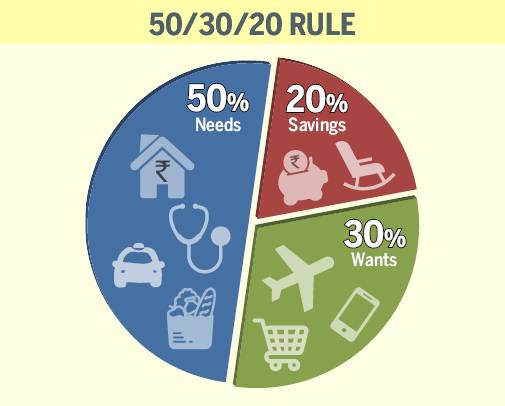

What is the 50-30-20 rule?

You can partition your spending plan into three classifications — necessities, needs, and monetary objectives — by utilizing the 50/30/20 general methodology. It’s to a greater degree an overall principle to assist you with making a strong monetary spending plan than a firm rule.

The 50/30/20 Rule of Thumb: What Is It?

The 50/30/20 guideline gives a basic arrangement of standards for spending plan arranging. As indicated by ET, you split your post-charge income between the accompanying gatherings utilizing them.

Needs half

You can’t, or possibly not effectively, live without needs. They comprise of the accompanying:

- Rent

- Food

- Utility expenses: including water, power from there, the sky is the limit

Needs 30%

What you want however don’t need to endure are called needs. Among them could be:

A couple of models incorporate side interests, travel, feasting out, and computerized and real time features like Netflix and Hulu.

Monetary Goals 20%

Two significant points are covered under this classification:

- All speculations, including retirement assets, initial installment reserves, and 529 school investment funds plans (pay heed that 401(k) installments are produced using pre-charge pay).

- Reimbursement of debt

You’ll have to utilize another thing to follow spending since this is just a rule for making your financial plans, similar to a financial plan tracker like YNAB (You Need a Budget), Mint, or Quicken. The 50/30/20 rates can then be set as focuses in whichever spending plan tracker you like.

Step by step instructions to Budget Using the 50/30/20 Rule of Thumb

A great many people spend more than they save, frequently without acknowledging it. The 50/30/20 guideline could assist you with turning out to be more aware of your spending designs and forestall under-and overspending. You can build your investment funds for the things that are vital to you by saving on the things that don’t make any difference.

This is the means by which it goes:

- Decide your month to month pay by totalling the assets that are kept into your ledger every month. Figure out how much is kept on the off chance that you have a work environment retirement plan, and add it to your salary. Diminish your month to month pay sum assuming you cover charges.

- Decide a spending cap for each classification: For an ideal add up to spend on every region, duplicate your salary by 0.50 (for needs), 0.30 (for needs), and 0.20 (for monetary goals).

- Base your financial plan on the accompanying figures: Consider these three spending regions as “containers” that you can top off with customary outgoings. Verify whether you are spending not exactly the month to month spending objectives you set in the past stage by posting and totalling your month to month expenses under all classifications they have a place in.

- Adhere to your financial plan Keep tabs on your consumptions every month and change as important to remain inside your spending plan moving forward.