Also in this letter:

■ Volumes on crypto trading platforms decline as new tax norms set in

■ Paytm Payments Bank yet to appoint firm for IT audit: MoS finance

■ Elon Musk discloses 9.2% stake in Twitter

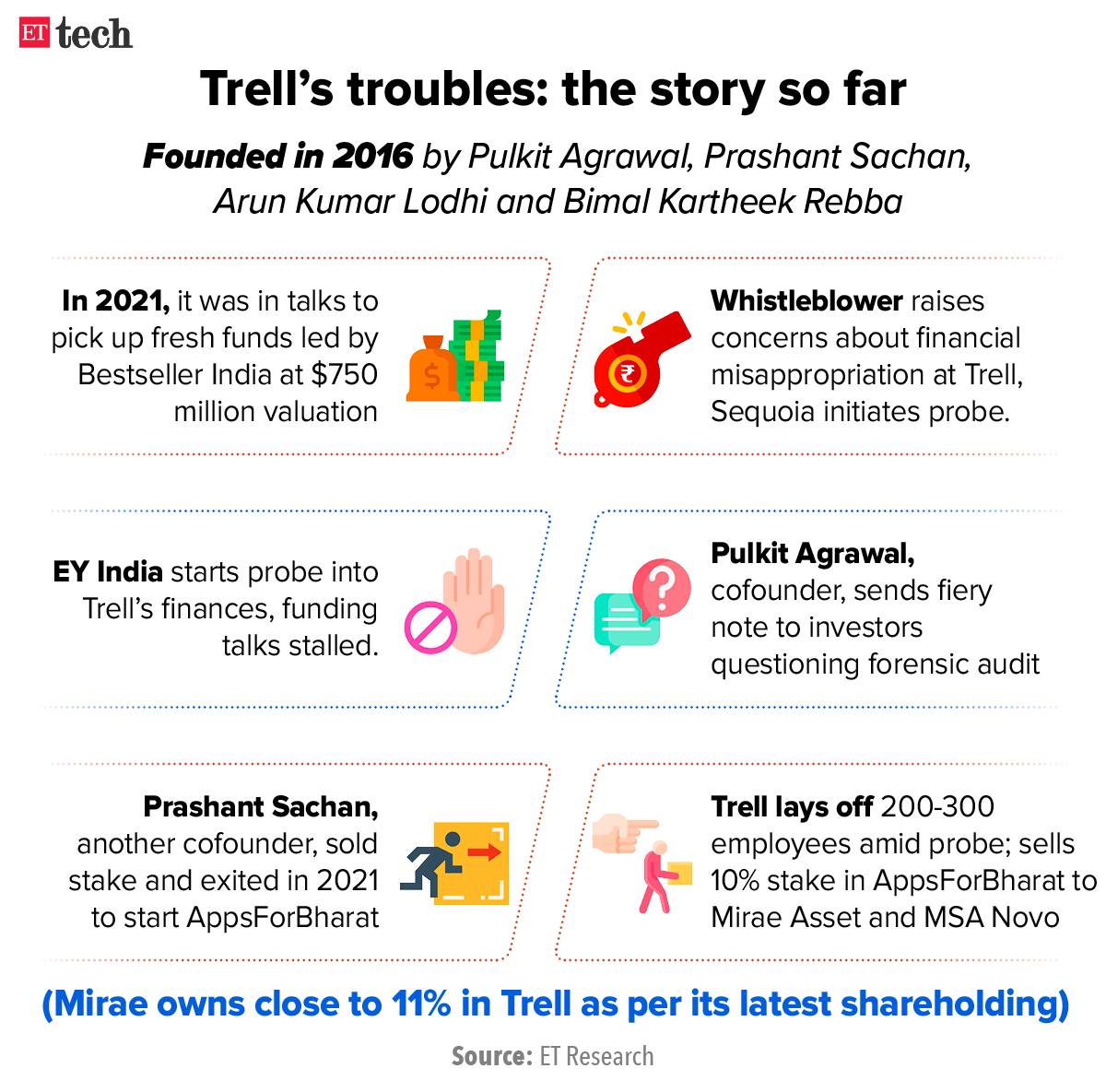

Investors buy Trell’s stake in AppsForBharat for $7 million

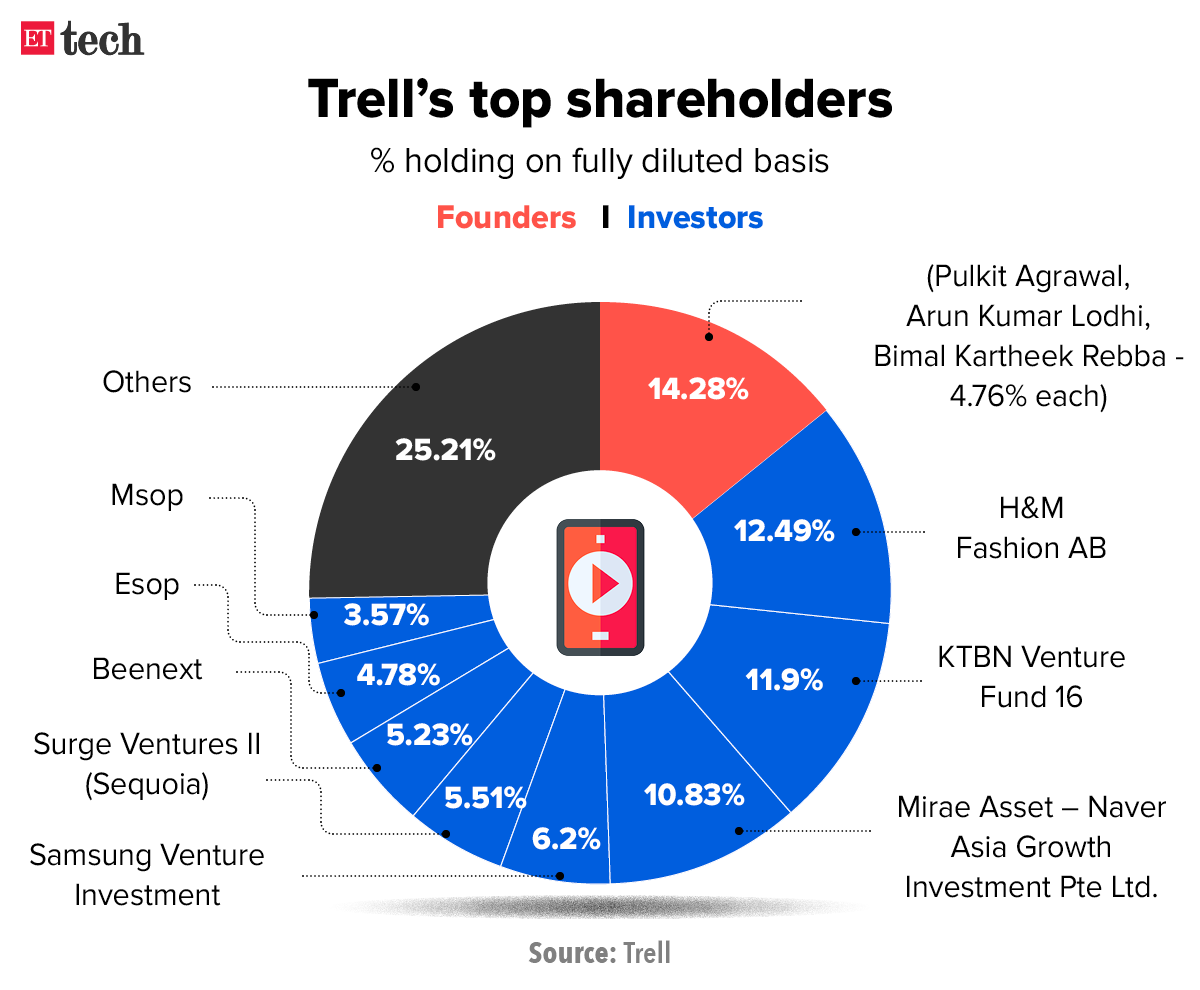

Influencer-led social commerce app Trell, which has been under a probe for financial irregularities, has sold about 10% stake it held in AppsForBharat to one of its existing investors Mirae Asset, multiple sources briefed on the matter said. The secondary transaction also saw Middle-East-based MSA Novo buy shares from Trell, a person in the know said.

- Mirae owns close to 11% in Trell as per its latest shareholding

- Sequoia Capital is a common investor in Trell and AppsForBharat

Deal details: The transaction amounting to $9-10 million is an effort by the company to keep itself afloat even as the startup has laid off around 200-300 of its employees, said another person privy to the matter. “This will be used as a lifeline for the company to come clean… it is enough cash to survive the next 12 months..”, said one of the sources quoted above.

Troubled times: A forensic team from EY India has been looking into alleged related-party transactions by Trell, incorrect reporting of business numbers, and other financial irregularities.

AppsForBharat, a product studio for spiritual and devotional content, was founded by Prashant Sachan, one of the Trell founders. Sachan left Trell and sold his entire stake last year, as ET first reported on March 21.

Details: Sachan said he first diluted the majority of his equity in Trell by transferring it to the management stock options plan (Msop) in December 2020. He later sold his remaining stake, about 1.5%, to LogX Venture Partners and LetsVenture syndicate in October 2021.

Trell had received a 17% stake in AppsForBharat for Rs 85,000 because Sachan started working on it while at Trell. It later diluted its holding to about 10% as AppsForBharat closed two funding rounds of about $14 million from Elevation Capital, Sequoia Capital India, Beenext, and Matrix Partners India.

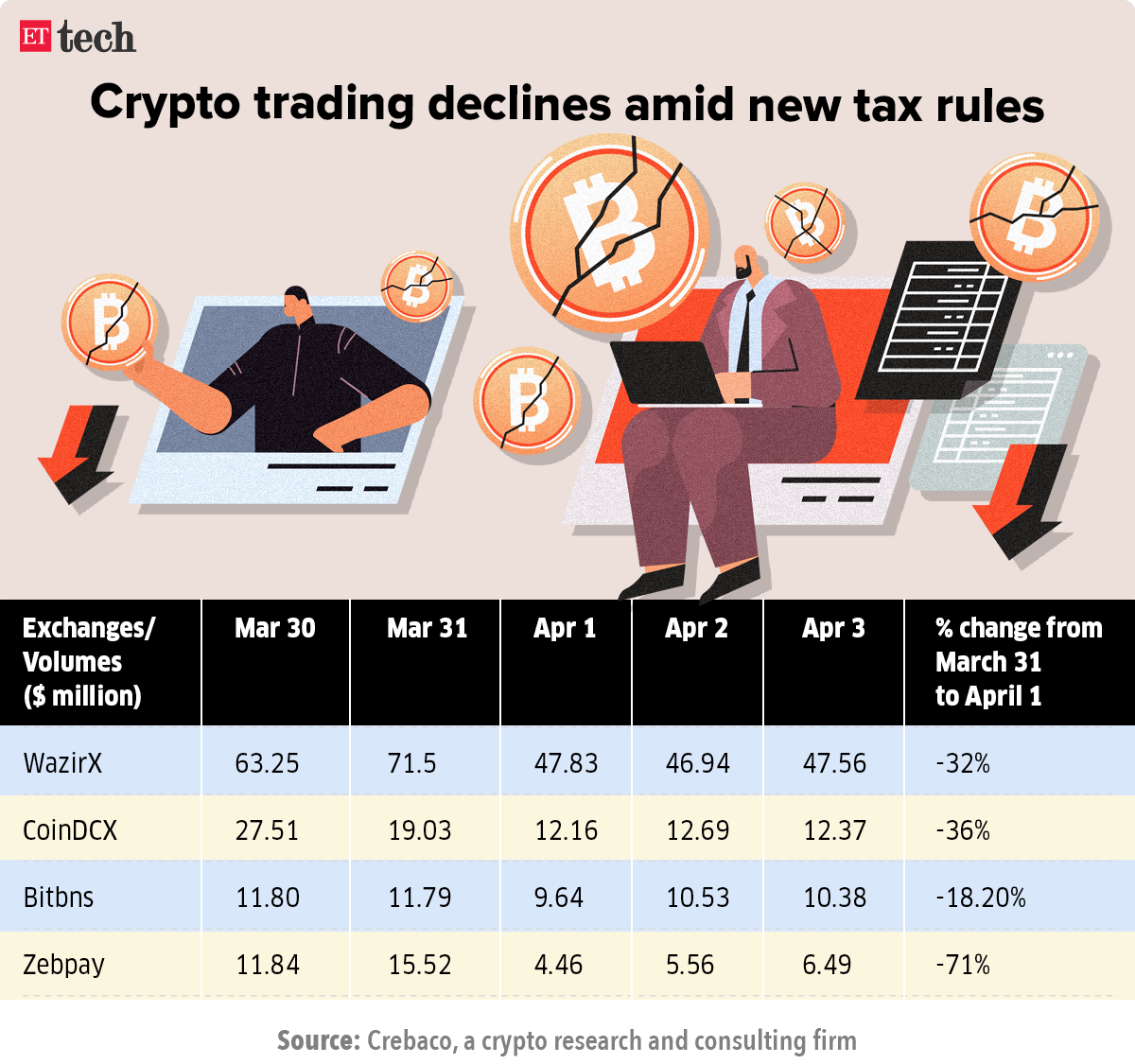

Volumes on crypto trading platforms decline as new tax norms come into effect

After the new rules to tax digital assets were implemented on April 1, crypto trading volumes in India have plunged.

Trading volumes on cryptocurrency exchanges have declined by 30-70% after hitting a monthly peak on March 31. We reported on April 1 that up to 50% of volumes from crypto platforms will evaporate once the new tax norms are fully in force.

Yes, but why? Volumes across top crypto trading platforms surged on the last day of the financial year as traders squared off their positions before a new tax regime governing virtual digital assets (VDAs) came into effect on April 1.

On April 3, volumes at these trading platforms were down 30-50% compared to March 31, according to data compiled by secondary research firm Crebaco, but were steady compared to April 2.

Also Read: Crypto investor profile changes as tax regulations kick in

Taxing issues: The new laws tax crypto revenue at a single rate of 30% and do not enable losses to be offset against gains. A tax deducted at source (TDS) of 1% will also come into effect from July, which is when crypto platforms are expecting a major hit, as intraday traders account for a bulk of daily volumes.

Quote: “The trading volume was the highest on 31st March as users/ investors squared off their positions before the start of the new financial year. Starting April 1 there has been a decline, which is a usual trend at the start of every Financial year, however, this year we are seeing a sharper decline due to the stringent tax laws,” said Minal Thukral, senior vice president, growth and strategy, CoinDCX.

Tweet of the day

Paytm Payments Bank yet to appoint firm for IT audit: MoS finance to Lok Sabha

Minister of state for finance Bhagwat Karad told the Lok Sabha today that the Paytm Payments Bank is yet to appoint a firm to conduct an audit of its information technology (IT) systems.

Karad to the Parliament: “The RBI (Reserve Bank of India) has further informed that the Paytm Payments Bank Limited has not yet appointed the IT audit firm to conduct a comprehensive System Audit of the IT system of the bank.”

Catch up quick: Paytm Payments Bank has been directed to appoint an IT audit firm to conduct a comprehensive audit of its IT systems.

Earlier in March, ET reported that the central bank would set the terms of reference for an independent technology audit of Paytm Payments Bank. This was a follow-up action after the regulator banned the onboarding of new customers for alleged violations of customer acquisition and privacy rules that may have included possible data flow to companies of Chinese origin.

Not the first time: This is the second time that Paytm is facing a regulatory ban. In June 2018, RBI had made certain observations about the processes the company followed to acquire new users, especially in relation to know-your-customer (KYC) norms. RBI’s reply to the RTI (Right to Information) question also mentioned that Paytm failed to maintain the end-of-the-day balance limit of Rs 100,000 per account.

ETtech Done Deals

■ Bengaluru-based agritech startup Agrizy on Monday said it has raised $4 million in a funding round led by Ankur Capital. The round also saw participation from Omnivore and angels such as Rajesh Yabaji (CEO, BlackBuck), Zetwerk’s Co-founders Srinath Ramakkrushnan, Amrit Acharya, Rahul Sharma, and Vishal Chaudhary among others.

■ Hyper-social gaming platform Bombay Play has raised $7 million, led by Kalaari Capital. Online gaming platform Winzo also participated in the round along with Lumikai Fund, Leo Capital and PlayCo, AdvantEdge VC, and AMEA Ventures. The company plans to invest the new funds in scaling its existing ‘hyper-social’ game offerings, supporting upcoming projects and allocating capital toward product development.

Elon Musk discloses 9.2% stake in Twitter

Tesla Inc Chief Executive Officer Elon Musk has built a 9.2% stake in Twitter Inc a regulatory filing showed on Monday, potentially making him the biggest stakeholder in the micro-blogging site.

Taking stock: Twitter shares soared 26% in premarket trading after the filing, which comes close on the heels of Musk tweeting that he was giving “serious thought” to building a new social media platform.

Musk owns 73.5 million Twitter shares, valuing his passive stake in the company at up to $2.9 billion based on the stock’s Friday close. The shares are held by the Elon Musk Revocable Trust.

Musk, a prolific user of Twitter, has over 80 million followers on the site since joining in 2009 and has used the platform to make several announcements, including teasing a go-private deal for Tesla that landed him in regulatory scrutiny.

He, however, has been critical of the social media platform and its policies of late and has said the company is undermining democracy by failing to adhere to free speech principles.

Today’s ETtech Top 5 newsletter was curated by Arun Padmanabhan in New Delhi and Aishwarya Dabhade in Mumbai. Graphics and illustrations by Rahul Awasthi.