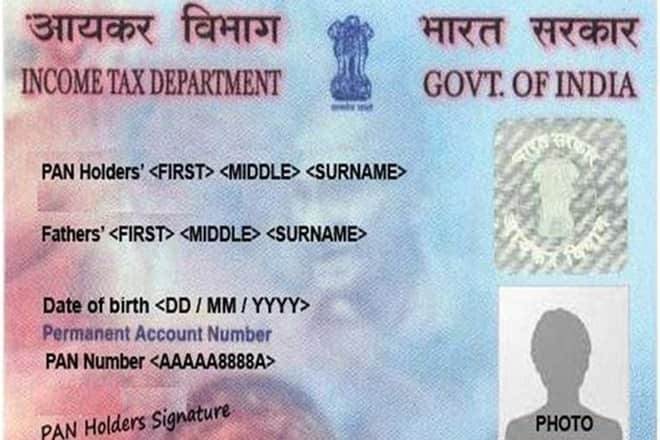

The Indian Income Tax Department gives individuals and businesses in India a unique identification number known as a PAN card, which stands for “Permanent Account Number.” It is used for paying taxes, opening bank accounts, and getting loans, among other financial transactions.

However, there have been instances in which other people’s PAN cards have been abused or used fraudulently.

It is essential for individuals to regularly check the usage history of their PAN card to ensure that it is being used appropriately in order to avoid such instances of fraud. This can be accomplished by contacting the Income Tax Department directly or using the department’s online portal.

The Income Tax Department’s e-filing portal is one way to examine your PAN card’s history. You will need to sign up for an account on the portal and log in with your PAN card number and other information to accomplish this.

You can see your PAN card’s details, including any transactions or changes, once you’re logged in. You may be able to identify any unauthorized use of your PAN card and take corrective action with the assistance of this.

You can also get in touch with the customer service center of the Income Tax Department if you are unable to access the e-filing portal or would rather talk to someone directly. You can get information about the history of your PAN card from the customer service center, and they can also assist you in resolving any issues you may be having.

It is important to note that the Income Tax Department has taken steps to safeguard individuals’ financial information and takes fraud and misuse of PAN cards very seriously. However, in order to ensure that their PAN card is being used appropriately, individuals should continue to exercise extreme caution and routinely review its usage history.

Note: You can help protect yourself from fraud and misuse of your PAN card by checking its history on a regular basis. This can be accomplished by contacting the customer service center or using the online portal of the Income Tax Department.

You can safeguard your PAN card and avoid any potential issues by remaining informed and taking proactive measures to safeguard your financial information.