Also in today’s edition:

■ CCI clears PayU BillDesk after a year of deal announcement

■ Mid-sized IT firms step up campus hiring to reduce costs

■ MeitY nod for Rs 500 crore Pune EMC project

Wary investors walk away from big funding deals citing tech turbulence

Late-stage funding deals which typically are above $100 million have been rare to come by this year. Some of these rounds have come close to the finish line but then investors have walked away amid the public market rout of tech stocks and overall economic uncertainty.

Go deeper: The Good Glamm Group had been on a tear, closing a series of acquisitions and raising back-to-back funding rounds last year as it sold its content-to-commerce playbook to investors. The Mumbai-based company, which is valued at $1.2 billion now faces a reckoning as late-stage funding dries up and investors increasingly steer clear from loss-making tech firms. Private equity fund TPG Growth walked away from Good Glamm’s fundraise just a few months ago, multiple people privy to the deal talks told ET. The financing would have valued the company at over $1.5 billion if the transaction took place, they added.

PayU’s u-turn on Acko: Bengaluru-based Acko had signed a term sheet with PayU, owned by Prosus, but the South African conglomerate decided not to go ahead with the financing.

Acko wanted the funds to enter the life insurance business. Its shareholders include General Atlantic, Multiples Private Equity, Amazon, Flipkart’s cofounder Binny Bansal, among others.

People privy with the matter said the insurtech startup valued at $1.1 billion is now likely to close an internal round led by General Atlantic at a slightly higher valuation compared to what was ascribed to it last year.

What’s changed? “The market has changed so much that late-stage deals that started around six months ago will have only two outcomes – fall through or settle at much lower valuations than initial conversations,” said Abhay Pandey, managing partner at A91 Partners, a Mumbai-based investment firm which has backed the likes of Digit Insurance, Sugar Cosmetics, and Paper Boat, among others.

“All drivers for rapid ‘deployment’ – FOMO (fear of missing out), very low cost of capital, and seemingly unlimited capital – disappeared and, so, investors chose to walk or negotiate better…,” he said.

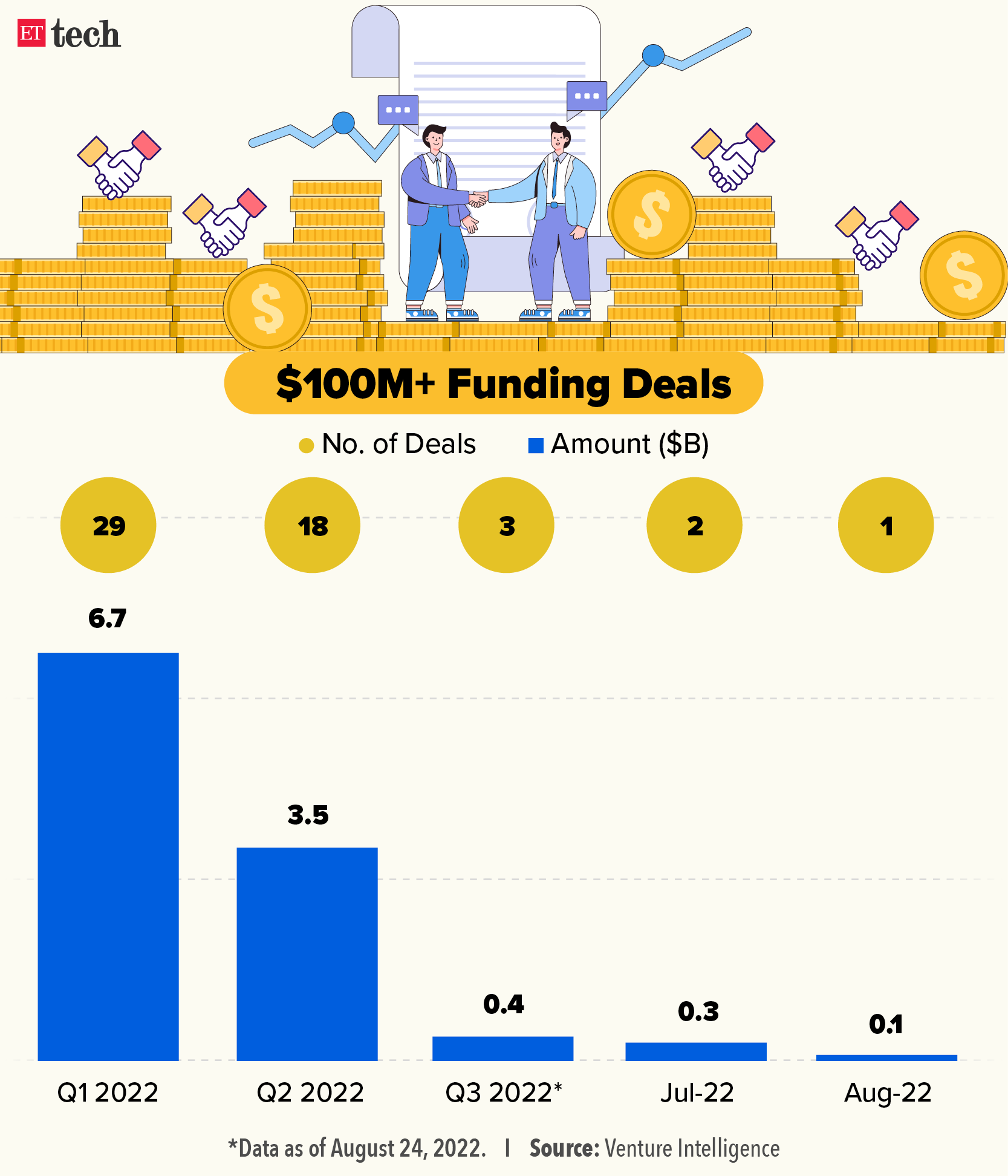

What are the numbers saying? The drop in funding rounds of $100 million and upwards has been conspicuous this year, having fallen to 18 in the second quarter of the current calendar year from 29 in the preceding quarter. By value, the funding rounds in June quarter racked up $3.6 billion, down from $6.7 billion in the quarter ended March, as per data by Venture Intelligence.

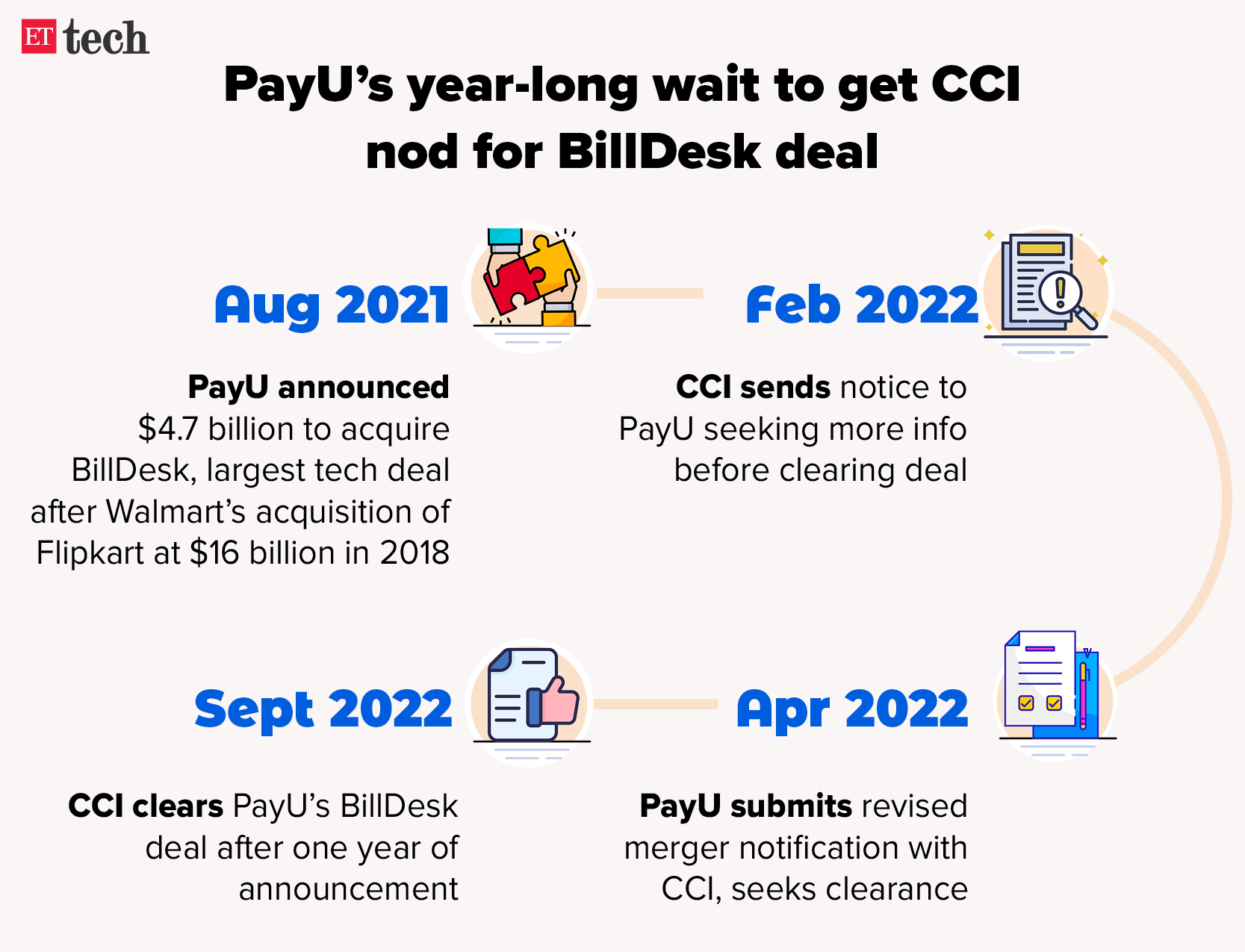

CCI clears PayU BillDesk after a year of deal announcement

The Competition Commission of India (CCI) has cleared online payments major PayU’s $4.7 billion acquisition of payment gateway firm BillDesk, the antitrust regulator said in a tweet on Monday evening.

A year-long wait: This comes after a year-long wait for the Prosus-owned PayU which has had to answer several questions from the regulator over the past year since the deal was officially announced in August 2021.

PayU’s statement: PayU India said the proposed transaction “involved novel assessment by the CCI of dynamic digital markets”. “ Prosus firmly believes that this acquisition of BillDesk will have significant pro-competitive benefits for the Indian economy and will strengthen the Indian digital payments market, which is fully regulated by the Reserve Bank of India,” Anirban Mukherjee, CEO of PayU India, said in a statement. “This acquisition by PayU of BillDesk is also consistent with the Government of India’s Digital India mission and will benefit Indian merchants, government institutions and consumers,” he said.

Past troubles: PayU had filed a revised merger notification with the CCI on the deal and the revised notification said “the proposed transaction will not cause any appreciable adverse effect on competition in any of the above relevant markets or their constituent segments.”

The earlier merger application filed by PayU was marked as ‘Notice Not Valid’ on CCI’s website, which typically means that the regulator is not convinced about the application.

ET Ecommerce Index

We’ve launched three indices – ET Ecommerce, ET Ecommerce Profitable, and ET Ecommerce Non-Profitable – to track the performance of recently listed tech firms. Here’s how they’ve fared so far.

Mid-sized IT firms step up campus hiring to reduce costs

IT companies such as Cognizant, Mindtree and Larsen & Toubro Infotech are seeking to step up campus hiring in FY23 despite recent reports of circumspect staff rewards at local bellwethers.

What’s the news? Upbeat hiring plans, more so among some mid-sized players, come at a time when the sector is beset with high staff costs. Infosys and Wipro either reduced or held back variable pay for certain sections of employees, while Tata Consultancy Services (TCS), the biggest locally by market capitalization, altered its pay hike structure. All of this is happening when there has been a big debate about IT workers opting for moonlighting.

More details: Mindtree plans to onboard around 5,000-6,000 campus hires in FY23, its highest-ever hiring from campuses. Larsen & Toubro Infotech plans to recruit 10% more freshers than last year, its highest hiring target in the last three years.

In Quotes: “There is uncertainty in the macro environment, but tech will continue to grow, though not at the same pace,” said Sangeeta Gupta, senior vice-president of industry body Nasscom. “Expanding the supply pool of talent is a way to control attrition, which is why companies are putting in effort into campus hiring.”

IT biggies grappling with margin pressure: During the first quarter of the current financial year, top IT companies such as Tata Consultancy Services (TCS), Infosys, and Wipro reported an impact on margins of 150-240 basis points from salary hikes.

Read more: Variable pay, attrition, moonlighting add to IT companies’ challenges

MeitY nod for Rs 500 crore Pune EMC project

The Indian government has approved an Electronics Manufacturing Cluster (EMC) in Pune at a cost of Rs 500 crore, according to senior officials. The EMC will come up in Ranjangaon Phase III, and will be set up over an area of 297 acres.

What’s the proposal? The proposal, approved by the Ministry of Electronics and Information Technology, is expected to attract investments of up to Rs 2,000 crore, an official said.

Who does it help? The scheme’s objective is to provide financial assistance for setting up EMC projects as well as common facility centres (CFCs). Interested electronics manufacturing companies can apply for financial assistance from the central government till 2023.

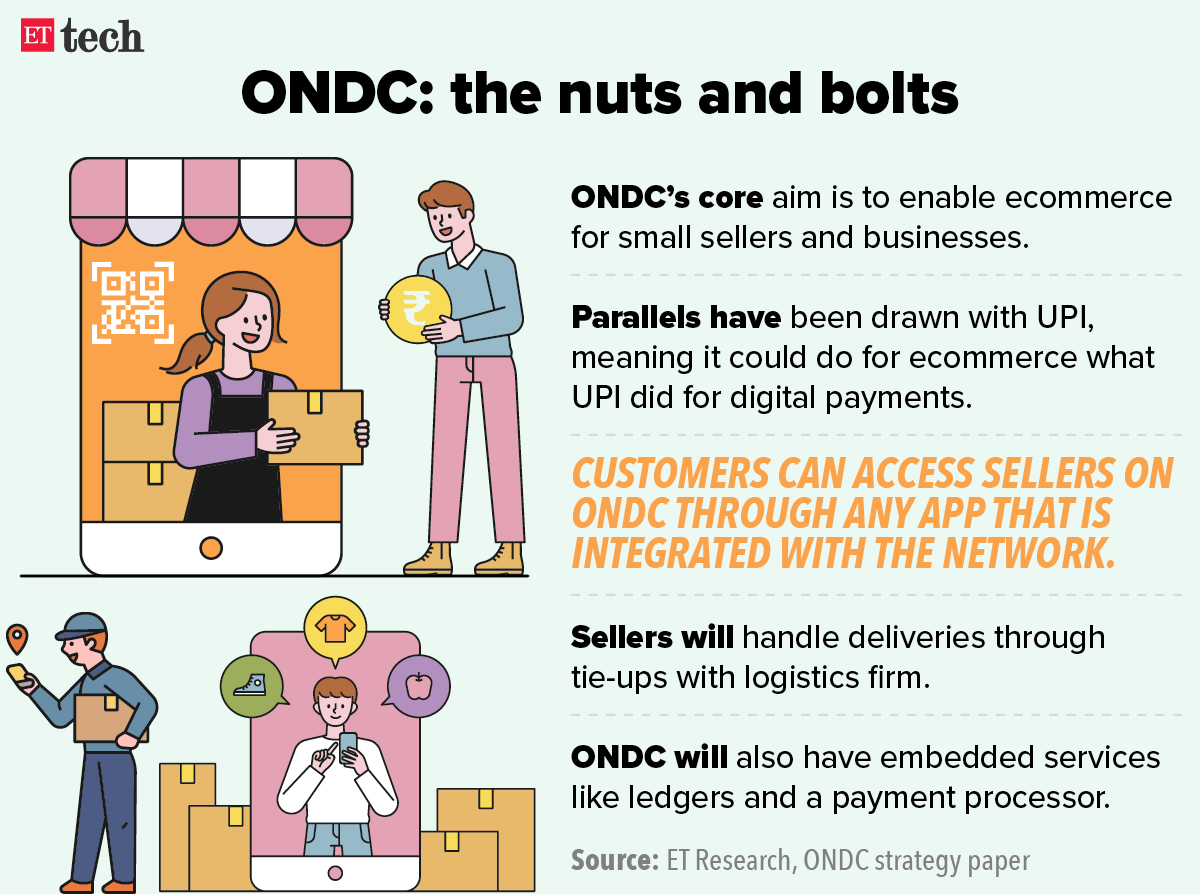

Flipkart, Amazon may provide ONDC scale and credibility: report

Everyone thought the government’s ecommerce initiative ONDC would be the giant killer that would disrupt Amazon and Walmart-backed Flipkart. But, turns out the best-case scenario for ONDC would be to work along with the incumbents, JM Financials has said in a report.

Why? It said that onboarding some of the larger incumbents early might provide ONDC with the much-needed scale and credibility with buyers and sellers. We were the first to report that Flipkart, Amazon, and Reliance may join the network in May. Flipkart’s e-kart, its payment app PhonePe, and Reliance’s Grab have already integrated with ONDC.

Not so disruptive: JM Financials did some data analysis based on the testing that is being done in over 100 cities. In food tech, the price comparison of some products in Bengaluru restaurants suggests the final order value on ONDC is on par or sometimes even higher than other apps.

However, discounts and other offers on the Zomato platform can make it a better value proposition for the customer compared to ordering from ONDC.

In the groceries category, ONDC has most products listed on the MRP and a delivery fee is charged on orders. On quick commerce apps (Swiggy Instamart and Dunzo), these are available at a discount and free delivery is offered above a certain order value.

Still lucrative: According to the report, the commission on ONDC could be 8-15% depending on the category, and might still be lucrative for investors. Sources have told us that over 300 players have signed up to integrate with the network on the buyer and seller side, as well as in logistics.

Also read: Exclusive | NPCI set to pick up 9-10% stake in government’s e-commerce project ONDC

IT ministry may write to Wikimedia Foundation

The ministry of electronics and information technology (MeitY) is likely to write to Wikimedia Foundation to seek an explanation on how the Wikipedia page entry of Arshdeep Singh, a fast bowler from the India men’s cricket team, was changed to reflect an association with Khalistan.

Way forward: The IT ministry may also later summon Wikimedia India executives if it is not satisfied with the reply received from the foundation regarding the checks and balances put in place to contain unauthorised editing by volunteers, sources told us.

Catch up quick: The Wikipedia page entry of Singh was changed after India’s five-wicket loss to Pakistan in the ongoing Asia cup on Sunday. The page entries, changed and subsequently restored, read that Singh had been selected to play for the ‘Khalistani national cricket team.

This happened after the 23-year-old fast bowler was criticised heavily on Twitter by fans of the Indian cricket team after he dropped a catch during a crucial stage in the game.

TWEET OF THE DAY

Other Top Stories by Our Reporters

Rahul Mishra

Shemaroo, Seracle in Web3 tie-up: Content distribution company Shemaroo has forayed into Web 3.0 solutions through a partnership with blockchain solutions provider Seracle. Through this partnership Shemaroo will extend entertainment for consumers in the Web 3.0 space with offerings ranging from IP-backed non-fungible tokens (NFT) to entertainment in the Metaverse, bridging the traditional fandom with the Web 3.0 ecosystem.

Unacademy acquires Gate Academy; will launch 50 Youtube channels: Edtech unicorn Unacademy has acquired Gate Academy, for an undisclosed amount, in a bid to bolster its presence in the graduate aptitude test in engineering (GATE) test preparation segment. As a part of the transaction, the entire team of Gate Academy will join the edtech firm.

Global Picks We Are Reading

■ ‘I didn’t want it anywhere near me’: how the Apple AirTag became a gift to stalkers (The Guardian)

■ An AI-Generated Picture Won an Art Prize. Artists Aren’t Happy (NYT)

■ 4,000 Google cafeteria workers quietly unionized during the pandemic (The Washington Post)