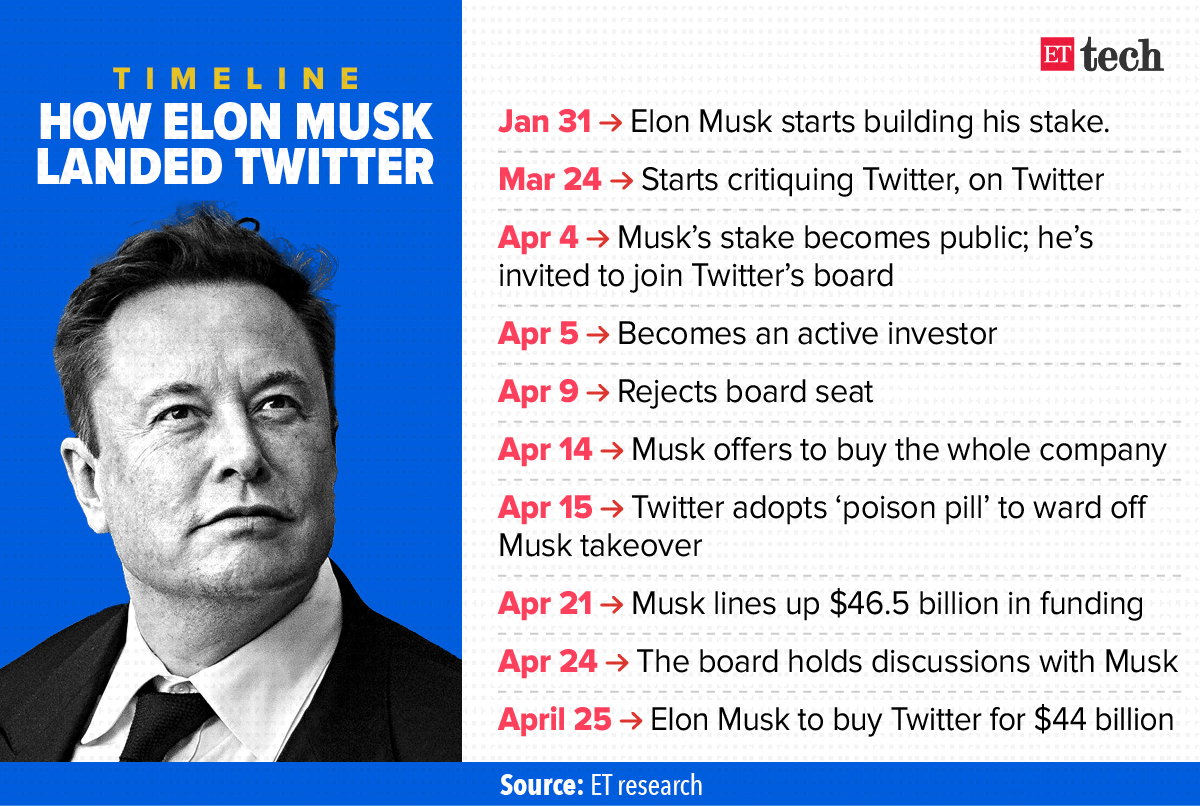

On Monday, Twitter agreed to sell itself to Musk for about $44 billion. There’s a lot we know about the deal but also plenty we don’t know yet. Let’s start with the unknowns.

What we don’t know

Musk’s own financing: Twitter said Musk would pay about $21 billion from his own pocket to buy the company but there were no further details about where it would come from.

But now that the deal has turned friendly, private equity firms, which typically shy away from hostile transactions, may be more likely to come on board. Some existing shareholders could also decide to roll their Twitter stakes into a private company. All of this means that Musk might not be on the hook for much of the money himself.

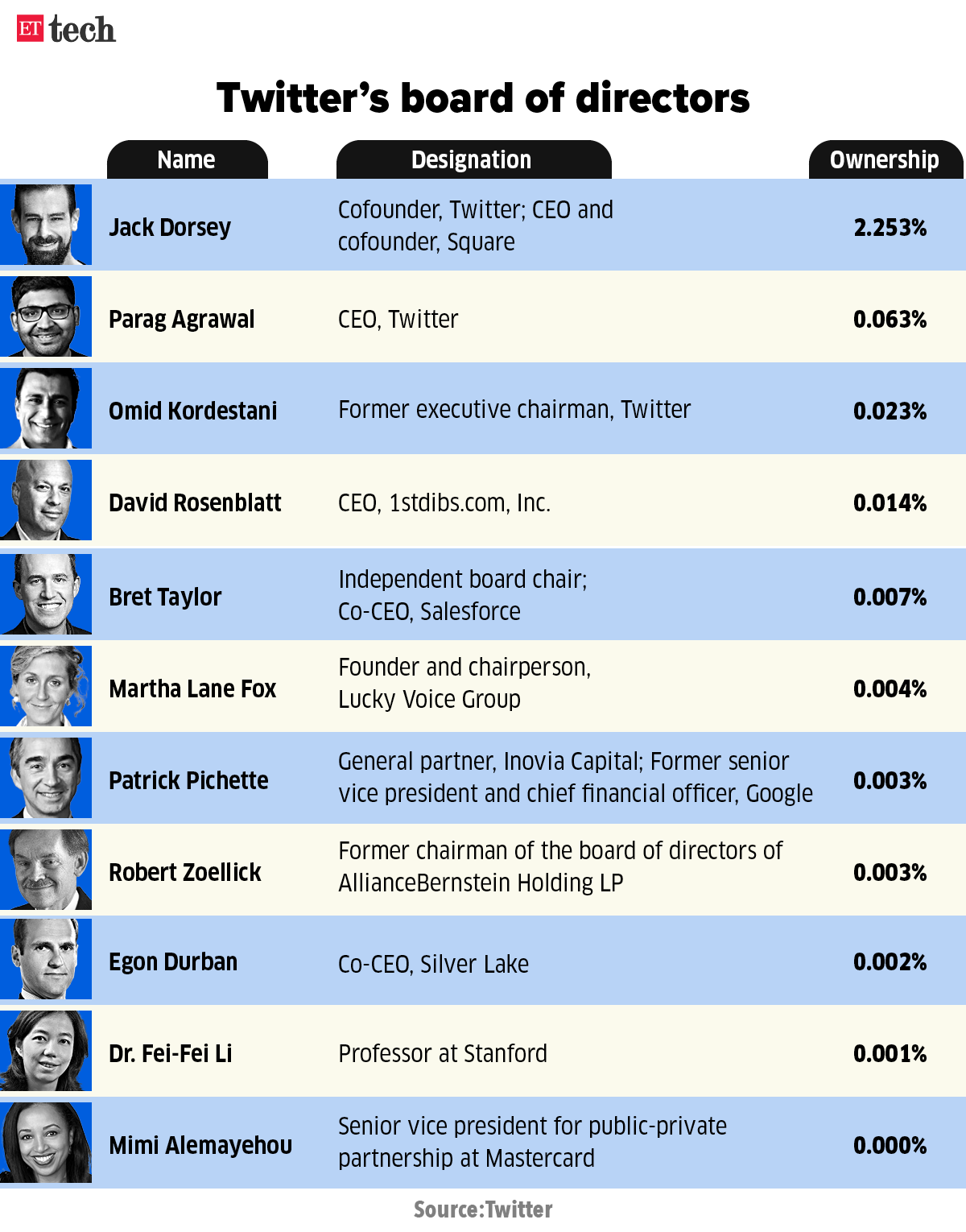

Who’ll run Twitter: Both CEO Parag Agrawal and chairman Bret Taylor were quoted in Twitter’s statement announcing the deal on Monday, so they’re still in their roles – for now. But over the past couple of weeks, Musk has repeatedly tweeted his dissatisfaction with Twitter’s board.

Former Twitter CEO Jack Dorsey, for one, clearly supports Musk’s takeover, tweeting, “Elon is the singular solution” he trusts to make Twitter a successful company.

How it will be run: Musk has spoken openly about his plans to make the platform a haven for unfettered speech. He’s also floated ideas about adding an edit button, removing ads for paid users, and tightening the platform’s authentication checks. But beyond these scant details, little is known about how Musk plans to run Twitter.

Also Read: Timeline: How Elon Musk’s Twitter takeover unfolded

What we know

Who’ll own Twitter: Twitter has agreed to sell itself to an entity “wholly owned” by Musk. No co-investors were named in the statement and the wording implies any that do join will be no more than minority stakeholders.

Price: Musk said in his original bid $54.20 a share was his “best and final offer”. He stuck to that promise, announcing the all-cash deal for exactly that amount.

External financing: Musk revealed last week he has raised $25.5 billion in loans from a dozen banks to back the bid.

Breakup fee: Monday’s statement didn’t say whether either side has agreed to pay a termination fee if the deal falls apart, but Bloomberg News reported that Musk will be on the hook if the deal falls apart.

Also Read: Twitter takeover was brash and fast, with Elon Musk calling the shots

Govt’s expectations unchanged after Twitter-Musk deal, says Chandrasekhar

The Indian government’s expectations of accountability of all intermediaries, including Twitter, remain unchanged, minister of state for electronics and IT Rajeev Chandrasekhar told us exclusively after the social media platform struck a deal with Musk, who calls himself “free speech absolutist”.

“I wish Elon Musk the very best,” Chandrasekhar said, adding, “Our goals and expectations of accountability, safety and trust of all intermediaries operating in India remain unchanged.”

In the middle of last year, Twitter was involved in a lengthy scuffle with the government over the newly announced Information Technology Rules, 2021 and its decision to label certain tweets by BJP members as “manipulated media”. On May 24, 2021, scores of officers from Delhi Police’s Special Cell paid a visit to Twitter India’s offices in Delhi and Gurgaon.

Will Musk’s takeover lead to more such scuffles with governments around the world? No one knows for sure right now.

Here are some more reactions to the deal:

The White House: White House press secretary Jen Psaki said, “No matter who owns or runs Twitter, the president has long been concerned about the power of large social media platforms”, which “must be held accountable for the harms they cause.”

Parag Agrawal: Twitter’s chief executive told employees on Monday that the future of the social media firm was uncertain. “Once the deal closes, we don’t know which direction the platform will go,” Agrawal said in response to a question about whether former US president Donald Trump would be allowed back on the platform.

Also Read: Twitter CEO Parag Agrawal set to receive $42 million if terminated after Elon Musk deal

Human rights groups: Various human rights groups, including Amnesty International and the American Civil Liberties Union (ACLU), raised concerns about hate speech on Twitter after the deal was announced.

Also Read: Twitter under Elon Musk will be a scary place

Tweet of the day

Tesla shouldn’t import cars from China for sale in India: Gadkari

US electric vehicle maker Tesla Inc is welcome to set up shop in India, make cars here for sale and export them, but must not import cars from China, transport minister Nitin Gadkari said on Tuesday.

“Making in China and selling here is not a good proposition,” he said at a government conference.

Taxing issue: Tesla is desperate to import and sell its electric vehicles in India, having lobbied officials in New Delhi for nearly a year to cut tariffs, which chief executive Elon Musk says are among the highest in the world.

But its efforts are at a stalemate as Tesla has not revealed a firm plan to invest in India.

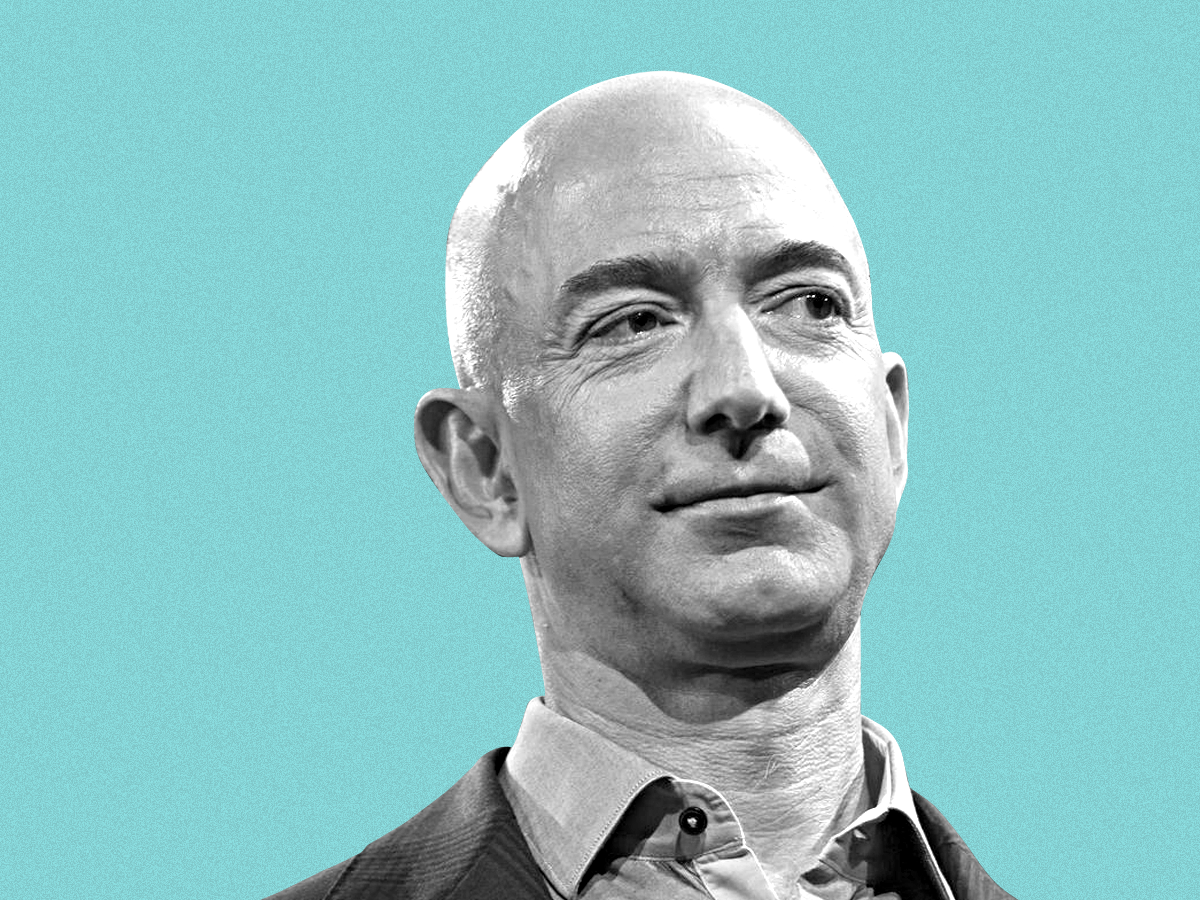

Bezos takes aim at Musk’s Twitter deal

Amazon founder Jeff Bezos posed a provocative question after Musk clinched a $44 billion takeover of Twitter, suggesting he could be beholden to China.

“Interesting question. Did the Chinese government just gain a bit of leverage over the town square (Twitter)?” tweeted Bezos, who also owns the Washington Post.

Context: Musk has championed free speech on the platform, but Twitter — like most American social media platforms — is banned in China by officials wary of its impact on public discourse.

Tesla has boomed in China thanks in part to tax breaks, cheap loans and the green light to wholly own its domestic operations. But the company last year came under fire after state media and regulators questioned Tesla’s attitude toward customers. Bezos’s company also operates in the country, but it’s a distant competitor to local leaders Alibaba Group Holding Ltd. and JD.com Inc.

ETtech Done Deals

■ Debt marketplace CredAvenue has acquired a majority stake in Corpository, a software-as-a-service (SaaS)-based credit underwriting company at a valuation of Rs 100 crore through a combination of primary investment and secondary purchase from existing shareholders.

■ Navikenz, an Artificial Intelligence (AI) consulting company, has raised $4 million in its seed round, led by prominent investors including Sudip Nandy, senior advisor at private equity firm ChrysCapital and P R Chandrasekar, the former chief executive of Hexaware. Navikenz will use the investment to expand its footprint in India and the US.

■ Sateeq, an investing platform, said it has raised an undisclosed angel round from a clutch of founders and angel investors. Investors include Himanshu Periwal, founder, Unlu; Sarthak Goel, founder, Y-Combinator backed InVoid; Vaibhav Jalan, Smallcase; Nikunj Jain, Amitesh Sinha, partner SIMA Funds; Kunwar and Amit, founder, UnFinance.

■ DeHaat, an agritech platform, has acquired a majority stake in Y-Cook India in an all-cash deal. Investors include Omnivore Partners, Oikocredit, and 021 Capital, to name a few. While OikCredit and 021 Capital will get an exit through this transaction, Omnivore, which is also an investor in DeHaat, will swap its equity.

Ether prepares for epic ‘merge’ in quest to eclipse bitcoin

Ether has promised to do better. It has promised to go to the next level, edging out crypto rivals and even outshining the godfather, bitcoin. But the clock’s ticking.

Tell me more: The #2 cryptocurrency was supposed to be weeks away from the “merge“, a transformative June upgrade of its blockchain Ethereum to make it faster, cheaper and less power hungry, holding out the prospect of a meaner and cleaner crypto future.

The anticipation had supported ether this year, even as inflation and monetary tightening shackled bitcoin. But that merge – which would see ether mining transition away from the energy-intensive proof-of-work method to proof-of-stake – has been delayed, frustrating investors.

Taking stock: Ether fell 8% from $3,215 to $2,947 on April 11, the day Ethereum lead developer Tim Beiko said on Twitter that the June rollout had been pushed back as tests continued. It is down 13% this month, at $2,844.

Today’s ETtech Top 5 newsletter was curated by Arun Padmanabhan in New Delhi and Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.