In an SEC filing the previous day, the Tesla CEO had accused Twitter of breaking their agreement by not giving him sufficient data on spam bots. Last month, he said he was putting the deal “temporarily on hold” for the same reason.

The Post report, which cited an unnamed source familiar with Twitter’s thinking, said the company was willing to give Musk access to its so-called ‘firehose’ API, which is an unfiltered stream of every tweet as it’s posted.

More than 10,000 tweets are published worldwide every second, so the term ‘firehose’ is quite apt.

Credit: Giphy

It’s a decidedly passive-aggressive way of telling Musk – who has repeatedly demanded to know what percentage of Twitter users are spam bots – “Here, you figure it out.”

What’s the firehose?

Surprisingly little is known about Twitter’s firehose API. Twitter has allowed only a handful of companies to access it, and is said to charge hundreds of thousands of dollars a month for the

privilege. In addition to all real-time tweets, the firehose includes information about user accounts and the devices they are posted from.

What we do know is that Twitter cut off general access to the firehose in April 2015, when it ended all third-party agreements for the resale of this data.

Before Twitter took it in-house, firehose data was made available to third-party apps via three authorised resellers – Gnip (which Twitter acquired in 2014), Datasift and NTT Data.

Two months before that, Twitter had struck a deal with Google to provide access to its firehose stream, allowing the search giant to index tweets in real time and show them in search results.

It was the second time the two companies had struck a deal for firehose data. The previous one was signed in October 2009 but expired in July 2011, so real-time tweets disappeared from Google search results for three-and-a-half years.

When it revamped its developer APIs in July 2020,Twitter said firehose data would continue to be available only in limited partnerships. It said at the time that even the most data-hungry developers shun the full firehose because it’s difficult to work with.

Musk wanted more data from Twitter, and now he’s getting literally all of it.

Written by Zaheer Merchant

Digital payments

Credit card payments on UPI present many challenges to fintech firms

Even as the fintech industry cheers the RBI’s decision to allow credit cards to be linked with the Unified Payments Interface (UPI), it faces challenges on consent architecture, merchant know-your-customer (KYC) guidelines and the zero merchant discount rate (MDR) regime for UPI.

The RBI on Wednesday allowed credit cards – starting with RuPay cards – to be linked with UPI, a move that experts said has the potential to expand the market for credit by nearly five times.

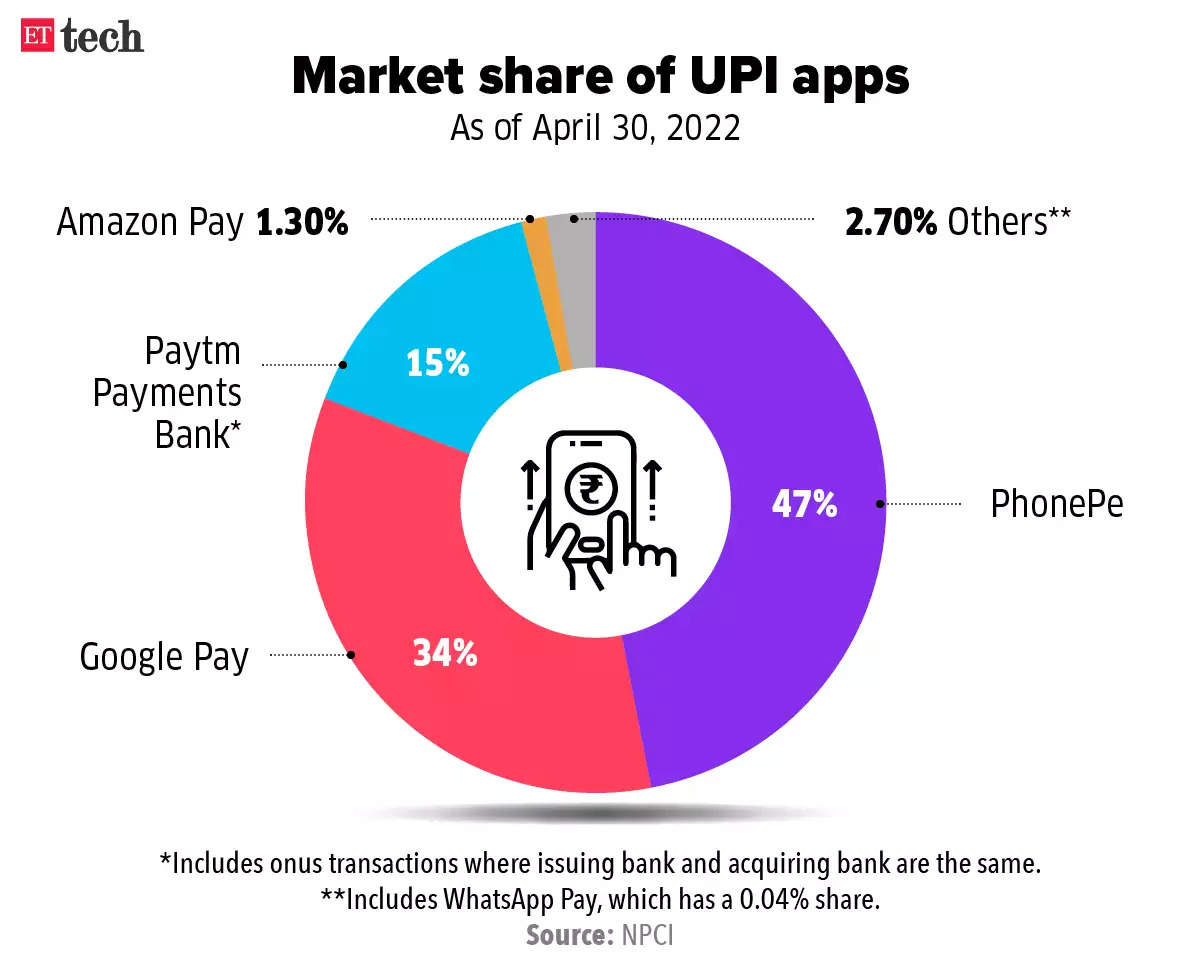

NPCI may defer UPI market cap rules to Jan 2025: The NPCI may postpone the implementation of its contentious rules, which would bar any single UPI app from having a market share of more than 30%, to January 2025, sources told us. In a recent letter to the Reserve Bank of India, the nodal agency suggested that leading UPI apps be given two more years to bring their market share below 30%, one of the sources said.

Replace SMS transaction alerts with app notifications, say fintech firms: Fintech majors including the likes of GooglePay and Paytm are among those petitioning the government to consider in-app alerts as an alternative to SMS notifications for banking transactions, sources told us. They said SMS notifications cost more and present security risks.

Banks start asking customers to tokenise credit cards by June 30

Indian banks and merchants have started asking customers to tokenise their credit and debit cards before the June 30 deadline set by the RBI, according to communication seen by ET. But several merchants remain worried about the readiness of the ecosystem to handle transaction and tokenisation volumes, and avoid disruptions for consumers.

Policy updates

MeitY unlikely to relent on six-hour rule of Cert-In despite pushback from industry

MeitY releases proposed changes to IT rules that it yanked last week: Earlier, the ministry published a draft of proposed changes to India’s technology and social media regulations with the aim of providing “more effective grievance redressal”, and to plug “infirmities and gaps” in the rules.

Tech policy groups push back against new cybersecurity rules: Several tech policy groups have hit back against the Indian Computer Emergency Response Team’s (Cert-In) new cybersecurity directives. The US India Business Council, the Cybersecurity Coalition, the US Chamber of Commerce, the Bank Policy Institute, the Internet and Mobile Association of India, AccessNow, SFLC.in and others have written to MeitY and Cert-In, saying the guidelines for VPN providers, such as retaining customer details for five years, would “put people’s privacy at risk”.

MeitY plans egaming policy to help firms grow, play by rules

The government is developing a national framework for online gaming platforms, sources in the know told us. This is aimed at ensuring that these platforms are “effectively regulated” without impeding their growth, they added.

ETtech Done Deals

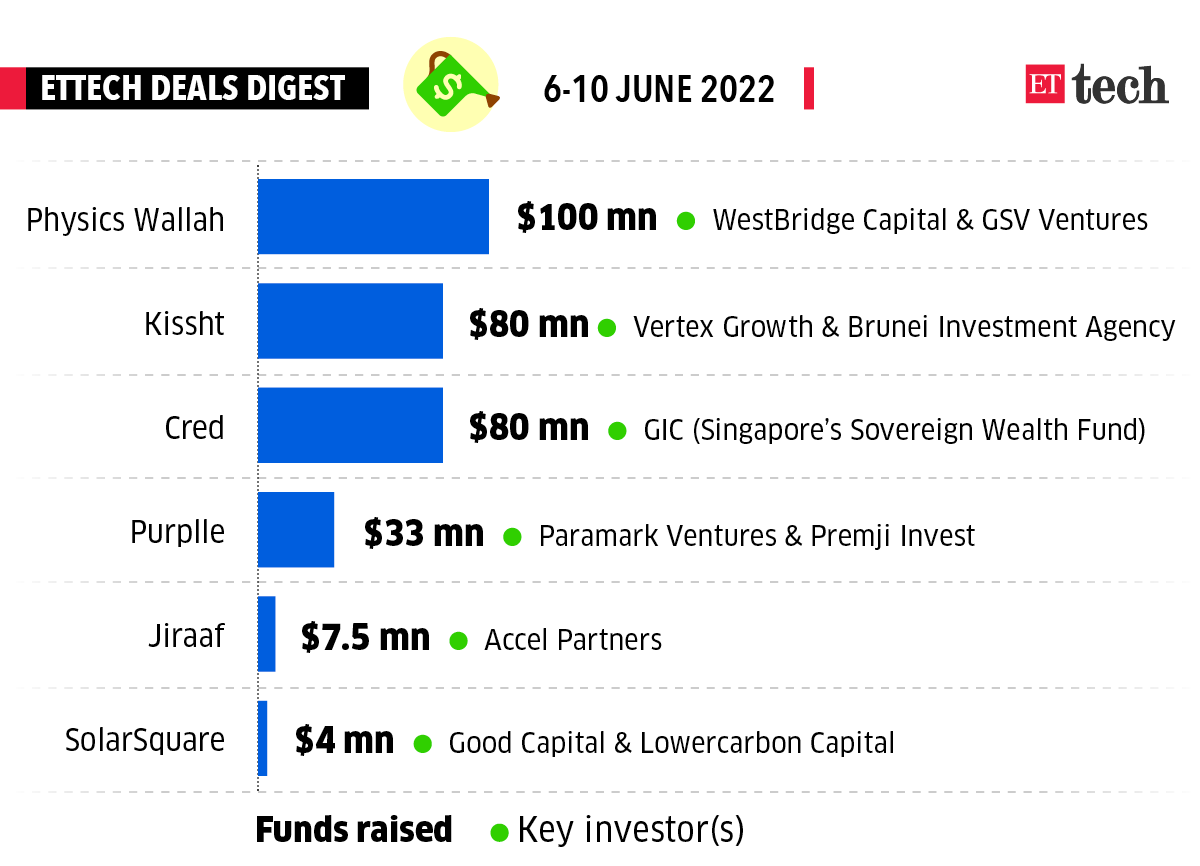

■ Fintech startup Cred has raised Rs 617 crore (about $80 million) in the first tranche of its latest funding round, according to filings with the Ministry of Corporate Affairs. The company told us it was raising $140 million in a mix of primary and secondary funding, which will value it at around $6.4 billion.

■ Online beauty and personal care products retailer Purplle has raised $33 million from Paramark Ventures at a valuation of $1.1 billion.

■ Physics Wallah, a bootstrapped online education startup, has raised $100 million at a valuation of $1.1 billion in its maiden funding round led by WestBridge Capital and GSV Ventures.

■ Digital infrastructure company Equinix said it would invest over $86 million to build its third international business exchange (IBX) data centre in Mumbai. To be named MB3, the first phase is scheduled to open in the second quarter of 2024.

■ Health technology startup Pristyn Care, which recently entered the unicorn club, has acquired Ratan Tata and Tiger Global backed health-tech platform Lybrate for an undisclosed amount.

Ecommerce corner

Flipkart on road to profitability, says Walmart’s Judith McKenna

Walmart International CEO and president Judith McKenna said on Wednesday the US retailer is confident that Flipkart will hit profitability and that the Indian ecommerce major has lived up to expectations ever since it was acquired by Walmart four years ago.

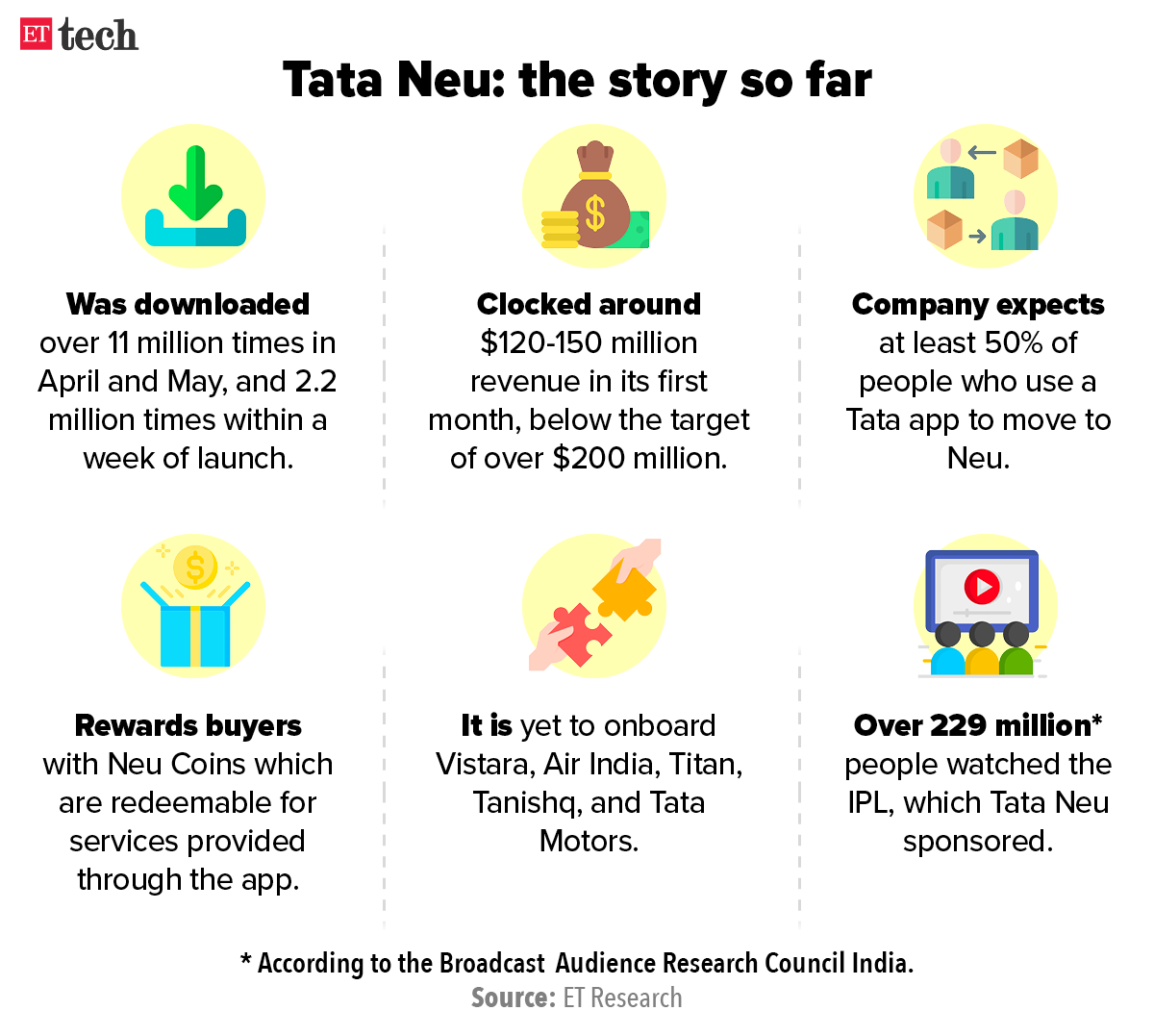

Tata Neu misses first-month sales target: Tata Digital, which launched its super app Tata Neu during the Indian Premier League (IPL), is aiming to clock gross sales of around $2-2.5 billion in the first year, people briefed on the matter said. In its first month of operations since launching the app, Tata Neu has clocked gross sales in the range $120-$150 million, sources said. This is lower than the internal target of $200 million in gross merchandise (GMV) value per month, the people added.

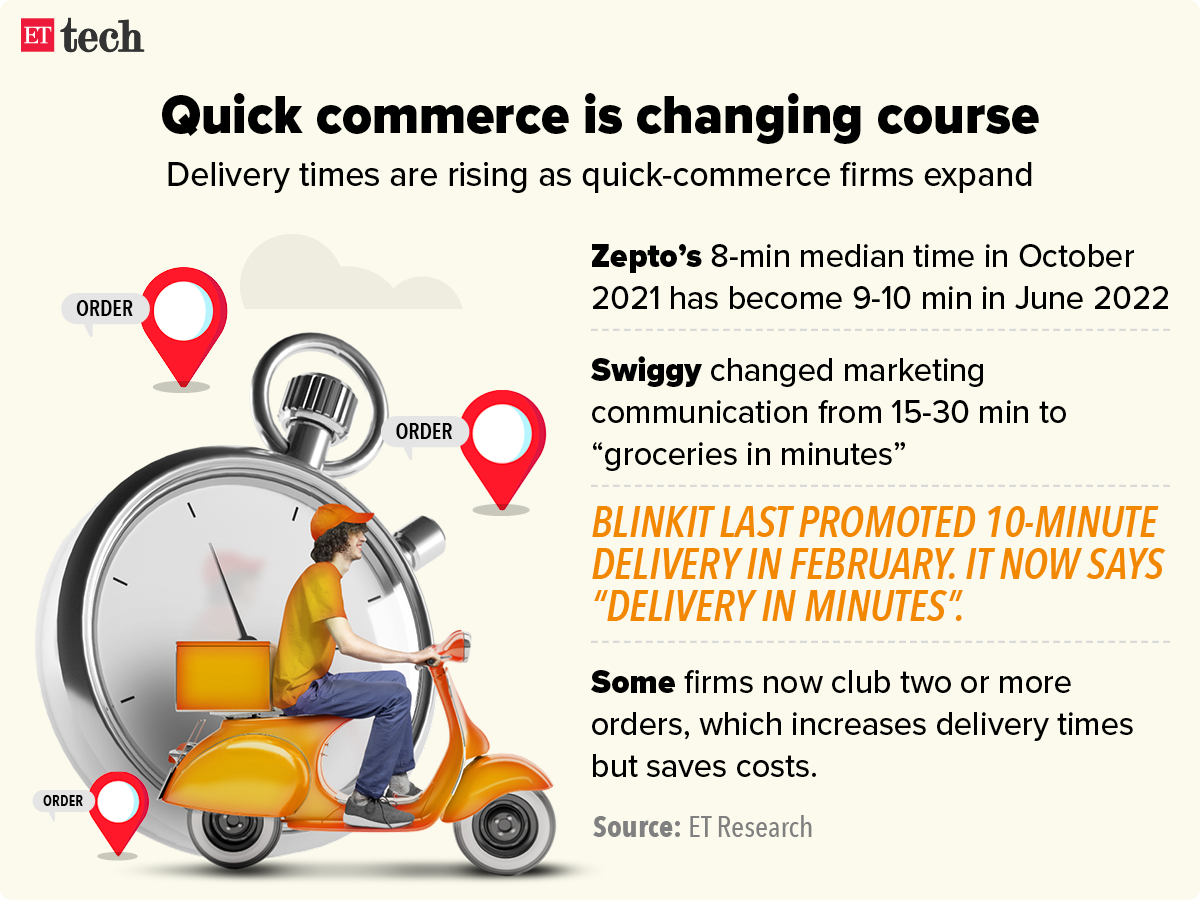

Startups recalibrate approach to 10-min deliveries

It took Blinkit just a few months to shift from its 10-minute delivery credo to “grocery delivery in minutes”. In fact, February was the last time you saw Blinkit (formerly Grofers) promoting 10-minute delivery on social media. The Zomato-backed quick commerce company rebranded itself from Grofers last December and aggressively advertised its pivot to the red-hot ultrafast delivery segment.

IT corner

Staffing firms win big amid record attrition

Companies the world over may be battling unprecedented attrition levels but staffing services providers are directly benefiting from this. Two of India’s largest staffing firms — Quess Corp and Teamlease Services – say their double-digit revenue growth will continue this fiscal year after they posted record numbers in the previous one.

IT firms brace for growth hit: IT-Business Process Management services are expected to show some level of recessionary impact on growth in the near- to mid-term as concerns over inflation and recession grow across the United States and Europe, the largest markets for TCS, Infosys and Wipro.

TCS well-placed for growth, says N Chandrasekaran: Tata Sons chairperson N Chandrasekaran has cautioned against a “stagflationary impulse” in the backdrop of the Russia-Ukraine conflict. Addressing the 27th annual general meeting of TCS, he said the company was well positioned to leverage the demand for digital solutions in this environment.

Ecommerce firms and banks enter the metaverse

The metaverse – a collection of futuristic virtual spaces that combine aspects of digital and physical worlds – is increasingly attracting traditional businesses. The trend is partly driven by FOMO (fear of missing out) on the next big way to engage with audiences. Dedicated metaverses for industries such as ecommerce and banking are coming to life as companies look at virtual environments for engagement and lead generation.

Curated by Judy Franko in New Delhi. Graphics and illustrations by Rahul Awasthi.

That’s all from us this week. Stay safe.