Also in this letter:

■ Key takeaways from Boat’s draft IPO prospectus

■ Ranveer Singh, Jacqueline Fernandez violate influencer rules

■ Zomato down 10% as shares of new-age firms tank again

Got a minute? ETtech’s goal is to bring you the latest news, exclusives and analysis from the thriving technology and startup sector, and we’re always looking to improve. You can help us do so by filling in a short survey here. Thank you!

On Rahul Gandhi’s allegations, Twitter says follower counts can fluctuate

Twitter has said that follower counts on its platform “can and do fluctuate” as it removes millions of accounts each week for violating its policies, platform manipulation or spam. The company was responding to allegations by Congress leader Rahul Gandhi.

Driving the news: Gandhi wrote a letter to newly appointed Twitter CEO Parag Agrawal on December 27, alleging that his follower count had frozen since his account was briefly blocked last August. He alleged that the social media company was working under pressure from the Modi government.

- “I have been reliably, albeit discreetly, informed by people at Twitter India that they are under immense pressure by the government to silence my voice. My account was even blocked for a few days for no legitimate reason. There were many other Twitter handles, including Government ones, which had tweeted similar photos of the same people. None of those accounts were blocked. My account was singularly targeted,” Gandhi wrote to Agarwal.

The numbers: According to a report by the Wall Street Journal, Gandhi’s follower count, currently 19.5 million, has barely increased for several months following the August suspension.

The data, independently verified by the WSJ using two social-media analytics companies, Emplifi and Social Blade, showed that Gandhi gained an average of nearly 400,000 new users a month in the first seven months of 2021.

That plummeted to an average of fewer than 2,500 monthly followers from September to December, WSJ said.

On Friday, his account suddenly gained about 11,000 new followers and since then it has attracted an average of nearly 10,000 more each day—the highest gains since early August, it added.

Twitter’s response: The company said it removes millions of accounts each week for violating its policies on platform manipulation and spam. It said that while some accounts notice a minor difference, in certain cases the number could be higher.

Previous controversy: In August 2021, Twitter temporarily locked Gandhi’s account after he posted a picture of him with the family of a nine-year-old Dalit girl who died after allegedly being raped in Delhi. A message from Twitter read that the tweet had violated its rules.

Govt vs social media: Twitter and other social networking platforms have faced growing scrutiny in India over the past few years. Last year, the company had flagged “the potential threat to freedom of expression” in India and “the use of intimidation tactics by the police” during its clash with the government over the IT Rules, 2021. The statement came after the Delhi Police visited its offices over a row between the Congress and the government.

Key takeaways from Boat’s draft IPO prospectus

Imagine Marketing, the parent company of D2C audio brand Boat, filed its draft red herring prospectus for an initial public offering on Thursday.

The company is looking to hit the capital markets by the first quarter of the next financial year and is expected to seek a valuation of around $1.5-$2 billion in the offering, as we had previously reported. Founded in 2016, the company was last valued at around Rs 2,200 crore when it raised Rs 50 crore from Qualcomm Ventures in April last year.

Here are the key takeaways from the DRHP:

Issue size: The company said it is looking to raise Rs 2,000 crore, including Rs 900 crore by issuing new shares. The remaining Rs 1,100 crore will be raised through an offer for sale, in which existing investors will sell some of their shares.

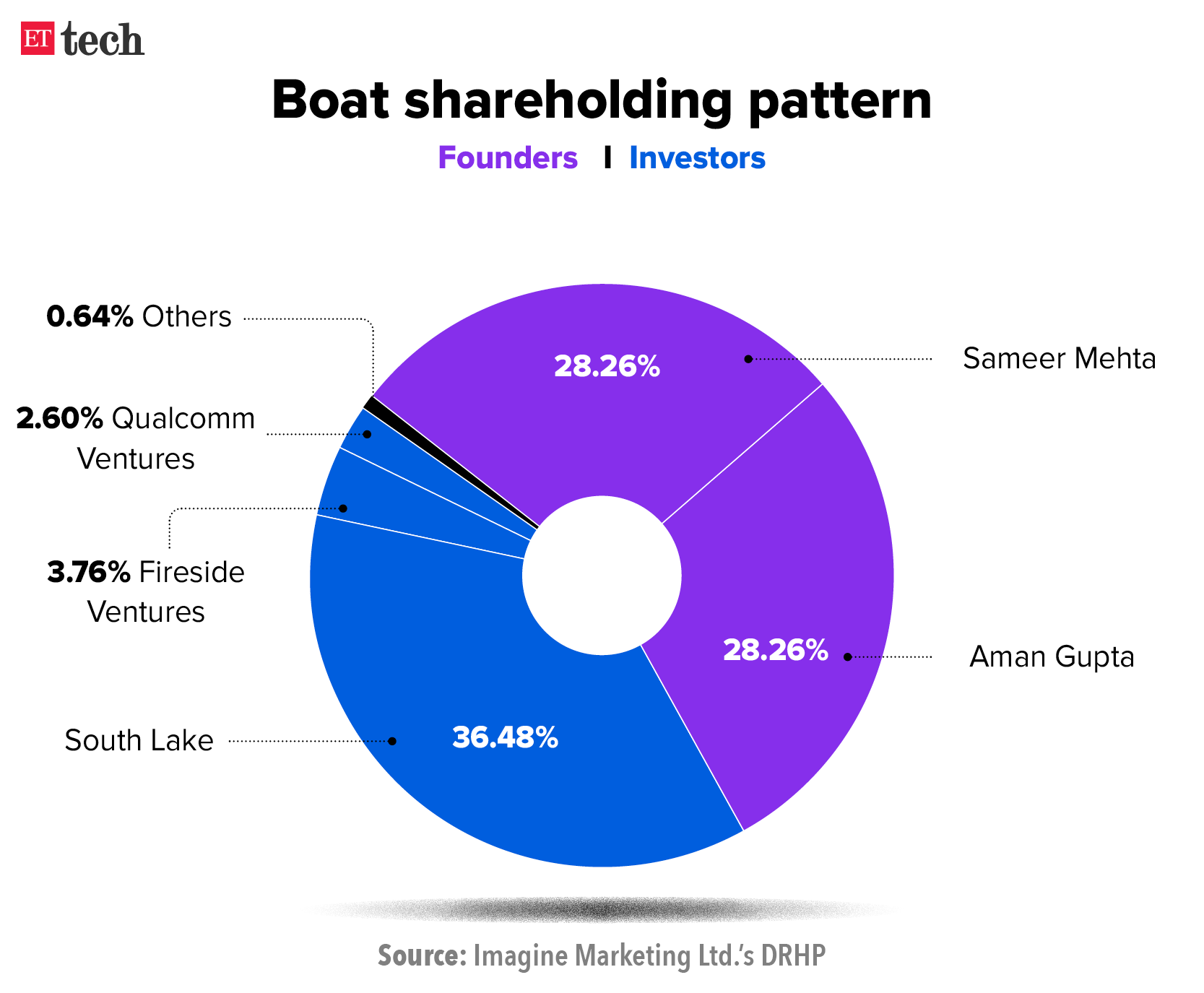

Shareholding: Boat’s founders Aman Gupta and Sameer Mehta have a combined 56% stake in the company. That’s higher than any new-age Indian company that has listed on the domestic stock markets or is looking to do so. Nykaa’s Falguni Nayar is a close second with a 52.56% stake in her company.

Private equity major Warburg Pincus is the single largest shareholder in Boat with around 36% in the company.

Offloading stakes: South Lake Investment, a vehicle of Warburg Pincus, will sell shares worth up to Rs 800 crore in the IPO. Gupta and Mehta are expected to sell a small number of shares.

What will the funds be used for? The company plans to use the IPO proceeds to repay or prepay debt.

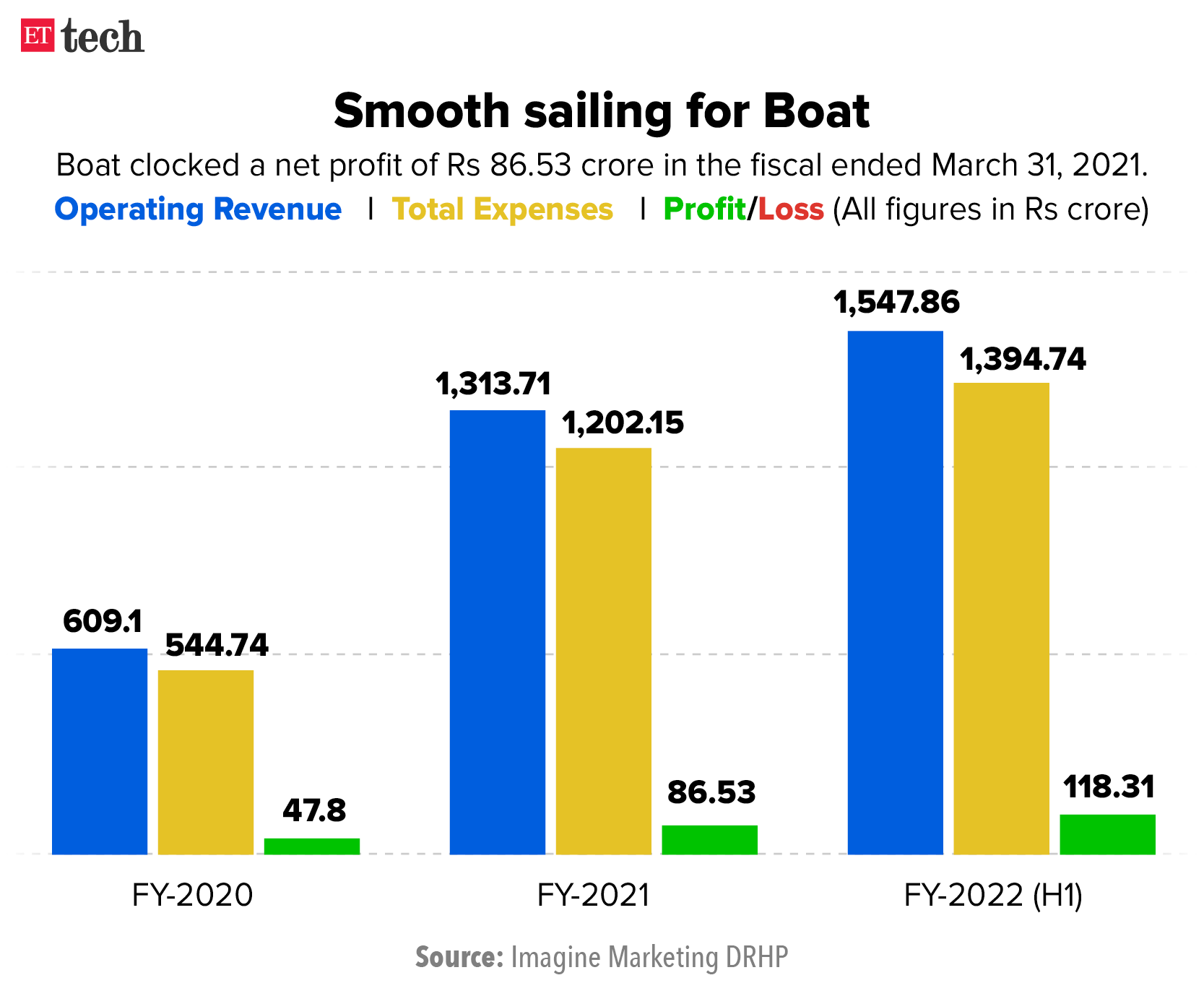

Financials: For the six months ended September 2021, Boat’s operating revenues have surpassed FY21 figures and stand close to Rs 1,550 crore, with net profit surging to Rs 118 crore.

Pre-IPO placement: The company may consider a pre-IPO round. It is in consultation with book running lead managers and is likely to raise upto Rs 180 crore before the offering.

IPO parade continues: By filing for an IPO, Boat joins the growing number of Indian startups looking to tap the public markets. 2021 was a signal year for tech startup IPOs in India, with the likes of Zomato, Nykaa, Paytm, Policybazaar listing on the bourses.

But these companies’ share prices have taken a beating in 2022, thanks in part to a huge sell-off in US tech stocks as investors anticipate interest rate hikes.

Ranveer Singh, Jacqueline Fernandez violate ASCI’s influencer norms

Actors Ranveer Singh and Jacqueline Fernandez are among more than two dozen digital creators who are in breach of the Advertising Standards Council of India’s (ASCI) guidelines for influencer advertising in digital media.

What happened? These celebrities failed to include disclosure labels with their paid posts on the first instance and on subsequent routine checks, ASCI said. They represent brands and businesses including Myntra, Nykaa, Manyavar, Kama Ayurveda.

ASCI said its complaints team contacted the influencers and companies and asked them to follow the guidelines.

Quote: “We hope this signals to the industry that we are serious about consumer protection and pushing the agenda around misleading ads,” said Manisha Kapoor, general secretary, ASCI.

Regulating the space: Last June, ASCI made it mandatory for influencers to label their promotional posts to ensure transparency and safeguard the interests of consumers.

In July-December 2021, about 5,000 posts, stories and feeds from influencers’ handles were screened for complaints, including those from consumers.

Zomato down 10% as shares of new-age companies tank again

Shares of new-age companies fell again as the Sensex and Nifty tanked further on Thursday. The Sensex lost 581.21 points or 1% to end at 57,276.94, while the Nifty declined 167.80 points or 0.97% to close at 17,110.15. The markets – like others across Asia – tanked after Federal Reserve Chair Jerome Powell said the US central bank was ready to raise interest rates in March to tackle the highest inflation in a generation.

Taking stock: Shares of Zomato, Nykaa, Paytm, Policybazaar and Cartrade all ended in the red.

■ Zomato’s stock tanked 9.86% on Thursday to end at Rs 90.50. The counter has slumped in six of the last seven sessions amid heavy sell-off in tech stocks in the US and general aversion of investors to staying invested in loss-making companies. Zomato is now trading 48% down from its all-time high.

■ Nykaa, which opened the day at Rs 1,648.80, dropped 2.42% to Rs 1621.60.

■ PB Fintech, the parent company of PolicyBazaar, ended the day 5.36% lower at Rs 734.60.

■ Paytm’s parent firm One97 Communications dropped to Rs 880 at one point before closing the day at Rs 893.35, down 2.44%.

■ Cartrade closed the day at Rs 674.95, down 6.48%.

Tweet of the day

B Capital appoints Chiratae’s Karan Mohla as partner

Karan Mohla

Facebook co-founder Eduardo Saverin led early-stage fund, B Capital Group, has brought on board a set of new partners and roped in Karan Mohla, a Chiratae Ventures old-timer, to identify early-stage startups in India and Southeast Asia.

Mohla’s appointment at B Capital is aimed to bolster its early-stage deals in India and Southeast Asia. Overall, the fund is also looking to get more aggressive here through its growth stage bets.

Quote: “At present, the idea is to partner with entrepreneurs who are innovating early on in areas which are of core focus to B Capital. The lifecycle to go from seed to a scaled company has also become far shorter, even as the market depth in India has increased in the early-stages,” Mohla said.

New appointments: Along with Mohla who will be joining B Capital as a partner, the firm also announced the appointment of Matt Levinson and Adam Seabrook to bolster its investments across blockchain, fintech and digital healthcare.

The portfolio: B Capital’s portfolio in India includes Byju’s, Meesho, Khatabook and Dailyhunt, among others.

Investment trend: B Capital’s early-stage cheques will typically start with $500,000 and go up to $6 million depending on various factors. Its growth stage deals will continue to be in the range of $20-100 million.

ETtech Done Deals

■ Digital skills assessment platform iMocha has raised $14 million in a funding round led by global investment firm Eight Roads Ventures, with participation from existing investors Upekkha and Better Capital. The company will use the funds to increase its skill library selection, reach more global enterprises, and widen its partnership base within the HR Tech ecosystem.

■ Agritech startup Our Food on Thursday said it has raised $6 million (around Rs 45 crore) in a funding round led by existing investor 3Lines Venture Capital and a new investor, C4D Asia Fund. The company will use the funds to ramp up operations, increase manufacturing capacity and improve India’s agricultural food supply chain.

■ Community-led live learning platform Growth School announced that it has raised $5 million in a funding round led by Sequoia Capital India and Owl Ventures. The company said it plans to use the funds to expand its team and build a robust technology platform.

■ Space technology startup Skyroot Aerospace has raised $4.5 million (about Rs 34 crore) in a bridge round to Series B funding led by Google’s founding board member Ram Shriram’s Sherpalo Ventures. Skyroot plans to use the fund to build the infrastructure required to launch space vehicles. It expects to launch a space vehicle this year.

■ Snacks brand TagZ Foods said it has raised an undisclosed sum from Ashneer Grover of BharatPe and Namita Thapar, executive director of Emcure Pharmaceuticals. The company plans to use the funds to expand its product line and production capacity, and expand to more cities.

Today’s ETtech Top 5 newsletter was curated by Arun Padmanaban in New Delhi and Zaheer Merchant in Mumbai.