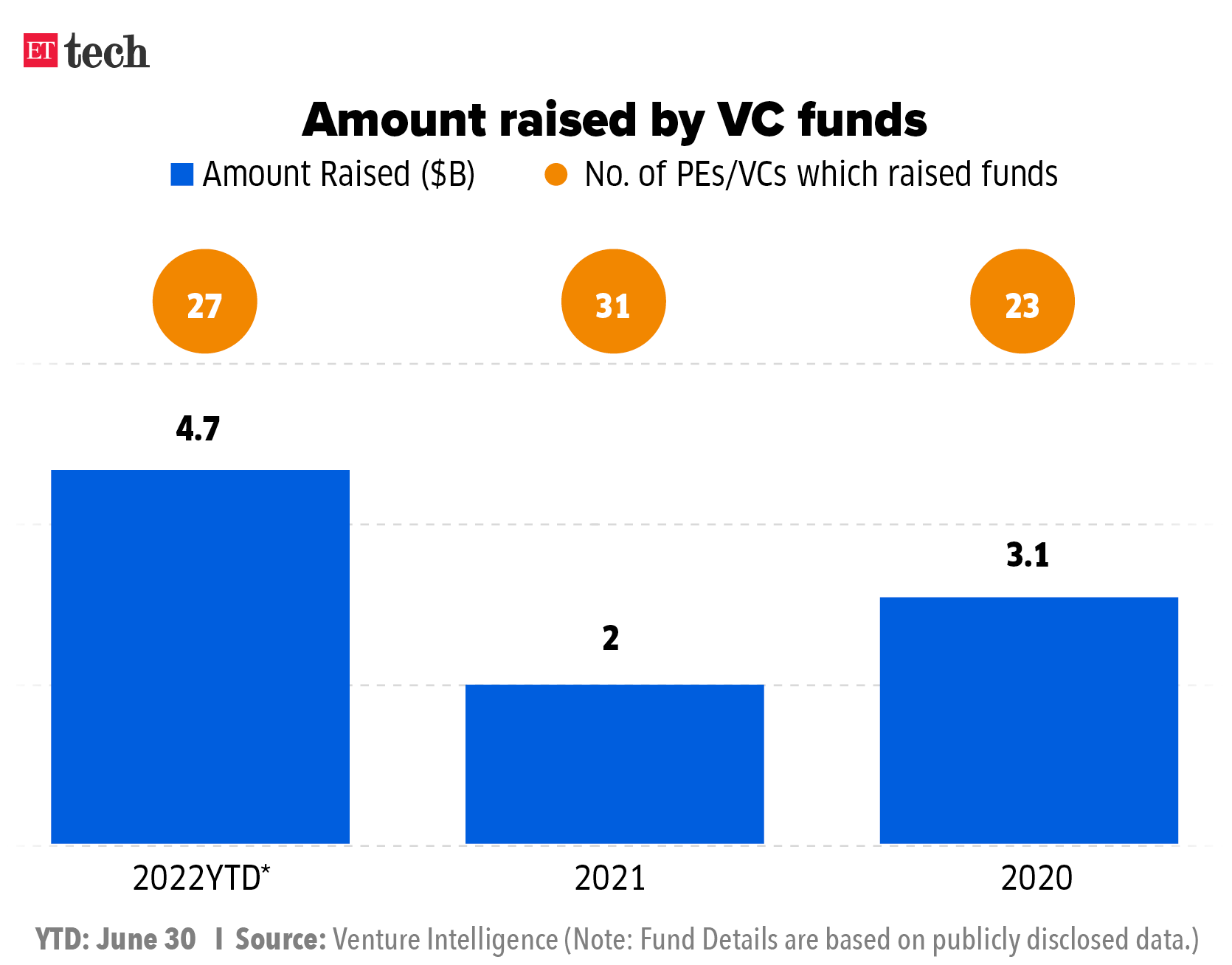

Six months into the new year, despite raising a record $4.7 billion of dry powder compared to $2 billion last year (as per Venture Intelligence data) for investing in startups alone, over a dozen VC firms, including Lightspeed Venture Partners, Sequoia Capital, Elevation Capital, and a number of smaller sized funds, have closed fewer deals in the first half versus the same period in 2021, data sourced from Tracxn and respective funds showed.

While the pace of early-stage deals is still moderately higher, there is no rush to issue a term sheet (an agreement sent by an investor before finalising funding), indicating a reversal of sentiment from 2021 among the investor community.

While Lightspeed completed 10 deals in the first half of this year compared to 16 in the first six months of last year, Elevation Capital closed 21 versus 37 in the same period.

Both VCs have raised their largest ever India corpus this year, at $500 million for Lightspeed and $670 million for Elevation.

The $4.7 billion fundraise so far does not include Lightspeed’s $500 million India and South Asia fund since it was announced earlier this month.

Discover the stories of your interest

ETtech

ETtechThe big difference this year is a lack of FOMO, which is prompting VCs to sit back and not be in a hurry to deploy the funds they have picked.

Over half a dozen executives, partners at top VC firms and investment bankers explained to ET what lies at the heart of this contradiction and how things will play out in the Indian startup ecosystem. Some of them requested anonymity.

The fund cycles for most VCs include active deployment for the first three years, after which growth-stage investments start coming in. The typical lifecycle of a VC fund is 10 years, by when investors look for an exit.

“Just because VCs have the dry powder, it doesn’t mean they have to deploy the capital quickly because there’s uncertainty and nobody knows what the rock bottom for the markets is,” said an investor who did not wish to be named.

For instance, the number of deals Sequoia Capital India has completed this year is 28 compared to 32 during the first six months of last year, according to data sourced from Tracxn.

Sequoia raised $2.85 billion across growth, venture and Southeast Asia.

IvyCap Ventures, a small fund, has reduced its pace of dealmaking by almost 50% despite mopping up

$214 million as part of its first close for the third fund. IvyCap made five investments in the first half of the year compared to 11 in the same period last year.

Vikram Gupta, founder and managing partner of IvyCap Ventures, said the fund was taking longer to close a deal at more favourable terms.

“There is obviously a little bit of caution… If you give time from a negotiation perspective, you get the terms that you would like, so we have seen that trend, and therefore, we are not in a hurry to deploy capital,” Gupta said.

On the funds raised by investors and the slowdown in funding, Bejul Somaia, partner at Lightspeed, told ET in a recent interview, “With respect to the capital that has been raised, in some periods, it may get deployed quicker than three years, and in some periods, it might take longer… What happens at times like this is that there is a flight to quality. For example, the third or the fourth company in a sector will find it very difficult to raise capital. Investors will be a lot more discerning than six months ago.”

ETtech

ETtechFewer exits

“In a market like today, when exits become harder, VCs want to give themselves the time for companies to reach a point where they can exit… Otherwise, limited partners (LPs) are bound to ask questions on maturity of last funds and exits during the next raise. Therefore, fund deployment will continue to be slow,” said a partner at a leading VC firm.

Last year, exit opportunities were plenty through successful domestic public offerings of companies like

, Freshworks, and PolicyBazaar in a never-seen-before technology bull run.

The macro headwinds this year have also made several funds tap early-stage investments, with the likes of

Tiger Global participating in $2.6 million funding rounds like the one in ecommerce enablement startup Shopflo.

The New York-based investment firm has ramped up early-stage deployments, making 16 early-stage bets this year until June-end, compared to seven last year, according to data from Tracxn, which counts seed to Series B as early-stage funding.

For instance,

Accel, which recently closed its $650 million India-focused fund, said that it would remain excited about the early-stage opportunity in India. The firm made 31 investments this year in the first six months, compared to 18 last year. It has closed 19 early-stage rounds in 2022 versus 11 last year, Tracxn data showed.

“The correction and slowdown in early stages is presently minimal but that may change going forward. Also, we are yet to see a fewer number of startups tapping the private funding market. However, the next three to six months will be crucial, and we will get a better picture by the end of the year,” Karan Mohla, who is leading the Asia team for Ascent Fund, an early-stage fund

with a corpus of $250 million from B Capital, told ET last week.

ETtech

ETtechEveryone is waiting for some degree of consolidation to occur around the top players in a category, said Vikram Chachra, partner at 8i Ventures which has backed startups like fintech Slice.

“VCs are trying to see who’s winning in the end and who can survive. They want to see a very clear path to profitability. Things like the market share and gross margin gains are being looked at. So, we are now starting to think almost like public market investors,” Chachra said.

He added that larger VCs may spend more time working on the existing portfolio companies so that they grow into their valuations.

8i ventures, which is in the market to close its $50 million fund, has closed two deals in the first six months. According to Chachra, they typically close one or two deals every quarter.