HDFC Bank in its post-profit require the September quarter said that it hopes to finish its consolidation with HDFC Ltd. a couple of months in front of the specified course of events. The consolidation of the parent firm with its auxiliary bank is, nonetheless, booked to be finished up by mid-2023.

The consolidation proposition of the two elements has proactively got a large portion of the endorsements, excepting the investors’ gesture (booked on November 25) alongside the last leeway from the Reserve Bank of India (RBI).

In this way, as things push forward, it’s a good idea to comprehend what the consolidation will mean for the shared asset portfolios.

A gander at mutual fund portfolios of HDFC Bank and HDFC

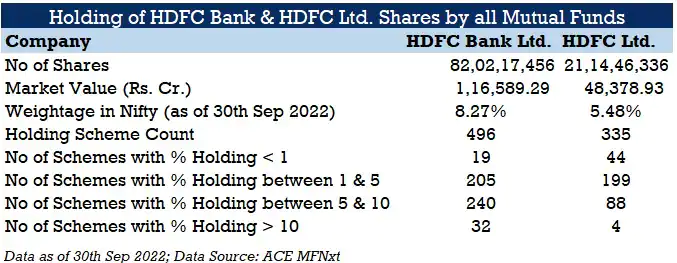

As of September 30, 2022, mutual fund schemes on the whole held Rs.1.65 lakh crore worth of HDFC Bank and HDFC Ltd. shares under different portfolios. The holding count plans remained at 496 for HDFC Bank and 335 for HDFC Ltd.

The joined weightage of both these elements was 13.75 percent.

As per Gopal Kavalireddi, Head of Exploration at FYERS, the trade proportion will be 42 portions of HDFC Bank for each 25 portions of HDFC Ltd held.

“Post the consolidation, HDFC Bank will keep on working as a solitary substance,” he said.

The ongoing standards

According to the standards determined by the capital business sectors controller, Sebi, for broadened equity funds, the interest in equity offers or value related protections of a solitary organization should not surpass 10% of the net resources of the plan.

This guideline doesn’t matter to area explicit or thematic funds.

The effect on mutual funds

According to the last accessible information, the quantity of plans across all AMCs holding HDFC Bank more noteworthy than 10% in their portfolios was 32 plans, and for HDFC Ltd, just 4 plans.

Thus, upon finishing of the HDFC Bank – HDFC consolidation, a solitary substance would remain, and mutual fund supervisors of differentiated value plans are supposed to make the essential acclimations to their particular portfolios, cutting down the most extreme holding rate equivalent to or under 10%, expressed Kavalireddi while conversing with CNBC-TV18.com.

Thus, mutual funds might rejig their portfolios.

The effect on NSE

Experts are expecting weighty variances in the Clever on the conceivable asset outpourings on the consolidation of the HDFC twins which together control more than 13% of the Clever at this point.

Considering this colossal load of the HDFC twins in the benchmark file, NSE has given a conference note on the potential results of the consolidation on the record and the resultant rejection of HDFC and consideration of a substitution stock.

How should investors respond?

According to Kavalireddi, investors need not be exorbitantly stressed over any conceivable offer off, as the changes because of the consolidation can be effectively consumed by different plans.