He was joking, of course, and thank god for that. Because even as a part-time influencer, the world’s richest person has managed to move markets at least once every month this year. Here’s a recap:

Elon Musk, CEO of Tesla, SpaceX and The Boring Co.

January 27: Shares of US brick-and-mortar video game retailer GameStop surged 50% after Musk tweeted “Gamestonk!!” with a link to Reddit’s now-infamous Wallstreetbets discussion group, where supporters affectionately refer to the Tesla CEO as Papa Musk.

February 4: After a flurry of Musk tweets, including “Dogecoin is the people’s crypto”, “I am become meme, Destroyer of shorts”, and simply “Doge”, the price of the meme-based cryptocurrency surged more than 60%.

March 24: Musk tweeted that consumers could buy Tesla cars with Bitcoin. The price of the cryptocurrency surged to new highs following the announcement, hitting $44,200.

April 28: Musk simply tweeted: “The Dogefather SNL May 8”, ahead of his appearance on The US comedy sketch show Saturday Night Live the following week. That tweet, and one from fellow billionaire Mark Cuban, caused the price of Dogecoin to jump 20% in 24 hours.

May 13: Cryptocurrencies tumbled after Musk tweeted Tesla would no longer accept Bitcoin as payment, and “Energy usage trend over past few months is insane.” That tweet caused the price of Bitcoin to plummet around 15%.

June 13: Cryptocurrency and blockchain-related firms surged when Musk tweeted “When there’s confirmation of reasonable (~50%) clean energy usage by miners with a positive future trend, Tesla will resume allowing Bitcoin transactions.”

July 21: It wasn’t from a tweet, but the price of Ether rose as much as 12% during the day after Musk said at a conference that he owns the cryptocurrency. A few days later he posted this meme.

August: In the second half of the year, Musk took a whole month off from toying with the prices of cryptocurrencies to launch some rockets. Priorities, eh?

September 13: Musk tweeted a picture of a new Shiba Inu puppy sleeping on the floor with the words ‘Floki has arrived’. This sparked a frenzy in floki-themed cryptocurrencies. The crypto Floki surged 250% after Musk’s tweet, while Floki Inu rose 60% and Floki Shiba jumped 25%.

October 14: Musk tweeted that he was in talks with airlines about installing Starlink, a satellite-based broadband service owned by his company SpaceX. Shares of in-flight internet provider Gogo Inc. fell as much as 5%.

November: In one of his strangest tweets yet—and it’s a high bar—Musk asked his followers if he should sell 10% of his Tesla stock, adding, “I will abide by the results of this poll, whichever way it goes.” After almost 58% of 3.5 million Twitter users voted yes, Tesla shares saw their biggest fall in eight months.

December 14: Musk tweeted on Tuesday that Tesla would accept Dogecoin as payment for merchandise on a test basis, sending the meme-based cryptocurrency up more than 20%. Dogecoin, which was created as a joke in 2013, has seen its price increase by a staggering 5,859% over the past one year, according to data from Coinbase, largely fueled by Musk’s tweets.

BIG STORIES BY OUR REPORTERS

Flipkart CEO outlines 2022 IPO plans

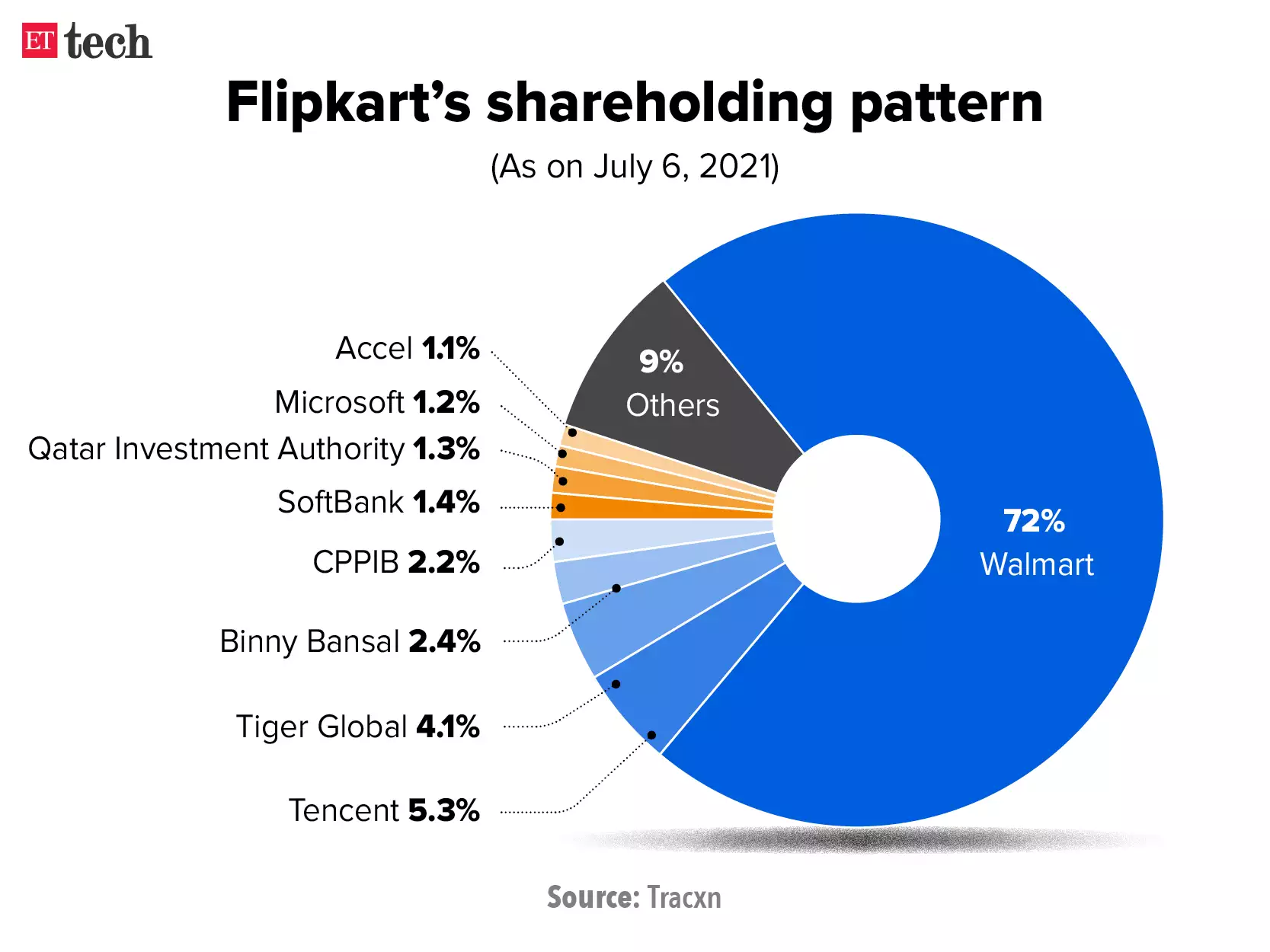

Walmart Inc.-owned Flipkart has begun discussions for an initial public offering likely before the end of next year.

Driving the news: Flipkart Group CEO Kalyan Krishnamurthy told a select group of key executives at an offsite earlier this week that the company was looking at an IPO outside India around November-December 2022, sources told us. A US listing may get stretched to March 2023, depending on market conditions and other external factors, they said.

The Walmart-owned firm is considering raising a pre-IPO round in the next quarter or so, to benchmark its valuation before the offering. Flipkart was last valued at $37.6 billion in July, after raising $3.6 billion from the Canada Pension Plan Investment Board and others.

Related developments: The ecommerce major has started offering groceries as a category on its five-month-old social commerce platform Shopsy.

- Groceries on Shopsy will be available across 700 cities, spanning over 5,800 pin codes. It will have 6,000 products across 230 categories such as staples, fast-moving consumer goods, and other dry groceries, matching the selection and range available on Flipkart Grocery.

CEO Krishnamurthy sees the grocery business as key to Flipkart’s IPO plans. Towards that endeavour, the company and its parent Walmart invested $145 million in Ninjacart, a supply chain company for fresh produce, in what it claimed was the biggest deal in India’s agritech space.

- This is the third time Flipkart is investing in Ninjacart. It first invested an undisclosed amount in the Bengaluru-based startup in 2019 and then put around $30 million more in it late last year with Walmart.

The deal comes amid Flipkart’s plans to scale its 90-minute online grocery business, Flipkart Quick, to 200 cities by the end of 2022. The Ninjacart investment will also be leveraged by Flipkart to strengthen its wider grocery offering Supermart.

CCI suspends Amazon’s Future Coupons deal

The Competition Commission of India (CCI) has suspended Amazon’s 2019 deal with Future Group after reviewing allegations that the company had concealed information while seeking regulatory approval. The antitrust regulator has also fined Amazon Rs 200 crore.

Context: The CCI order was based on an application filed in March by Future Group subsidiary Future Coupons Pvt. Ltd., which accused Amazon of concealing facts and flouting India’s foreign direct investment and exchange laws while seeking the watchdog’s approval in 2019 for its investment into Future Coupons.

- The CCI’s unprecedented step could have far-reaching consequences for Amazon’s legal battles with Future Group. For months, Amazon successfully used the terms of its $200 million investment in Future Coupons in 2019 to block the company’s attempt to sell its retail assets to Reliance Industries for $3.4 billion.

Also Read: Amazon, Reliance and the fight for Future

Tatas courts Microsoft for digital dream

Tata Group Chairman N Chandrasekaran

Tata Group has held talks with Microsoft Corp. to come on board as an anchor investor in its new digital platform, sources said. They added that the Indian conglomerate is keen to rope in one or two strategic investors and launch a full-blown fundraising drive.

Tata Sons Chairman N Chandrasekaran is determined to modernise the group’s diverse consumer businesses by combining digital assets under a new entity to take on behemoths such as Amazon.com Inc. and Reliance Industries in ecommerce.

- Chandrasekaran is keen to replicate Reliance Jio’s playbook, which saw it raise Rs 1.45 lakh crore ($20 billion) from investors including Facebook and Google last year.

Super app delayed: Tata Neu, the long-awaited super app of the coffee-to-cars conglomerate, is now likely to be launched in March 2022.

- The app was originally supposed to go live in early 2021 but the launch was later postponed to the second half. Now it has been pushed to complete integration of group entities such as 1mg or Tata Cliq onto a single platform and iron out any issues.

Tata Neu will act as an ecommerce gateway for its consumer products and services, from appliances to groceries and medicines to resorts and jewellery.

ETtech DEALS DIGEST

- Mohalla Tech, the parent company of Moj and ShareChat, has raised $266 million in a Series G funding round led by Alkeon Capital, at a valuation of $3.7 billion.

- Innovaccer, a healthcare software-as-a-service (SaaS) firm, has raised $150 million in new funding, after which its valuation has more than doubled to $3.2 billion.

- Juspay has raised $60 million in a funding round led by SoftBank Vision Fund II, in what is the Japanese firm’s first fintech investment in India after Paytm.

Also Read: Risk investors put a record $6.8 billion into Indian startups in November

India’s super-rich win big on domestic startup bets

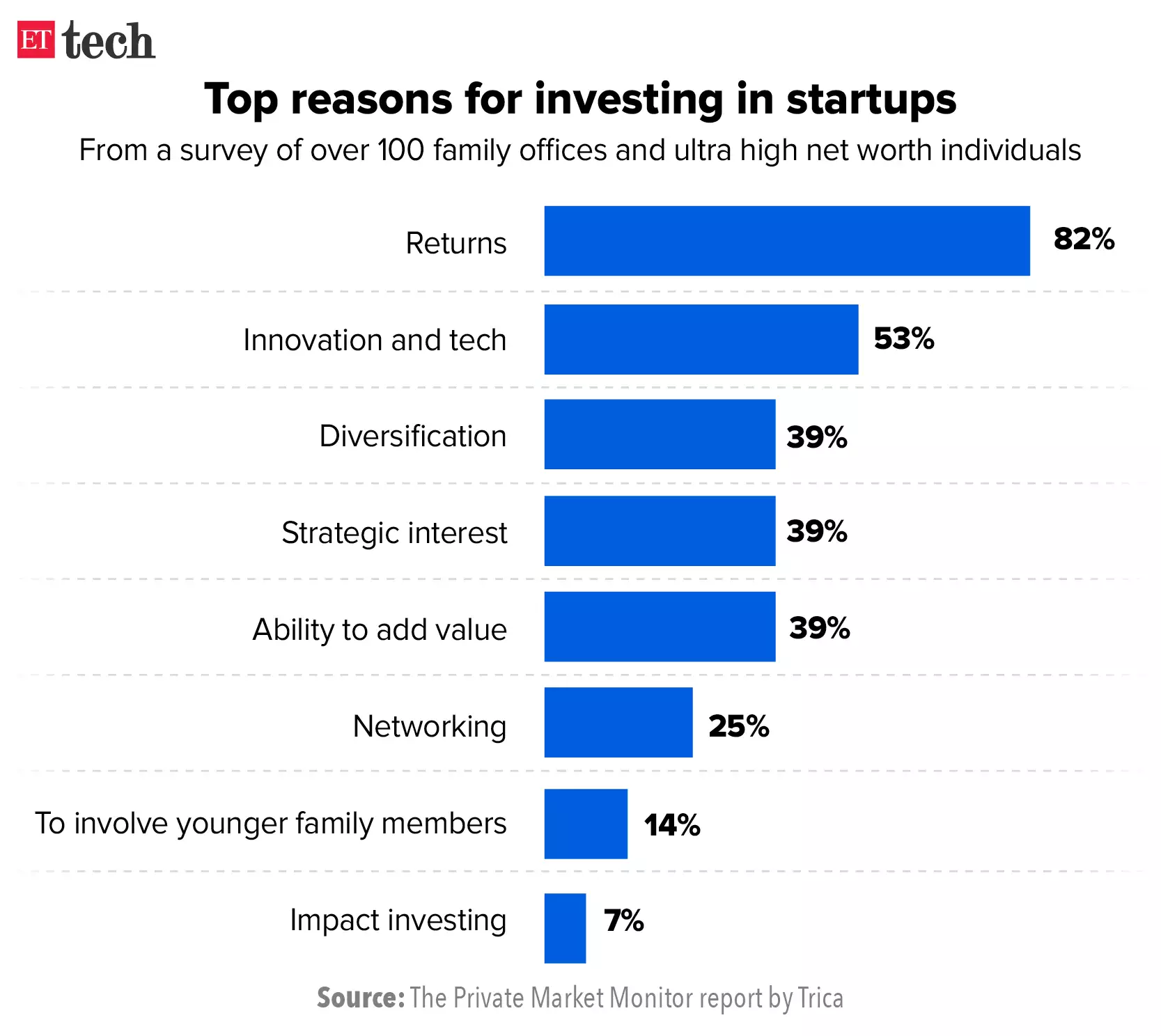

Family offices and high net-worth individuals in India have clocked huge gains this year. With their aggressive bets on new-age Indian startups like Nykaa and Zomato that have paid off handsomely.

- A survey of 100 family offices and ultra HNIs — those whose net worth exceeds Rs 500 crore — found that more than 40% had doubled their allocation to private markets in the past five years.

Indian startups have raised a record $31.9 billion as of December 10, according to Venture Intelligence data. About 10% of this has been domestic capital, comprising Indian funds, family offices and UHNIs, and angel investors, said Nimesh Kampani, cofounder and chief executive officer of Trica which conducted the survey.

Grofers goes beyond groceries with Blinkit rebrand

Blinkit cofounder Albinder Dhindsa

Grofers, which four months ago pivoted to the quick commerce model, is moving beyond just groceries.

- The company, backed by SoftBank and Zomato, has rebranded itself as Blinkit. That’s because it’s looking to reposition itself as a quick-commerce platform that delivers anything a consumer might need urgently in 10 minutes—a phone charger, stationery, medicines and more—its founder Albinder Dhindsa told us.

“The rebranding is an attempt to position ourselves as not just grocery but [one that delivers] anything you need in 10 minutes,” Dhindsa said.

Byju’s in talks to go public through SPAC route

Byju’s founder Byju Raveendran

Byju’s is considering a public market listing in the US through a special purpose acquisition company (SPAC), sources with knowledge of the company’s plans said.

- It is also evaluating a domestic listing in the second half of 2022 and is in talks with bankers, sources said.

“Michael Klein’s Churchill Capital has made an offer of investing $4 billion at a valuation of more than $48 billion,” the source said. “Since a large part of the business is in the US, a listing in the market is being considered,” the person added.

From The Crypto World

In favour of total crypto ban, RBI tells its central board: The Reserve Bank of India (RBI) made a detailed presentation to its central board highlighting “serious concerns” relating to macroeconomic and financial stability as well as exchange management. It also highlighted the challenge of regulating intangible assets that originate overseas. (read more)

Crypto Bill may not be introduced in winter session: The government is considering changes to the proposed cryptocurrency framework, a senior government official said. This means that it may not be introduced in the winter session of Parliament as planned. (read more)

Crypto exchanges set for consolidation amid regulatory flux: Crypto exchanges are set to see consolidation amidst concerns and confusion over government attempts to regulate crypto assets. Some exchanges have begun exploratory talks with other Indian exchanges and foreign players. (read more)

DeFi firms ask government for clarity on crypto bill: Decentralised Finance (DeFi) companies have reached out to the finance ministry for details on the proposed crypto regulations, seeking clarity on how the government would manage and streamline blockchain operations. (read more)

Amid volatility, Indian crypto investors find refuge in stablecoins: Indian crypto investors are turning to stablecoins that are pegged to fiat currencies like US dollar as a hedge against rising volatility in Bitcoin and other tokens, even as the Indian government moves to regulate or ban crypto assets. (read more)

Ola delivers first 100 scooters without some promised features

Ola Electric has delivered the first 100 Ola S1 scooters to customers in Bengaluru and Chennai, without some promised features.

- Customers, who took deliveries of their Ola scooters at an event organised at the firm’s headquarters in Bengaluru, said that several features—including the mobile app, hill hold, cruise control, voice commands and Bluetooth—were yet to be enabled.

- Varun Dubey, chief marketing officer of Ola Electric, told ET that the company had already announced that certain features could only be enabled through over the air updates.

Ola Electric has been under pressure from customers for delay in delivery of scooters, which the company promised would begin in October.

Lenskart eyes $250 million fundraising at $5 billion valuation

Lenskart founder Peyush Bansal

Softbank-backed unicorn Lenskart is on the verge of closing a $250 million funding round at $5 billion valuation within five months of raising $315 million at $2.5 billion, according to people close to the deal.

- The valuation is close to the market capitalisation of recently listed Warby Parker, an American online retailer of prescription glasses and sunglasses.

This is not a pre-initial public offer round as has been the case with other unicorns in the past few months, sources said. The company’s management feels it would like to scale up globally before deciding on a market listing in the next two-three years.

UpGrad eyeing IPO in next 24 months, says cofounder

UpGrad cofounder Ronnie Screwvala

UpGrad Education, which entered the unicorn club earlier this year, is looking at an IPO over the next 18-24 months, according to the edtech startup’s cofounder.

- The firm has so far raised $185 million from investors, the lowest among major peers.

“You don’t need billions of dollars to create a category-defining business like ours,” upGrad cofounder Ronnie Screwvala said. “For me personally, having been on both sides, of being an acquirer and a company that was acquired, I have come to realise ROCE (return on capital employed) is all that matters.”

“We might look to raise one or two more rounds before we go for an IPO,” he said.

IndiaTech urges govt to frame online gaming rules

IndiaTech, an industry association for technology startups, has urged the government to frame guidelines for the online gaming sector based on age and genre-based classifications.

- The industry association, whose members include leading online gaming companies such as Dream11 and Mobile Premier League, has written to Union Minister of Electronics and Information Technology Ashwini Vaishnaw to include “age-restricted content” and set standards similar to the Entertainment Software Rating Board.

“People from the civil society feel that online gaming is addictive and leads to behavioural issues besides causing financial stress,” said Rameesh Kailasam, president and CEO of IndiaTech. “Before the governments and lawmakers jump into any form of conclusion, we wanted to present guiding principles and means to regulate the industry and for government and industry to jointly work towards a Code for Responsible Online Gaming.”

That’s all from us this week. Stay safe and get that jab.