Just three years after it hit a valuation of $1 billion, new-age trucking logistics firm Rivigo is in deep trouble. Unable to raise funds, the startup is exploring a sale and has held talks with Flipkart or FirstCry, sources told us. We have more in the edition.

Also in this letter:

■ Egaming task force may set spend limits in framework

■ View: Alpha founders, VC greed

■ Unicorn India Ventures to sell stakes in six startups to US fund

Logistics unicorn Rivigo in sale talks with Flipkart, FirstCry

Rivigo has held talks with ecommerce marketplace Flipkart and omnichannel baby products retailer FirstCry for a potential sale, multiple sources aware of the matter told us. The logistics unicorn has struggled to raise fresh funds for sometime now, which is further amplified as investors turn skittish due to the ongoing economic slowdown.

Yes, but: The discussions around Rivigo’s acquisition have been preliminary and may or may not result in a deal, the people said. Rivigo, they said, had evaluated merging its operations with Flipkart’s logistics arm e-Kart, and FirstCry’s e-commerce focussed logistics unicorn Xpressbees.

A few months ago, the company’s board decided that it should look for potential buyers and that staying independent wasn’t an option anymore, said a person in the know of the development.

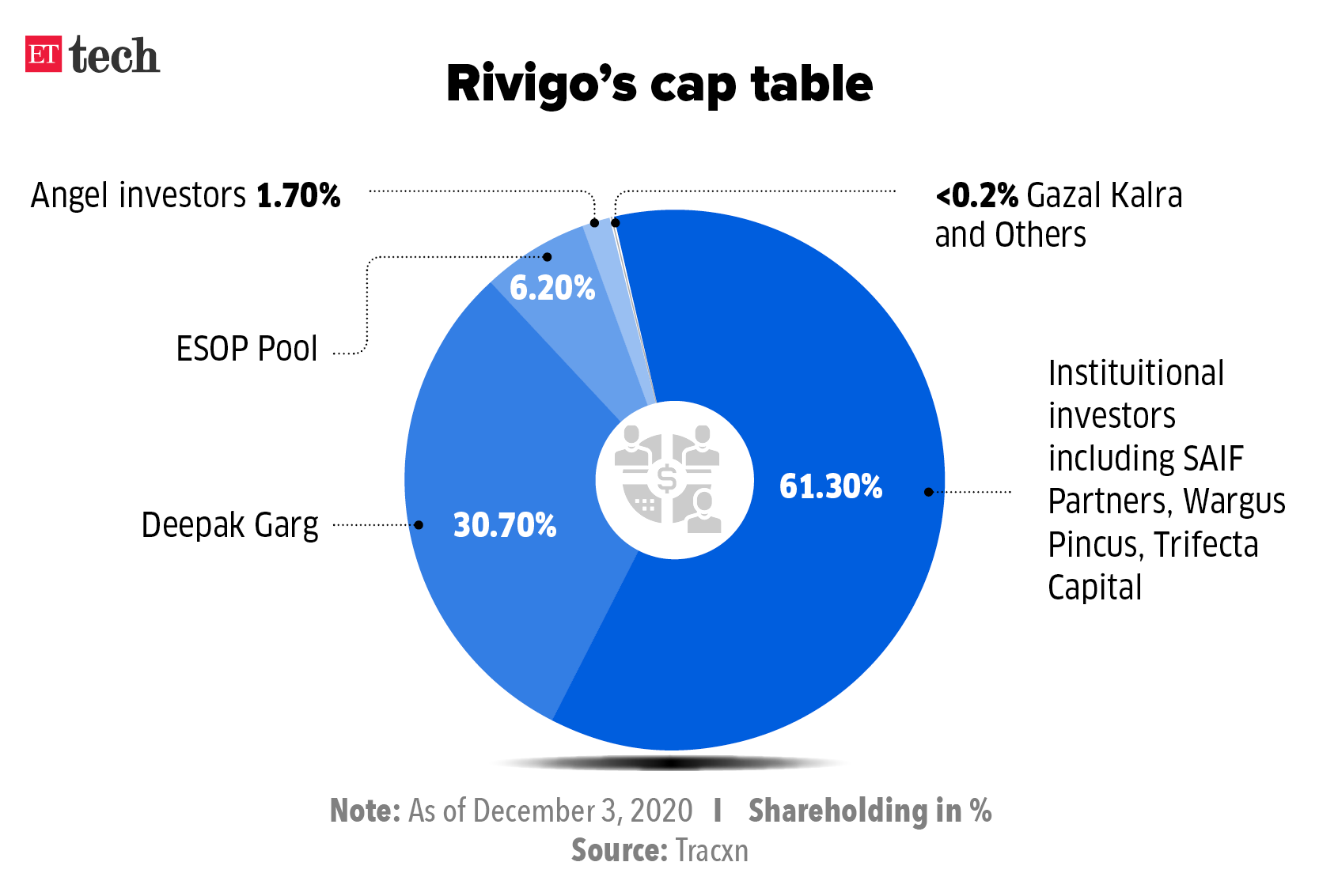

Backed by venture fund Elevation Capital (formerly SAIF Partners), private equity major Warburg Pincus, among others, the Gurugram-based logistics firm has faced headwinds over the past few years.

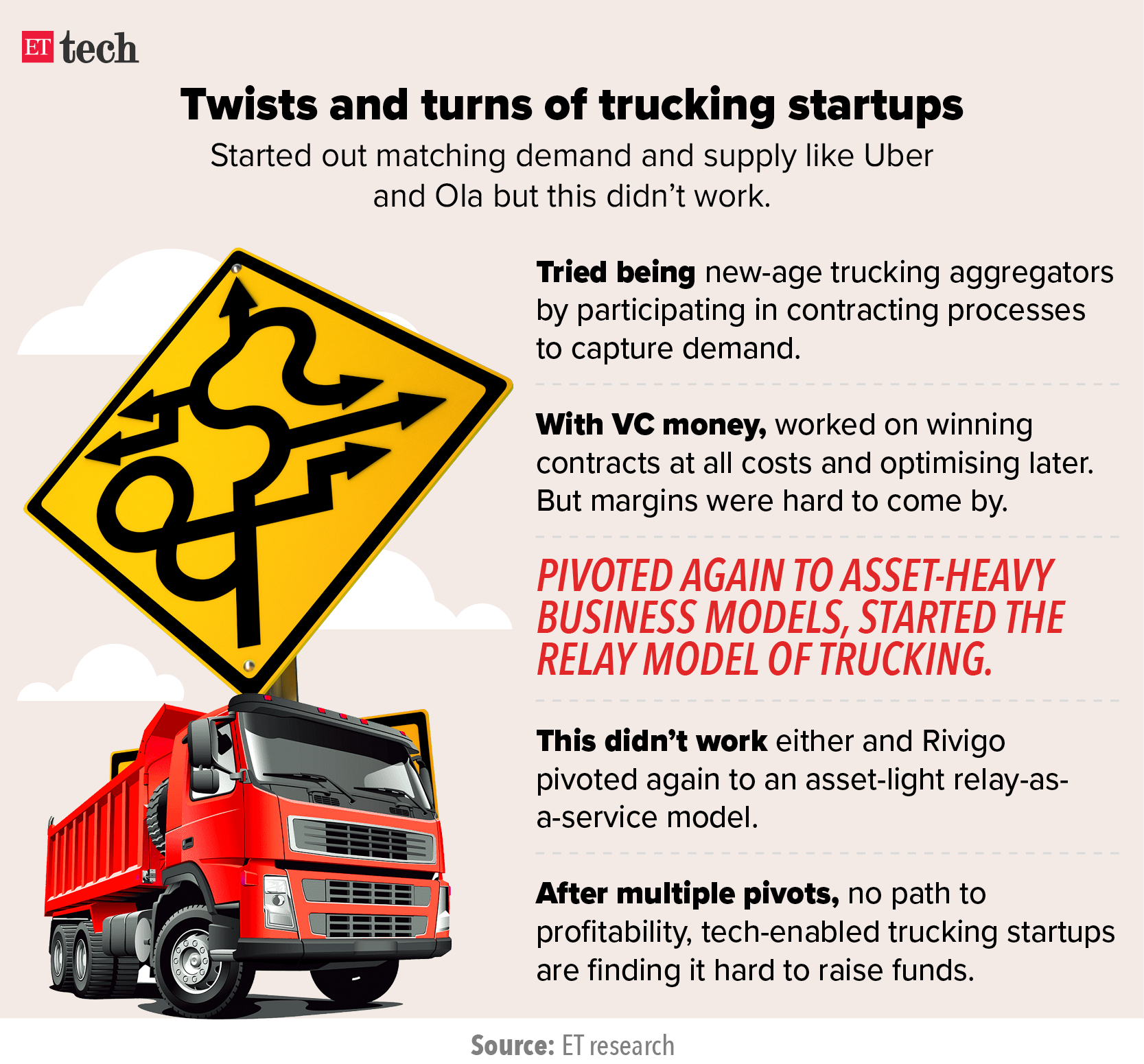

Pivots galore: Rivigo, which operated in a “relay trucking model”, pivoted to relay-as-a-service model during the Covid-19 pandemic.

According to Prahlad Tanwar, partner at KPMG who tracks the logistics space in India, over 100 startups emerged in 2014–15 to disrupt the highly fragmented, $60-70 billion trucking sector. But multiple pivots and no path to profitability have made it increasingly difficult for tech-enabled trucking startups to raise funds, Tanwar added.

Egaming task force may set spend limits in framework

An inter-ministerial group tasked with drawing up a framework to regulate online gaming is likely to introduce rules governing the amount of money individual players spend in a game, people in the know told us.

The task force set up by the Ministry of Electronics and Information Technology (Meity) could also set a limit on the money spent daily by players on in-game purchases, according to the sources, who said the central idea is to ensure “consumer and gamer protection.”

The draft regulations are likely to be finalised over the next month and will then be brought out for public consultation, they said.

Catch up quick: The seven-member inter-ministerial task force, which was set up in May, has members from the Niti Aayog, as well as secretaries of the Ministry of Home Affairs, the Department of Revenue, Department for Promotion of Industry and Internal Trade, the Ministry of Information and Broadcasting as well as the Meity secretary.

At a meeting earlier this month, the ministerial grouping had suggested that Meity amend the Information Technology Act of 2000 to include rules for the gaming sector, similar to how the Intermediary Guidelines and Digital Media Ethics Code were introduced in February 2021, a government official who attended the meeting told us.

Uniform rules: At an earlier meeting on June 7, between representatives from gaming companies and senior officials from the IT ministry, including Minister of State Rajeev Chandrasekhar, the sector was asked to draw up comprehensive policies on various aspects, including an objective definition of games of skill and chance, according to a senior official.

At the meeting with Meity, representatives from nearly 40 online gaming platforms had expressed concerns about the varying regulations announced by state governments such as Karnataka, Tamil Nadu and Karnataka.

View: Alpha founders, VC greed

Last week Adam Neumann, the once celebrated and later controversial founder of the office-sharing startup WeWork, raised $350 million for his latest venture Flow, a startup looking to disrupt the residential rental real estate market in the US. The massive financing – the largest cheque signed off by venture capital firm Andreessen Horowitz in an individual company – valued Flow at $1 billion.

WTF moment: Remember that the startup isn’t operational yet. The development grabbed headlines and everyone weighed in on what this meant, keeping Neumann’s unceremonious exit from WeWork in mind. The news was even more eye-popping having come at a time when ‘funding winter’ has hit technology companies across public and private markets. Aside from the size of the fundraise and the timing, it also stirred up hot-takes on how VCs aren’t shy to back entrepreneurs who have had a chequered past.

Chequered past: Neumann’s rise and fall have been well-documented. The OTT show WeCrashed catapulted him into the league of global celebrity founders. From the highs of being valued at $47 billion, today WeWork’s market cap is at $3.5 billion, leaving investors like Masayoshi Son’s SoftBank in a deep hole.

But clearly that track record did not keep away web browser Netscape cofounder and VC Marc Andreessen. While announcing the fund’s investment in Flow, he wrote in a blog post that Neumann was a ‘visionary leader’ who revolutionised the second largest asset class in the world – commercial real estate.

What’s the deal? Investors want to back alpha founders chasing massive markets – the bigger the total addressable market (TAM), the bigger the potential of an outsized outcome.

Click here to read the full column.

TWEET OF THE DAY

Unicorn India Ventures to sell stakes in six startups to US fund

Early-stage investment firm Unicorn India Ventures is selling its stake in six startups to a US-based investor for Rs 50 crore, doubling returns for its limited partners (LPs).

Details: The companies include robotics startup Genrobotics, cybersecurity firm Sequretek, customer experience analytics startup Clootrack, digital business publication Inc42, digital media startup Inntot, and healthcare startup NeuroEquilibrium.

These were investments from the firm’s first tranche of funds of Rs 100 crore, raised in 2016 and deployed across 17 early-stage startups.

This fund’s life cycle ends early next year.

Write-offs: Unicorn India Ventures’ partner Bhaskar Majumdar told us the firm had to write off its investment in three companies out of the 17 startups.

The firm exited two companies, ecommerce personalisation startup Boxx.ai in 2019 and pharmaceutical supply chain startup Pharmarack in 2021.

ONDC may open to public by early September

Government-backed e-commerce initiative, the Open Network for Digital Commerce (ONDC), may open to the public towards the end of this month or early September.

ONDC is currently live in 45 cities. These are locations where it has started doing live transactions, albeit with invited users. It is not open to the public yet.

“We are days away from opening the platform to the public. We expect to go public by August end or early September. All the other organisations supporting ONDC are supporting us in this endeavour. It will be one city at a time. It may not even be an entire city,” Shireesh Joshi, chief business officer, ONDC, told us.

State of play: ONDC had set an ambitious target to go live in 100 cities by August and started pilots in five cities from April 29. The focus is currently on ironing out teething troubles and improving customer experience. ONDC plans to go live in 10 more cities in the next few days, as we reported previously.

It is working to increase merchants, categories, network participants, locations, horizontally to create the local push, T Koshy, chief of ONDC had told us recently.

Other Top Stories By Our Reporters

Nandan Nilekani-backed ShopX files for bankruptcy: Ecommerce platform ShopX has shut down and filed for bankruptcy. The company, backed by Infosys cofounder Nandan Nilekani, filed an application under Section 10 of the Insolvency and Bankruptcy Code, filings with the Ministry of Corporate Affairs showed.

IRCTC responds to privacy concerns: Railway passengers can opt-out of the digital data monetisation plan of the IRCTC, official sources told ET on Monday. They also said the activity will strictly stay within “the confines of law.” This comes after privacy experts raised concerns over IRCTC’s Expression of Interest to rope in a consultant to explore avenues for passenger data monetisation.

Global Picks We Are Reading

■ How to spot fake reviews on Amazon (Wired)

■ As crypto slumps, Goldman Sachs aims for a Wall Street built on blockchain (WSJ)

■ Sony could face £5 billion in legal claims over PlayStation game charges (The Guardian)