Credit: Giphy

Also in this letter:

■ SoftBank’s Son says slow down tech investments

■ Facebook resorts to old smear tactics against TikTok

■ Reliance defends takeover of Future stores in letter

UPI hits a new milestone of five billion transactions a month in March

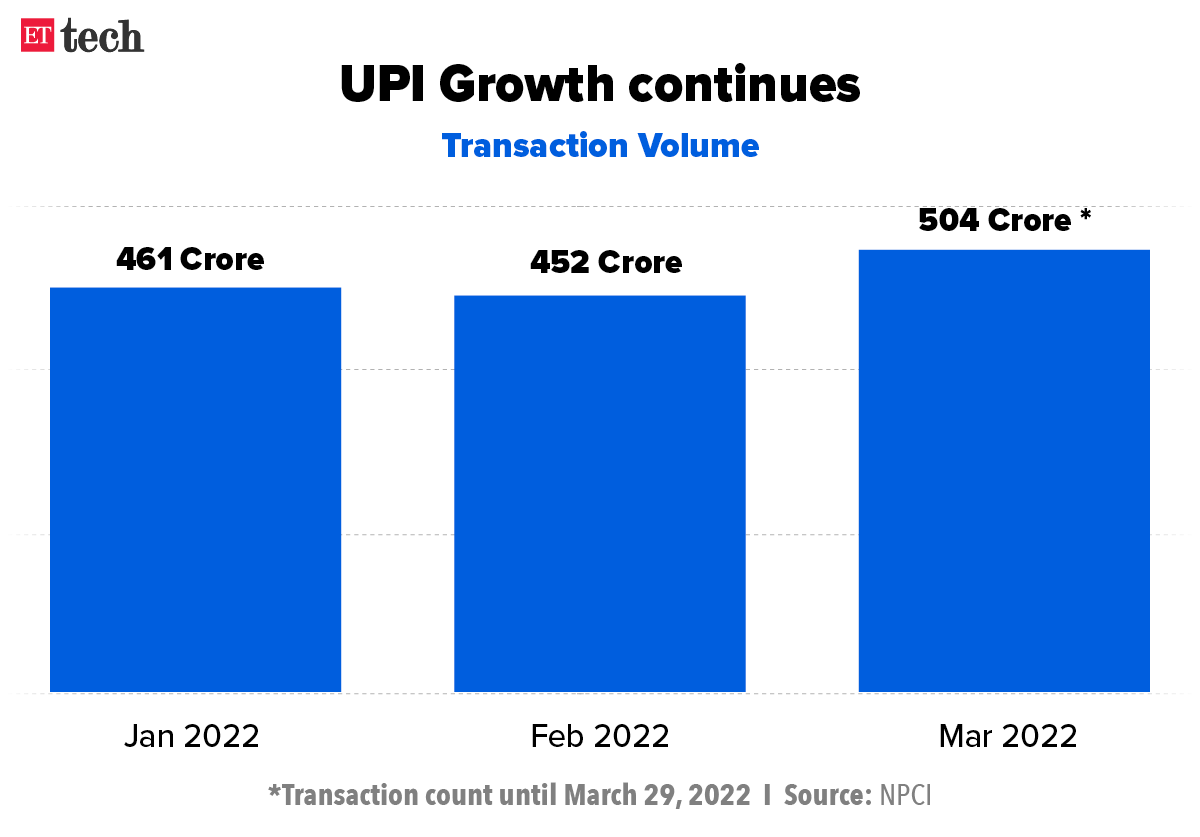

As digital payments gain traction, in a first, unified payments interface (UPI) transactions in the country has breached the 5 billion mark in March, as per the latest data released by the National Payments Corporation of India (NPCI).

By the numbers: NPCI, which operates UPI along with other payments infrastructures including Bharat Bill Payment System (BBPS), Aadhaar Enabled Payment System (AePS) among others said that total UPI transactions recorded stood at 5.04 billion (or 504 crores), for a total value of Rs 8.88 lakh crore, in March this year.

The latest data released by NPCI is as of March 29, 2022.

In comparison, total UPI transactions in February stood at 4.5 billion (or 452 crores, with a total value of Rs 8.26 lakh crore processed by the infrastructure. Usually, February witnesses a dip in overall UPI transactions, owing to a lesser number of days as compared to March.

Low-value transactions lead the way: According to NPCI’s estimates, 75% of the total retail transactions in the country continue to be below Rs 100 in value. On UPI, almost 50% of the total offline transaction is upto Rs 200 in value.

Also Read: Digital economy to see exponential growth to $800 bn by 2030: FM

SoftBank’s Son says slow down tech investments: Report

SoftBank chief executive officer Masayoshi Son

Masayoshi Son, the founder of SoftBank, recently told his top leadership of the fund to slow down tech investments, according to a report in Financial Times (FT).

This is significant as SoftBank is one of the largest and most influential tech investors in the world. Son’s remark is also an indication of the broader correction in the valuation of technology companies–both in private and public markets.

The timing: According to the FT report, Son’s comments come at a time when the Japanese investor is ‘pushing to raise cash and is evaluating assets that could be liquidated’.

Concerns over valuations: The report quoted an unnamed individual from SoftBank’s China team saying valuations of its Chinese companies listed overseas have collapsed. “We don’t expect a turnaround anytime soon,” this person said in the FT report. Following China’s crackdown on its top tech companies, Son had said he is pausing on Chinese investments and will wait for it to stabilise.

Son’s top lieutenant Rajeev Misra, CEO of SB Investment Advisors, also told ET earlier this month that private financing will be limited this year unlike 2021 and 2020.

Quote: “I can see the change already today between December and January..So if a company is raising early-stage $50-$150 million, and you have to write $20 million cheques, there is a lot of crowd willing to do that. But if the company is trying to raise $250 or $500 million, they’re struggling to find the lead investor who will come in with $100-$150 million, Misra said in an interview at the ET Global Business Summit

Tweet of the day

Reliance defends takeover of Future stores in letter

Reliance, has privately defended an abrupt takeover of the stores of debt-laden rival Future Retail, saying mounting dues of $634 million compelled it to act beyond expectations, a company letter shows.

Battle for supremacy: The takeover was part of the race to dominate a $900-billion retail sector that set off a bitter dispute in which the Supreme Court will decide whether Reliance or Amazon.com Inc gets to scoop up Future’s assets.

The move stunned not only Future but also Amazon, which has cited violation of certain contracts to legally block, since 2020, a $3.4-billion deal between the two Indian giants.

What did the letter say? In the letter, Reliance said it went ” well and truly beyond what can be expected” to keep Future “out of harm’s way,” as it took “significant steps” to ensure business continuity at Future and make sure there was “no impediment” to their deal.

- These steps included financial support of Rs 4,800 crore ($634 million), comprising Rs 1,100 crore of unpaid lease rentals and Rs 3,700 crore of working capital.

- As Future proved unable to pay outstanding dues and losses in its retail operations swelled, Reliance faced “compelling circumstances” and decided to exercise its legal right to take over the stores, the letter added.

Over months, Reliance had taken over the leases of more than 900 of Future’s 1,500 stores, while still allowing the company to run them.

Facebook resorts to old smear tactics against TikTok

Meta Platforms, facebook’s parent, is paying one of the biggest Republican consulting firms in the country to orchestrate a nationwide campaign against TikTok, according to a Washington Post report.

Targeted Victory, according to the Post, contracted with dozens of public relations firms across the US to help “sway public opinion against TikTok” by planting local news stories and helping place op-eds targeting TikTok around the country, the story says.

One of many such campaigns: Eleven years ago, Facebook was caught red-handed after it hired a prominent public relations firm to try to plant stories harshly criticizing Google’s privacy practices in leading news outlets.

In 2018, it hired the PR firm Definers to do opposition research on the company’s critics, including billionaire philanthropist George Soros. The company’s longtime head of communications, Elliot Schrage, took the blame for approving the hiring of Definers and similar firms and left Facebook.

The Post obtained internal emails from Targeted Victory that outlined a campaign to undermine TikTok, which is owned by the Chinese company ByteDance. The firm used a mix of “genuine concerns and unfounded anxieties” about TikTok in order to try to turn public and political sentiment against it.

ETtech Done Deals

■ HealthQuad, an India-focused healthcare venture capital firm, has raised $162 million (Rs 1,215 crore) in the final close of its second fund. The firm, which counts Medikabazaar, Ekincare, Healthifyme and Qure.ai in its portfolio of invested companies, has got global pharma maker MSD (Merck & Co, Inc.) as its anchor investor for the new fund.

■ Chennai-based digital supply chain startup Wiz Freight has raised Rs 275 crore in a funding round led by Tiger Global with participation from Axilor, Foundamental, Arali Ventures, Stride Ventures and Alteria Capital.

■ Non-banking financial company Finova Capital has raised $65 million from Norwest Venture Partners, Maj Invest and Faering Capital. The micro, small and medium enterprises or MSME-focused lender will use the funds to grow its loan book, invest in technology, expand geographically and further its vision of enabling financial inclusion at scale.

■ OneCode, a platform which provides on-ground resellers to financial firms, has raised $13 million (or Rs 100 crore) as part of its latest round of funding led by General Catalyst, the company said. According to the company, it will use the capital to invest in hiring across functions and accelerate its product and technology development. With the investment, the company will be expanding its presence to 100 additional cities and will increase the size of its agent network.

Today’s ETtech Top 5 newsletter was curated by Arun Padmanabhan in New Delhi. Graphics and illustrations by Rahul Awasthi.