Credit: Giphy

Also in this letter:

■ FirstCry appoints bankers, eyes IPO in 2022

■ Pine Labs valued at over $5B in latest fundraise

■ US Justice Dept names new ‘crypto czar’

Indiamart among global marketplaces flagged by the US for selling fake goods

Indiamart is among a host of online marketplaces named in the US government’s latest “notorious markets” list.

What’s that? Prepared by The Office of the United States Trade Representative (USTR), the list names businesses alleged to be engaging in or facilitating the sale of counterfeit goods, thereby affecting US intellectual property owners.

The latest list also included Chinese heavyweights Alibaba and WeChat for the first time.

Also Read: US adds e-commerce sites operated by Tencent, Alibaba to ‘notorious markets’ list

The aim of preparing the notorious markets list (NML) is to motivate appropriate action by the private sector and governments to reduce piracy and counterfeiting, said a report by USTR.

On Indiamart: “Counterfeit goods can allegedly be found in large volumes on Indiamart, including counterfeit pharmaceuticals, electronics, and apparel. Right holders are concerned with Indiamart’s failure to adequately implement anti-counterfeiting best practices, including seller verification, penalties against known sellers of counterfeit goods, or proactive monitoring of infringing goods,” the report said.

Indiamart responds: In a written response to ET, Indiamart said it was a “law-abiding company” and had zero tolerance for any misuse of its website for illegitimate or illegal activities.

It said that the USTR published the report without any prior communication and did not give it a chance to respond to the allegations.

“We will get in touch with them to seek details of instances which led them to believe that our process is lax in this regard,” the company said.

Who else? The list identifies 42 online markets and 35 physical markets in total. Also included are China’s Alibaba, Taobao, Pinduoduo and Wechat, Indonesia’s Tokopedia, and Singapore’s Shopee. The physical marketplaces included bazaars in Delhi, Mumbai and Kolkata.

FirstCry appoints bankers, eyes IPO in 2022

FirstCry has begun work on an initial public offering (IPO) in India and hopes to hit the stock exchanges before the end of the calendar year, sources aware of the matter told us.

- “Work has begun for the IPO. They (FirstCry) are aiming to go public this year but the size of the issue is not yet finalised. It will be a mix of primary share sale and an offer for sale (OFS), and the company will use the funds for M&As,” one of the people aware of the matter said.

Details: The ecommerce firm, which specialises in babycare products, has appointed investment bankers Kotak Mahindra Capital and Morgan Stanely for its IPO, the sources said. It is in discussions with other bankers too.

- FirstCry’s parent firm Brainbees Solutions is said to be valued at over $2 billion. SoftBank is its single largest shareholder with around 30%.

- Its IPO will also include its ecommerce roll up business Globalbees, which was recently valued at over $1.1 billion, making it a unicorn.

- Besides FirstCry and Globalbees, the company also has a logistics arm – Xpressbees — which was spun out in 2015. Xpressbees also became a unicorn on February 9 after closing a $300 million funding round.

We reported on February 3 that FirstCry concluded a $240-million secondary funding led by India’s sovereign wealth fund, the National Investment and Infrastructure Fund (NIIF).

Now’s not the time: A host of leading Indian startups such as Delhivery and Oyo Hotels & Homes have filed for IPOs but are reconsidering their timelines because of the rout in global markets and the correction in valuations of tech companies. “For FirstCry, an IPO will only happen in the second half of the year,” one of the sources said.

Also Read: Paytm, Zomato’s fate forcing Oyo Hotels and Delhivery to delay IPOs

On Friday morning we reported that online pharmacy PharmEasy may have to reduce the valuation it was aiming for in its IPO as new-age companies feel the pressure of the market rout. Its shares are currently trading between Rs 70 and Rs 80 on the grey market. They had been trading at more than Rs 100 earlier this year.

And on February 10 we reported that Oyo was planning to substantially reduce the size of its IPO. The IPO issue size is expected to be much lower than $1 billion, sources told us. In draft IPO papers filed with the markets regulator, Oyo had sought to raise $1.2 billion.

Pine Labs raises $150 million from Alpha Wave, valued at over $5 billion

IPO-bound Pine Labs has raised $150 million in a mix of primary and secondary funding from Alpha Wave Global (formerly Falcon Edge), at a valuation of more than $5 billion, according to multiple people in the know.

The digital payments and financial service provider has already received the first tranche of $75 million from Alpha Wave, regulatory filings filed by the company in Singapore show.

The funding also includes a secondary raise in the range of $50 million to $75 million. This was reported first by Dealstreet Asia.

IPO plans: Last month, Pine Labs had filed for a ‘confidential’ initial public offering (IPO) worth $500 million with the US Securities and Exchange Commission, and was seeking a valuation between $6 billion and $7 billion.

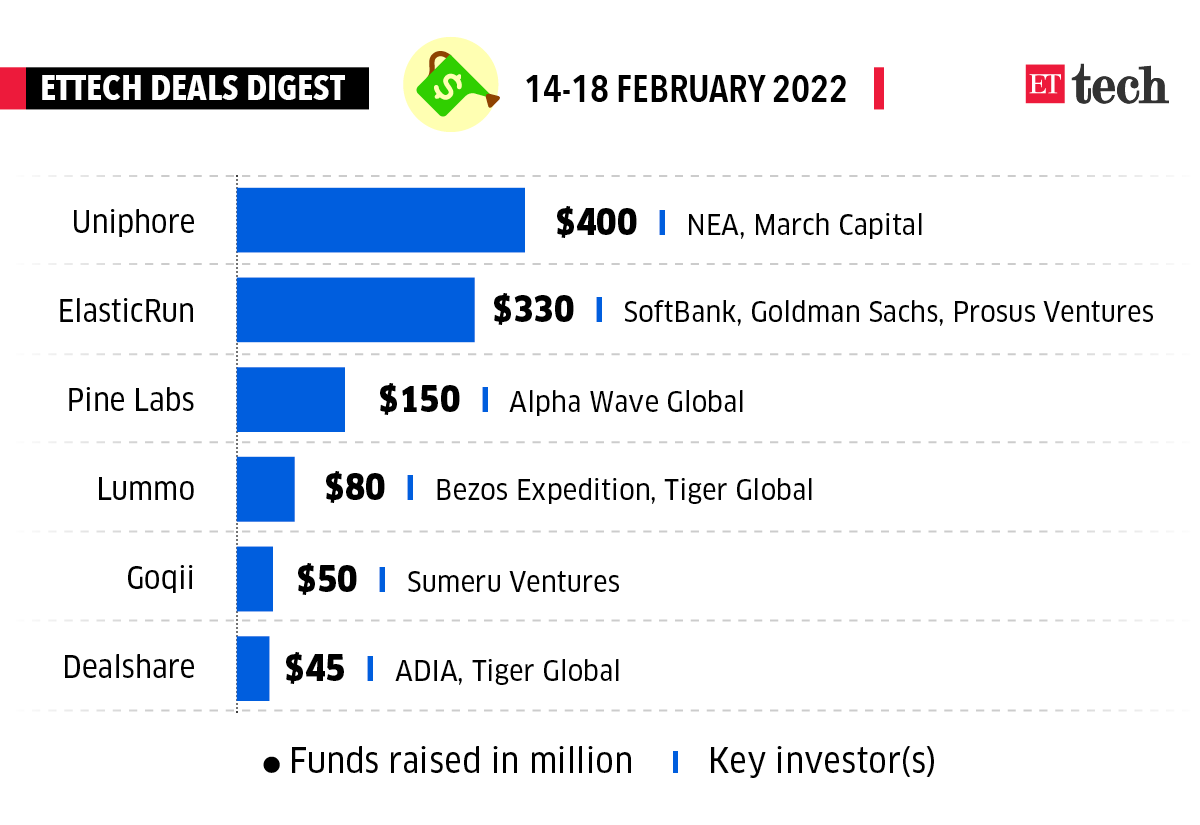

ETtech Deals Digest

Artificial intelligence platform Uniphore, business-to-business (B2B) ecommerce firm ElasticRun and digital payments and financial service provider Pine Labs were among the startups that raised funds this week. Here’s a look at the top funding deals of the week.

Metaverse to increase data use by 20 times in next 10 years: Credit Suisse

The transition of digital ecosystems to the metaverse will increase data usage by 20 times across the globe by 2032, and telecom operators Bharti Airtel and Reliance Jio are suitably placed to benefit from the surge in India, a Credit Suisse report has said.

- The report said the metaverse has enormous potential to further expand screen time and drive data use.

- While 5G will support the metaverse ecosystem, the emergence of 6G will enhance metaverse use cases, it said.

Quote: “Internet traffic is already 80% video and has been growing at a 30% CAGR (compound annual growth rate). Our team projects that even modest metaverse usage could drive a further 37% CAGR in the next decade to 20x current data usage,” the report said.

Gaming is key: It said the gaming segment is one of the segments where early use cases of the metaverse are expected.

The report said that gaming is at an early stage in India and is being driven by mobile gaming due to the emergence of affordable smartphones and 4G services.

Connectivity concerns: The report added that India was one of the leading countries in the world in terms of number of hours spent on mobile per day but has low penetration of fixed broadband compared to global peers, which will be key to realising the full potential of the metaverse.

The report estimated that fixed broadband penetration in India would increase to 9% in the current fiscal from 6.8% in FY20.

FBI to form digital currency unit, Justice Dept taps new crypto czar

The US Justice Department has tapped a seasoned computer crimes prosecutor to lead its new national cryptocurrency enforcement team and announced that the FBI is launching a unit for blockchain analysis and virtual asset seizure.

Eun Young Choi will be the first director of the National Cryptocurrency Enforcement Team, which will serve as the focal point for efforts to identify and dismantle the misuse of cryptocurrencies and other digital assets, Deputy Attorney General Lisa Monaco said.

Big haul: The creation of the FBI’s “virtual asset exploitation” unit comes after the Justice Department’s largest-ever financial seizure earlier this month. It charged a married New York couple with allegedly laundering bitcoins now valued at over $4.5 billion that were stolen in the 2016 hack of the digital currency exchange Bitfinex.

Crypto crackdown: US regulators under President Joe Biden have been ratcheting up their scrutiny of the crypto industry in the wake of a series of high-profile cyberattacks last year on the largest US fuel pipeline network and the world’s largest beef supplier. Ransomware groups often demand their fees in Bitcoin.

Today’s ETtech Top 5 newsletter was curated by Arun Padmanabhan in New Delhi and Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.