Also in the letter:

■ Rs 1 lakh crore corpus announced for R&D push

■ Startups to enjoy tax incentives till 2025

■ EV ecosystem, deeptech in govt’s focus

Paytm admits hypergrowth led to compliance and tech shortfalls after RBI ban

A day after the Reserve Bank of India effectively barred all services offered by Paytm Payments Bank, the leadership of One 97 Communications, an associate company of the bank, alluded to issues around setting up controls regarding compliance and technology in a way that could satisfy the banking regulator, as a reason which attracted the penal action.

Breaking down the news: Neither the central bank, nor Paytm founder Vijay Shekhar Sharma disclosed the exact reason for which the bank faced such stringent penal action. However, Sharma acknowledged, during an analyst call held on Thursday, that in the event of quick growth, the bank might have had issues with risk and compliance.

From the horse’s mouth: “This is an opportunity for us to come out better, stronger, abler and more capable for the regulator’s eye and we are going to make sure that we will get out of this situation,” Sharma said during the call.

Earlier in the day, he wrote in a WhatsApp group of startup founders that nothing can deter them from continuing to build.

Possible reasons: Industry insiders alluded to multiple likely reasons behind the harsh action. Some felt there could be issues around data security while others said the reason could be too much overlap between Paytm and Paytm Payments Bank. But Paytm denied any data sharing between the two entities.

Also read | RBI action on Paytm indicates tough times ahead for fintech startups

Markets react: Shares of One 97 Communications, the entity which operates Paytm, crashed 20% today to hit the lower circuit at Rs 608.80 on BSE as investors started dumping the new-age stock after RBI action.

Support for Paytm: Many founders and investors came out in support of Sharma and Paytm, taking to public platforms to point out that the RBI’s directive has come across as being harsh, with the potential of affecting millions of consumers and businesses.

Also read | Brokerage firms warn of ‘regulatory overhang’ around Paytm’s future

Byju’s shareholder group calls for EGM, to vote for ouster of Byju Raveendran, board

The founder-shareholder rift at Byju’s is widening. A group of key shareholders at the troubled edtech firm has issued a notice calling for an extraordinary general meeting (EGM) to address ‘persistent issues’ including a change of management.

Driving the news: These shareholders, together holding over 30% stake in the company, will vote to oust founder and CEO Byju Raveendran and the existing board on February 23, seeking to wrest control of the once-celebrated and most valued startup of the country amidst concerns about its leadership and corporate governance.

Brewing dissent: Investors have been asking Raveendran to step aside from an operating role, but this is the first instance of them issuing a statement together.

“The issuance of this EGM notice follows many months of continued efforts by shareholders to engage with the company to address persistent issues relating to corporate governance, mismanagement and compliance,” the investor group said in a statement.

Signatories of the statement include Prosus, Peak XV Partners, Sofina, General Atlantic, Owl Ventures, Chan Zuckerberg Initiative and Sands Capital.

Tell me more: While acknowledging the independent advisory council’s efforts, the investor group expressed “deep concern” for Byju’s parent company’s “future stability” under the current leadership and board composition. Former SBI chairman Rajnish Kumar and ex-Infosys CFO Mohandas Pai are part of the council. Currently, founder Raveendran, his wife and cofounder of Byju’s Divya Gokulnath and his brother Riju Ravindran are on board of Think & Learn–parent of the edtech company.

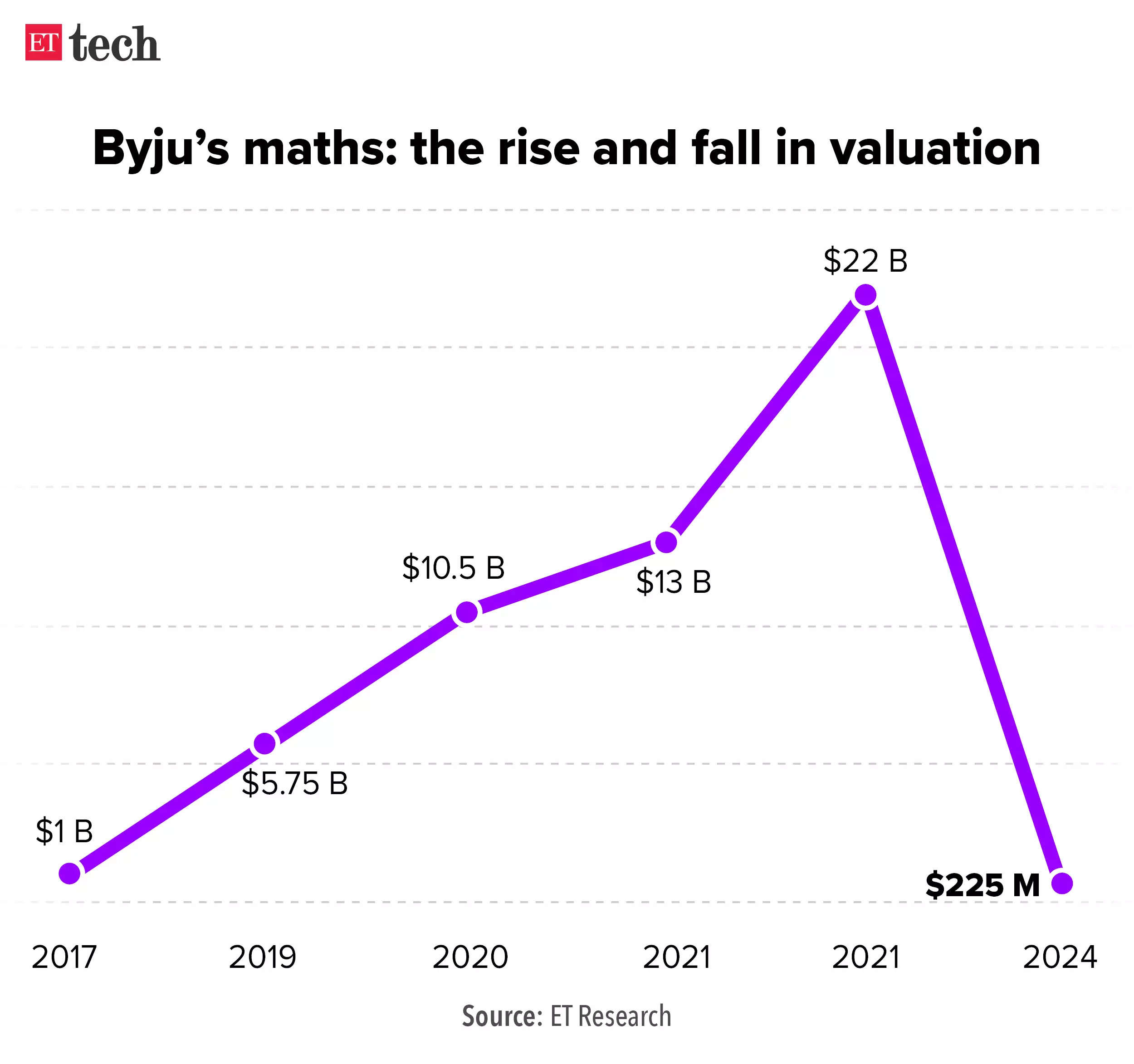

Quick catch-up: On January 29, Byju’s issued a notice to investors for a rights issue likely to be priced at a 99% discount to the company’s previous peak valuation of $22 billion in 2021.

ET reported on January 31 that a rights issue at such a low price will lead to a reset of the cap table if any investor decides not to subscribe to the share sale.

Budget 2024: FM Sitharaman announces Rs 1 lakh crore corpus for R&D push

Making a big push for research & development (R&D), the government on Thursday announced a corpus of Rs 1 lakh crore to promote technological innovation in sunrise sectors.

Details: “A corpus of Rs 1 lakh crore will be established with a 50-year interest-free loan provided. The corpus will provide long term financing or refinancing with long tenures and low or nil interest rates,” the finance minister said, hailing what she described as the ‘golden era’ for the country’s tech-savvy youth.

India’s share of R&D in overall GDP is much lower compared to developed countries and this announcement serves a long-standing demand of industry body Nasscom.

Calling on private players: Sitharaman said this will encourage the private sector to scale up research and innovation significantly in sunrise domains, while underscoring the need for programmes harnessing the power of India’s technology.

Welcome move: The move was praised by the industry, political leaders and analysts. Union education minister Dharmendra Pradhan called it a “game-changer policy”. MoS IT Rajeev Chandrasekhar also lauded the move.

“The large interest-free outlay will further boost the tech startup ecosystem in emerging areas around 5G, generative AI, agritech and healthtech,” Peeyush Vaish, partner at Deloitte, said in a statement.

Also read | Budget 2024: Key takeaways for tech and startup sectors

Government extends tax holiday for startups, sovereign funds

The interim budget for 2024-25 has proposed to extend the tax incentive for startups and investments made by sovereign wealth or pension funds for one more year till March 2025.

Details: Announced for the first time in the Union Budget 2017, the tax holiday scheme for startups offers 100% tax rebate to eligible startups on profits made for a period of three years in a total time frame of 10 years of operations.

Eligibility criteria: Startups with a turnover of less than Rs 100 crore are eligible for the tax incentives. The government has been extending the benefits for one year in every budget since 2017.

Hit or miss? Industry executives said the tax holiday only applies to a small number of startups. As per the department for promotion of industry and internal trade (DPIIT), around 1,17,000 startups are registered under the Startup India Scheme, and only 1-2% of those are eligible for tax holidays.

Quote unquote: “The focus on deep tech startups in the defence sector and the extension of tax benefits until March 2025 for startups, sovereign wealth, and pension funds signify a government committed to supporting growth and resilience,” said Bipin Preet Singh, cofounder and CEO, Mobikwik.

Also read | Budget 2024 | India’s DPI new factor of production, says FM

Govt says it will expand EV ecosystem; industry optimistic

FM Nirmala Sitharaman said the government will expand the electric vehicle (EV) ecosystem to support charging infrastructure, and e-buses will be encouraged to strengthen public transport networks.

The finance minister did not provide any updates on schemes like the production linked incentives (PLI) scheme or the Faster Adoption and Manufacturing of Electric Vehicles (FAME) subsidies.

Also read | Govt charts plan to paint 800k diesel buses green, scheme likely to replace FAME III

Expert view: Senior executives in the EV ecosystem said the focus on charging infrastructure was a natural next step for the government after it pushed out schemes related to the manufacture and ownership of EVs. Some, however, said they had expected further details in the speech.

Word for word: “We know that a lot of work has been going on in the background on improving and expanding schemes for EV adoption, but a public declaration always gives a sense of finalisation,” Amitabh Saran, founder and chief executive at commercial EV maker Altigreen Propulsion Labs, told ET.

Deeptech focus: The government will announce a new scheme to strengthen deeptech for the defence sector, Sitharaman said. Also, public and private investment in post-harvesting agriculture activities will be promoted.

Today’s ETtech Top 5 newsletter was curated by Vaibhavi Khanwalkar in Bengaluru.