Also in this letter:

■ Netflix’s India ops under I-T radar

■ SoftBank sells 2% stake in Paytm

■ Meity notice to WhatsApp on spam calls

Exclusive: Pine Labs, PharmEasy face markdowns by US investor Neuberger Berman

Hi, it is Pranav Mukul in New Delhi. Even though Indian startups haven’t started witnessing down rounds like some of their US-based counterparts, valuation markdowns – an accounting exercise undertaken by asset management companies – have begun in full swing.

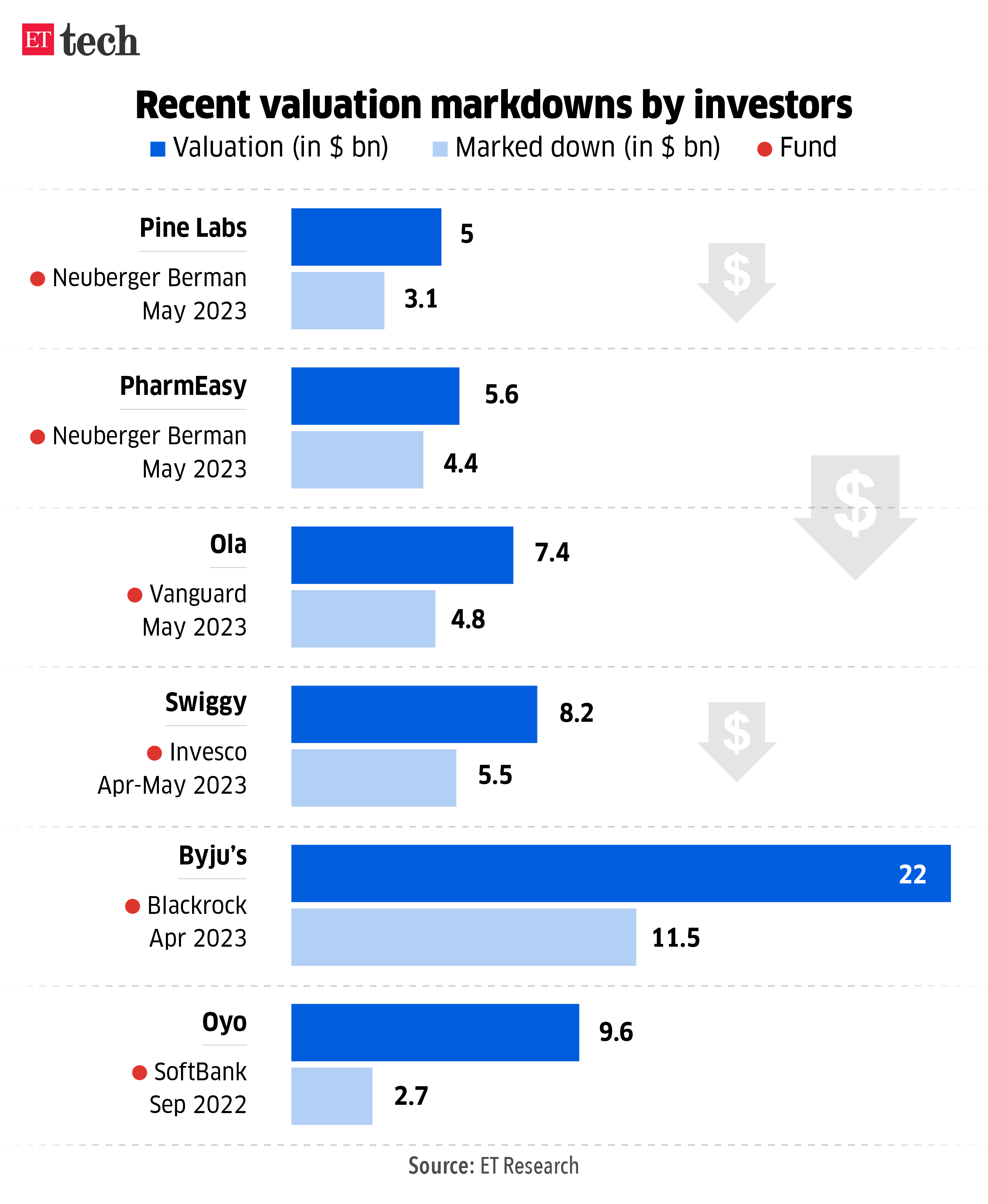

Driving the news: Fintech major Pine Labs and online pharmacy PharmEasy have joined Ola, Swiggy, Byju’s and Oyo, all of which have seen their valuations being cut by their investors.

Tell me more: Funds managed by New York-based investment management firm Neuberger Berman marked down valuations of shares they hold in Pine Labs by 38% and in PharmEasy’s parent company API Holdings by 21%, according to filings made with the US Securities and Exchange Commission. Following this, these companies were valued at $3.1 billion and $4.4 billion, respectively, as against $5 billion and $5.6 billion at the time of their last fundraising rounds.

Also read | Wary investors walk away from large-funding deals at unicorns citing tech turbulence

The big picture: These markdowns are indicative of the cooling of the consumer internet investment ecosystem and the slowing growth of startups in India. Even as venture investors dubbed the markdowns as theoretical, they alluded to these exercises being precursors to some companies raising money at lower valuations than before.

Quote, unquote: “It’s a very standard process. Every fund does this every quarter. The markdown happens when the fund wants to show its investors what the reality of the situation is because a markup will happen when a fundraise round happens at a higher valuation,” a partner at an early-stage venture capital fund said.

Paytm likely to forego buyer app commission on ONDC

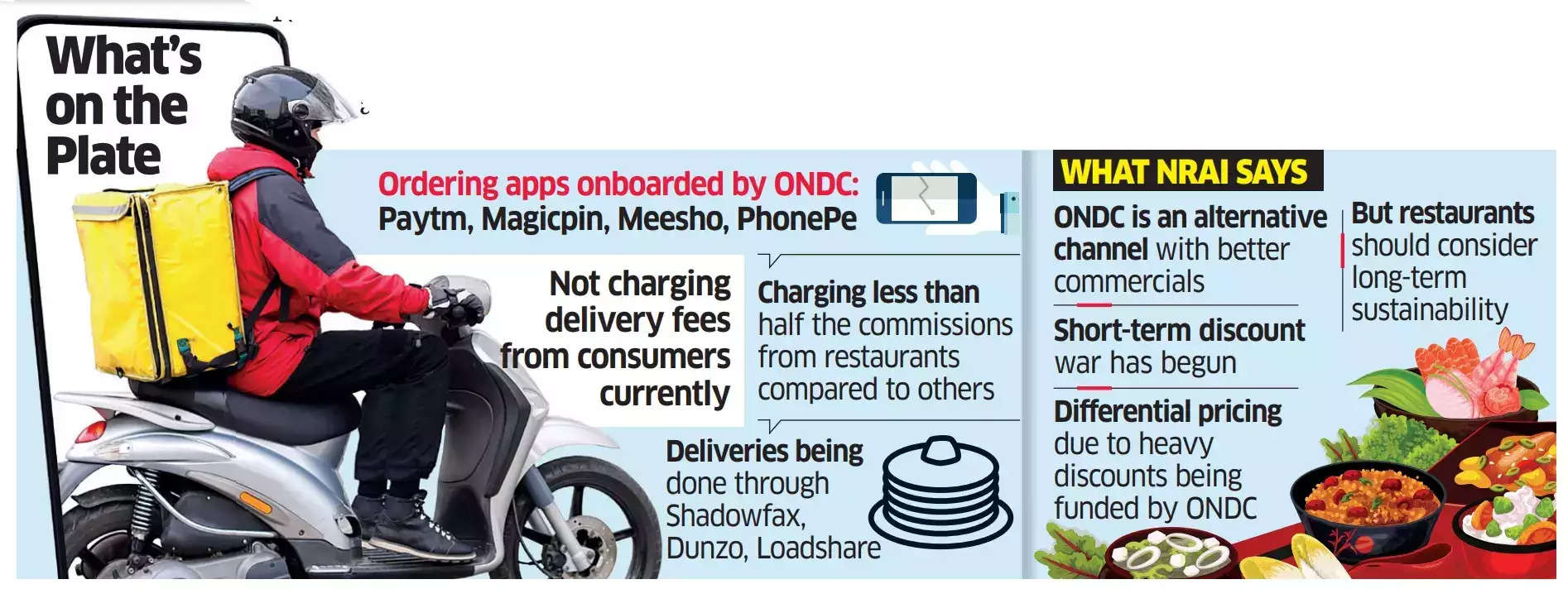

Paytm, which comprises about a third of the total orders on the Open Network for Digital Commerce (ONDC), may forego the 3% commission it charges as a buyer app on the network, intensifying the challenge ONDC poses to the Swiggy-Zomato duopoly.

Driving the news: Paytm, one of the first buyer apps to go live on ONDC, plans to forego commission on orders fulfilled by sellers where there are no customer complaints, sources told us. This move will further fuel customer participation in the fast-growing network.

Also read | ONDC logs slow ecommerce uptake, snags may hit expansion

ONDC chief T Koshy refused to comment on the specifics of the scheme offered through Paytm, but told ET that various network participants will be coming out with different schemes to encourage the establishment of the network.

Change in incentives: Earlier, ONDC offered an incentive of up to Rs 75 as a discount for buyer’s logistics on every eligible order. But, on May 7, ONDC sent a communication to seller-network participants capping daily maximum incentives for seller-side apps – merchant-facing platforms that connect retailers with ONDC – and sellers.

Also read | Explained: ONDC vs Zomato-Swiggy and what it means for the food-delivery space

On watchlist: Govt seeks to tax Netflix income in India

Income tax authorities are seeking to tax Netflix Inc’s income earned from streaming services in India, sources have told ET. This would be the first such levy for an overseas digital company providing electronic commerce services in India.

Details: Tax authorities have held that the US-headquartered entertainment company has a permanent establishment (PE) in India and is thus liable to get its income in the country assessed for tax. In a draft order, the tax authorities attributed about Rs 55 crore income to Netflix’s Indian PE in the assessment year 2021-22.

The India unit of Netflix has infrastructure and seconded (loaned for a short period of time) employees from its parent company, headquartered in the US, and is thus eligible as a PE, and liable for tax assessment.

Appealing tax assessments: In international taxation, the assessee, Netflix Inc in this case, can object to a draft order before the assessing officer (AO) or Dispute Resolution Panel (DRP). The AO or the panel issues a final order. If the DRP is approached, its decision is binding on the income tax department but not the assessee, and it must give a decision within nine months.

ET Ecommerce Index

We’ve launched three indices – ET Ecommerce, ET Ecommerce Profitable, and ET Ecommerce Non-Profitable – to track the performance of recently listed tech firms. Here’s how they’ve fared so far.

SoftBank Vision Fund logs $32 billion annual loss; sells 2% in Paytm

Technology investor SoftBank’s Vision Fund recorded an annual loss of $32 billion ending March 31 as valuations of tech firms undergo correction in private and public markets. This is an increase of around 70% on a year-on-year basis. SoftBank Group Corp reported an annual net loss of $7.18 billion for the year ended March 31.

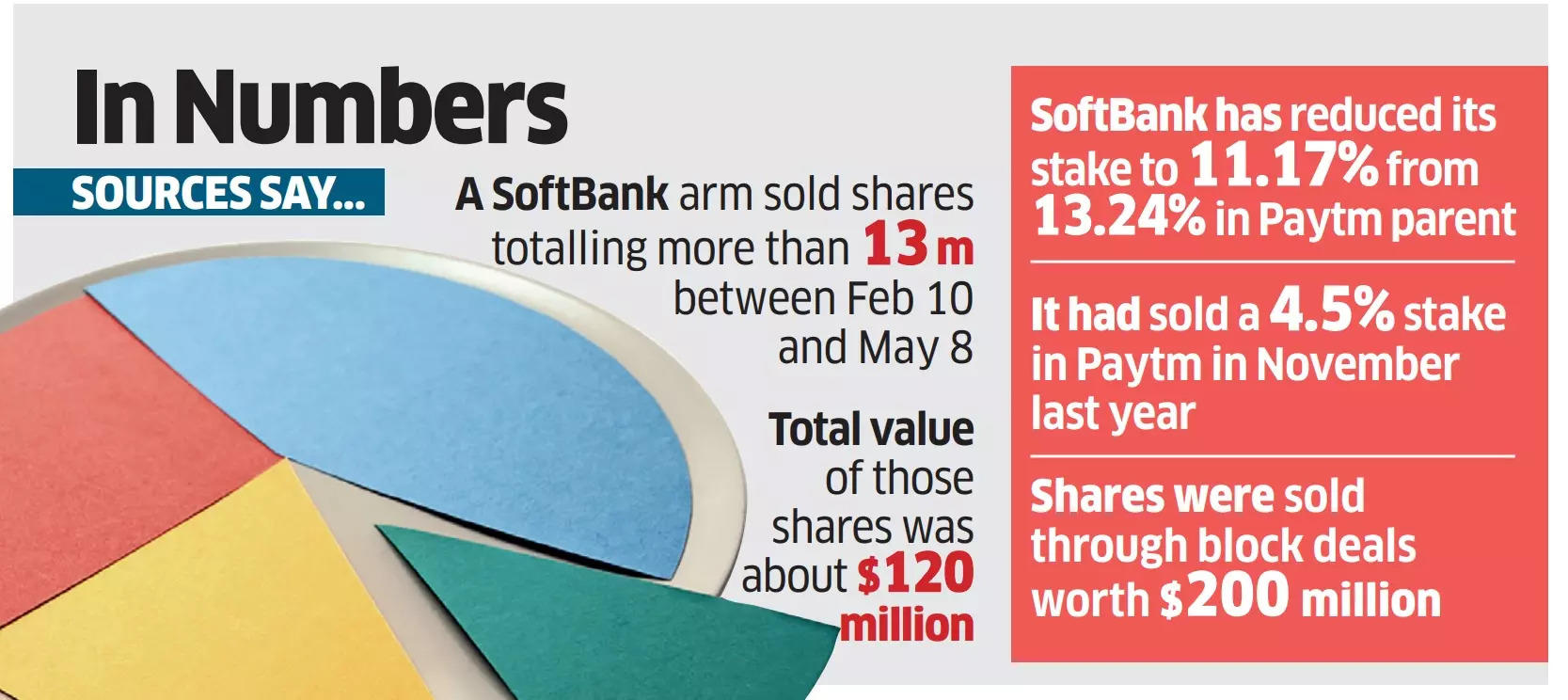

SoftBank sells 2% stake in Paytm: SoftBank on Thursday said in a regulatory filing it has sold 2.07% stake in Paytm-parent One 97 Communications in a series of open-market transactions since February 2023. This was to comply with Sebi’s takeover regulations. After the sale, SoftBank’s stake in Paytm is down to 11.17%, with the market value of the total sale estimated at around $120 million.

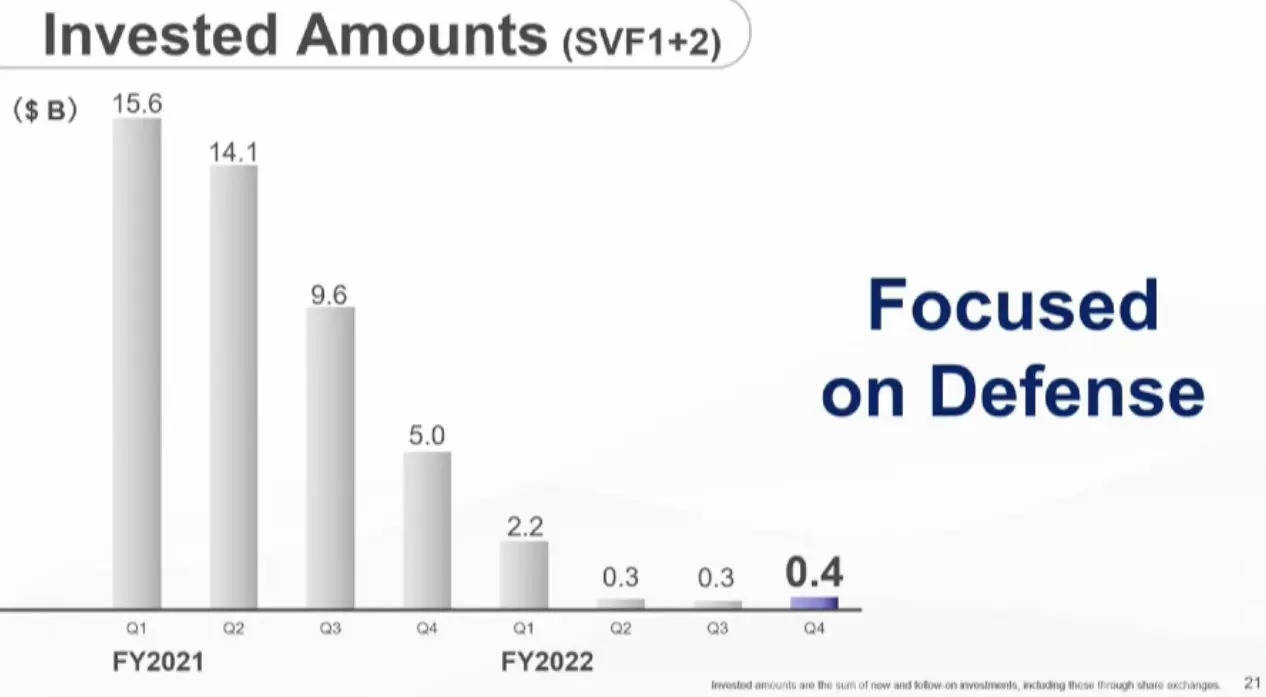

Defensive mode: SoftBank CEO Masayoshi Son, who no longer attends earnings calls, had said the influential tech investor will be in defensive mode. His top lieutenants reiterated the same on Thursday.

What are the numbers? SoftBank invested only $400 million in the March quarter compared to $5 billion a year ago. On a sequential basis, the Ola, Oyo and Paytm investor had only made investments worth $300 million in the previous quarter.

Tweet of the day

Meity to send notice to WhatsApp over spam calls: MoS IT

Following several complaints of international spam calls on WhatsApp from users and telcos, minister of state for IT Rajeev Chandrasekhar said on Thursday that the IT ministry will send a notice to the social messaging platform to know the reasons behind this sudden spurt.

Details: The IT ministry will also ask WhatsApp if these spam calls were via bots who were sending messages and making calls by using random number generations which had a +91 prefix indicating they were from India, Chandrasekhar said.

Quote, unquote: “One of the problems we are looking at is how do these numbers get out? How are they (spammers) able to identify which numbers are on WhatsApp? Are they just doing it blindly or this is some database that they have? If there is a database, then it is a violation of privacy,” the minister said on the sidelines of an event by the Public Affairs Forum of India.

Catch up quick: ET reported on May 11 that WhatsApp users have been inundated with spam calls originating from outside the country with prefixes of +62, +84, +254 and +251, indicating they originated from Indonesia, Vietnam, Kenya, and Ethiopia.

Other Top Stories By Our Reporters

Karnataka HC quashes Rs 21,000 crore GST notice against Gameskraft: The Karnataka High Court on Thursday quashed a show cause notice issued by the Directorate General of GST Intelligence (DGGI) to online gaming platform Gameskraft Technologies despite a court stay on a previous tax demand claim of Rs 21,000 crore.

IPL viewership continues to surge: The consumption of the Indian Premier League (IPL) on both TV and digital continues to swell as the nail-biting matches have ensured that viewers rein glued to their screens.

Global Picks We Are Reading

■ The Surprising Synergy Between Acupuncture and AI (Wired)

■ The Vietnamese military has a troll army and Facebook is its weapon (Rest of World)

■ How YouTube Plans to Use NFL Sunday Ticket to Take On Cable (WSJ)