Also in this letter:

■ NPCI plans to take UPI global to make remittances faster and cheaper

■ Axilor launches $100 million second fund for Indian startups

■ Crypto lender Voyager Digital files for bankruptcy

Twitter withholds Goddess Kaali tweet on govt’s request

Twitter India on Wednesday withheld a July 2 tweet by filmmaker Leena Manimekalai that featured a poster of her film, which depicts the Indian Goddess Kaali smoking a cigarette.

The takedown, which Twitter reported to the Lumen Database, was In response to a legal request from the union government. On Tuesday, Twitter sued the government in the Karnataka High Court, saying some of its takedown requests constituted an abuse of power and an infringement of free speech.

Lumen is an American collaborative archive that aims to protect lawful online activity from legal threats.

The controversy: Canada-based Manimekalai’s film Kaali was screened at the Aga Khan Museum in Toronto on July 2. Following the announcement, the filmmaker faced severe social media backlash.

The Indian High Commission on Monday urged the Canadian authorities to withdraw the poster and other “provocative” material.

On Tuesday, the Delhi Police and the Uttar Pradesh Police filed separate FIRs against Manimekalai.

The same day, the Aga Khan Museum offered an apology. It said the film was screened once on July 2 and was no longer being shown.

Twitter sues govt: The takedown comes a day after Twitter took the Ministry of Electronics and Information Technology (MeitY) to court, challenging some of its takedown and content withholding orders issued under Section 69A of the Information Technology Act.

Last week we reported that the government had given Twitter India “one last opportunity” to comply with the IT rules by July 4 or risk losing its immunity as an intermediary.

Twitter complied this week, so as not to lose liability exemptions available to it as a host of content, but sued the government soon after.

NPCI plans to take UPI global to make remittances faster and cheaper

The National Payments Corporation of India (NPCI), which built and runs the hugely popular Unified Payments Interface (UPI), now wants to use India’s digital payments backbone to make it cheaper and earlier for non-resident Indians to send money home.

What’s going on? NPCI is in the process of connecting the UPI platform to systems in other countries to replicate its domestic success. It is negotiating collaborations with governments, fintech companies and service providers around the world, aiming to reduce transaction costs and enable more small-ticket transactions, said Ritesh Shukla, chief executive officer of NPCI International Payments Ltd.

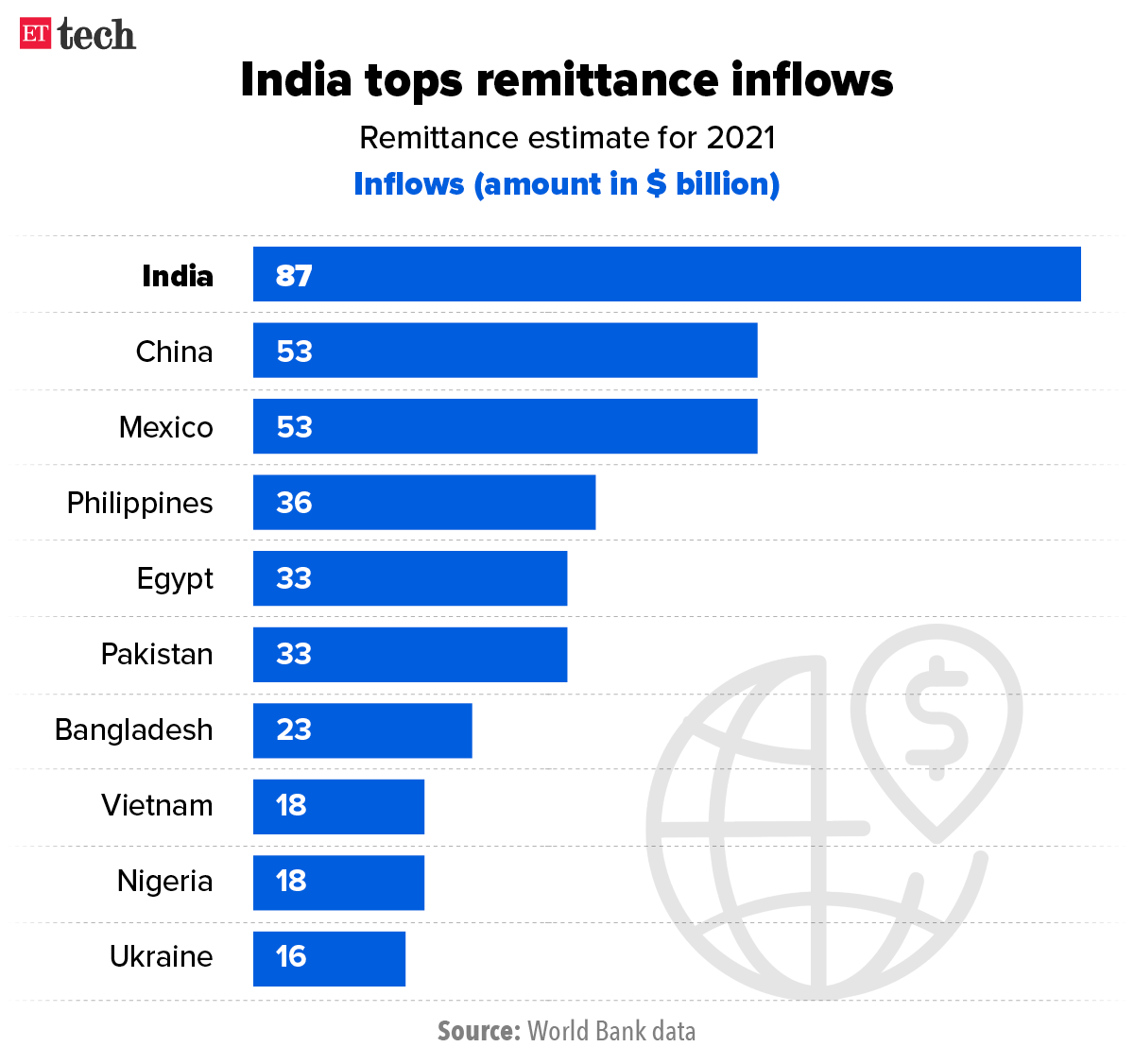

Why it matters: Indians overseas remitted $87 billion last year, the biggest inflow for any country tracked by the World Bank. The remittances market, where it costs $13 on average to send $200 across borders, is ripe for disruption, according to Shukla.

Successful overseas forays by NPCI would give India a home-grown alternative to SWIFT, the Belgium-based cross-border payment system operator, though Shukla stressed that the objective was not to displace existing platforms.

About 330 banks and 25 apps — including Alphabet Inc.’s Google Pay and Meta Platform Inc.’s WhatsApp — use UPI, which has helped make instant digital payments a $3 trillion market in India.

Cutting costs: “This is going to take the payments world by storm,” said Mayank Goyal, CEO of moneyHop, a cross-border banking app that lets users make international remittances through the SWIFT network. The company will seek to integrate UPI rails into the app as it makes cross-border payments easier, Goyal said.

UPI’s linkage with overseas nations will further anchor trade, travel and remittance flows between the countries and lower the cost of cross-border remittances, the Reserve Bank of India said in a report.

Tweet of the day

Axilor launches $100 million second fund for Indian startups

Ganapathy Venugopal, cofounder, Axilor Ventures

In the wake of rising early-stage investments by VCs, Axilor Ventures is launching its second technology fund Axilor Technology Fund-II, worth $100 million, as it looks to double down on its Indian startup investments.

Founded by former Infosys cofounders Kris Gopalakrishnan, SD Shibulal and others, the firm used 90% of its first fund, worth Rs 200 crore, to back about 54 companies.

Axilor will now look to back 100-125 new companies across SaaS, supply-chain tech, fintech, healthcare and agritech at a time when late-stage funding has slowed down.

ETtech Done Deals

■ Financial infrastructure provider M2P Fintech acquired cloud-lending platform FinFlux for an undisclosed sum. Launched in 2010, Bengaluru-based Finflux offers loan origination, loan management, BNPL products and credit scoring services via its cloud platform, servicing over 12 million borrowers.

■ Direct-to-consumer (D2C) bakery brand The Baker’s Dozen raised $5 million in a mix of debt and equity funding led by Fireside Ventures. Founded in 2013 by Aditi Handa and Sneh Jain, The Baker’s Dozen makes bakery staples like sourdough bread, cakes, and cookies.

■ Finvu AA, a consent-based account aggregator, raised $2.5 million in funding from Varanium Nexgen Fund, IIFL, DMI Sparkle Fund and others. The company has processed over 7,50,000 consent requests and executed over two million APIs.

Crypto lender Voyager Digital files for bankruptcy

Stephen Ehrlich, founder, Voyager Digital

Days after suspending all withdrawals and deposits, crypto lender Voyager Digital has filed for bankruptcy, becoming the latest casualty of the ongoing crypto winter.

The company’s filings revealed it had more than 100,000 creditors, $1-10 billion in crypto assets, and about the same amount in liabilities.

Domino effect: “The prolonged volatility and contagion in the crypto markets over the past few months and the default of Three Arrows Capital on a loan from the company’s subsidiary, Voyager Digital, LLC, require us to take deliberate and decisive action now,” said Stephen Ehrlich, chief executive officer, Voyager Digital.

The sudden implosion of stablecoin terraUSD in May has roiled the crypto markets, with several companies pausing withdrawals and giants like crypto hedge fund Three Arrows Capital going broke.

Amazon faces UK probe over suspected anti-competitive practices

Britain’s antitrust watchdog is investigating Amazon on concerns it was hurting competition by giving its own sellers an unfair advantage in its marketplace over third parties, adding to global regulatory scrutiny of the US tech giant.

Driving the news: Britain’s Competition and Markets Authority (CMA) said it opened an investigation on Tuesday into whether Amazon’s practices that affect sellers on its domestic marketplace may be anti-competitive and result in a worse deal for customers.

A spokesperson for Amazon said the company would work closely with the CMA during its investigation, adding that sales from the company’s selling partners continued to grow faster than Amazon’s retail sales.

Activision deal: The CMA also said it had started an investigation into Microsoft’s $68.7 billion deal to buy ‘Call of Duty’ maker Activision Blizzard. The deal, announced in January, would be the biggest ever in the gaming industry if approved.

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant in Mumbai and Ruchir Vyas in New Delhi. Graphics and illustrations by Rahul Awasthi.