Also in this letter:

- Linking Aadhaar with voter ID is dangerous: privacy advocates

- Snapdeal likely to file draft IPO papers in a few days

- Zepto raises $100 million as quick commerce booms

Tech firms say tokenisation will cause mayhem, urge RBI to postpone it

India’s technology firms are rushing to petition the Reserve Bank of India to delay the implementation of its tokenisation mandate.

What’s that? The RBI’s mandate requires online merchants to erase all stored payment details of customers by December 31. Tokenisation enables card transactions without disclosing the cardholder’s account information to either the merchant or any intermediaries. It involves replacing a 16-digit credit or debit card number with another string of 16-digit numbers known as a “token”, which is unique for each combination of card, token requestor and device.

Driving the news: Global and local companies that are a part of industry bodies such as Nasscom and the Alliance of Digital India Foundation ( ADIF) fear the new mandate will cause “large-scale disruption” and “mayhem” across online payments platforms from January 1. They will ask the RBI to implement the mandate in phases, and for two years to make the transition, multiple sources told us.

Who said what: “We are asking for more time. No one wants to wake up to mayhem on January 1,” said Sijo Kuruvilla George, executive director of ADIF, which represents companies such as Paytm and BharatMatrimony.

ADIF meanwhile said that an abrupt transition to the new system could shave off close to one-third of the digital industry’s revenues, and cause hundreds of small and medium merchants and payment operators to go out of business.

Ashish Aggarwal, vice-president of public policy at Nasscom said, “Unless 80% of the cards used can be tokenised, the transition should not be forced.”

The new rules: In September, the RBI amended its tokenisation framework — first introduced in March 2020 – to include card-on-file data.

According to the new rules, online shoppers must either key in their card details every time they make a purchase or agree to tokenise their card data through an additional factor of authentication. Online merchants and payment aggregators can store the last four digits of the actual card number and card issuer’s name, but only after receiving specific consent.

Double whammy: Nasscom also said that the short timeline for tokenisation means a double whammy for the digital commerce sector, especially small players who are already “adversely affected due to the recurring payments mandate and are still trying to emerge from it”.

The RBI’s new rules on recurring payment, which came into effect from October, allows banks to process auto debit transactions only after they send a notification to customers at least 24 hours before the payment. It also requires a separate flow for auto transactions above Rs 5,000 that customers need to authenticate such payments manually with a one-time password.

Linking Aadhaar with voter ID is dangerous, say privacy advocates

Privacy advocates have strongly criticised the Election Laws (Amendment) Bill, 2021, which the Lok Sabha passed with a voice vote amid huge opposition on Monday.

Dangerous for democracy: They said that the bill, which allows for the “voluntary” linking of Aadhaar with a person’s voter’s ID, is “dangerous” for democracy as it violates citizens’ right to privacy by enabling voter profiling through linking of data sets.

“It is a dangerous law that will undermine electoral democracy; free and fair elections; individual privacy. We have no data protection law. The one under consideration is leaky as a sieve,” Apar Gupta of the Internet Freedom Foundation said on Twitter.

Govt’s view: The government has said that linking Aadhaar to voter IDs is key to weeding out fake and duplicate voter cards and making elections fair and transparent. Minister of Law and Justice Kiren Rijiju said the legislation will end bogus voting in the country and make the electoral process more credible.

Unconstitutional: But election reform advocates claimed the proposed linking was unconstitutional as it did not meet the test of proportionality laid down by the Supreme Court in its judgement on privacy in the Justice KS Puttaswamy vs Union of India case.

They said that in the absence of a strong data protection law, the proposed law could disenfranchise voters and violate the secrecy of ballots.

“This is not a reform. In fact, it is a step backwards that will make voting difficult for many people. The government always says Aadhaar linkages are voluntary but ultimately it becomes compulsory. Voting is a fundamental right of the citizen,” said Jagdeep S Chhokar, co-founder of the Association for Democratic Reforms (ADR).

Playing with fire: Cyber law expert Pavan Duggal said the government was playing with fire. “The law is silent on cybersecurity mechanisms. This [linking] can threaten India’s sovereignty in case of a data breach. Linking Aadhaar to voter IDs would be a double bonanza for cyber criminals,” he said.

Tweet of the day

Snapdeal likely to file draft IPO papers in a few days

Online marketplace Snapdeal is expected to file its draft initial public offering (IPO) papers with markets regulator Securities and Exchange Board of India (Sebi) in the next few days, sources told us.

Details: Snapdeal, once a challenger to Flipkart and Amazon India, is looking to raise around Rs 1,250 crore through primary share sale. The IPO will also include an offer for sale (OFS) component of anywhere between Rs 400 crore and Rs 500 crore.

SoftBank may pare stake: Japanese investor SoftBank, which made early bets on the Indian ecommerce company, may offload parts of its holding to trim its stake down to below 25%, the sources added.

Snapdeal founders Kunal Bahl and Rohit Bansal are unlikely to sell any shares in the IPO, people briefed on the matter said.

Over the past three to four years, the company has largely focussed on selling unbranded products and reducing its monthly cash burn. In 2017, it walked away from a potential merger with bigger rival Flipkart, which is now majority-owned by Walmart.

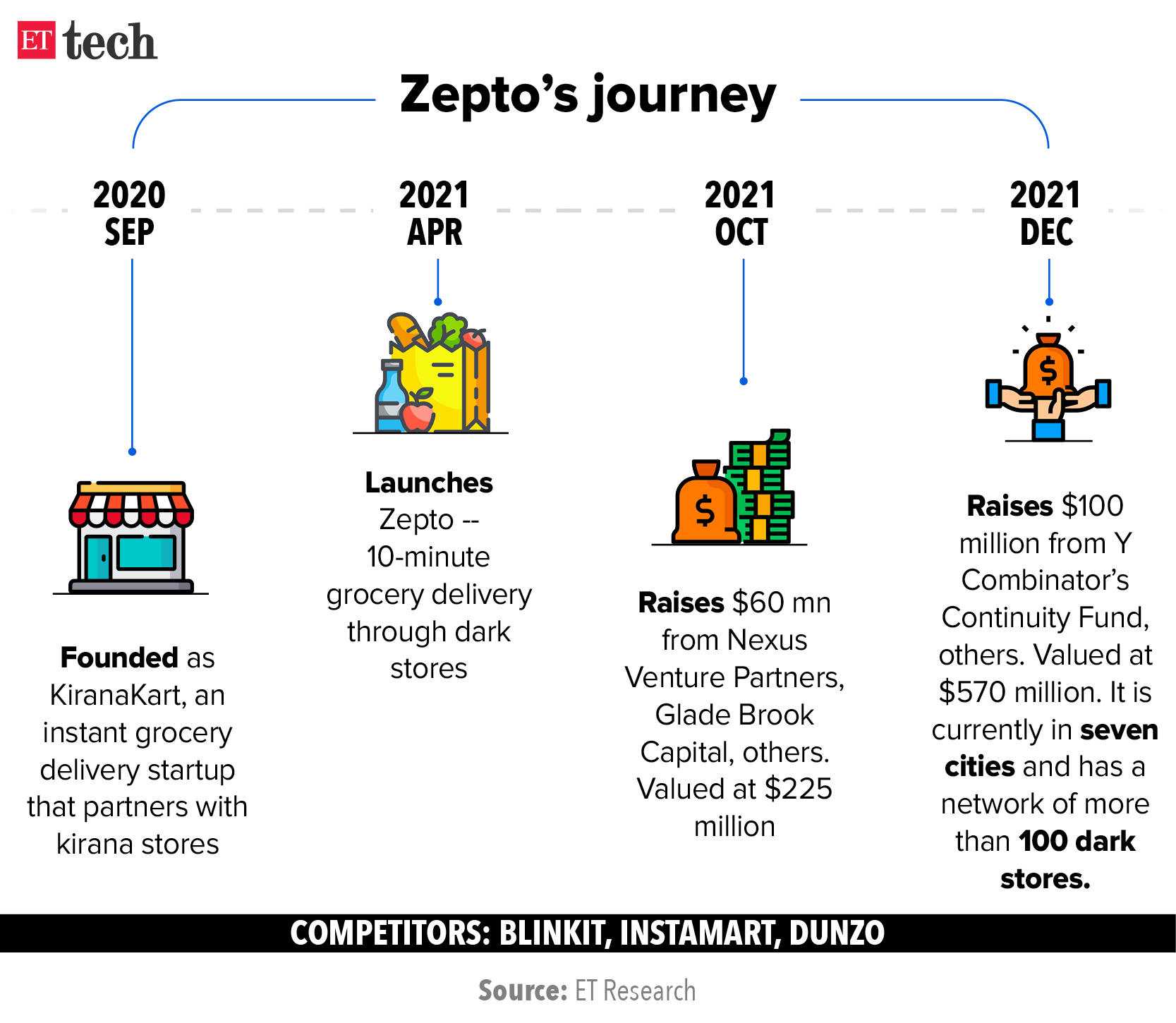

Zepto raises $100 million as quick commerce booms

Keeping up the frenetic dealmaking in the ultrafast delivery segment, Mumbai-based Zepto has raised $100 million in a round led by its existing investor, Silicon Valley startup incubator Y Combinator’s Continuity Fund.

Valuation soars: The company, which is among the most buzzy startups this year, has more than doubled its valuation to $570 million, just two months after it raised $60 million at a valuation of $225 million.

“We are growing 200% month-on-month. Since the last round, we have grown 10-fold in terms of volume. We are planning to increase our volume by 10x in the next 2-3 months,” cofounder Aadit Palicha said.

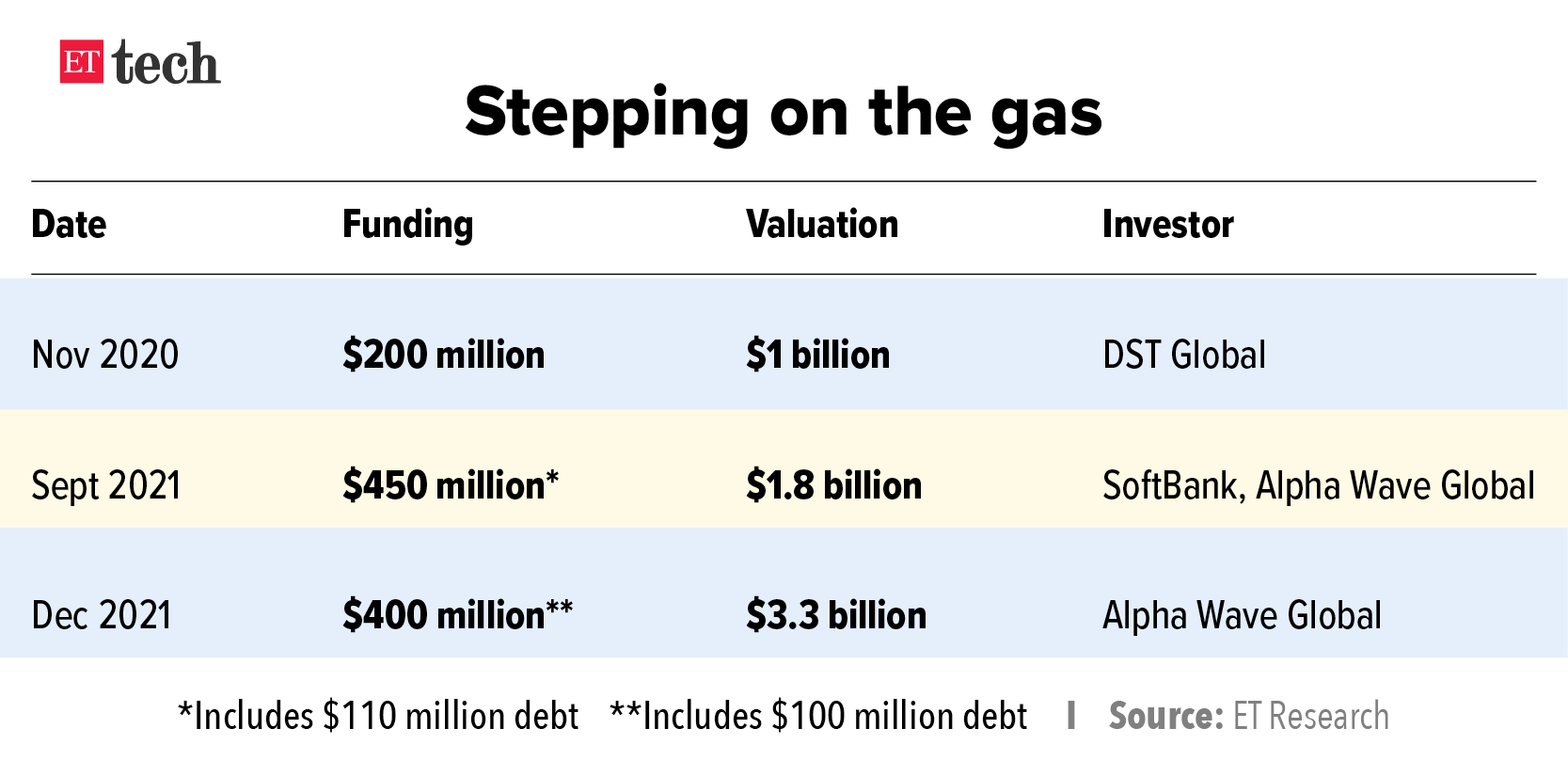

Car24’s valuation hits $3.3B: Cars24, a platform for buying and selling used cars, said it has closed a $400 million funding round led by Alpha Wave Global.

The funding bumps the company valuation to $3.3 billion, up more than 80% from its previous funding round in September, when it raised $450 million from SoftBank Vision Fund, Alpha Wave Global and Yuri Milner’s DST Global among others at a valuation of $1.8 billion.

The deal, which we first reported about on November 29, includes a $100-million debt component that has been sourced from investors such as Commercial Bank of Dubai and IFM Investors in Australia.

Cars24 will use the new capital to build large refurbishing centres across the country to improve the quality of cars before they are sold to customers. This is part of its plans to go deeper within India.

OfBusiness raises $325M: Meanwhile, business-to-business (B2B) commerce startup OfBusiness is now valued at almost $5 billion after raising $325 million from Alpha Wave Global, Tiger Global and SoftBank Vision Fund 2. Alpha Wave Global invested around $175 million, Tiger Global $100 million and SoftBank $50 million.

The round also included a secondary share sale of around $140 million in which existing investors Matrix Partners India, Creation Investments and Zodius Technologies sold some of their shares. Around 80 employees with stock options also participated in the secondary transaction.

IPO on the horizon: OfBusiness cofounder and CEO Asish Mohapatra said the startup will use the new funds to go deeper into supply chain on the commerce side and build technology for its software-as-a-service (SaaS) solutions and financing vertical. He added that the company was also aiming for an initial public offering in India in the next 9-12 months.

Other Done Deals

■ Online beauty and personal care startup, The Good Glamm Group, which owns the MyGlamm brand, has acquired an undisclosed majority stake in feminine hygiene startup Sirona in an all-cash deal worth Rs 100 crore. The early backers of Sirona – which makes feminine hygiene products including menstrual cups – have exited while Good Glamm has committed a further Rs 100 crore ($13.5 million) of primary investment in the company, Darpan Sanghvi, founder and CEO of the Good Glamm Group told ET in an exclusive interview.

■ Bizongo, a business-to-business (B2B) ecommerce and supply chain enablement platform, said it has raised $110 million in a new funding round led by New York-based Tiger Global, taking its valuation to $600 million. The round also saw CDC and IFC EAF joining as new investors. It also involved existing investors B Capital, Chiratae Ventures, Schroder Adveq, IFC and Add Ventures by SCG. Manish Choksi, a member of Bizongo’s advisory board and vice chairman at Asian Paints, also invested in his personal capacity.

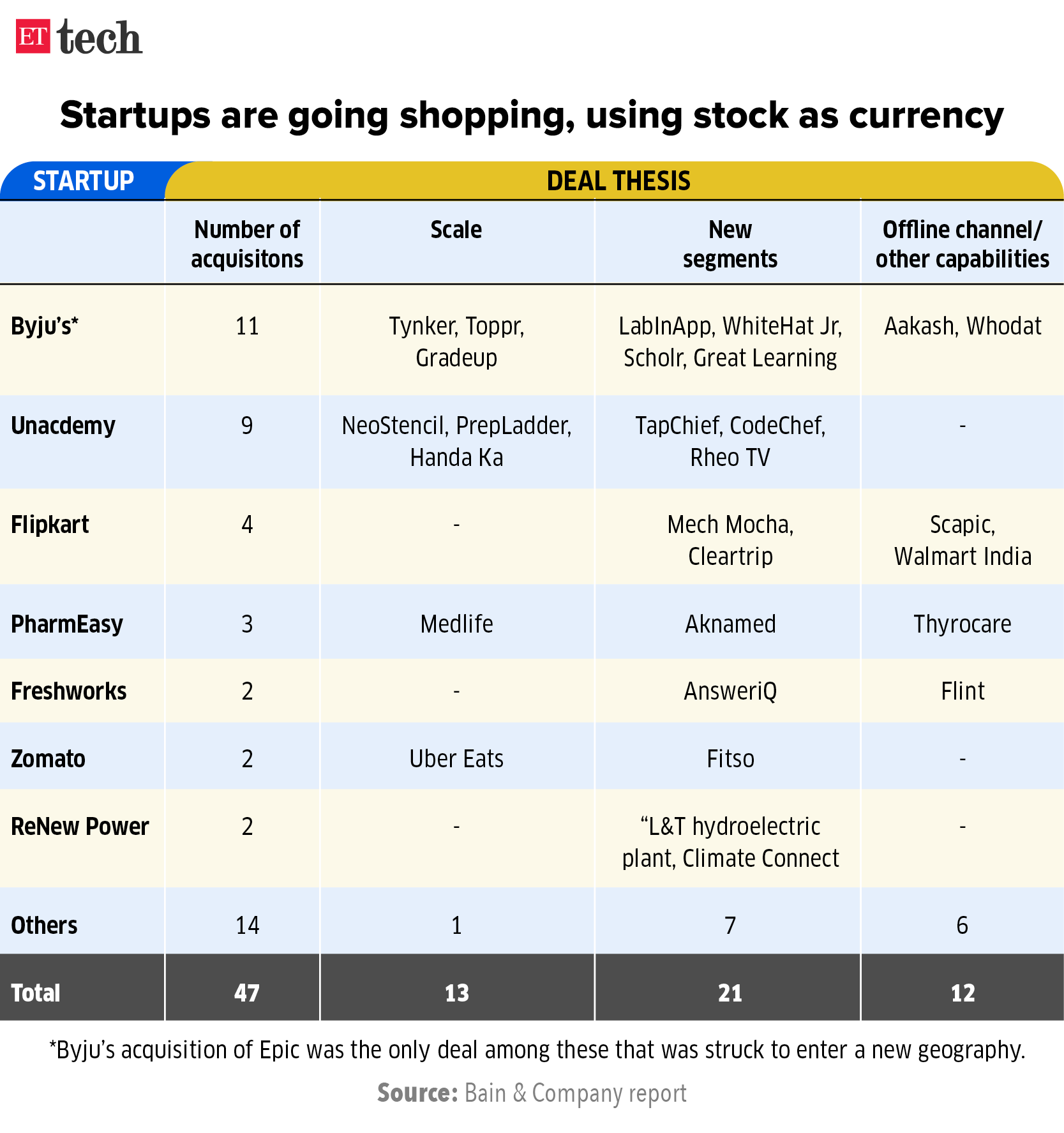

M&As near all-time high as startups drive activity

Mergers and acquisition (M&A) deals in India are nearing an all-time high as first-time buyers, especially startups, drive deal volume valued at more than $75 million.

Why now? The Covid-19 pandemic has accelerated disruption across sectors and large conglomerates as well as startups are responding to the changes through M&As and divestitures.

The number of such deals is expected to touch 85 this calendar year with first-time buyers accounting for almost 80% of them, according to a report by Bain and Company shared with ET.

Unlike in 2017-2019, when mega deals – valued at $5 billion or more – comprised a majority of deal activity in India, the last two years have seen heightened activity in mid-sized deals.

Quote: “Scope and capability deals are increasing in the market and what it means is that the nature of M&A is changing from just sort of growing the business and building scale to now really transforming the business and a lot of that is transforming for a post Covid-19 world,” said Vikram Chandrashekhar, partner at Bain & Company.

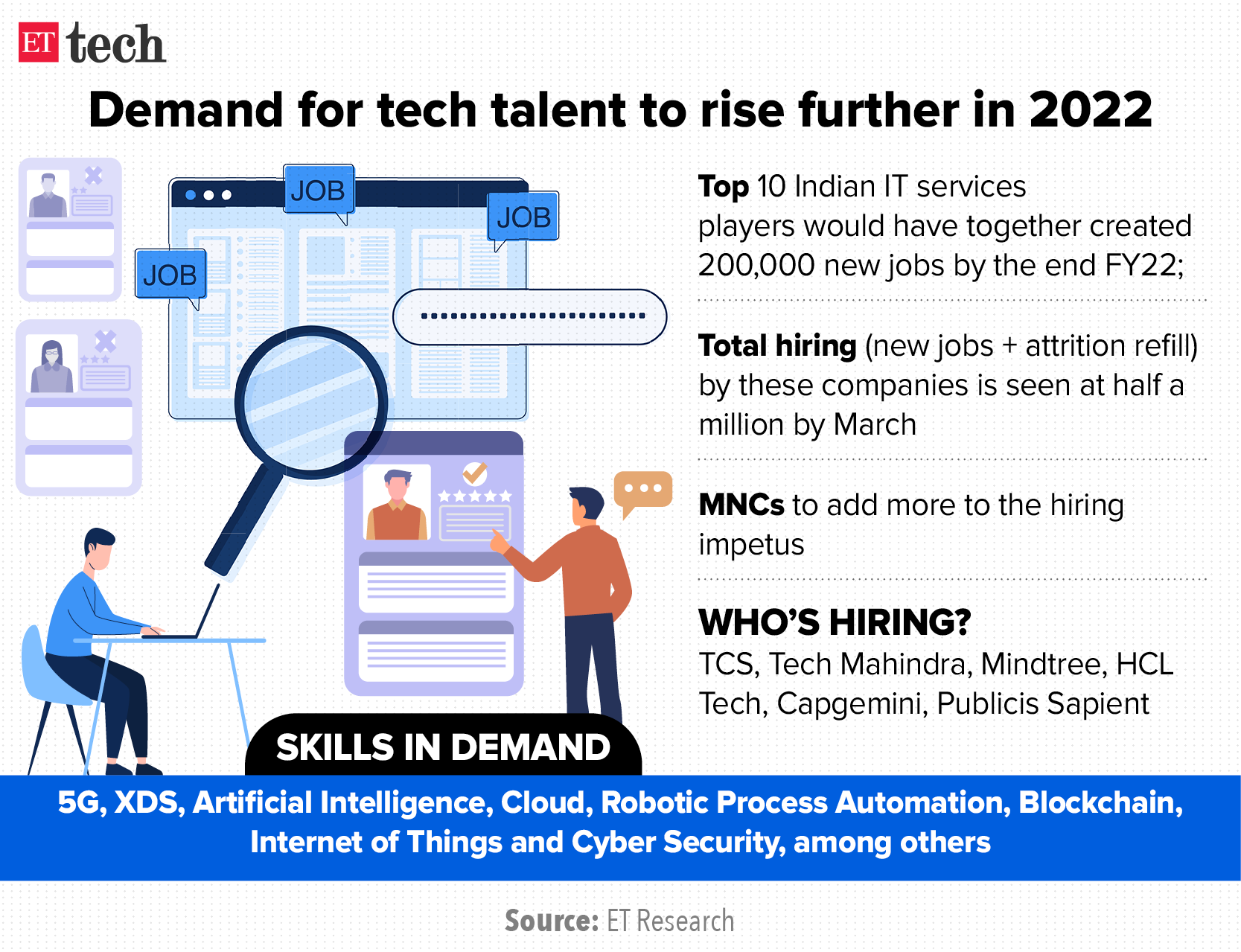

IT companies set to crank up talent war in 2022

The demand for new-age tech talent will increase further in 2022, intensifying the war for manpower in the tech space, industry experts and top company executives told us.

200,000 new jobs: The top 10 Indian IT services players, including Tata Consultancy Services, Infosys, Wipro, Tech Mahindra, HCL Technologies and Mindtree, will have together created 200,000 new jobs by the end of this fiscal year in March, according to an estimate by specialist staffing firm Xpheno based on quarterly reports of companies.

“After a series of reactive corrections over 2020, the IT services sector found its rhythm in 2021 and nearly doubled its talent demand as compared to 2020,” said Kamal Karanth, cofounder, Xpheno. “The second half of 2021 has been strong with monthly active openings exceeding 110,000 and this is expected to stay for the rest of the fiscal (year) and well into the next.”

Other Top Stories By Our Reporters

Wipro to acquire cybersecurity consulting provider Edglie: IT services major Wipro on Monday announced it has signed an agreement to acquire Texas-headquartered cybersecurity consulting provider Edgile for an all-cash consideration of $230 million, as it looks to strengthen its position in the fast-growing cybersecurity services space.

Blinkit temporarily halts operations in areas where it can’t deliver in 10 minutes: Blinkit, a quick commerce startup formerly known as Grofers, has temporarily stopped operations in areas where it cannot service within 10 minutes, co-founder Albinder Dhindsa said in a Twitter post on Monday. The decision comes on the back of the company’s rebranding amid increased competition.

Apna.co says witnessed 430% increase in female users in 2021: Apna.co has witnessed a more than fivefold increase in the number of female users on its platform in 2021, a trend the professional networking app expects to continue next year.

Global Picks We Are Reading

- China’s venture investors see 65% drop in fundraising (The Information)

- Oracle to buy Cerner for $28 billion, its largest-ever acquisition (Axios)

- Six months with Lina Khan’s FTC (Axios)