While the world’s largest crypto asset is receiving its fair share of attention amid the wipeout, most of the focus was on a different class of cryptocurrencies, known as stablecoins. Unlike ‘regular’ cryptocurrencies, which are highly volatile, stablecoins are designed to have a fixed value – typically $1.

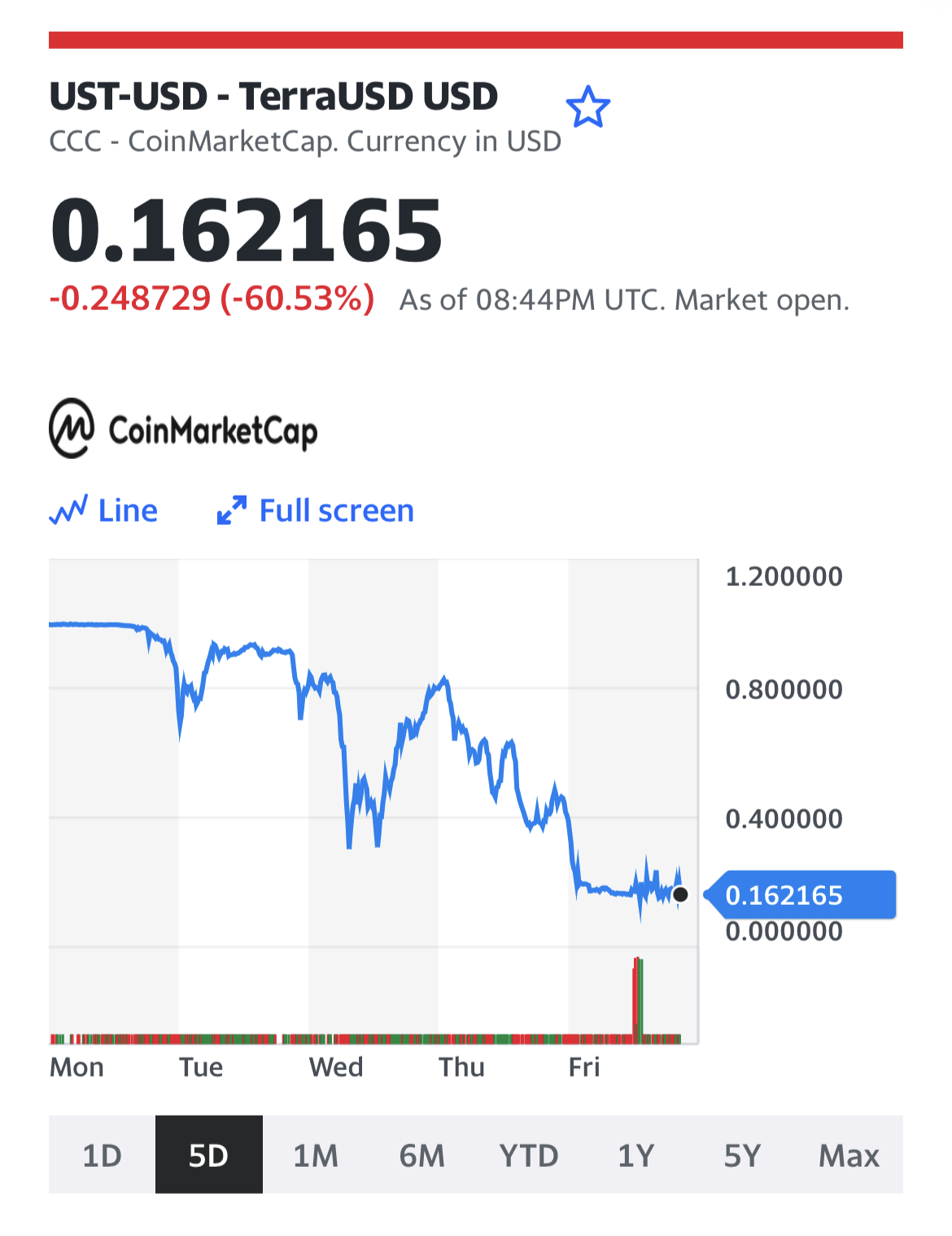

Crypto-quake: On Monday, the stablecoin terraUSD (aka UST), which runs on the Terra blockchain, “broke its peg” to the dollar after investors seemingly lost faith in the project. That seemed to trigger a wider crypto crash, with bitcoin falling below $30,000 for the first time since July 2021 and dragging other top cryptocurrencies down with it.

Then on Thursday tether, the largest stablecoin of all with a $80 billion market cap, also broke its peg to the dollar, falling to as low as 94 cents. Tether is a cornerstone of the crypto ecosystem, so this sent bitcoin and other cryptocurrencies into freefall.

Credit: Yahoo Finance

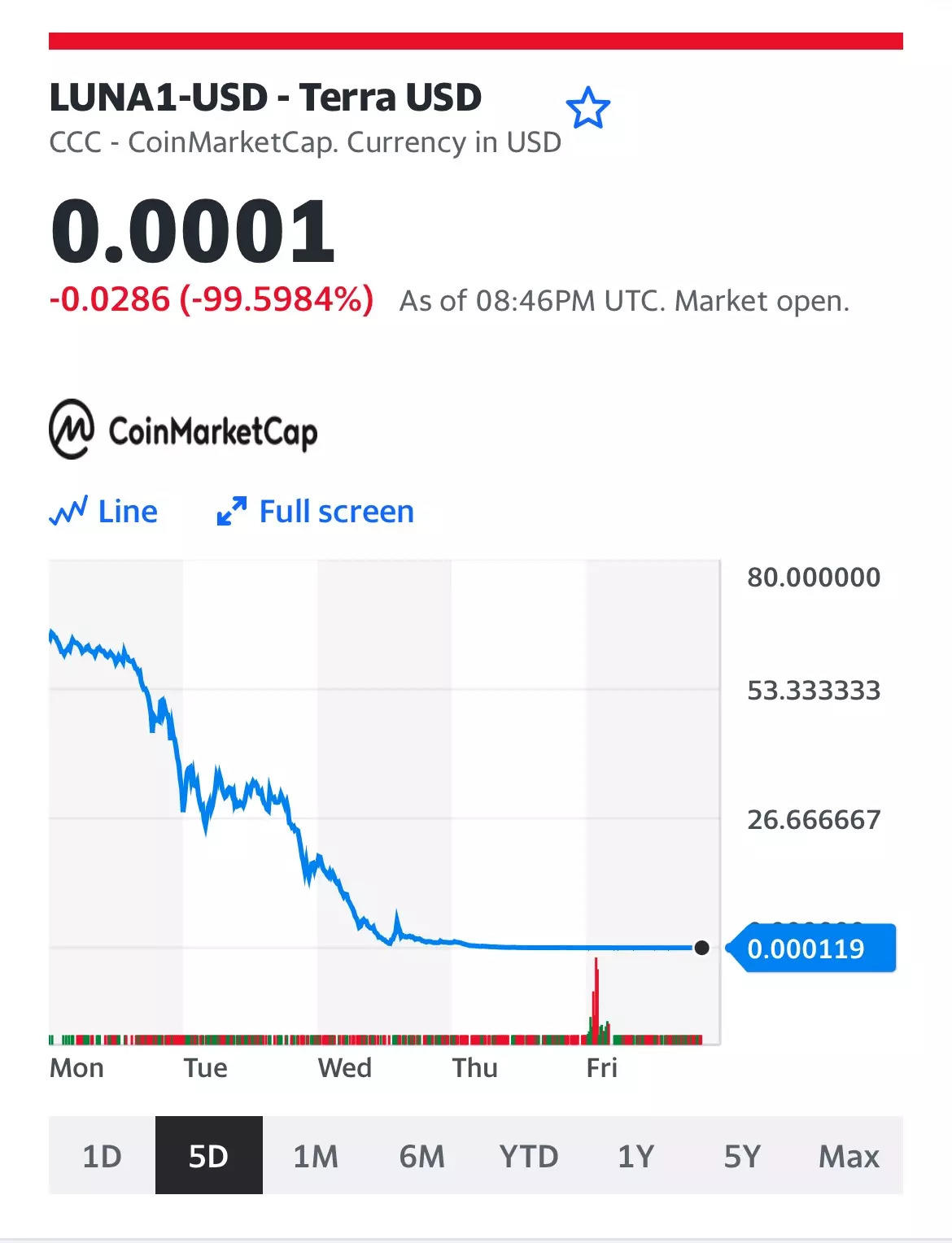

Game over: By Friday the gig was up for UST, which plummeted to around 14 cents. Luna, its ‘sister token’, which is meant to help UST maintain its peg to the dollar, was worth $0 as investors abandoned the project altogether.

Major exchanges in India and around the world, including Binance, quickly suspended trading in UST and Luna.

In a Twitter thread, Binance CEO Changpeng Zhao explained the reason behind the company’s decision.

“An exponential amount of new Luna were minted due to flaws in the design of the Terra protocol. Their validators have suspended their entire network, resulting in no deposits or withdrawals possible to or from any exchange,” Zhao said.

“Some of our users, unaware of the large amounts of newly minted Luna outside the exchange, started to buy Luna again, without understanding that as soon as deposits are allowed, the price will likely crash further. Due to these significant risks, we suspended trading,” he said.

A told-you-so moment: Stablecoins have long been controversial in the crypto community. They were created as an alternative to the high volatility of regular cryptocurrencies. Stablecoins maintain their value by being tied, or “pegged”, to a currency such as the US dollar or a commodity such as gold.

This makes them useful for managing crypto investments as they directly connect fiat money to these digital assets.

But critics have said that many stablecoins are in fact highly risky investments, prone to severe bouts of illiquidity, and have the ability to do some serious macroeconomic damage if left unchecked.

Given what we’ve seen over the past week, they may have a point, especially with the new generation of stablecoins such as terra.

Types of stablecoins: First-generation stablecoins, such as tether, are backed by actual assets – or at least they’re meant to be. Though Tether has claimed its tokens are backed 1:1 by US dollars, the group has been criticised for its lack of transparency on its holdings. Last year it was fined $41 million by the US Commodity Futures Trading Commission for making misleading statements about its reserves.

But second-gen stablecoins, which include UST, are even more controversial. Known as ‘algorithmic stablecoins’, they maintain their value using complex software, not actual assets like bonds or gold. The lack of physical assets in reserve means they’ve been harder for regulators to rein in.

How algorithmic stablecoins work: UST runs on the Terra blockchain alongside its ‘sister token’ Luna.

The Terra protocol tries to keep the price of UST at $1 by ensuring its supply always meets the demand for it. It does so through price arbitrage between UST and Luna, using a complex set of algorithms.

When UST is trading at more than $1, it implies demand is higher than supply. The protocol automatically incentivises users to mint more UST by burning Luna and make a profit off the price difference.

This lowers the price of UST by increasing its supply and increases the price of Luna by reducing its supply. Users continue this arbitrage process until UST returns to $1. When UST falls below $1, the protocol incentivises users to do the opposite – burn UST and mint Luna – until UST rises to $1.

For a while the system worked, keeping UST stable at $1 – until this week.

Abandon ship: The entire Terra ecosystem, like most of crypto, relies on traders and investors having faith in Luna’s value – once enough of them lose faith, the gig is up. That’s exactly what happened last weekend, when investors began pulling out of both UST and Luna, triggering the crash on Monday.

By Tuesday, UST was at 60 cents, down 40% as the sell-off continued. Terra’s creators tried to stabilise the token by throwing money at the problem, but in vain. On Wednesday, UST dropped to 30 cents. By Friday, UST and Luna were history.

So, what’s next? In a word, regulation. Amid the turmoil this week, US Securities and Exchange Commission chairman Gary Gensler accused crypto exchanges of “trading against their customers”. He also pointed out that major stablecoin projects such as Tether, USD Coin and Binance USD are affiliated with large exchanges.

Gensler told Bloomberg, “I don’t think it’s a coincidence. Each one of the three big ones were founded by the trading platforms to facilitate trading on those platforms and potentially avoid AML (anti-money laundering) and KYC (know your customer).”

By Zaheer Merchant in Mumbai.

Top Stories By Our Reporters

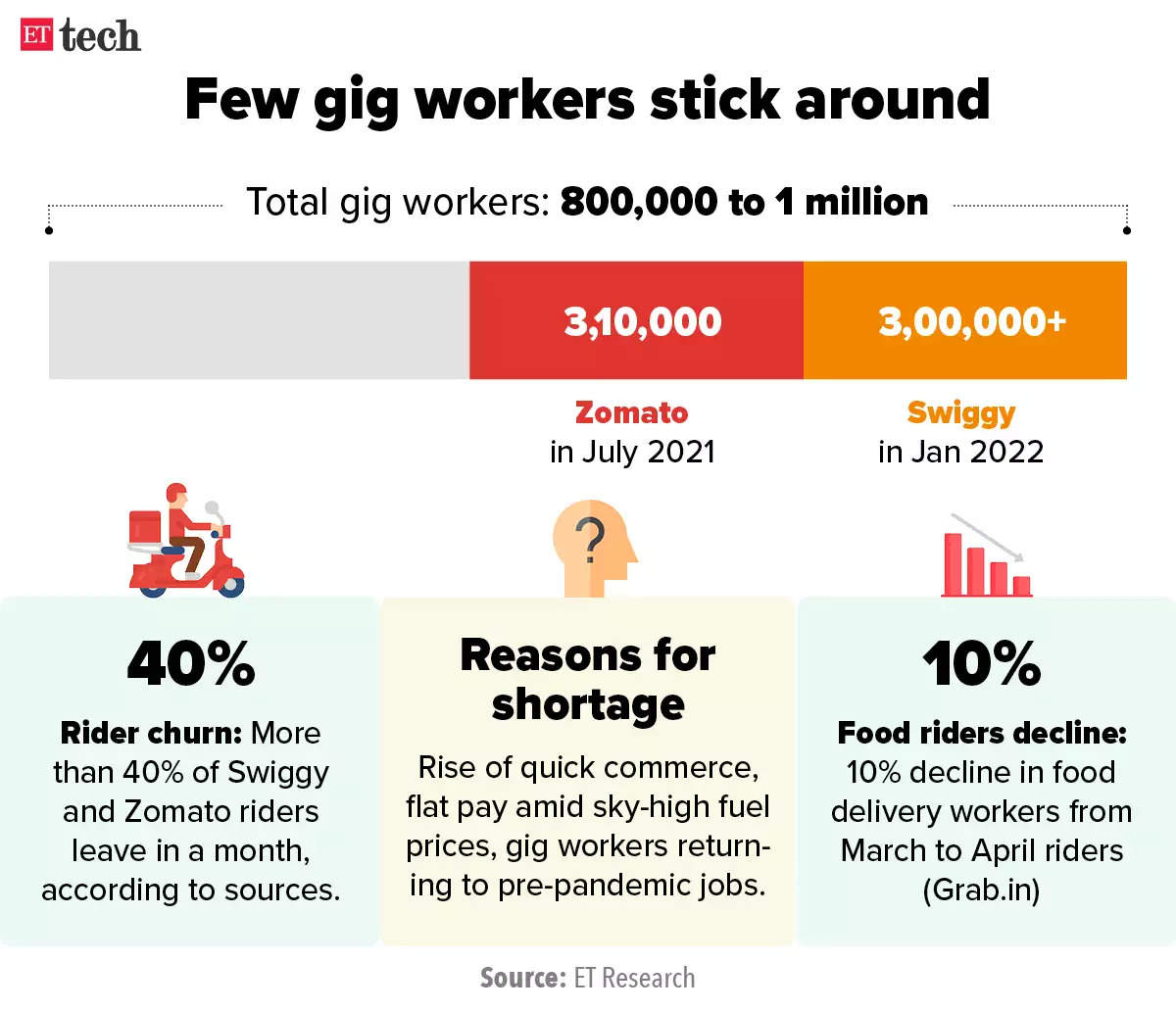

Shortage of gig workers hits food delivery, quick commerce startups

An acute shortage of delivery personnel is proving a huge concern for online platforms, which are unable to meet rising demand amid supply-side challenges in the gig economy, sources told us.

Zomato, Swiggy and Zepto, among others, are seeing delivery timelines lengthen as workers battle rising fuel prices and high inflation, with some even choosing to return to pre-pandemic jobs. Gig workers are freelancers and do not receive benefits offered to permanent employees.

Zomato’s 10-minute delivery plan hits a speed bump: Zomatois reviewing its plan for 10-minute deliveries as it hasn’t been able to meet the time target for all orders during its pilot in Gurugram, several industry executives told us. The company said the pilot, which was launched in April, is running as expected. But on the app, Zomato Instant shows delivery times of 15-20 minutes on average.

Elon Musk says $44-billion Twitter deal on hold

Elon Musk on Friday said the deal to take over Twitter is ‘on hold’ till there’s some clarity on whether spam or fake accounts represent less than 5% of the microblogging site. “Twitter deal temporarily on hold pending details supporting calculation that spam/fake accounts do indeed represent less than 5% of users,” Musk tweeted.

Startups pull out all the stops for those with specific skills

India’s startups are stepping up their efforts to retain workers with specific skills and stem high attrition rates by offering attractive growth prospects. Skills in data science, engineering, product, digital marketing, design, artificial intelligence and machine learning are commanding a premium, and companies such as Livspace, Urban Company, Chargebee, BankBazaar, Clear and API Holdings are pulling out all the stops to hire and retain people with these skills.

Ecommerce corner

Flipkart, Reliance and Amazon in talks to join ONDC

Ecommerce giants Amazon, Flipkart and Reliance Retail are in talks to join India’s ambitious Open Network for Digital Commerce (ONDC), sources told us.

The news comes as the network’s pilot programme to onboard kiranas and other small and medium businesses gets underway in Bengaluru and four other cities.

Ecommerce continues to grow even as offline stores and markets reopen: People are continuing to buy online even though footfalls and sales at offline markets and large retail stores have returned to pre-Covid levels, according to the latest financial data from many top companies.

Flipkart to shut one of its seller fulfillment services: Flipkart is shutting down one of its seller services, called Smart Fulfillment, it said in a note to sellers who use the service. Under Smart Fulfillment, sellers would allocate a separate area for their products at their own warehouse or place of business, which would be linked to Flipkart’s systems so these goods could be delivered more quickly.

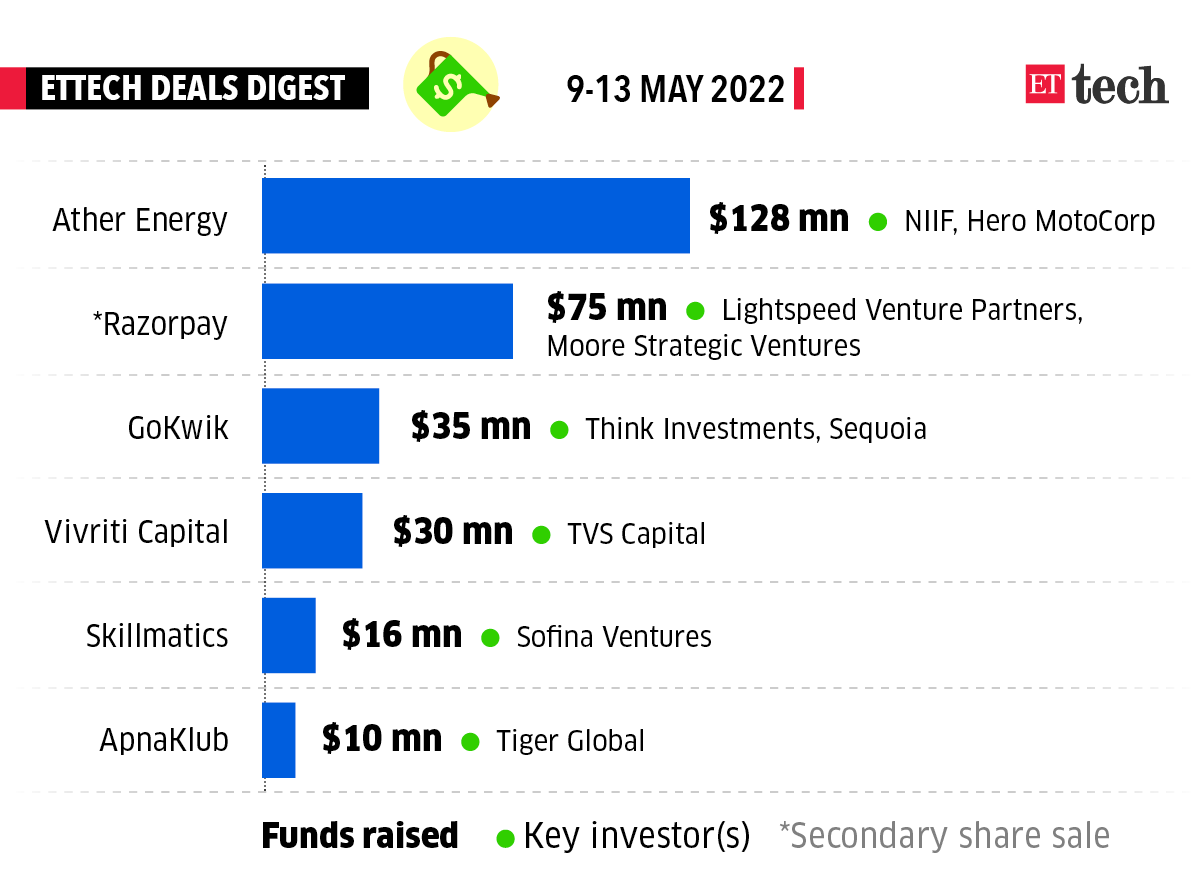

Ecommerce enablers bag big bucks amid D2C boom: Several early-stage startups that provide software tools to fledgling direct-to-consumer (D2C) brands and online marketplaces, are catching the attention of risk investors. On

Wednesday, two such platforms — Shopflo and GoKwik — said they had raised fresh funds. GoKwik bagged $35 million in a round led by RTP Global and Think Investments – its third fundraise in less than year. Shopflo picked up $2.6 million in seed funding led by Tiger Global and TQ Ventures.

Funding, M&As return as food industry recovers to pre-Covid levels

Investor interest, fundraising and mergers and acquisitions are back in the fine dining, quick service and cafes sectors after a two-year pandemic-induced downturn, executives said.

At least a dozen deals are in the pipeline, and interest has picked up from private equity players for funding. Established chains are also looking to buy small businesses, startups and cloud kitchens.

Cryptoverse

Stablecoin’s collapse deals another blow to Indian crypto investors

Indian crypto investors’ portfolios have plummeted further over the past 48 hours, triggered by the crash of a popular stablecoin called Terra (UST). UST, also-called ‘algorithmic stablecoin’, is supposed to maintain a one-to-one peg against the US dollar. But it slumped nearly to $0.26 to the dollar on Wednesday night, after the complex mechanisms that are supposed to hold the dollar peg failed.

Trading volumes jump in India as bitcoin crashes to $30,000: Trading volumes on Indian crypto exchanges rose after a dry spell as Bitcoin, the world’s most valuable crypto asset, slid by more than 56% from its all-time high of around $69,000 in November 2021 to below $30,000 on May 9. Bitcoin prices have since stablised at around $31,000 but down about 20% since May 3.

Meanwhile, Indian crypto exchanges that have or are looking to move out of the country have reached out to their tax advisors to figure out if they will still be required to comply with India’s 1% tax on all crypto transactions.

VPNs under threat

New rules apply to VPNs for individuals, not companies, says CERT-In

The recent mandate directing virtual private networks (VPNs) to register and maintain logs of their customers does not apply to enterprise or corporate VPNs, India’s top cybersecurity agency said.

Earlier, industry and cybersecurity experts expressed concerns regarding the new cybersecurity guidelines issued by CERT-In on April 28. Under the new rules, enterprises must report any cybersecurity incident to CERT-In in six hours and store all data for a stipulated period of time. But security experts said it is often days or even months before enterprises realise they have been compromised.

IT corner

Huge demand for tech talent drives attrition to 50% in some jobs

Even as the $200-billion Indian IT industry battles unprecedented attrition levels, attrition areas such as cloud computing, artificial intelligence, big data, is almost at 50%, according data collated and analysed by ET.

Cloud to be the biggest spend area for clients: HCL CEO C Vijayakumar: HCL Technologies generated half its incremental revenue from the digital applications business and sees cloud as the area in which it will continue to increase investments rapidly, CEO C Vijayakumar told us in an interview.

Demand remains strong, says HCL chairperson: HCL Technologies continues to see a strong demand environment led by digital transformation even as businesses emerge from the impact of the pandemic, said chairperson Roshni Nadar Malhotra. The company will continue to focus on new geographies in addition to its large market of North America and Europe, she said.

SoftBank to slash investments by more than half this year, says Son

SoftBank CEO Masayoshi Son said on Thursday that this year the company will invest only half, or even a quarter, of what it did last year.

“Peak of investment was Q1 but there was a huge slowdown in Q4. Compared to the amount of investment made last year, I would say the amount of new investment will be half or could be as small as a quarter,” Son said in a post-earnings call in Tokyo.

ETtech Done Deals

■ Third Wave Coffee, a Bengaluru-based coffee chain that’s popular with the city’s startup community, is in advanced talks to raise its first institutional funding of around $20-25 million led by WestBridge Capital, sources told us.

■ Lightspeed Venture Partners and Moore Strategic Ventures have picked up a stake in digital payments firm Razorpay as part of a $75 million secondary share sale, the company said.

■ Byju’s group company Great Learning has acquired Singapore’s executive education provider Northwest Executive Education for roughly $100 million in a stock and cash deal, sources told us

■ Electric scooter maker Ather Energy said it has raised $128 million in funding even as its rivals struggle to contain the fallout from a spate of recent EV fires and battery explosions.

Curated by Judy Franko in New Delhi. Graphics and illustrations by Rahul Awasthi.

That’s all from us this week. Stay safe.