Here’s how things went from bad to horrific for Twitter this week.

August 23: The Washington Post and CNN reported on an 84-page whistleblower complaint filed in July by Twitter’s former security chief Peiter Zatko, who was fired by CEO Parag Agrawal in January.

In his complaint, Zatko alleged that Twitter prioritises user growth over reducing spam, does not have a strong security plan, and that half the company’s servers run outdated and vulnerable software.

The most explosive allegation, however, was the Indian government forced Twitter to put a government agent on the payroll, and that this agent would have had access to sensitive user data because of Twitter’s weak security infrastructure.

August 24: Agrawal addressed Zatko’s allegations at a weekly company meeting, telling employees, “This complaint that was filed yesterday is foundationally, technically and historically inaccurate… There are accusations in there without any evidence and many points made without important context.”

At the same meeting, Twitter executives told staff that employee attrition is currently 18.3%, Reuters reported. Before Musk made his $44 billion offer to buy the company, attrition hovered between 14% and 16%, which was consistent with competitors.

Hours later, reports said the US Senate Judiciary committee would hold a hearing with Zatko on September 13 to discuss his allegations. TechCrunch reported that two national data protection authorities in the EU – Ireland and France – were also following up on Zatko’s complaint.

August 25: The chair of the US House of Representatives and a key subcommittee demanded that Agrawal address the “disturbing” allegations about poor security and privacy practices, and misleading regulators.

They said Zatko pointed to “multiple instances where Twitter executives obfuscated and mischaracterised information to Congress, regulators, and its own board – and may have even bowed to pressure from foreign governments to put their operatives on the company’s payroll.”

“If any of these allegations are true, Twitter has a staggering security to-do list.”

August 26: Twitter founder and former chief executive Jack Dorsey tweeted that he regrets the social media platform became a company.

With the week it’s had, he’s not the only one.

Top Stories By Our Reporters

RBI, Fintechs and more

Payment aggregators to lobby RBI on lending rules: Following the latest circular on digital lending rules from the RBI, payment aggregators are set to lobby the central bank through the Fintech Association for Consumer Empowerment (FACE) as they seek relaxation in the guidelines for better business prospects. RBI mandates all loan disbursals to take place between the bank account of the borrower and entities regulated by the central bank.

Digital lending complaints fall after RBI issues new rules: The Reserve Bank of India’s new digital lending guidelines have already started having a positive impact as the number of complaints from victims of fraudulent apps has fallen since the guidelines were released earlier this month, according to people who work in the customer protection space.

ED finds more than Rs 800 crore crime proceeds in loan app probe: The Enforcement Directorate (ED) has allegedly found proceeds of crime of over Rs 800 crore as part of a long-drawn money laundering probe against 365 fintechs and their non-banking financial company (NBFC) partners, sources close to the matter told us.

Google removed 2,000 loan apps from India Play Store this year: Google India removed as many as 2,000 credit disbursement apps between January and June for violating its Play Store policies as well as rules around money lending by the Reserve Bank of India and law enforcement agencies, and on user feedback, the company said on Thursday.

Paytm shareholders vote to reappoint Vijay Shekhar Sharma as MD: Paytm parent firm One 97 Communications Ltd said 99.67% of its shareholders who voted approved the resolution to reappoint founder Vijay Shekhar Sharma as managing director of the company for five years – from December 19, 2022 to December 18, 2027.

Cryptoverse

ED raids CoinSwitch Kuber in money laundering probe: The ED on Thursday carried out searches at five locations linked to crypto exchange CoinSwitch Kuber, sources privy to the development told us. The searches were part of the ED’s money-laundering probe into the instant micro loan app scam, they said.

CoinDCX makes DeFi foray: Crypto exchange CoinDCX forayed into the burgeoning decentralised finance (DeFi) space with the launch of Okto — a keyless, self-custody wallet for peer-to-peer trading. Okto will work across over 20 blockchains and over 100 decentralised finance (DeFi) protocols, said Neeraj Khandelwal, cofounder of CoinDCX.

Big-ticket Deal Brewing

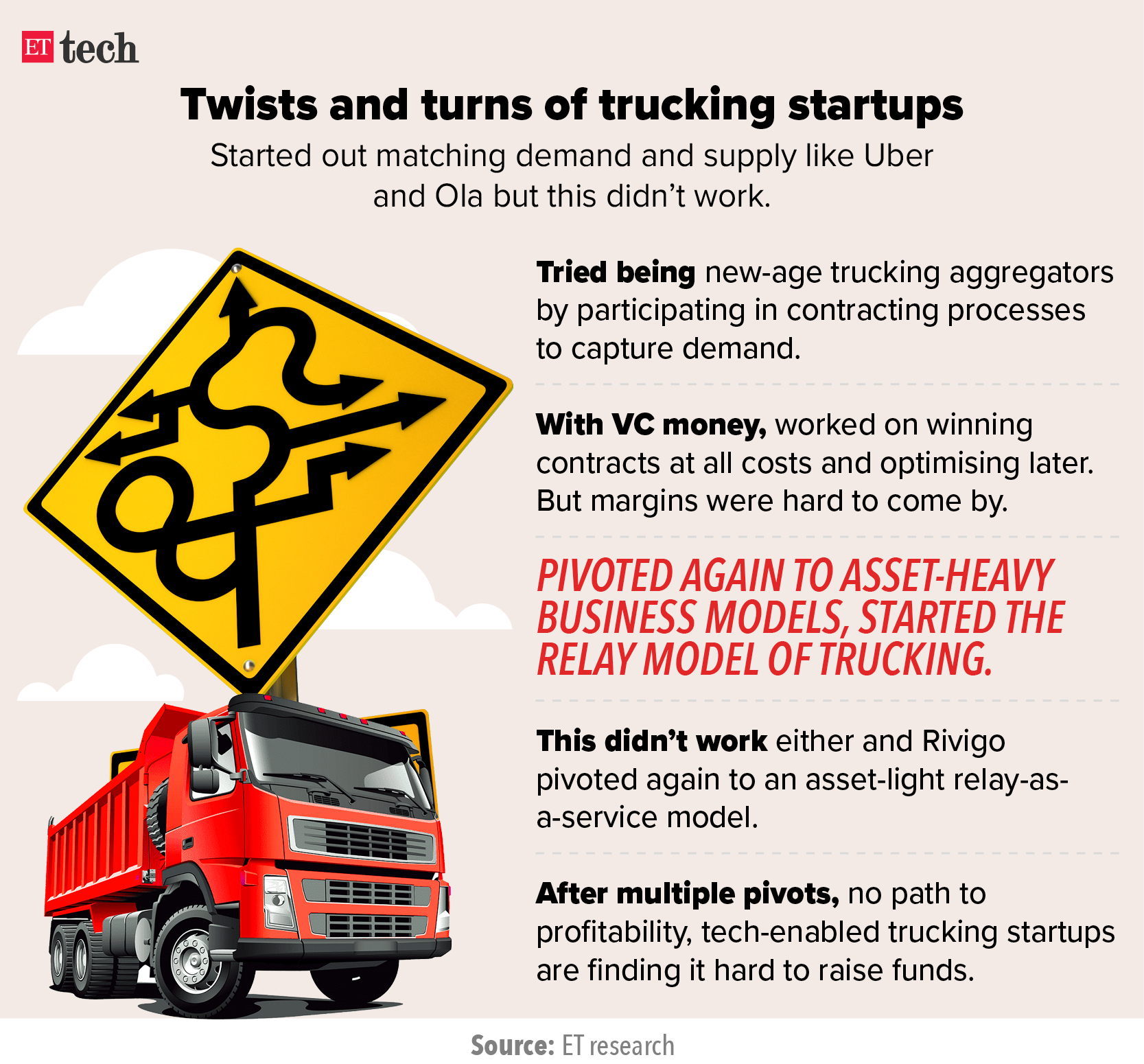

Logistics unicorn Rivigo in sale talks with Flipkart, FirstCry: Rivigo has held talks with ecommerce marketplace Flipkart and omnichannel baby products retailer FirstCry for a potential sale, multiple sources aware of the matter told us. The logistics unicorn has struggled to raise fresh funds for sometime now, which is further amplified as investors turn skittish due to the ongoing economic slowdown.

Tech Policy

No consideration to levy any charges for UPI services, says finance ministry: The finance ministry said United Payments Interface (UPI) is a digital public good and there is no consideration in the government to levy any charges on this.

Egaming task force may set spend limits in framework: An inter-ministerial group tasked with drawing up a framework to regulate online gaming is likely to introduce rules governing the amount of money individual players spend in a game, people in the know told us.

Privacy red flags as Digi Yatra app takes off in beta: The government’s Digi Yatra project for flyers has come in for criticism from activists who say it would affect user privacy, especially in the absence of a data protection law.

ETtech Opinion: Alpha founders, VC greed

Last week Adam Neumann, the once celebrated and later controversial founder of the office-sharing startup WeWork, raised $350 million for his latest venture Flow, a startup looking to disrupt the residential rental real estate market in the US. The massive financing – the largest cheque signed off by venture capital firm Andreessen Horowitz in an individual company – valued Flow at $1 billion.

Click here to read the full column.

IT Corner

Seniors at IT firms bear the brunt of variable pay cuts: Indian IT service providers are clamping down on the variable pay component of tech professionals to control attrition rates and costs, at a time of rising pressure on margins.

Hyperscalers’ slowdown could dent cloud revenue of IT firms: A third of the revenues of IT service providers could be hit by the dip in growth rates of the three largest cloud hyperscalers – Amazon Web Services (AWS), Microsoft Azure and Google Cloud.

IT attrition may spike again as firms delay performance-linked payouts: A decision to hold back variable pay by top IT companies such as Wipro could imply softening revenue growth for the $200-billion software services export industry. It could also mean attrition — which has already touched unprecedented levels — could further spike up due to the cut in the performance-linked incentive, analysts told us.

TCS to roll out 100% variable pay for its 600,000 plus employees: Days after reports surfaced that information technology (IT) firm Tata Consultancy Services (TCS) had delayed the June variable compensation payout by a month for some employees, the country’s largest IT firm said on Tuesday it will pay out 100% of variable pay for its 600,000-plus employees.

Startup Investments

Institutional investors oppose Esops of top startups: Institutional investors, including foreign funds, are opposing listed startups’ plans to dole out stock options and pay packages to some of their top employees.

Sebi may allow AIFs to extend lifecycle by two years: The Securities and Exchange Board of India (Sebi) is considering a plan to allow alternative investment funds (AIFs) to extend the life cycle of investment products that are set to be wound up by two more years, people with direct knowledge of the matter told us.

EV Corner

Car makers train in-house talent, hire from rivals in EV race: With auto companies going full throttle on electric and demand for talent outstripping supply, companies such as Mercedes Benz, Tata Motors and Ashok Leyland are focusing on skilling in-house talent for their electric vehicle (EV) divisions.

Govt to rework FAME-II sops to fix loopholes in EV policy: The government aims to usher in changes to the Faster Adoption and Manufacturing of (Hybrid and) Electric vehicles (FAME)-II policy, for which a digital mechanism will be put in place to calculate the domestic value addition, a note and presentation sent to vehicle manufacturers by the ministry of heavy industries showed.

Food-delivery Updates

Swiggy’s Instamart expands to 25 cities: Swiggy’s two-year-old quick commerce grocery business Instamart has been used by nine million customers and expanded to over 25 cities since it began operations, a senior executive told us.

Sequoia Capital offloads 2% of shareholding in Zomato: Sequoia Capital India, one of Zomato’s early backers, has sold a 2% stake in the company in the open market, according to a BSE filing by Zomato on Friday. Sequoia now holds a 4.4% stake in the food delivery firm.

ETtech Done Deals

■ Device management startup Servify has raised $65 million in funding as a part of its pre-initial public offering (IPO) round, led by Singularity Growth Opportunity Fund.

■ Edtech startup Brightchamps has acquired Singapore-based Schola, a live-learning platform for kids to develop communication and English skills, in a $15 million cash and stock deal. The company aims to use the acquisition to bolster its presence in the K-12 education segment.

In Other News

With IPO delayed, PharmEasy targets Ebitda breakeven by next year: PharmEasy, which has decided to postpone its IPO plan to next year, is cutting its burn and is aiming for Ebitda breakeven in a year, people in the know said. Ebitda, or earnings before interest, taxes, depreciation, and amortisation, is a measure of a company’s overall financial performance.

Bengaluru ranks 2nd in list of top APAC tech hubs: Bengaluru is close behind Beijing as one of the top tech hubs across the Asia-Pacific, followed by Chennai, Hyderabad, and Delhi, said a report by Cushman and Wakefield.