This week, Twitter cofounder Jack Dorsey and Tesla CEO Elon Musk tweeted criticisms of Web3, the supposed “next evolution” of the internet that’s got (almost) everyone excited.

But what is Web3, what promise does it hold, and why have Dorsey and Musk been dunking on it?

Tesla CEO Elon Musk (left) and Twitter cofounder Jack Dorsey

On Sunday, Musk tweeted a clip from a 1995 interview of Bill Gates by David Letterman, in which the Microsoft CEO, after describing the potential of a new-fangled technology called the internet, is promptly mocked by his host. The Tesla CEO wrote alongside: “Given the almost unimaginable nature of the present, what will the future be?”

In a follow-up tweet he wrote:

“I’m not suggesting Web3 is real—seems more like a marketing buzzword than reality right now—just wondering what the future will be like in 10, 20 or 30 years. 2051 sounds crazy futuristic!”

The next day, he tweeted, “Has anyone seen Web3? I can’t find it.” To this, Dorsey replied, “It’s somewhere between a and z,” hinting that Web3 is already controlled by venture capital firms such as Andreessen Horowitz, also known as A16z.

To drive the point home Dorsey put out another tweet, saying, “You (users) don’t own “Web3.” The [venture capitalists] and their [limited partners] do. It will never escape their incentives. It’s ultimately a centralised entity with a different label. Know what you’re getting into…” His mentions were instantly filled with upset Web3 evangelists calling him “dead wrong”—and those were just the polite ones.

Musk and Dorsey’s tweets, and the angry reactions to them, perfectly summed up the mixture of fervour and ridicule that the term Web3 evokes in 2021. It is, depending on who you ask, the promise of a utopian, decentralised internet, or a giant marketing scam by people driven only by power and money.

The primary idea behind Web3—the term was coined in 2014—is that it will be based on the same blockchain technology that powers things like cryptocurrencies and NFTs. Blockchains are essentially incorruptible digital ledgers that can be used to track the movement of digital assets.

Just as cryptocurrency in theory bypasses central authorities such as banks, Web3 would also bypass the central authorities we know as Big Tech. The dream of Web3 advocates is to create a decentralised web that isn’t beholden to the whims—and rent-seeking—of these firms. The thinking goes like this: if you create a piece of art—or shoot a photo or a video— and post it online, why should the platform you posted it on benefit more than you do?

Evolution of the web

The original world wide web, now called Web 1.0, decentralised power from the hands of publishers by allowing anyone with technical knowhow and an internet connection to publish things online. Those of a certain age will remember that this version of the web, while astounding at the time, was utterly static and not particularly useful. You could call Web 1.0 the read-only web.

Web 2.0, a term coined in 1999, saw the development of easy-to-use tools that let anyone create and publish content online and interact with each other. Ironically this democratisation of access led to centralisation of power with the creation of giant companies such as Facebook and Google.

Advocates of Web3 say blockchains and cryptocurrencies will one day allow internet users to own the connected services apps and games that are currently the property of Facebook, Google, Amazon and Microsoft.

That, ultimately, is why Dorsey’s criticism stung Web3 fans—because he was essentially saying this was all a pipe dream. That, rather than freeing internet users from the clutches of Big Tech, Web3 would simply mean replacing one set of powerful companies with another.

BIG STORIES BY OUR REPORTERS

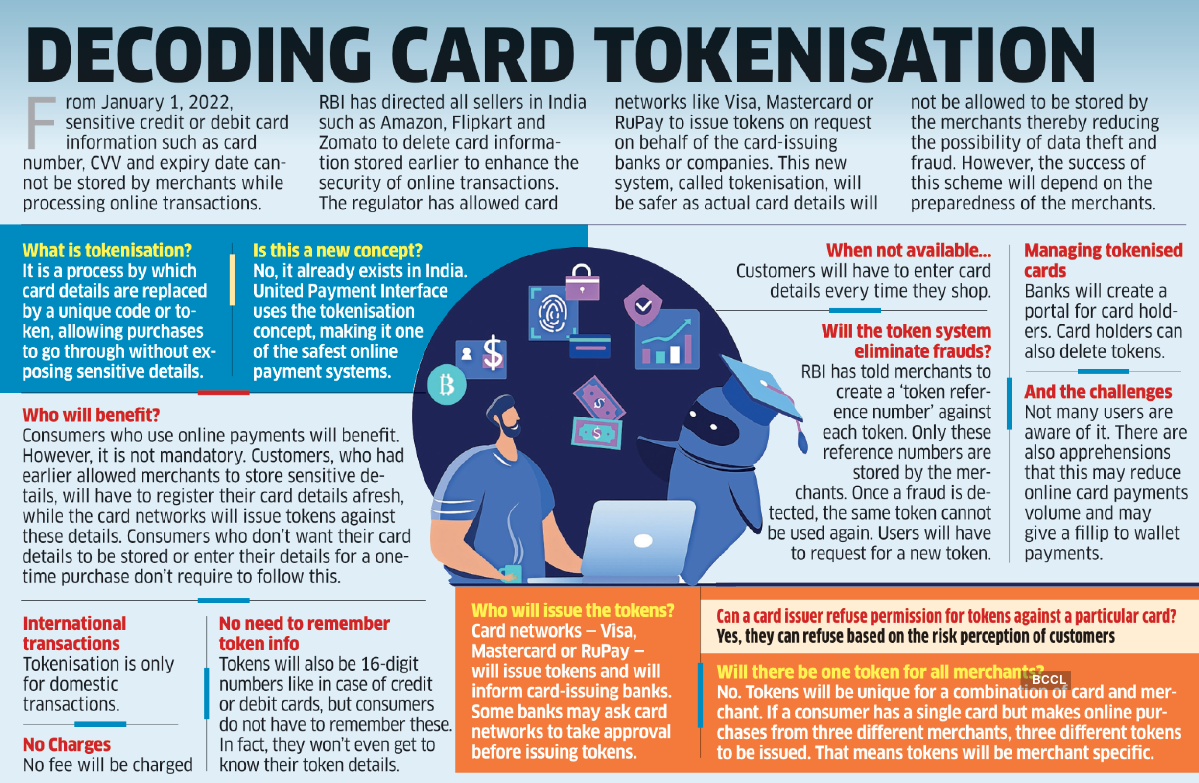

RBI postpones card tokenisation rule by six months

The Reserve Bank of India has postponed the implementation of its card tokenisation rule— which requires online merchants to erase all stored payment details of customers—by six months to June 30, 2022. It was originally meant to come into effect from January 1.We had reported on Wednesday that ecommerce firms and online service providers were bracing for chaos on January 1. About five million Indians have stored their card details with various online merchants.

What’s tokenisation? Tokenisation enables card transactions without disclosing the cardholder’s account information to either the merchant or any intermediaries.

It involves replacing a 16-digit credit or debit card number with another string of 16-digit numbers known as a “token”, which is unique for each combination of card, token requestor and device. Tokenisation only applies to domestic, online purchases. The measure, which the RBI had announced in September, is aimed at protecting cardholders from fraud.

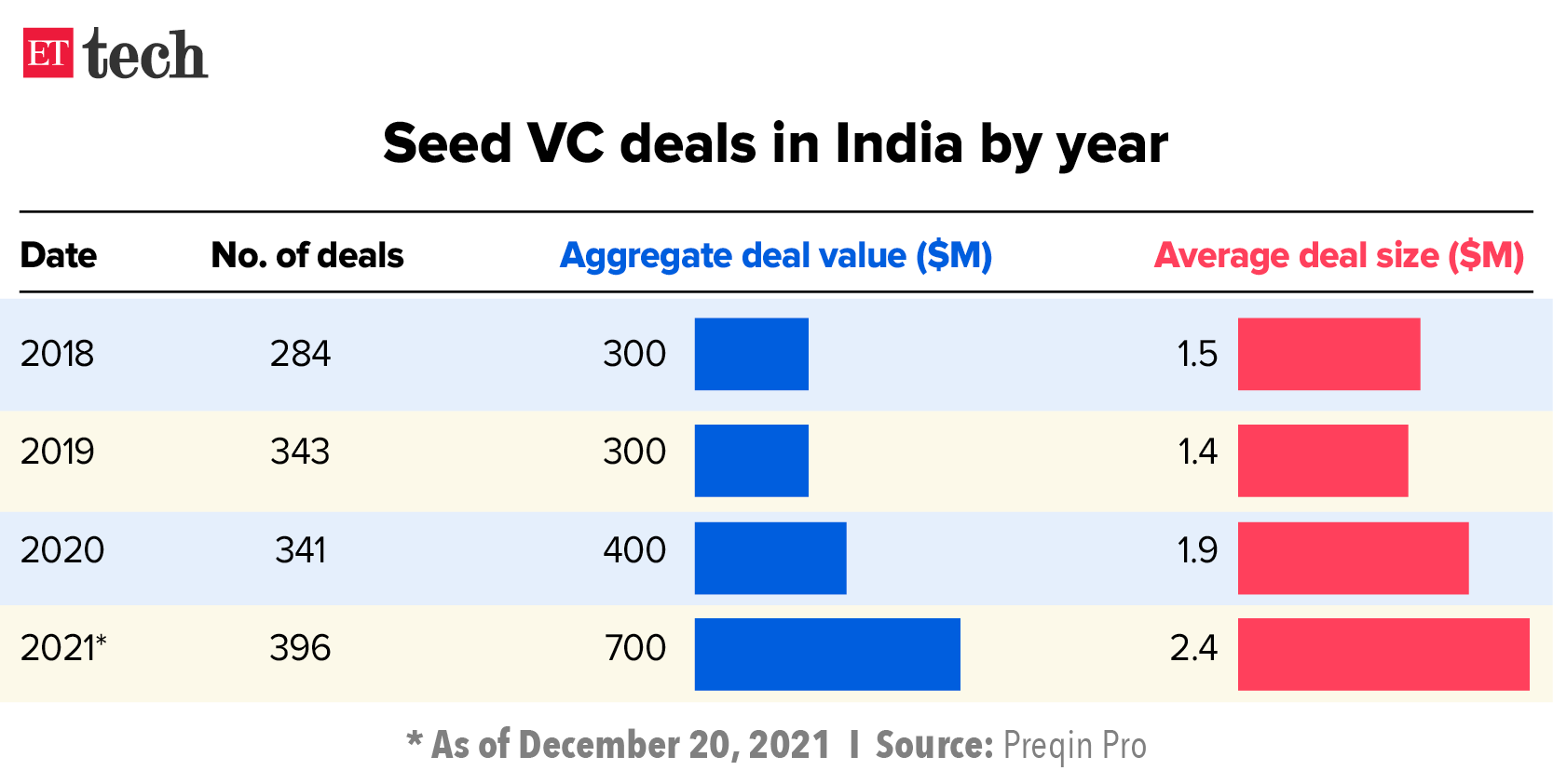

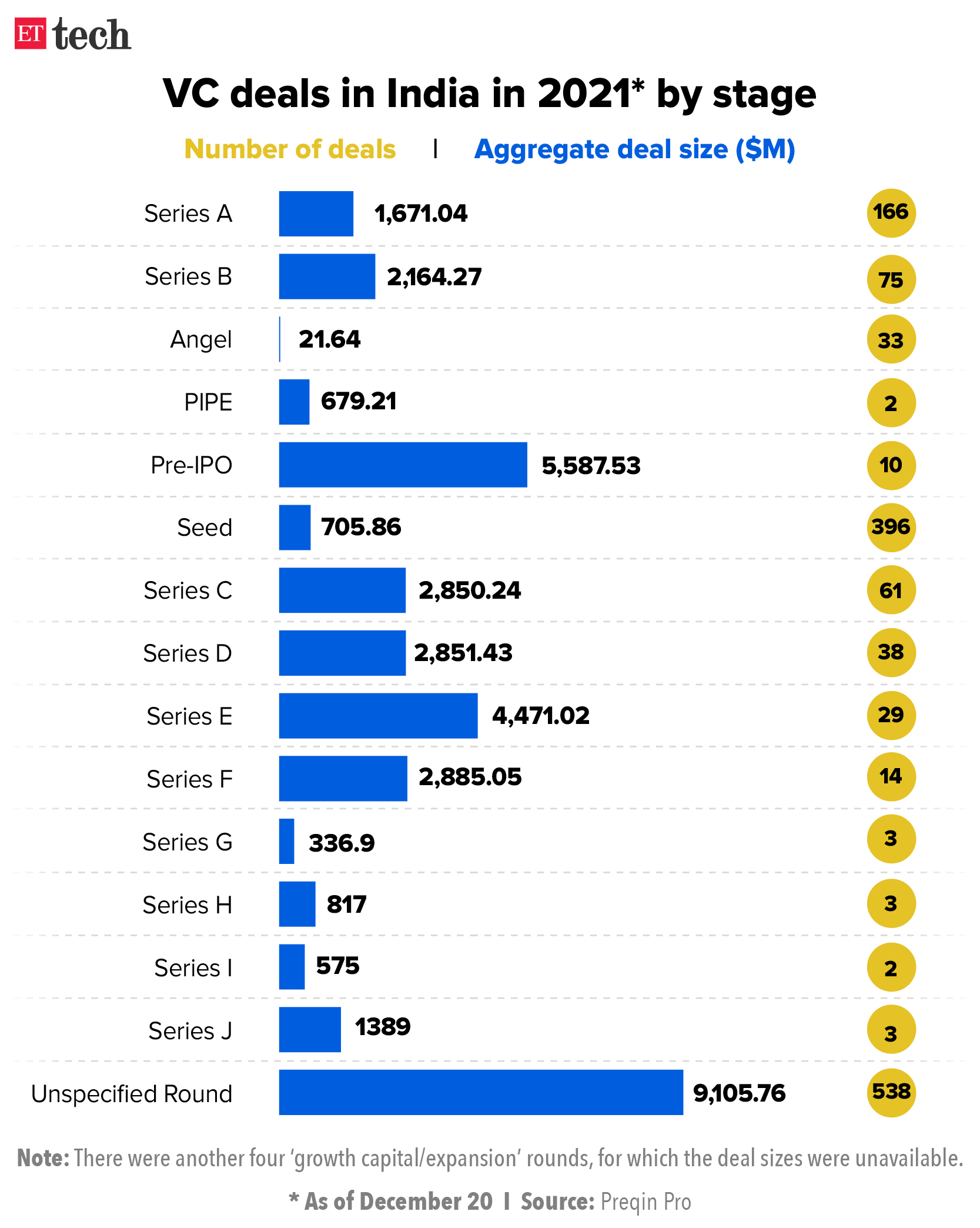

Indian startups rake in $36 billion in record-breaking year

India’s startups raised a record $36 billion from investors in 2021 as demand for digitisation skyrocketed during the second year of the Covid-19 pandemic.

- Preqin, an investment data platform based in the UK, estimated that venture and private equity investments increased more than 3X this year (as of December 20) from the $11 billion in 2020.

Seed-stage deals dominated in 202, with nearly 396 deals totalling to $705.86 million, while there were about 166 Series A rounds amounting to about $1.67 billion, the data showed.

But the bulk of the investments were in pre-IPO financing rounds of companies such as Zomato, Ola, Policybazaar and Paytm. The top 10 deals totalled $5.58 billion.

Omicron impact

Business as usual for Indian IT companies: Despite a surge in Covid-19 cases in the US and the UK, a wider fallout for the IT industry is unlikely since it is insulated by remote and hybrid working arrangements rolled out over the past year, existing and ongoing demand for digital solutions. A third Covid-19 wave globally would help speed up digital transformation initiatives, instead of hampering them.

IT firms cautious on return to office: Thanks to Omicron, India’s top software exporters are taking a cautious approach to their previously announced back-to-office plans, slated for January, senior executives told us.

- TCS said less than 10% of its associates are working from its offices currently, while any plans for a full-fledged return to office would be a “calibrated move.”

- Infosys said it has “taken a cautious approach” keeping in mind the “changing health situation”.

- HCL Technologies said it “will continue to monitor the emergence and impact of Covid variants which could limit the movement of employees.”

Etail to foodtech firms keep a close watch: These have started relying on measures they had taken during the second wave earlier this year, though they have yet to undertake any drastic changes in their operations.

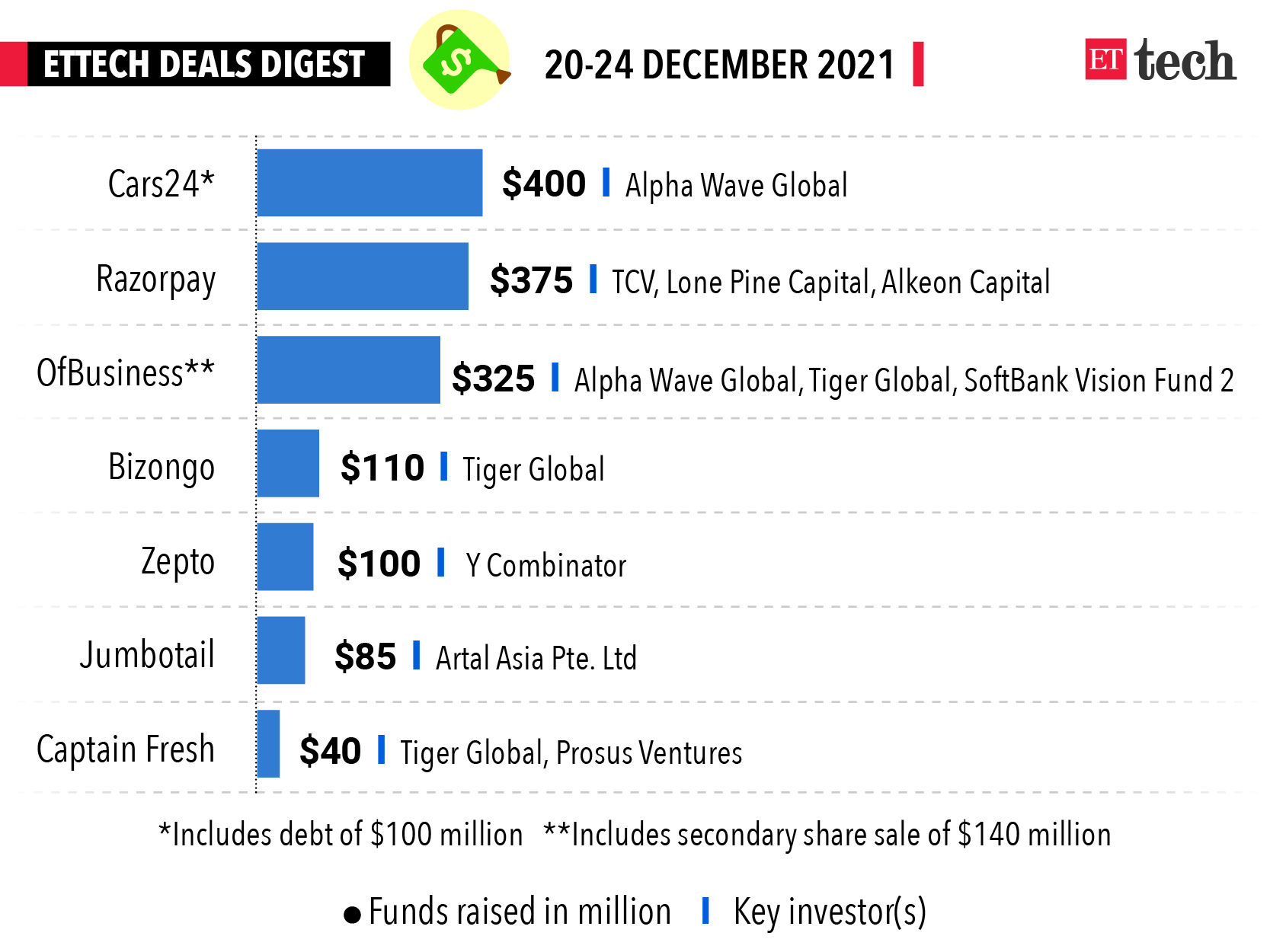

ETtech Deals Digest

■ Razorpay has raised $375 million (Rs 2,850 crore) in a new funding round, after which its valuation has grown to $7.5 billion—a jump of two-and-a-half times in eight months.

■ Google-backed neobank Open is in advanced stages of talks to close a fresh funding round of $100-150 million after which it will be valued at about $1.1-1.3 billion.

■ Swiggy is in the final stages of discussions to invest in bike-taxi startup Rapido. If the deal goes through, it will help Swiggy enhance its last-mile delivery capabilities and bolster its quick commerce ambitions.

■ Epiq Capital has made the first close of $100 million for its second fund, with limited partners such as actor Aamir Khan, cricketer Virat Kohli and entrepreneurs such as Curefit founder Mukesh Bansal joining in as sponsors.

■ Mumbai-based Zepto has raised $100 million in a funding round led by its existing investor Silicon Valley startup incubator Y Combinator’s Continuity Fund. its valuation has more than doubled to $570 million.

IPO, M&A Buzz

Snapdeal seeks Sebi nod for Rs 1,250-crore IPO: The online marketplace Snapdeal has filed its draft red herring prospectus to raise Rs 1,250 crore through issuance of new shares. The IPO will also see an offer-for-sale component of 30,769,600 shares where Snapdeal’s existing investors—SoftBank, Foxconn, Sequoia Capital and others—will offload part stakes in the company.

MapmyIndia founders strike gold on stellar debut: Rakesh and Rashmi Verma, who own nearly 54% of MapmyIndia, struck gold after their company’s stock surged 35% to Rs 1,393.65 on market debut. The husband-and-wife team is now worth $586 million.

First-time buyers drive M&A activity in 2021: M&A deals in India are nearing an all-time high as first-time buyers, especially startups, drive deal volume valued at an upward of $75 million. The number of such deals is expected to touch 85 this year with first-time buyers accounting for almost 80% of them.

Demand for pros in M&A, strategy roles skyrocket in India: More than two dozen finance professionals working with private equity or venture capital funds, investment banks, etc. have taken up roles in companies that are aggressive in their inorganic growth plans in the last 6-12 months.

News from the Crypto world

Crypto firms suggest a dual licence regime: One of the biggest challenges to the adoption of cryptocurrency is the ease with which money can flow between traditional (fiat) and crypto ecosystems and the on-ramp and off-ramp (converting crypto to fiat) exchanges facilitate that transfer. (read more)

Exchanges offer top dollar for crypto talent in India: The average salary offered to techies across cryptocurrency exchanges is around Rs 2 lakh per month for those with 2-4 years of experience, say industry trackers. (read more)

Amazon sues ED, asks court to quash probe into Future deal

Amazon has moved the Delhi High Court seeking relief from an ongoing investigation by the Enforcement Directorate (ED) into its 2019 investment in a Future Group company.

- The ED had started the probe last month to find out if Amazon had violated India’s foreign exchange rules while investing into Future Coupons Pvt. Ltd. in 2019.

- Amazon also alleged that the ED has asked it for accounts of privileged legal opinion given to it by lawyers and law firms in India. It said it also asked it to provide a list of former employees in its legal team, and accounts of bank details and legal expenses it has incurred in India in the past 10 years.

Accusing the ED of conducting a “fishing and roving inquiry”, Amazon said such requests were beyond the agency’s powers.

Separately, Amazon is seeking regulatory approval to acquire Catamaran Venture’s entire stake in Prione Business Services, which houses Cloudtail, one of the largest sellers on the ecommerce major’s Indian platform.

‘Linking Aadhaar with voter ID is dangerous’

Privacy advocates have strongly criticised the Election Laws (Amendment) Bill, 2021, which the Lok Sabha passed with a voice vote amid huge opposition.

- They said that the bill, which allows for the “voluntary” linking of Aadhaar with a person’s voter’s ID, is “dangerous” for democracy as it violates citizens’ right to privacy by enabling voter profiling through linking of data sets.

“It is a dangerous law that will undermine electoral democracy; free and fair elections; individual privacy. We have no data protection law. The one under consideration is leaky as a sieve,” Apar Gupta of the Internet Freedom Foundation said on Twitter.

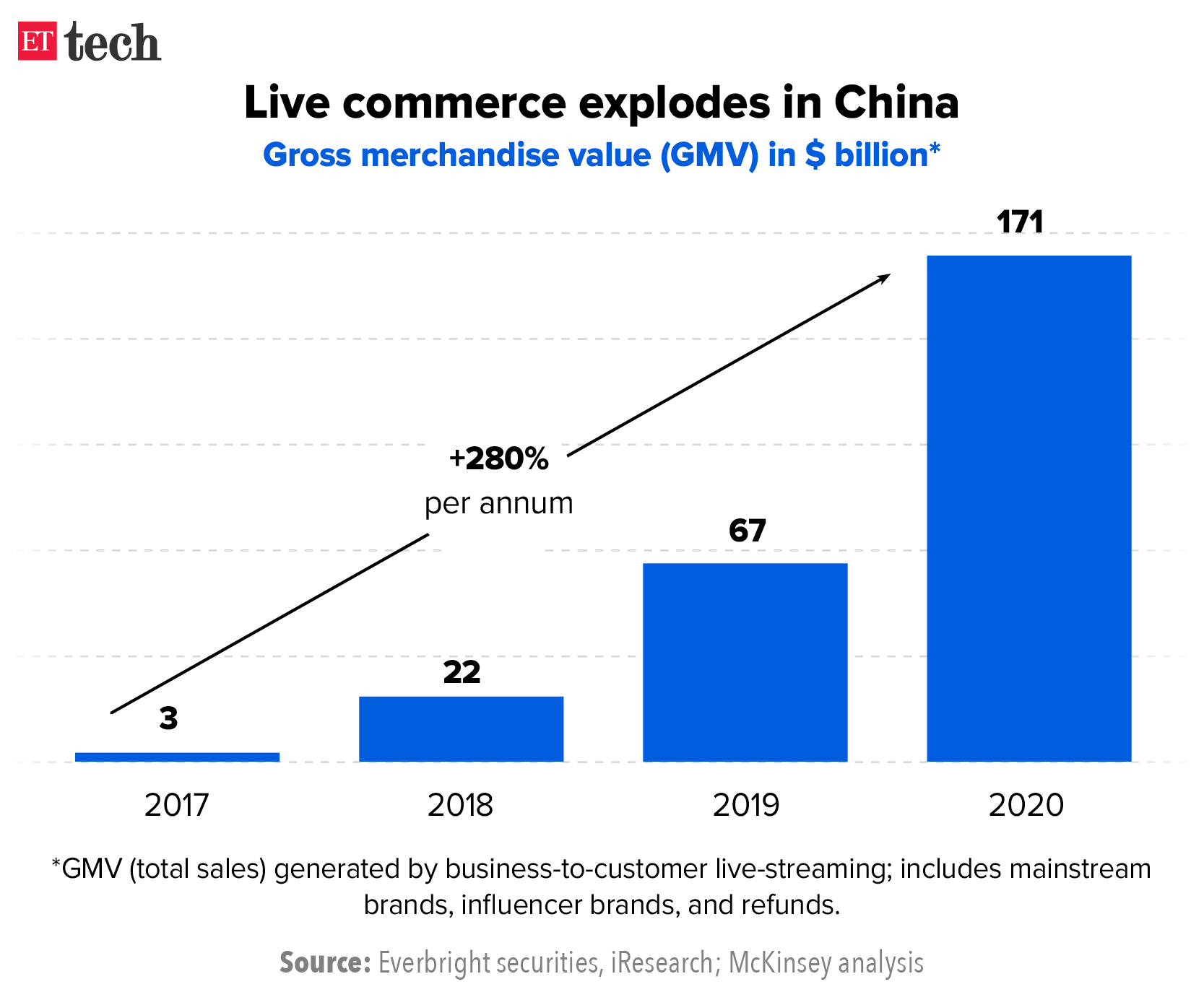

Meesho bets big on live commerce with streaming platform

Social commerce platform Meesho is building a live streaming platform, sources told us, as it looks to harness a lucrative new trend in ecommerce called live commerce. The service will be offered to sellers on the platform for a charge, one of the sources said.

Pioneered by the Chinese company Taobao, live commerce entails linking up an online livestream broadcast with an ecommerce store to allow viewers to watch and shop at the same time.

This is the model that Meesho—and others—are looking to replicate in India.

“Live streaming will be a big part [of the business],” one of the sources said. “If you onboard enough influencers on your app, they do the selling for you.” Since Meesho runs on a zero-commission model, ads by sellers are currently its only source of revenue.

Elsewhere, CityMall is preparing to launch fresh grocery deliveries in the next quarter, people aware of the matter told ET, at a time when non-metro cities are turning into a big focus area for new-age e-commerce startups.

This is the second attempt by CityMall to enter the fresh groceries space. The startup had struggled with supply chain issues despite attracting demand the first time around, a person aware of its plans said.

India bans 20 YouTube channels, two websites under new IT rules

India banned 20 YouTube channels and two websites for allegedly running “anti-India propaganda”. Of the 20 YouTube channels banned, 15 are owned by an entity called Naya Pakistan; others include ‘The Naked Truth’, ’48 News’ and ‘Junaid Halim official’.

- This is the first time India has invoked emergency powers under the new IT rules.

The content was initially flagged by India’s security agencies, after which the I&B ministry conducted an inquiry. I&B secretary Apurva Chandra then wrote to YouTube and the department of telecom, telling them to immediately block the content as it affected the sovereignty and integrity of India, sources told us.

That’s all from us this week. Stay safe and get that jab.