Also in this letter:

- Crypto body suggests exchanges share user data, tighten KYC

- Salarpuria-Sattva Group to take over Cloudtail’s electronics biz

- Dream Sports valuation hits $8 billion after fresh fundraise

Udaan enters grocery business, BigBasket to launch express deliveries next month

There’s a lot happening with cryptocurrencies in India. But we also have new developments to report from the online grocery sector, which has seen rapid increase in adoption due to the pandemic.

First up is Udaan, the business-to-business ecommerce major from Bengaluru. It is entering the consumer-focused grocery business with a new platform called Price Company, sources told us. At a time when online grocery adoption continues to grow, Udaan’s entry is noteworthy and significant for a B2B ecommerce firm. It also means SoftBank-backed Meesho and Tiger Global-backed DealShare have a new competitor.

Before we jump to the details of Udaan’s Price Company, our second story today is about the largest online grocery in India, BigBasket, now owned by the Tatas. ETtech first reported in July that it was planning to start express delivery in the coming months.

Its cofounder and CEO Hari Menon has now told us the service—called BB Now—will be launched next month. Interestingly, it will also bring all of BigBasket’s grocery offerings into its main app—instead of having different apps for different services.

Back to Udaan’s Price Company. Here’s how it will work, as per the current plans that sources told us about.

Udaan founders (from left) Amod Malviya, Vaibhav Gupta and Sujeet Kumar.

Retailers as community leaders: Udaan’s small retailers outside the top 30 cities will act as community leaders and place group orders for their neighbourhoods. You too can order individually and the community leader will either deliver it to you, or you can walk up to his outlet or kirana store and pick it up.

Why now? This plan has been in the making for some time at Udaan, but it gathered pace after the pandemic caused more people to buy groceries online. Udaan wants to leverage its network of small retailers and kirana store owners to tap into the consumer demand. By the way, Udaan has been testing a grocery delivery service called Pickily in Bengaluru, and recently expanded it to Hyderabad, but it’s at a small scale right now.

Quote: “Pickily is still small and will be in the top 10 or 20 cities. Price Company is for beyond the first 30 cities. This is a bigger focus for the company right now,” one of the sources said. “It will go national in the coming weeks and they (Udaan) are aiming to clock a million orders a month by December.” Udaan is present in 1,000 towns and cities across 12,000 pin codes right now. It aims to take Price Company to 1,500 towns by December 2022.

Chinese inspiration: Udaan is looking to replicate the model used by China’s Pinduoduo. That’s how DealShare started operations in India too, largely modeling itself on Pinduoduo, also known as PDD.

Timing: It’s all about timing. All of this is happening when Udaan appointed its cofounder Vaibhav Gupta, popularly called VG internally, as its CEO in September. Its core B2B commerce business, which surpassed pre-second wave volumes in July, is growing at about 50-60% per quarter when compared to a year ago. Food is growing at a faster pace for obvious reasons and so is the pharmaceuticals vertical.

Back to BigBasket: BB Now is likely to be launched by the middle of December. It is already an action-packed space with Swiggy’s Instamart, young upstart Zepto, Dunzo, SoftBank- and Zomato-backed Grofers jostling to deliver your groceries in 10-20 minutes.

As we mentioned, there is a migration in the works for all grocery services to be housed in the main BigBasket app. Menon told us, “We realised it’s better to have all the offerings in one app. We will have a separate meat section as well. These are being worked out and will be launched soon.”

BB Daily, which competes with Swiggy’s Supr Daily, Reliance Industries’ Milkbasket and others, is the prominent app that will be brought within the main BigBasket app. Its other business-to-business (B2B) app BB Mandi may also be brought into the main app.

Fresho Stores: We reported on Wednesday that BigBasket has opened its first physical outlet to sell fresh fruits and vegetables. It aims to set up 200 such stores, typically 2,000 sq ft each, across India by FY23. If all goes well, this number will hit 800 by 2026, as per the e-grocer’s plans.

Online grocery going offline? Yes, and here’s why Menon thinks it makes sense: “We want to be everything in [the] grocery [business]. This is very strategic as a large portion of customers still want offline shopping for groceries and fresh supplies. The total addressable market is very big,” Menon told ET after the launch of the store on Wednesday. “There will be good chunks of users that remain physical (offline).”

Fresho App: You can walk in to buy fresh supplies, but if you want other products from BigBasket, you’ll have to place the order on the Fresho app and pick it up at the store.

Click-and-Pick: That’s what the model is being called by some, including Menon. We reported in August that Amazon India is also enabling pickups from the outlets of the More supermarket chain for its online grocery orders.

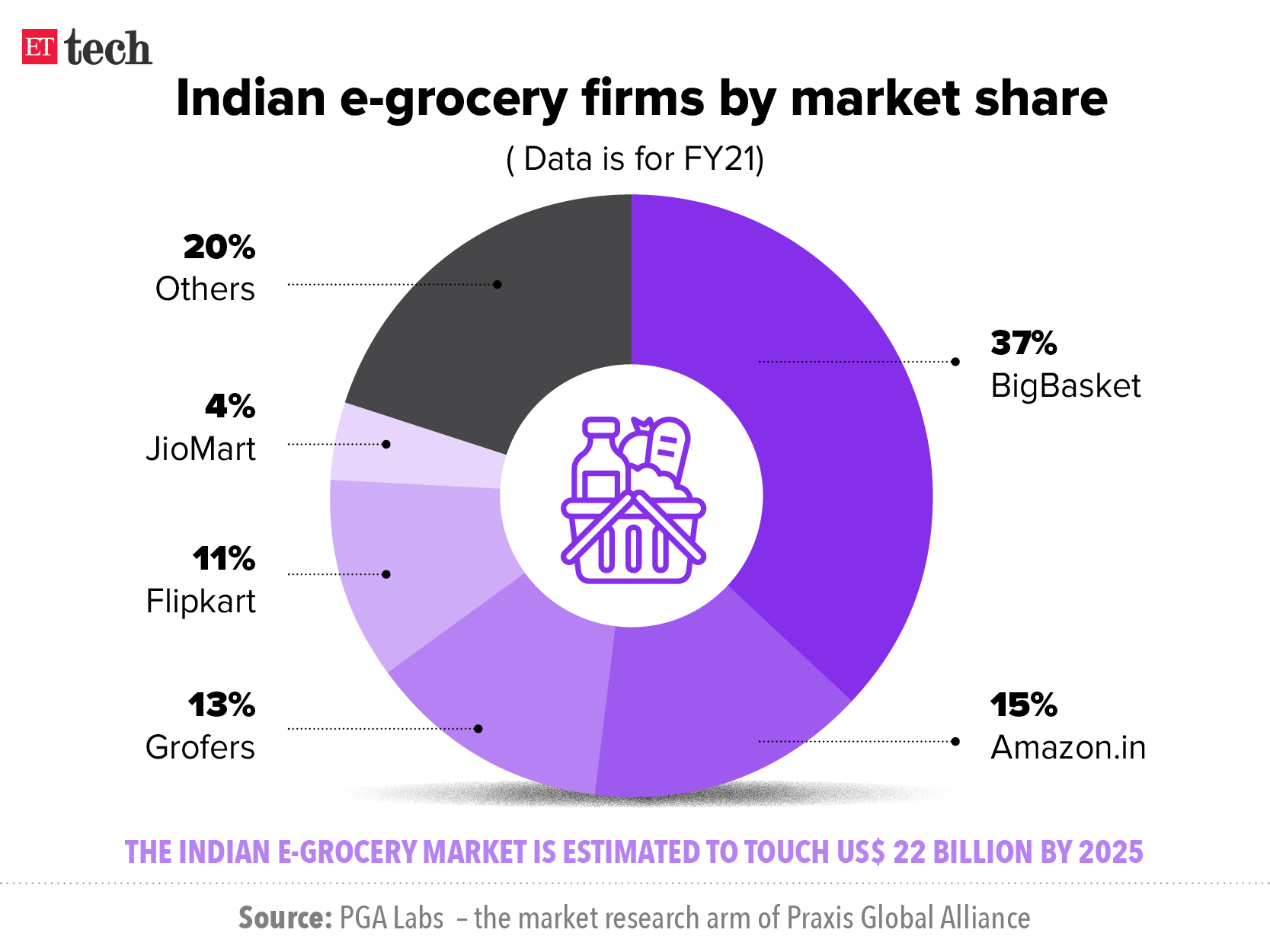

Quick Status Check: While all this happens here’s a quick breakup of the market share for online grocery in India as of FY21.

Crypto body recommends data sharing among exchanges, tighter KYC norms

IndiaTech — a crypto industry body — has suggested that cryptocurrency exchanges should implement stricter know-your-customer (KYC) procedures and share customer data between them so as to map all cryptocurrency investors in India.

The recommendations came after the crypto industry’s first-ever meeting with the Reserve Bank of India (RBI) earlier this month, sources told us, amid speculation of an impending ban on cryptocurrencies in India.

The government is set to introduce the Cryptocurrency and Regulation of Official Digital Currency Bill, 2021 for consideration in the upcoming winter session of the parliament.

IndiaTech also suggested developing a central filter that allows only certain coins to be listed. At present, crypto exchanges have internal frameworks to decide which coins to list.

The heat is on: “Given the current situation, exchanges are willing to work on a common data sharing practice if that assuages the government and regulators’ concerns,” a person aware of the discussions said.

Blanket ban? According to the Lok Sabha bulletin published on Tuesday, the crypto bill “seeks to prohibit all private cryptocurrencies in India” but allows for “certain exceptions to promote the underlying technology and its uses”.

The language was similar to that in a previous version of the bill from earlier this year, which reportedly called for a blanket ban on cryptocurrencies. However, people in the industry said discussions have come a long way since and the current phrasing could be interpreted in many positive ways.

Moment of truth for crypto: The cryptic language in the Lok Sabha bulletin has pushed the crypto community in India towards its moment of truth. Never before has the mere description of a bill set to be introduced in Parliament caused such a bloodbath.

We will soon discover whether the intent of lawmakers differs from the sweeping description of the proposed law that plans to “prohibit all private virtual currencies” while allowing for “certain exceptions to promote the underlying technology”.

Even as the crypto crowd struggles to decipher what this really means, it faces some big questions. Can blockchain survive without crypto assets? What does the government mean by “private” cryptocurrencies? What are the exceptions that the bill’s description mentions?

The future of crypto in India depends on the answers to these questions.

Also Read: India’s proposed crypto bill triggers panic among investors, selloff

Tweet of the day

Amazon gets Cloudtail’s replacement for electronics retail

The Salarpuria-Sattva Group, one of South India’s largest real estate developers, has set up a company that is poised to take over the entire consumer electronics business of Cloudtail, the largest seller on Amazon India, four industry executives told us.

Called Dawntech Electronics, the new firm is the first independent, well-funded, preferred seller to get a piece of Cloudtail’s business after it announced earlier this year that it would wind up operations by May 2022.

Amazon India is not a stakeholder in Dawntech, according to filings with the Registrar of Companies. The etailer is also appointing sellers in other categories to take over from Cloudtail, our sources said. It will likely finalise a seller to replace Cloudtail in the fashion category next month, said the chief executive of a top clothes brand.

Two peas in a pod: Amazon’s actions mirror those of rival Flipkart, which is also limiting the share of each seller’s sales on its platform and refraining from owning a stake in them. Both companies have been accused by opponents including small traders of operating front companies to sidestep India’s regulations that bar foreign-owned marketplaces from selling anything of their own.

Critics have also been targeting Infosys founder NR Narayana Murthy for his association with Cloudtail. The seller’s holding company, Prione Business Services, is a joint venture between Amazon and Murthy’s Catamaran Ventures.

Dream Sports hits $8 billion valuation after fresh fundraise

Dream Sports cofounder Harsh Jain.

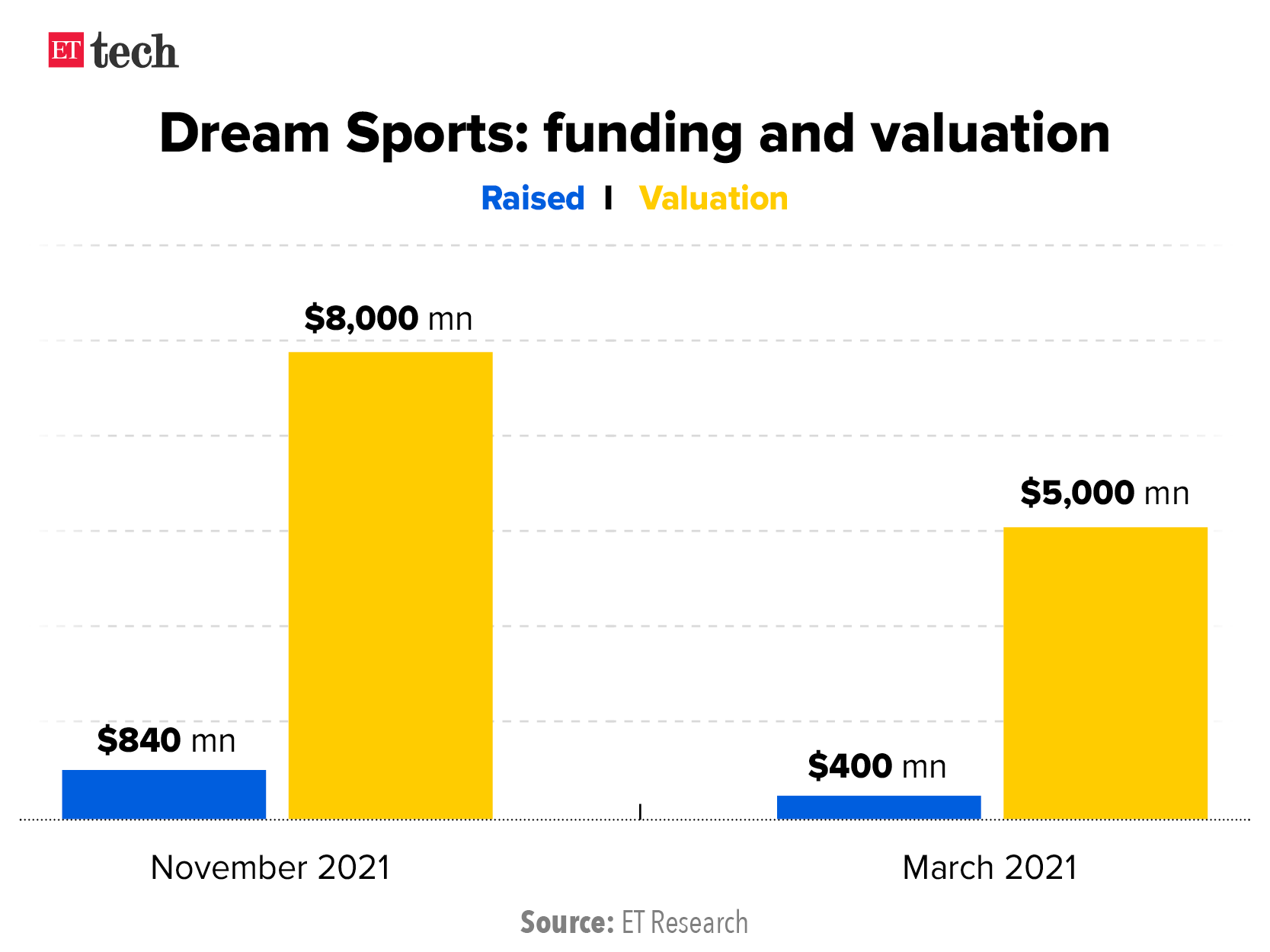

Dream Sports, the parent company of online fantasy gaming platform Dream11, has raised $840 million in a funding round led by Falcon Edge, DST Global, D1 Capital, Tiger Global and Redbird Capital, at a valuation of $8 billion.

The round also involved existing investors such as TPG and Footpath Ventures. In March we reported that Dream Sports closed a $400 million secondary funding round at a valuation of around $5 billion.

Diversifying: The 13-year-old company has diversified its offerings in recent years to cover the ambit of sports technology products and services. It recently committed $50 million to its in-house sports content and commerce platform, FanCode, in a broader push to become a one-stop destination for sports. It offers payment solutions through Dream Pay, launched an accelerator called DreamX, and operates DreamSetGo—a sports experiential company. In August it set up a corporate venture arm called Dream Capital with a corpus of $250 million to become a sports technology conglomerate.

No IPO plan for now: Harsh Jain, its cofounder and CEO, said that the company’s focus was to create a thriving sports ecosystem in India which goes beyond fantasy gaming.

He said the company will remain private for now, despite a spate of tech startups tapping the public markets. “We are not going to go public because the market is hot, we will do so when we think we are solving a problem. For the next year or so it is not in our plans,” he said.

Mobile gaming in India to hit $5B by 2025, report says: Dream Sports’ fresh funding comes amid unprecedented investments in Indian startups this year.

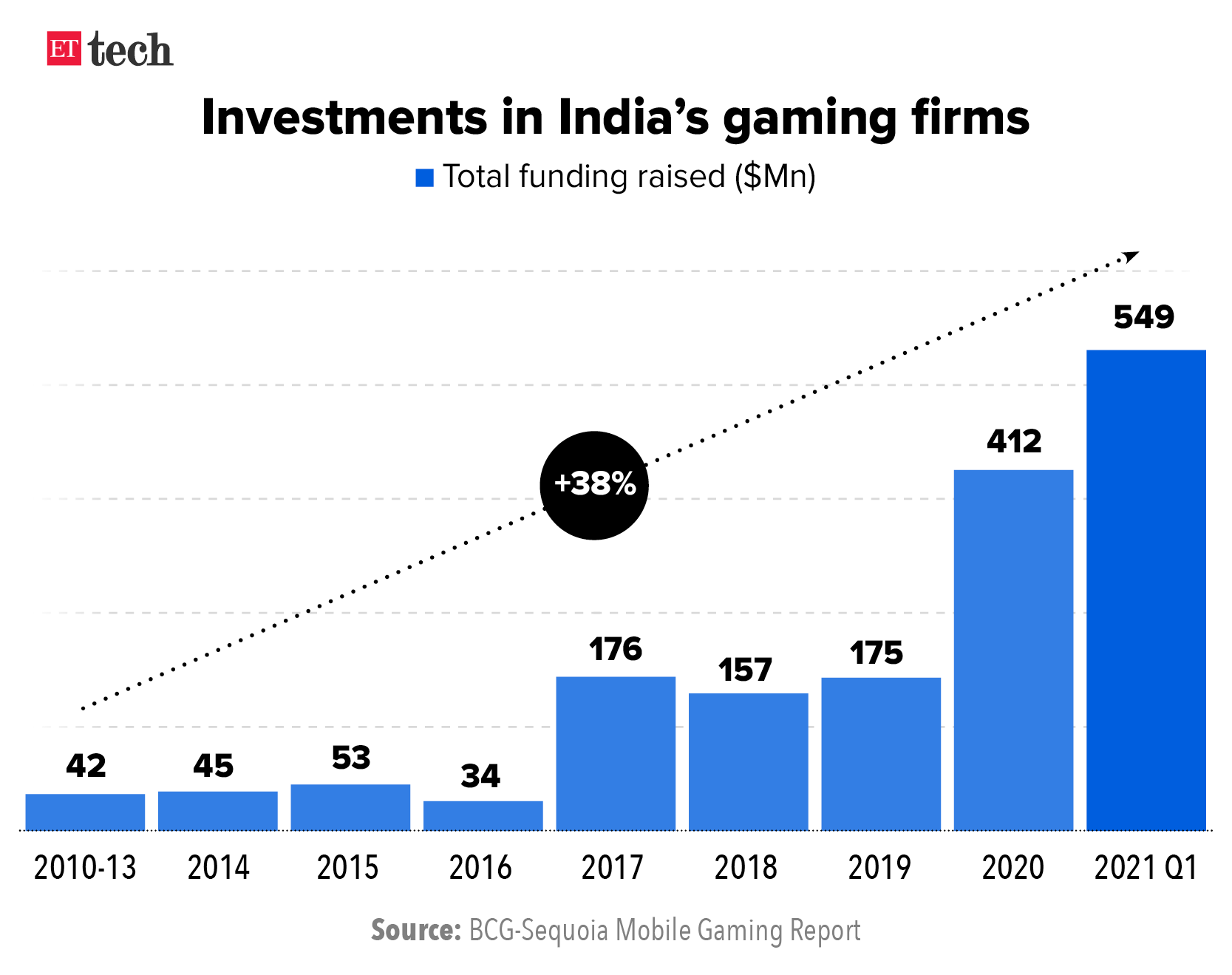

According to a report by Boston Consulting Group and Sequoia, India’s gaming startups raised $549 billion in the first quarter of 2021, more than the $412 billion they raised in all of 2020. For comparison, gaming startups raised just $34 million in 2016.

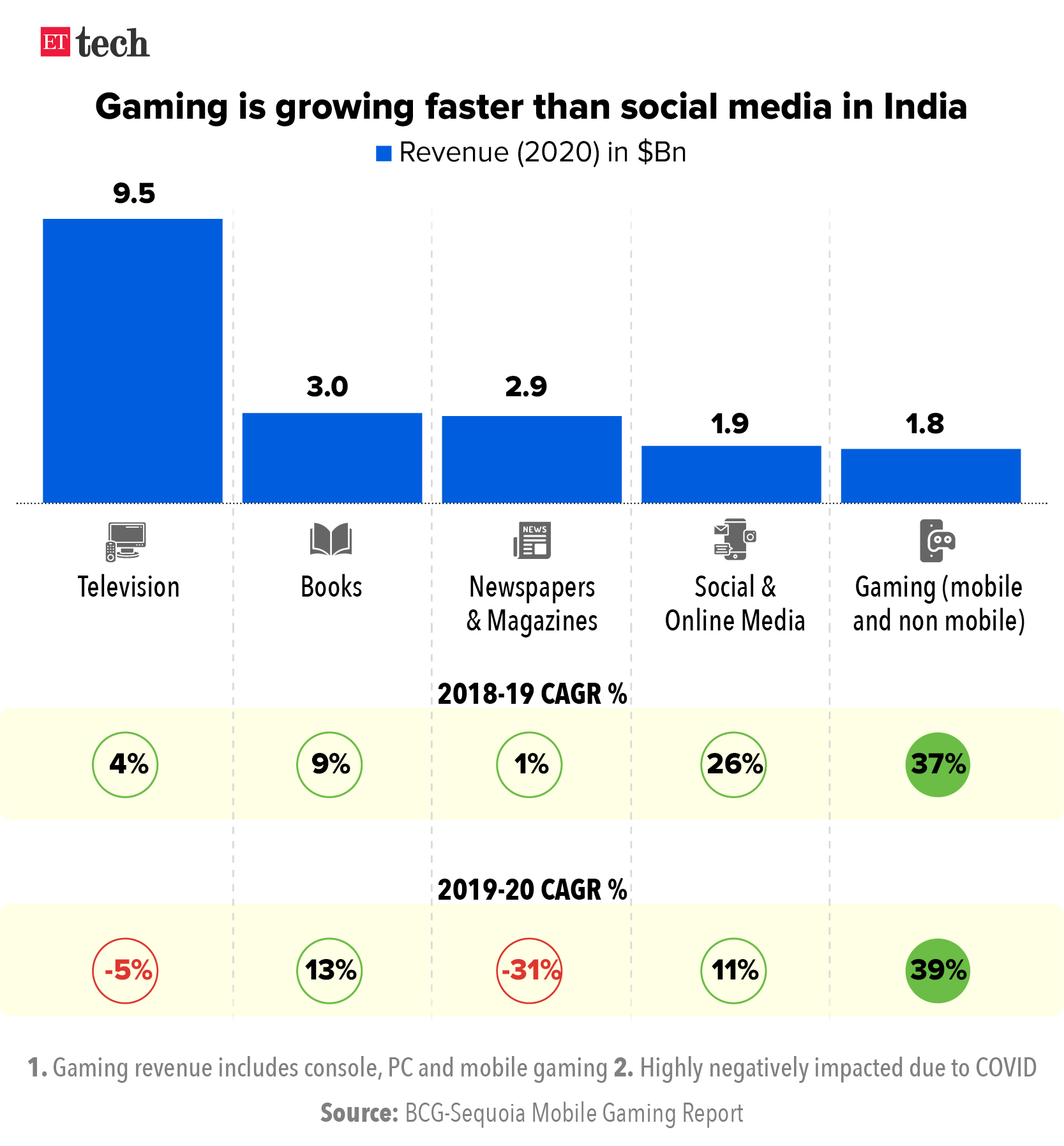

The country’s $1.8-billion gaming market, while small in global terms, is growing rapidly on the back of mobile-first games, the report said. Revenues from mobile gaming in India are expected to shoot up to at least $5 billion by 2025, it said.

It said that more than 300 million people play mobile games in India, and that the gaming market as a whole grew at a compound annual growth rate (CAGR) of 38% in 2019-2020 and 37% the previous fiscal. This means that gaming has been growing faster than social media in India over the past few years. India’s social media market grew by 11% in 2019-20 and 26% the previous fiscal.

ETtech Done Deals

■ GlobalBees, a direct-to-consumer (D2C) brand roll-up platform from the Firstcry stable, has invested in three startups—Healthyhey, Rey Naturals and Intellilens—to mark its foray into health and sports supplements and intelligent eyewear.

■ CoreStack, a multi-cloud governance SaaS provider, has raised $30 million in a Series B funding round led by Avatar Growth Capital for growth, expanding into newer markets and innovation.

■ Park+, an app for car users, has raised $25 million in a Series B funding round co-led by Sequoia Capital India, Matrix Partners India and Epiq Capital to strengthen its technology and for product development.

■ Bengaluru-based EV maker Simple Energy has raised $21 million to increase manufacturing capacity, accelerate new product development and expand the number of its experience centres.

■ Indifi Technologies has raised Rs 340 crore in a mix of debt and equity to serve more customers, identify additional segments of MSMEs and for technology and product development.

Spinny turns unicorn after raising $285 million

Spinny founder Niraj Singh

Online used car marketplace Spinny has raised $285 million in its Series E funding round, led by Abu Dhabi-based ADQ and New York-based investment firm Tiger Global.

The round marks its entry to the unicorn club, or those startups valued at $1 billion or more. Entrackr was first to report about the funding on Wednesday.

The valuation: The company was valued at $1.5 billion pre-money, or nearly twice what it was valued at when it raised $108 million from Tiger Global and others in July, sources said. The company’s post money valuation will be $1.75 billion, they said.

The latest fundraise includes a $35-million secondary sale component in which some existing investors have partially or fully cashed out.

Sources say: “ADQ and Tiger Global have invested $100 million each in the company, while $50 million has come from Avenir Growth and $25 million from Feroz Dewan’s Arena Holdings,” a person familiar with the development said.

Spinny is expected to use the funds to invest in developing tech and product capabilities, for branding, and to expand geographical reach, sources said.

Previous funding: Spinny raised $65 million in its Series C round in April from US-based General Catalyst, Elevation Capital, Alteria Capital, Think Capital, and Fundamentum Partnership at a post-money valuation of $350 million.

Expansion plans: Spinny is present in the top 15 Indian cities and is expected to expand to 25 cities by the end of the next calendar year.

Other Top Stories By Our Reporters

‘Social media firms must be accountable for content on platforms’: Social media firms must be “accountable” for the content on their platforms and cannot take cover behind “algorithms,” Rajeev Chandrasekhar, minister of state for electronics and information technology, told ET in an exclusive interview.

WaterBridge Ventures’ fundraising: WaterBridge Ventures, early stage venture capital firm, has raised its second fund at $150 million, 50% more than the planned size of $100 million, amid frenetic dealmaking in India’s startup ecosystem.

Most existing cryptos will perish, Rajan says: Around 6,000 cryptocurrencies are in existence and former RBI governor Raghuram Rajan believes that only one or two, or at most a handful, would survive.

Global Picks We Are Reading

■ Apple sues Israel’s NSO Group for surveillance of users (The Guardian)

■ How Fake News on Facebook Helped Fuel a Border Crisis in Europe (NYT)

■ Biden snubs Tesla at event touting electric vehicles (Bloomberg)

Today’s ETtech Morning Dispatch was curated by Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.