Also in this letter:

■ Ecomm continues to grow even as offline stores reopen

■ Indian IT firms strive to crack the exit code

■ Third Wave Coffee brews new funding deal

Delivery firms refuse to roll back rate hikes for logistics aggregators

The battle between large logistics companies and online logistics aggregators has intensified.

What’s going on? Last month we reported ecommerce-focussed logistics players Delhivery, Ecom Express and Xpressbees simultaneously increased shipment prices for the aggregators by as much as 35-40%. They did so after learning that the aggregators were trying to woo some of their clients away with cheaper rates.

Cold shoulder: Now, some of the aggregators have asked the companies to reconsider their decision and at least partially roll back the hikes, but the logistics companies aren’t willing to entertain these requests.

One of the companies, Xpressbees, even told some of its clients over email that it wouldn’t pick up new orders unless the aggregator formally agreed to the new pricing.

IPO-bound Delhivery and Ecom Express are also sticking to their hikes, albeit after giving a grace period to some of the aggregators last month.

An executive at one of the aggregators said. “I think some of the bigger aggregators going super-aggressive on pricing and approaching original clients of logistics firms has irked these companies, and thus there doesn’t seem to be much scope for negotiation.”

Customers face the brunt: Sources told us that this has now forced aggregators to increase prices for their customers. They are not imposing a uniform hike, though. The changes in pricing differ from client to client as they don’t want to lose a large chunk of order volumes at one go. Some of these companies are in the middle of fundraising talks, sources told us.

Jargon buster: Logistics aggregators like Shiprocket and Pickrr don’t own warehouses or build their own delivery infrastructure. They aggregate orders and take them to companies like Delhivery, Ecom Express and others, which have their own infrastructure and deal directly with enterprise clients with large shipment volumes.

Ecommerce continues to grow even as offline stores and markets reopen

People are continuing to buy online even though footfalls and sales at offline markets and large retail stores have returned to pre-Covid levels, according to the latest financial data from many top companies.

Story in numbers: The surge in ecommerce contribution is across categories – from daily necessities, apparel and shoes to televisions, refrigerators and mobile phones.

- Reliance Retail reported a 17% contribution from ecommerce sales to consumers and to smaller shops for orders booked digitally, as compared to 10% a year ago. For Tata-owned Trent Ltd this increased to 7% from 5% in FY21.

- Hindustan Unilever said in its earnings release that in the March quarter, digitised sales across platforms including ecommerce channels and internal ordering app Shikhar comprised more than 20% of overall sales.

- For Dabur, online sales have gone up by 1.5% to 6.5% in the last fiscal over the previous year.

- For Tata Consumer Products, the contribution of ecommerce channels went up from 2.5% in FY20 to 5.2% in FY21, and further increased to 7.3% last fiscal.

Covid boost: The sale of consumer goods online skyrocketed after the onset of the pandemic in 2020. However, the rate of growth dropped a bit in 2021-22 owing to a higher base, easing of restrictions and a dip in Covid infections in phases. Still, the contribution of online channels continued to go up.

Future’s online: Dabur India CEO Mohit Malhotra said in urban markets, ecommerce will be a key driver of growth in the future. “In the post-Covid world, ecommerce has emerged as the most preferred contactless method of making purchases,” he said. The company is aiming to triple the contribution of ecommerce to its sales to 19-20% in the next four years.

Indian IT firms strive to crack the exit code

Rising attrition is having a domino effect on the IT industry. It has already led to lower operating margins and stock prices, and piled pressure on the top IT service providers to hire more freshers and expand into tier II cities and beyond.

In fact, the mention of ‘attrition’ and ‘talent’ has doubled over the past year in the earnings transcripts of top IT firms, according to an informal analysis by ET.

Tata Consultancy Services (TCS), Infosys, HCL Technologies and Wipro reported record-high attrition levels in the fourth quarter of the previous financial year (FY22), compared to high single-digit and mid-teen levels in the same period of FY21.

While TCS reported an attrition rate of 17.4%, it was 27.7% for Infosys, 21.9% for HCL Tech and 23.8% for Wipro in the three-month period ended March 31.

This scenario is expected to last through the ongoing fiscal (FY23).

TWEET OF THE DAY

Third Wave Coffee brews new funding deal with WestBridge Capital

Third Wave Coffee, a Bengaluru-based coffee chain that’s popular with the city’s startup community, is in advanced talks to raise its first institutional funding of around $20-25 million led by WestBridge Capital, sources told us.

The round also includes a secondary share sale in which some of its early individual investors will exit. Once the deal is closed, the startup is expected to be valued at $80-100 million, people briefed on the matter said.

Started in 2017 by Sushant Goel, Ayush Bathwal and Anirudh Sharma, Third Wave has around 40-50 outlets across India’s top five cities, including Delhi-NCR and Bengaluru. Its monthly revenue is around Rs 7-8 crore, sources said. It also sells a range of coffee powders under the same brand.

The company will use the new capital to double down on post-pandemic expansion across Mumbai, Delhi and other cities.

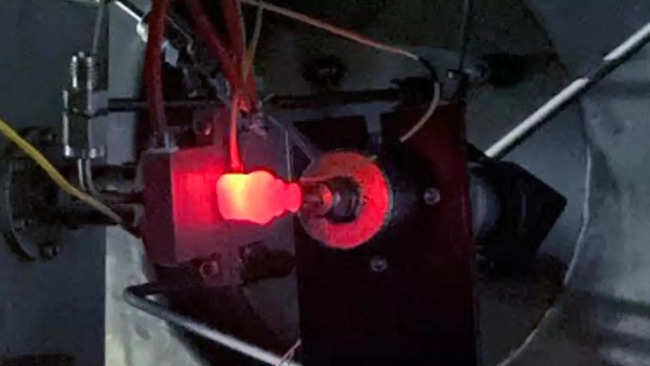

Bengaluru space startup readies green fuel that could be 20% more efficient

Bengaluru-based Bellatrix Aerospace has tested an eco-friendly propulsion system for satellites that cuts a new path from the hydrazine-dependent fuel systems and offers a potential 20% jump in fuel efficiency for space satellites, co-founder Yashas Karanam told us.

Satellite thrusters run on a toxic compound called hydrazine, which is known to have a severe environmental impact. This has pushed space researchers to search for more eco-friendly alternatives. Bellatrix’s recent testing of its green propulsion system also marks a key inflection point in the startup’s journey in building a space taxi system for satellites.

Bellatrix is among a clutch of space tech startups in India that have taken venture capital. The IISc-founded startup raised funds in June 2019 in a round led by IDFC Parampara.

Other Top Stories By Our Reporters

Concerns over cybersecurity rules: Industry and cybersecurity experts have expressed concerns regarding the new cybersecurity guidelines issued by CERT-In on April 28. Under the new rules, enterprises must report any cybersecurity incident to CERT-In in six hours and store all data for a stipulated period of time. But security experts said it is often days or even months before enterprises realise they have been compromised.

Employee-focused policies take centrestage at startups: In a post-Covid world, where employees are demanding better work-life balance, more flexibility, and a more inclusive work culture, startups such as Wakefit, Dream11, The Good Glamm Group, BeatO and Zepto have announced initiatives to keep employees happy and attract the right talent.

Tech will drive new opportunities for BPM, says Nasscom: Solutions across artificial intelligence, web3, the metaverse and analytics will drive new opportunities for India’s $44-billion business process management (BPM) industry, sector leaders said at a Nasscom roundtable recently.

Global Picks We Are Reading

■ The tech industry’s epic two-year run sputters (WSJ)

■ Why Elon Musk’s ambition to have Twitter “authenticate all real humans” will get people killed (Rest Of World)

■ California governor signs executive order shaping cryptocurrency regulation in the state (The Verge)

Today’s ETtech Morning Dispatch was curated by Zaheer Merchant in Mumbai and Judy Franko in New Delhi. Graphics and illustrations by Rahul Awasthi.