Credit: Giphy

Also in this letter:

■ Unicorns unwilling to take valuation cut face longer winter: SoftBank’s Son

■ Telecom giants plan gaming and e-sports push

■ India looks to end China’s dominance in budget smartphones

WazirX tries to allay employees’ concerns on ED action, Binance dispute

Crypto exchange WazirX on Monday attempted to allay the concerns of its employees, days after the Enforcement Directorate froze its banks assets, leading to a public spat between WazirX CEO Nischal Shetty and Binance CEO Changpeng Zhao, also known as CZ.

Driving the news: WazirX’s human resources department told employees in a Slack message that it disagrees with the ED’s allegations.

“In the light of recent news about WazirX, we wanted to let you know that we have been fully cooperating with the ED and have responded to all their queries fully and transparently. We do not agree with the allegations in the ED press release and are evaluating our plan of action,” read the Slack message, which we have reviewed.

Catch up quick: On Friday, the ED said it had conducted search operations against one of the directors of Zanmai Lab Pvt Ltd, the Indian entity that operates WazirX, and issued a freezing order on its bank accounts, which contain Rs 64.67 crore.

Shetty and Zhao have been at loggerheads on Twitter ever since over which entity has control of WazirX’s operations.

WazirX did not directly address this disagreement in the Slack note but said employees could ask questions “regarding the recent events”.

We reported on Monday morning that spat has dealt a blow to the about 15 million registered users of the Indian exchange, and that Zanmai Labs is exploring the possibility of taking legal action against Binance, according to sources.

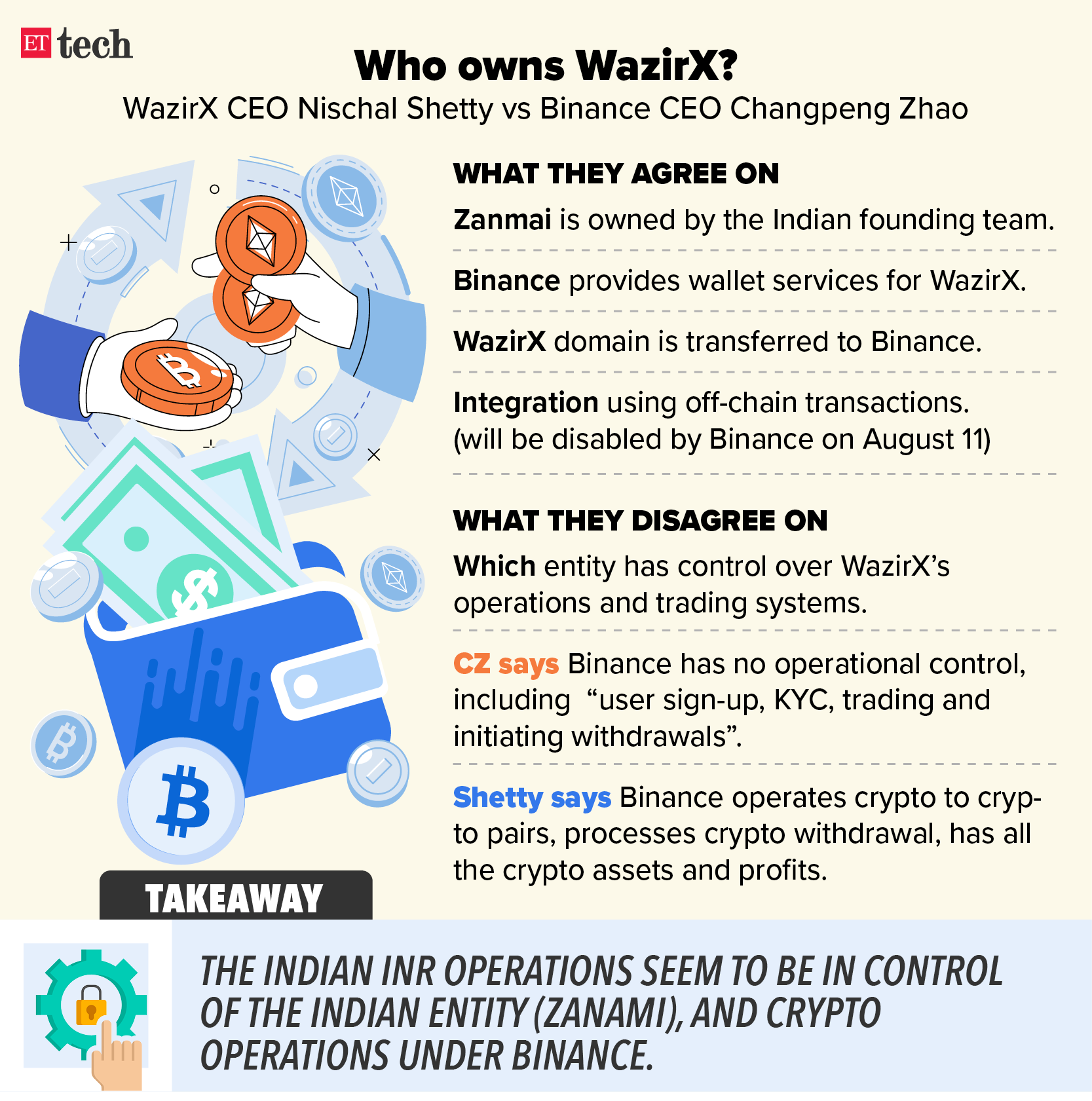

Binance statement: Meanwhile, Binance said on Monday that it does not manage WazirX users’ funds, as some were led to believe. It also said it was ending off-chain transfers with WazirX, as we first reported on August 8.

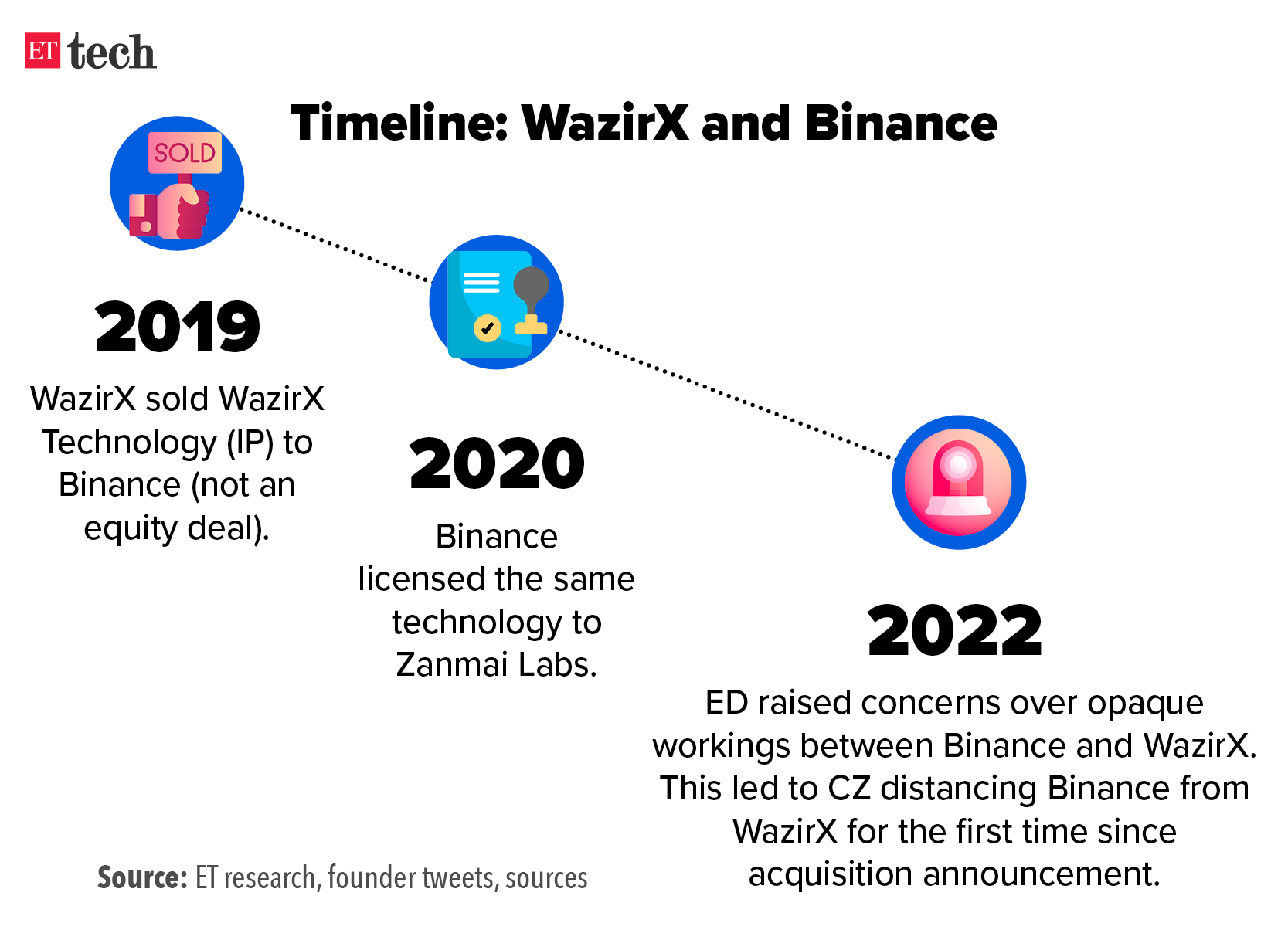

Genesis of the dispute: Almost three years ago, Binance said in a blog post that it had bought the Indian cryptocurrency exchange. But Zhao said on Friday that the shares were never transferred from WazirX’s parent entity Zanmai Labs, and the deal was not completed.

“Binance does NOT have control on operations including user sign-up, KYC, trading and initiating withdrawals, as stated earlier. WazirX’s founding team controls that. This was never transferred, despite our requests. The deal was never closed. No share xfers,” he posted on Twitter.

Shetty countered on Saturday, saying the deal his company struck involved Binance’s parent entity. “After some media reports on Binance structure, we asked about it. We were given an ambiguous answer that the parent entity is under restructuring. It’s been many months, still waiting for Binance parent entity… can Binance name [the] parent entity?” Shetty tweeted.

Unicorns unwilling to take valuation cut face longer winter: SoftBank’s Son

SoftBank chief executive Masayoshi Son said the ongoing funding winter will last longer for unicorn founders who are unwilling to accept a lower valuation to raise funds and continue to believe in their previous valuation. Unicorns are startups valued at $1 billion or more.

Driving the news: “Our Vision Fund saw huge losses but unfortunately unicorn company leaders still believe in their valuation and they would not accept the fact that they may have to see their valuation (go) lower than they think. So, until the multiple of unlisted companies is lower than [that] of listed companies, we should wait,” Son said in a post-earnings briefing.

Record losses: SoftBank saw a record loss of $17 billion in its Vision Fund during the June quarter. SoftBank Group as a whole recorded a loss of $23 billion in the quarter under review – also the biggest in its history.

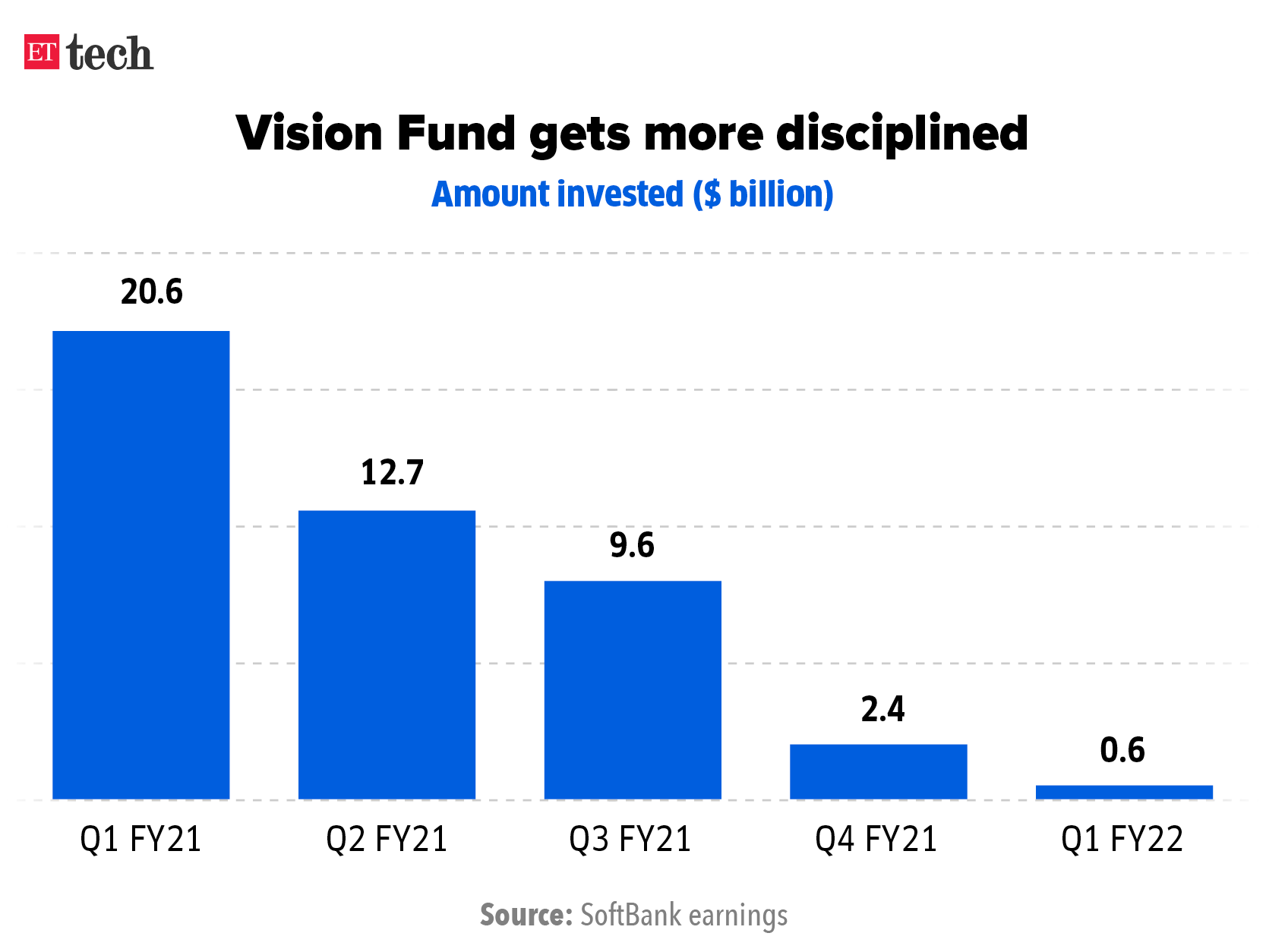

Discipline needed: Son said it must cut internal operational costs and be more disciplined in making new investments. It invested only $600 million in the first quarter of this year compared to over $20 billion in the same period last year.

Carnage: The Vision Fund losses come on the back of some of SoftBank’s top bets like Doordash and Coupang taking a hit on the stock markets.

- In India, its $100 million investment in Policybazaar was valued at $300 million at the end of the June quarter. It was worth $400 million as of FY22.

- Its investment in Paytm, which had a disastrous listing last November, had a fair value of $1 billion as of the June quarter compared to investment cost of $1.4 billion.

- Its $400 million investment in Delhivery, however, was worth $900 million.

Telecom giants plan gaming and e-sports push

India’s telecom giants Reliance Jio, Bharti Airtel and Vodafone Idea are planning to enter the fast-growing gaming and e-sports space as the rollout of 5G services across the country promises to drive more investment and growth in the sector.

Core focus: All three players have outlined gaming as a core focus of their business going forward as they look to increase their average revenue per user (ARPU) and subscribers. The Indian online gaming market is set to become a $5 billion opportunity from the current $1.8 billion, according to a report by the Boston Consulting Group and Sequoia India.

Quote: “For customer stickiness and increase in ARPU, we should expect to see a loyal shift of gamers on to the 5G networks (whenever they are launched), pertaining to the benefits of 5G,” said Pulkit Pandey, principal analyst, Communications Technology Team, CIO Industries Research Group, Gartner.

Reliance was the highest spender in India’s first 5G spectrum sale held last week — picking up 24.74 GHz of airwaves for Rs 88,078 crore. Airtel was second, acquiring 19.867 GHz of airwaves for Rs 43,084 crore.

Tweet of the day

India looks to end China’s dominance in budget smartphones

Amid a worsening geopolitical environment, India is planning to restrict Chinese smartphone giants like Xiaomi, Oppo, and Vivo from selling smartphones cheaper than Rs 12,000 ($150) in the country, looking to end their dominance and give a boost to homegrown players, Bloomberg reported.

Lion’s share: According to market tracker Counterpoint, Chinese smartphone makers accounted for 80% of India’s entry-level smartphone market in the June quarter. Chinese companies have been increasing their reliance on India ever since Covd-induced lockdowns hampered consumption demand in China.

Yes, but: The Indian government recently started cracking down on Chinese smartphone players owing to alleged tax evasion and data security concerns. The Directorate Revenue Intelligence (DRI) had detected alleged customs duty evasion of Rs 4,389 crores by Oppo, while Vivo was found to have allegedly evaded Rs 2,217 crore in taxes.

India has already banned over 300 Chinese apps, including TikTok and PUBG, owing to its strained relationship with Beijing.

Twitter users have spoken on fake accounts: Elon Musk

A Twitter poll conducted by Elon Musk on August 6 revealed that nearly 65% of his followers don’t believe Twitter’s claims that spam accounts comprise less than 5% of total accounts on the platform. Musk conducted the poll amidst an ongoing trial over his $44 billion takeover.

The Tesla CEO had earlier said in a tweet that he would complete his Twitter takeover if CEO Parag Agrawal proved the actual number of fake accounts on the platform. Musk and Twitter have been at loggerheads over the issue since the deal was announced, with Musk accusing the company of fraud last week.

While Musk claimed Twitter hoodwinked him, the social media company brushed aside his claims, calling them “factually inaccurate, legally insufficient, and commercially irrelevant”.

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant in Mumbai and Ruchir Vyas in New Delhi. Graphics and illustrations by Rahul Awasthi.