When it comes to making payments, credit and debit cards are the ones that people most frequently use. These two cards can be used for anything from in-store to online purchases. In addition, the 16-digit number, expiration dates, CVV code, and EMV chips on both cards are nearly identical. However, these cards are used in different ways.

Debit Cards: A bank will give you a debit card based on your current or savings account. Your bank is directly connected to the debit card. When a customer uses a debit card, they can only spend the money in their bank account. If a customer makes a certain amount of money, it will be taken directly out of their account.

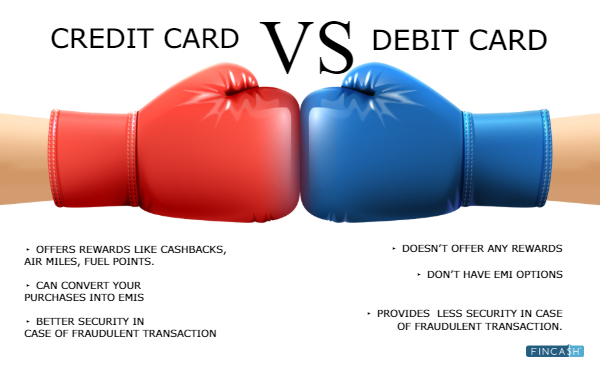

In most cases, debit cards do not charge a fee to withdraw cash, especially if you use an ATM at your bank. However, daily spend and cash withdrawal limits apply to debit cards. Using a debit card will not increase your credit score in any way.

Certain banks also offer cashbacks and discounts for debit card payments. Some debit cards do not charge anything at all. Depending on the bank, a minimum balance must be kept in the account for a debit card. The minimum balance on salary-linked debit cards is not required.

Credit Cards : These credit cards are usually issued by banks and a few non-bank financial companies, or NBFCs. However, these cards can also be issued by other approved organizations. Credit cards are nothing more than cards that allow customers to buy now and pay later.

When you pay with a credit card, the bank gives you credit for a certain amount of time, and the customer has to pay the bank for their purchase by a certain date. Monthly credit limits are set by banks and can vary based on the type of card or even your creditworthiness. Credit cards can be used to make purchases of goods and services at PoS terminals and online stores.

If you pay your bills on time, credit cards can help you build a good credit score. If these cards are enabled for international use, they can be used both domestically and internationally.

You should not use credit cards to withdraw cash from an ATM because you will typically be charged an upfront fee based on the amount you withdraw. Within India, you can also transfer money to bank accounts, debit cards, other credit cards, and prepaid cards, subject to limits and conditions that have been agreed upon.