Also in this letter:

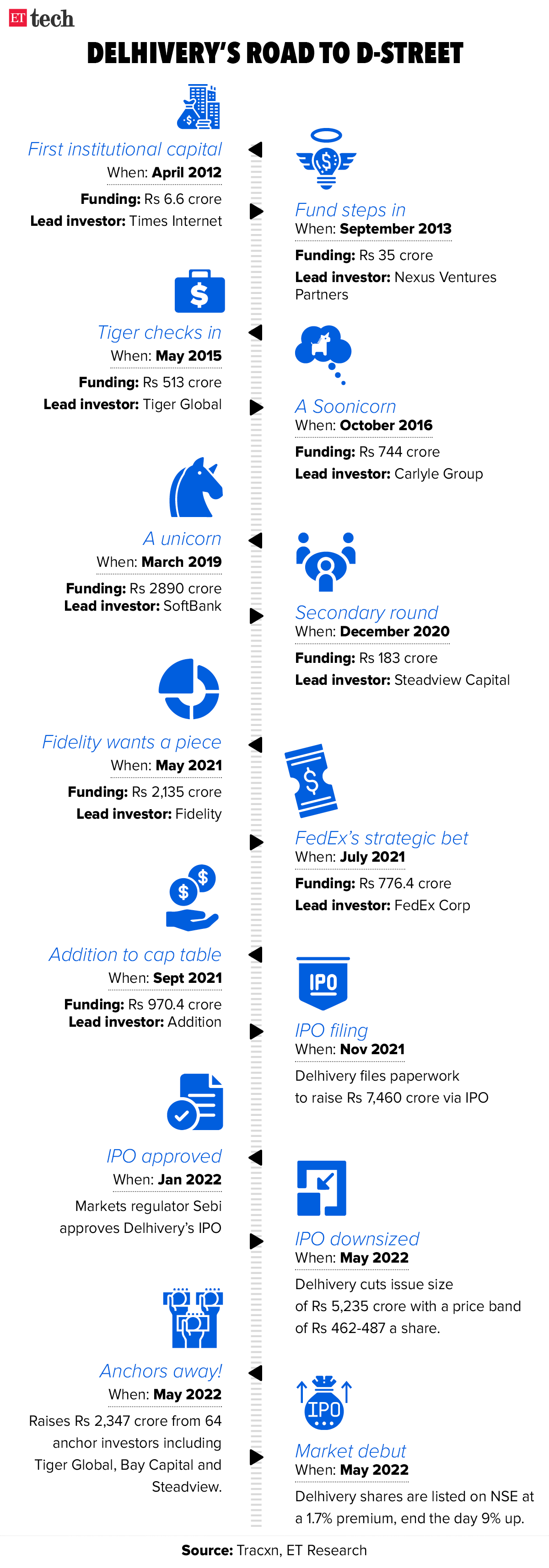

■ Delhivery’s debut more than doubles value of SoftBank’s stake

■ Startups chase venture debt as investments slow

■ Card tokenisation rules will cause havoc, industry bodies say

Volatile markets left us nervous before listing, says Delhivery CEO

Delhivery’s top management was “nervous” ahead of its listing on Tuesday due to uncertain investor sentiment but were never “really concerned” about the issue not being fully subscribed, cofounder and chief executive Sahil Barua told us after the listing.

Delhivery ended its first day as a public company at a share price of Rs 537.25 on BSE, up 10.3% from its issue price of Rs 487, and about 9% higher than its opening price of Rs 493.

Last week, Life Insurance Corporation of India (LIC) listed at a discount to its issue price, raising doubts about the prospects of other upcoming IPOs.

CEO speaks: “I would be lying if I said we were not nervous. But we knew about the institutional investors; they typically do not punch in their order on the first day of an issue opening. We did not have any concerns about the issue being fully subscribed. Yes, we did know that the retail part won’t get fully subscribed. Our job was to price the issue conservatively,” Barua said.

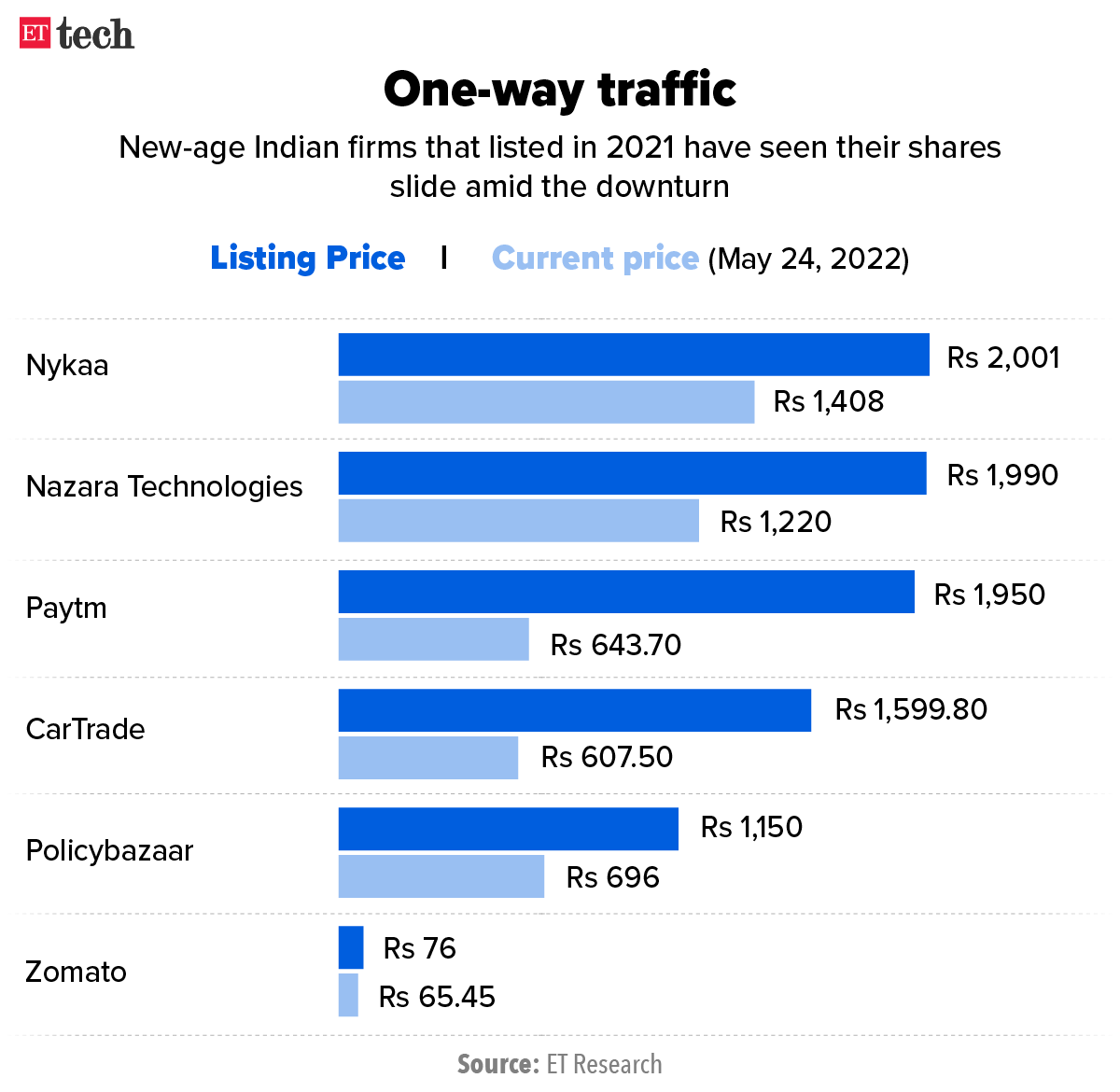

Tech rout: Barua also said that the public markets had completely swung over in the past few months. “… retail investors have been skittish, and we cannot blame them for it. They got into a lot of consumer internet stocks and have been affected by the current situation,” he said.

Shares of Zomato, PolicyBazaar and Paytm have all fallen sharply since their listings last year.

But Barua said Delhivery was more of a brick-and-mortar business, so it would be wrong to club it with other consumer tech businesses.

“We are an infrastructure and capacity building business. The decisions we will take, the kind of financials we will have, will play out in the long-term,” he said.

Delhivery’s market debut more than doubles SoftBank stake value to $1B

Amid a global rout in tech stocks, Delhivery’s market debut turned out to be one of the best by a SoftBank-backed firm this year.

- In 2019, SoftBank invested about $390 million in two tranches in Delhivery. That investment is now worth almost $1 billion based on Delhivery’s stock price after its first day of trading. SoftBank holds close to 19% in Delhivery.

- Nexus Venture Partners, which has invested about $40 million in the company, has also made significant gains. It holds 7.92%, which is now valued at around $400 million.

- Carlyle has 5.08% in Delhivery after the listing, which translates to a valuation of around $250 million.

- Times Internet, which publishes ETtech, owns 3.91% in Delhivery after the listing, valued at around $200 million.

Win some, lose some: In contrast, SoftBank’s huge bet on Paytm turned sour following a disastrous listing in November. Its $1.4 billion investment in Paytm was worth around $800 million at the end of March 2022. SoftBank continues to hold around 17% in the Noida-based firm.

Its relatively small investment of $100 million in Policybazaar has seen a gain of around $300 million, according to a recent earnings report by SoftBank.

TWEET OF THE DAY

Startups chase venture debt as investments slow

Venture debt is in high demand at startups following a sharp slowdown in equity funding over the past few months.

Startups across fintech, edtech, software-as-a-service (Saas) and the direct-to-consumer (D2C) space are tapping this option, said industry experts.

Venture capital firms closed 35-50 huge rounds in India last year but number has fallen drastically in 2022, Sharma said.

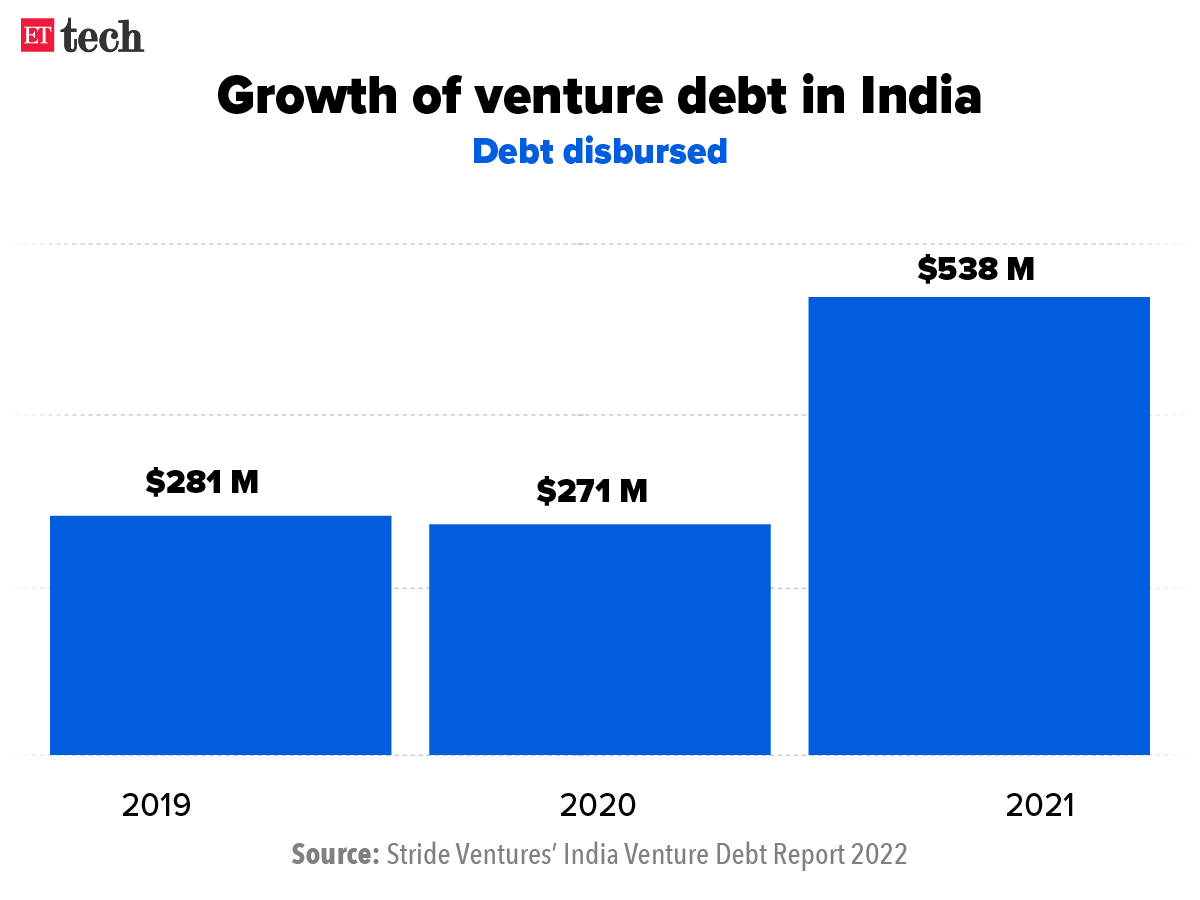

“Demand for venture debt has been steadily going up in the past 12 months. I think around $1 billion was deployed in 2021. We are seeing higher demand than supply, which is leading to a ‘flight to quality’ from a venture debt standpoint as well,” he added.

Another reason for the high demand for venture debt is caution among growth-stage investors. Even if startups want equity funding, they are not getting the desired valuations, said Ishpreet Singh Gandhi, founder and managing partner of venture debt firm Stride Ventures.

Venture debt firms believe the momentum set last year for lending to startups will continue without a pause this year as well.

The amount of venture debt disbursed in India doubled to $538 million in 2021 from $271 million in 2019, according to Stride Ventures’ recent India Venture Debt Report 2022. As per the report, venture debt’s average ticket size was $5.85 million in 2021, with 111 deals reported.

YC’s warning: Last week, Silicon Valley’s famed startup accelerator Y Combinator advised founders of its portfolio firms to plan for the worst and prepare for an economic downturn by cutting costs and extending their runways in the next 30 days.

RBI’s tokenisation rules will cause havoc, industry bodies say

The RBI’s mandate to replace card payments with unique tokens for all online, point-of-sale and in-app transactions, which comes into force on June 30, could cause severe disruptions, according to merchants and payment aggregators. They claim banks have not provided data on their “preparedness or success rate with tokenisation”.

Trouble looms: In December, the RBI had granted a six-month extension to merchants and payments aggregators to implement tokenisation and purge all existing card-on-file data.

With the deadline now only a month away, industry groupings said while online transactions currently take three to six seconds, generating a token can take anywhere from 10 minutes to 45 minutes. This, they said, will cause widespread disruption, especially among micro, small and medium businesses.

“We have written to the RBI (to) understand what the bank readiness is. We are still awaiting that information,” said Sijo Kuruvilla George, executive director of Alliance of Digital India Foundation (ADIF).

Tokenisation replaces a credit or debit card’s 16-digit number with a unique alternate 16-digit random character token derived from a combination of card, token requestor merchant and device that can be used for online transactions, mobile point-of-sale transactions or in-app transactions.

ETtech Done Deals

■ US-based live streaming commerce platform Firework said it has raised $150 million in a funding round led by Softbank Vision Fund 2. It plans to use the funds to increase its headcount across engineering, product and marketing, while focusing on enhancements to its platform.

■ Supply-chain financing provider Nakad said on Wednesday it has raised $7 million as a part of its seed funding round, co-led by Accel and Matrix Partners India. The round also saw participation from AdvantEdge Founders and several prominent startup founders.

■ Electric vehicle (EV) cab company BluSmart said it has raised $25 million in a combination of equity and debt funding. The equity round was led by BP Ventures and Green Frontier Capital and the venture debt funding came from Stride Ventures, Alteria Capital, BlackSoil and UCIC.

■ Polymerize, a Singapore-based software-as-a-service (SaaS) startup, has raised $4.2 million in a funding round led by Elevation Capital. The round also saw participation from existing investor InfoEdge Ventures. Polymerize plans to use the new funds to ramp up hiring and expand its footprint across India, Japan and the US.

■ Jovian, an edtech firm focused on data science and machine learning, said on Tuesday it has raised $1.5 million in funding led by Multiply Ventures. The new funding will be used to expand the startup’s team of data science experts, improve its curriculum, and offer mentorship to its growing student base.

Other Top Stories By Our Reporters

MeitY brainstorms with startups: The Ministry of Electronics and Information Technology on Tuesday organised a brainstorming session with more than 80 startups and other researchers to discuss India’s strategy in the field of artificial intelligence and language technology. The meeting was chaired by Minister of State for Information Technology Rajeev Chandrasekhar.

HCL partners with WEF on freshwater management: HCL Group will commit $15 million over five years to support water-focused entrepreneurs and drive innovation in freshwater resource management. It has partnered with UpLink, the open innovation platform of the World Economic Forum that connects promising startups with the partners and funding they need to scale.

Global Picks We Are Reading

■ Dutch police create deepfake video of murdered boy, 13, in hope of new leads (The Guardian)

■ Broadcom weighs paying $60 billion for VMware (WSJ)

■ Nothing could slow inDriver’s rise from Siberian startup to global Uber competitor. Then Russia invaded Ukraine (Rest of World)

Today’s ETtech Morning Dispatch was curated by Zaheer Merchant in Mumbai and Judy Franko in New Delhi. Graphics and illustrations by Rahul Awasthi.