Within a year it had 100 million users and was clocking more than a billion views a day.

The company that built it quickly decided to release an international version, which it did in 2017.

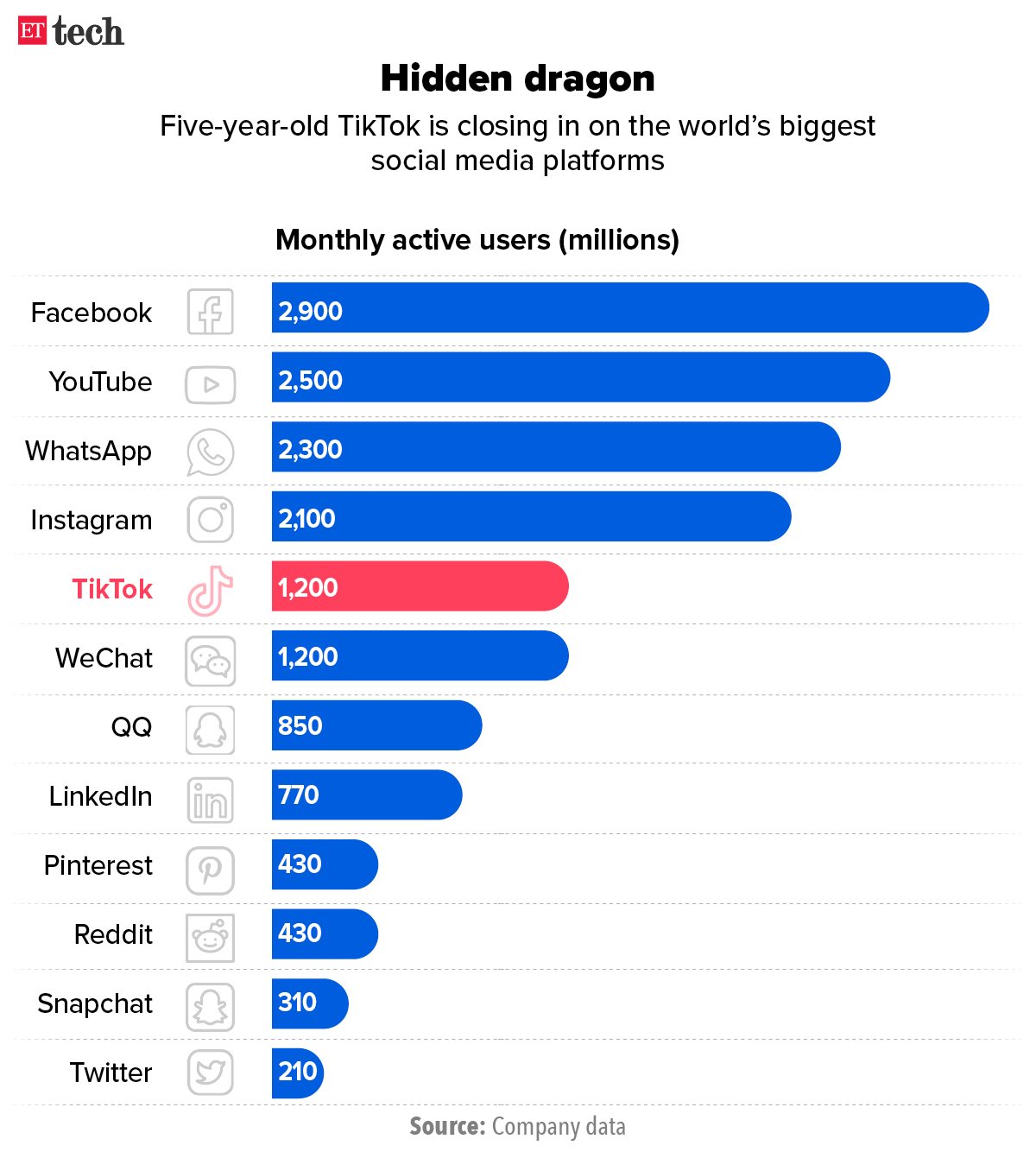

Five years later, this app is rapidly closing in on the world’s biggest social networks on popularity and influence, having already surpassed them in terms of controversy.

We’re talking, of course, about TikTok.

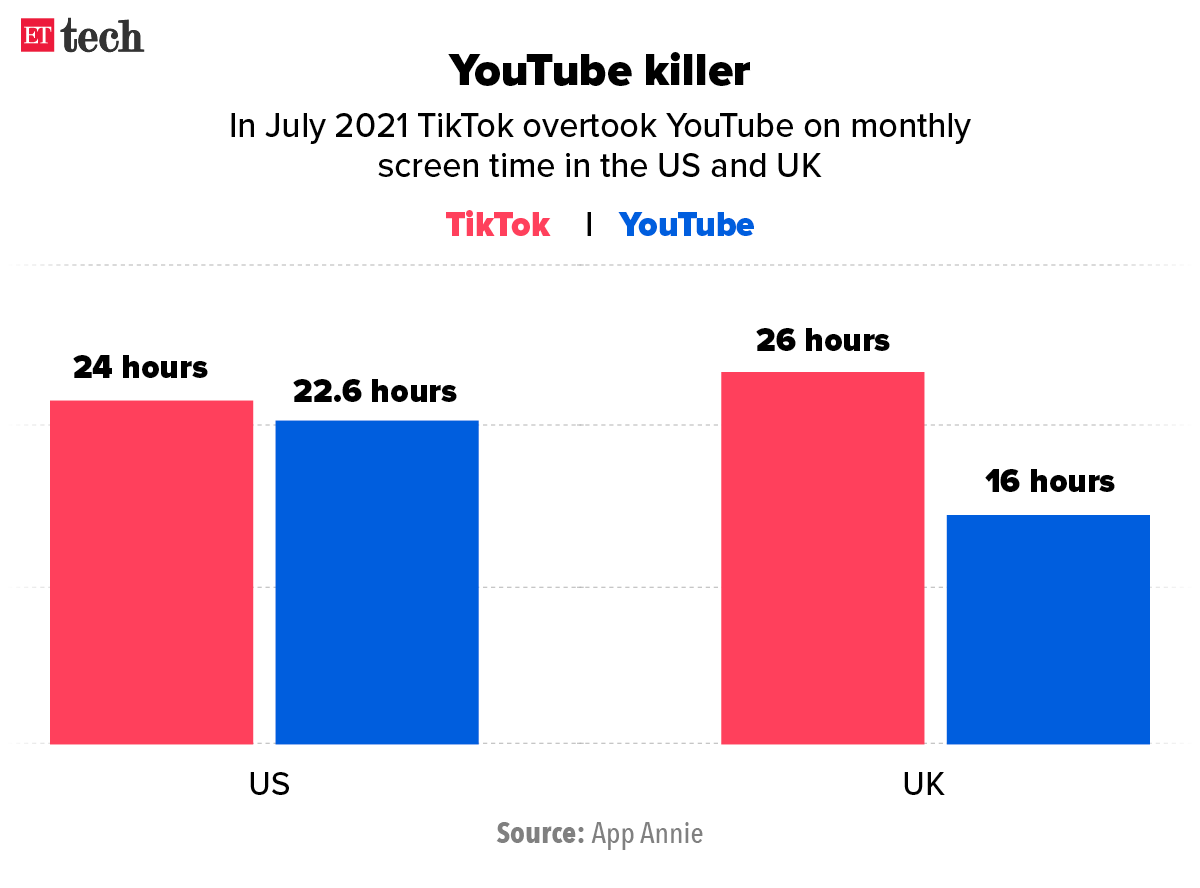

Originally launched as a short-form video sharing platform for lip-syncing and dancing videos, TikTok has grown into a full-fledged video service. A whole 12 years younger than YouTube, it surpassed the granddaddy of video streaming on screen time in both the US and UK last year.

Few Chinese apps have done well outside their home country, most notably Tencent’s WeChat. ByteDance’s TikTok got a foothold overseas with its $1 billion acquisition of Musical.ly in November 2017. This instantly gave it 80 million users, mostly in the US, which it brought to its own platform.

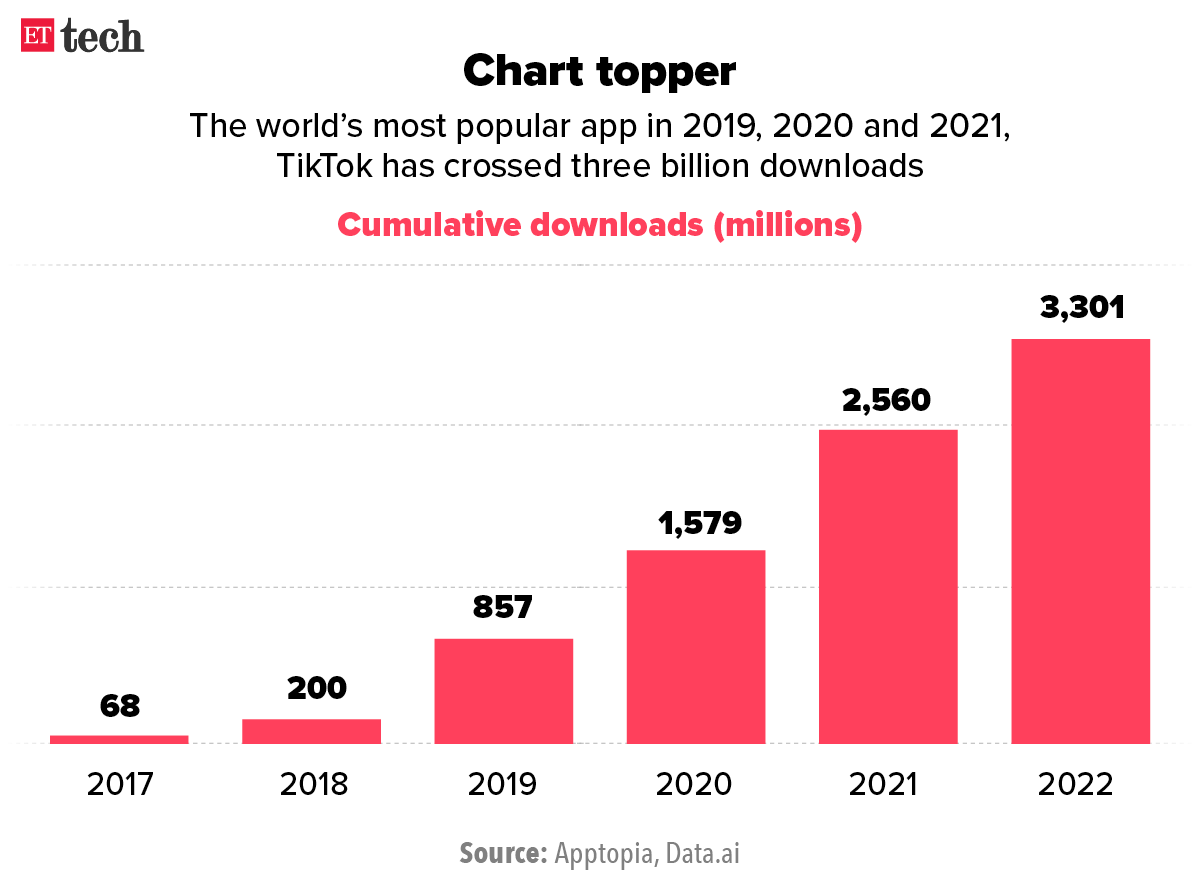

By 2019 it was the world’s most downloaded app, a feat it repeated in 2020 and 2021. Astonishingly, it was the seventh-most downloaded app of the 2010s though it was around for only two years and three months of that decade.

Under fire

TikTok, like any large social network, has had its share of controversies.

The Indian government banned it along with 58 other apps with Chinese links, including WeChat, UC Browser and PUBG, on June 29, 2020. The Ministry of Electronics and Information Technology said the apps were “prejudicial to sovereignty and integrity of India, defence of India, security of state and public order.”

When it was banned, TikTok had 190 million users in India, making it the app’s second largest market behind China at the time.

The ban was made permanent in January 2021 and the following month TikTok said it would be forced to lay off over 2,000 employees in India.

In 2020, the US government also announced it was considering banning TikTok on a request from then President Donald Trump. ByteDance initially planned to sell a small portion of TikTok to an American company but eventually agreed to divest TikTok to prevent a US ban.

But the following June, President Joe Biden signed an executive order revoking Trump’s TikTok ban. He instead ordered the secretary of commerce to investigate whether the app posed a threat to US national security.

In a letter to Apple and Google that was disclosed this week, US Federal Communications Commission (FCC) chief Brendan Carr called TikTok “a sophisticated surveillance tool that harvests extensive amounts of personal and sensitive data.” He called on the companies to remove the app from their stores.

And last week, BuzzFeed News reported that ByteDance’s employees have repeatedly accessed the data of US TikTok users.

Bulletproof

Despite being banned in a country of more than a billion people and becoming a geopolitical pawn twice over, TikTok remains one of the world’s fastest growing apps, rapidly closing in on social media giants Instagram, WhatsApp, YouTube and Facebook in terms of users.

It had 1.2 billion monthly active users in Q4 2021 and is expected to hit 1.8 billion by the end of 2022.

In the US, TikTok has been installed 321.6 million times, and generated $694.3 million in consumer spending, which may translate to about $208.3 million in fees for Apple’s and Google’s app stores, according to SensorTower.

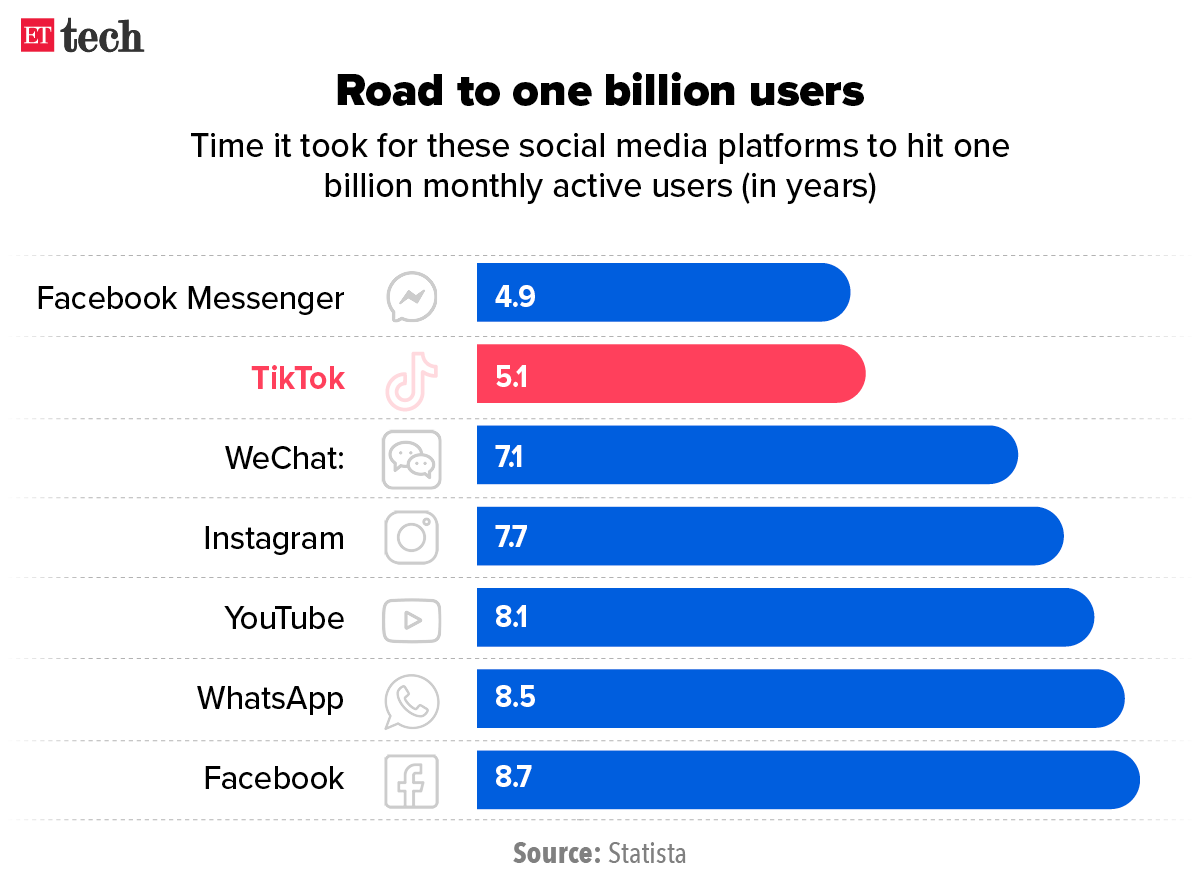

The app took just over five years to hit a billion users, despite being confined to China for the first year. It took Facebook almost nine years to achieve the feat, and YouTube eight.

TikTok, like the march of time its name evokes, seems unstoppable for now.

Where will it stand at the end of this decade?

Written by Zaheer Merchant

Top Stories By Our Reporters

Private-market correction just getting started: Alpha Wave’s Navroz Udwadia

It has been a meteoric rise for Falcon Edge (now Alpha Wave Global), which has been catapulted into the top league of technology investors locally in a short time. After a hyper-busy two years of dealmaking and with a $10-billion corpus at its disposal, Alpha Wave has emerged among the biggest propellants of the latest technology bull run in India, which is now coming to an end. “We do think the private market correction is still in its infancy – (there is) much more to come, and so, patience is critical,” Navroz Udwadia, cofounder and partner at Alpha Wave Global, told ET in an interview.

Meanwhile, Global venture capital firm Insight Partners is likely to increase its pace of investments in India, a top executive told ET. The firm has so far deployed nearly $1 billion in the country, with 78% of that flowing in during the last 18 months, said Nikhil Sachdev, managing director, Insight Partners.

Smear campaigns are rampant on Startup Twitter

What’s common on Political Twitter has spilled over to Startup Twitter, one of the most active communities on the microblogging platform in India. Over the past few weeks, the chatter has been about how startups in India are using paid marketing tools to defame competitors.

It all started when ecommerce platform Meesho sent out legal notices to some social media accounts and certain people, according to sources, for allegedly running smear campaigns against the company. These include Jaymin Shah, who runs influencer marketing digital agency SocialGrid.

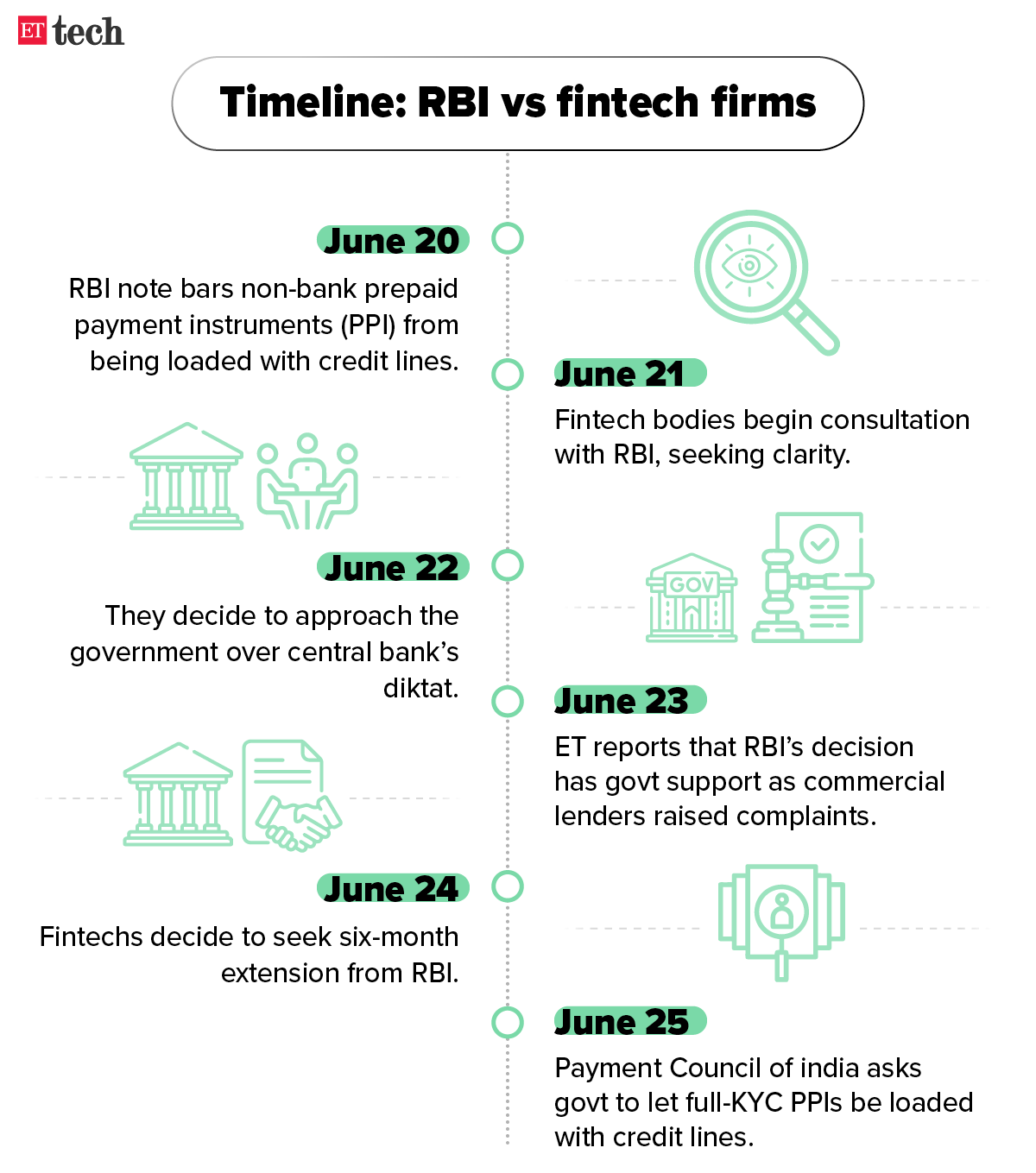

RBI and fintech

Bank-led PPI issuers onboarding only full KYC users after RBI rap

Bank-led prepaid card issuers such as Slice and Uni Card are onboarding only full-KYC customers on their platforms after the Reserve Bank of India (RBI) diktat disallowed non-banks from loading credit lines on such instruments, two people aware of the development said.

Banks rethink fintech partnerships after RBI’s new rule: Indian banks are rethinking partnerships with credit-card based fintech firms following recent directives by the Reserve Bank of India (RBI) with respect to the co-branded card segment. Several banks have reached out to RBI to understand the regulator’s thinking after it issued orders for debit, credit and co-branded cards in April.

Payments Council of India seeks govt’s help: The Payments Council of India (PCI) and several fintech firms have urged the government to step in to resolve the fallout from a recent directive by the Reserve Bank of India (RBI), which barred payment companies from loading credit lines onto wallets and prepaid payment instruments (PPIs).

LazyPay updates terms to comply with RBI order: LazyPay, the lending arm of PayU India, has updated its terms and conditions to comply with a recent directive by the Reserve Bank of India (RBI) that barred prepaid payment instruments (PPIs) from being loaded with credit lines.

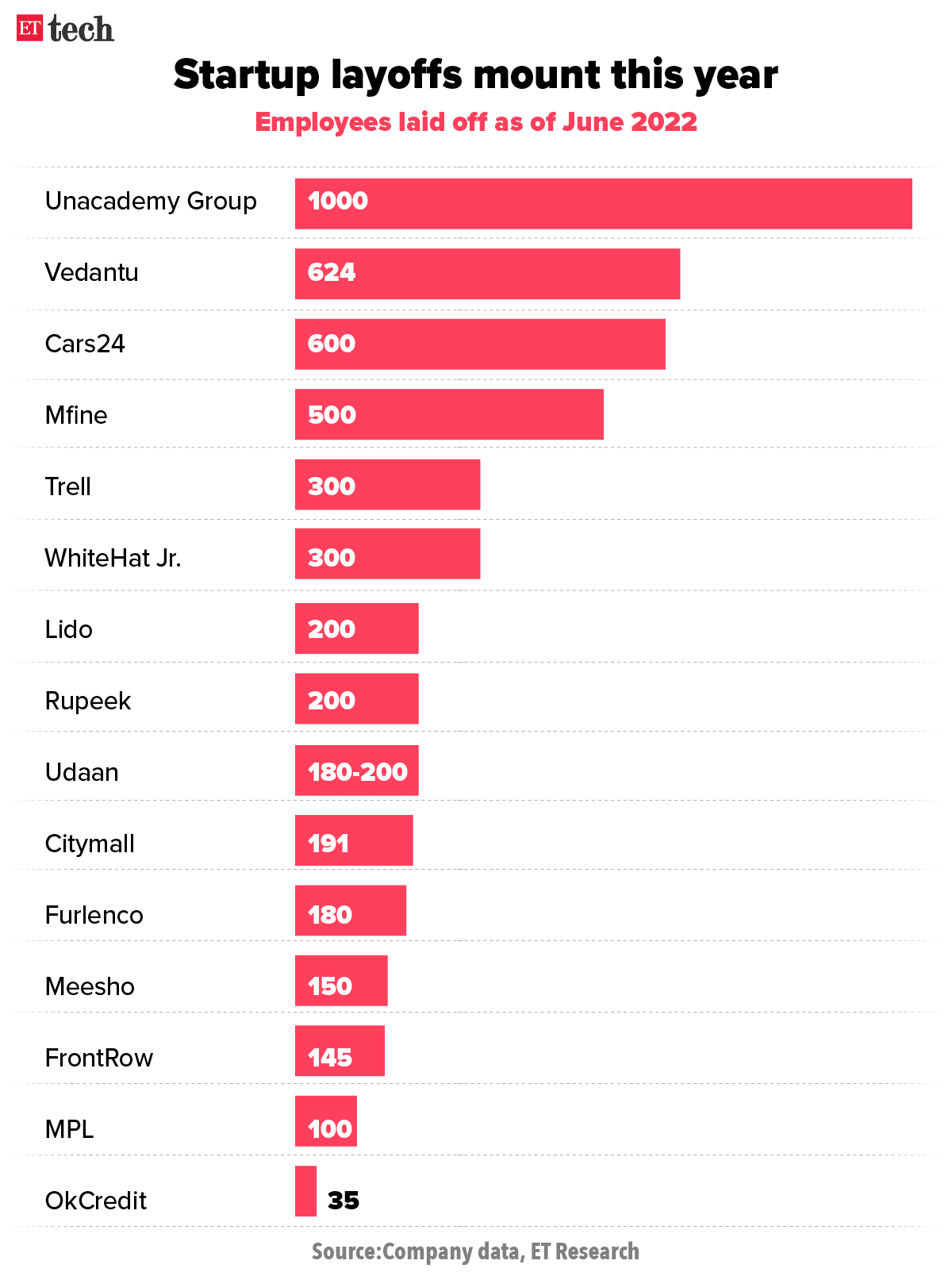

Startups and layoffs

Byju’s may rebrand WhiteHat Jr, fires another 300 at Toppr

Edtech major Byju’s is in active discussions to rebrand its code-teaching unit WhiteHat Jr, which it acquired in a $300 million deal in 2020, multiple sources told us. WhiteHat Jr, which teaches coding to children, has run into trouble in the past for allegedly misleading advertisements and promises on the outcomes of their courses. WhiteHat Jr challenged its critics in court but eventually withdrew its petition last year.

Byju’s pushes back payments for billion-dollar Aakash deal: Byju’s sought a two-month extension from Blackstone and other shareholders of test-preparation provider Aakash Educational Services on payments that were due this month, sources told us. The payment deadline has been extended to August, they said.

Udaan fires 180-200 staff, 5% of its workforce, to cut costs: Business-to-business (B2B) ecommerce unicorn Udaan has laid off around 180-200 employees, or 5% of its workforce, according to a person briefed on the matter. In a town hall with employees on Monday, the company termed the move “unusual”.

Some influencers say Trell hasn’t paid them for months; 100 more staff leave: Influencer-led video commerce platform Trell has not paid its dues to a section of content creators for the past six to seven months, three creators told us. About 100 employees of Trell have also voluntarily left the company over the last two months, a source said.

Web3 and online gaming

Govt to cover a lot of ground in final eGaming framework

The union government is drawing up an extensive framework to regulate online gaming companies including proposals for time-bound retention of specific user data and robust grievance redressal mechanisms, senior government officials told us.

Indian gaming companies plan to leverage Web3, play-to-earn: Indian game publishers are looking to leverage the metaverse and play-to-earn (p2e) elements of web3, influenced by blockchain-based games such as The Sandbox in the US and Axie Infinity in Southeast Asian nations.

MPL forays into web3 gaming, in talks to raise $10-$15 million: Mobile Premier League (MPL) is launching a new web3 gaming venture, GGX, multiple sources privy to the development said, as the gaming unicorn taps the play-to-earn (P2E) gaming sector. GGX is expected to be an in-game non fungible token (NFT) marketplace that will offer a platform for owning and trading in-game assets, like an exchange.

Cryptocurrencies a ‘clear danger’ to financial systems: RBI governor

.jpg)

Reiterating his long-held stance on cryptocurrencies, the Reserve Bank of India (RBI) governor Shaktikanta Das said in the 25th issue of the RBI’s Financial Stability Report (FSR) that “we must be mindful of the emerging risks on the horizon”. “Cryptocurrencies are a clear danger. Anything that derives value based on make-believe, without any underlying, is just speculation under a sophisticated name,” Das said in the foreword of the report, released on Thursday.

Swiggy, Byju’s, PayU drive ‘strong growth’ for Prosus in India

Prosus NV, the Dutch-listed arm of Naspers, said it has seen strong growth in its Indian portfolio, while announcing its results for the financial year 2021-2022 (FY22). It said Swiggy contributed $212 million of its almost $3 billion food tech revenues. Overall losses for Prosus’ foodtech arm stood at $724 million in FY22, on account of its portfolio companies expanding into quick commerce.

.jpg)

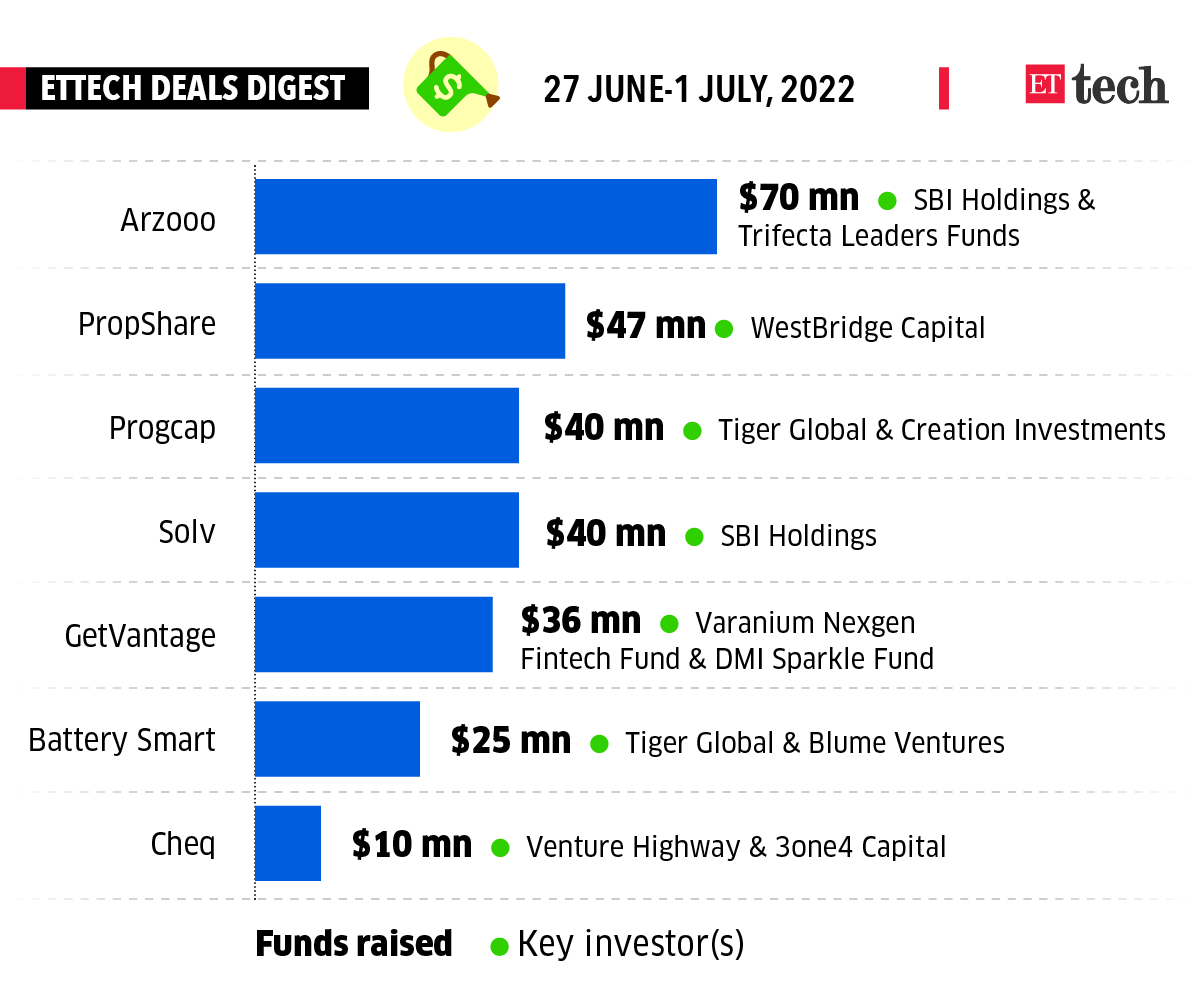

ETtech Deals Digest

■ Lenskart, the Softbank-backed omni-channel eye-wear retailer, has picked up a majority stake in Owndays – a Japanese direct-to-consumer eyewear brand – the company said. The strategic partnership through this merger will build Asia’s largest omni-channel eyewear retailer, Lenskart added.

■ Bertelsmann India Investments, the VC arm of the German media giant, Bertelsmann, has raised $500 million to back more early-stage Indian startups, Pankaj Makkar, managing director, Bertelsmann India Investments, told us.

■ Early-stage venture capital firm Fundamental VC has launched its maiden fund with a target corpus of $130 million. Early-stage venture capital firm Fundamental VC has launched its maiden fund with a target corpus of $130 million.

Policy update

MeitY flags Twitter’s lack of response to notices

The government sent several notices to Twitter India over the last six to eight months but received “no or inadequate” response in at least five such cases, sources told us. The Ministry of Electronics and Information Technology (MeitY) issued the notices to the social media platform under Section 69A of the Information Technology (IT) Act.

Cert-in gives a three-month breather to VPN providers, small businesses: The Indian Computer Emergency Response Team (CERT-in) has given a three-month extension to VPN providers, small and medium businesses, and data centres to comply with its cybersecurity rules. Issued on April 28, the rules were to come into effect on June 28. They will now come into force on September 25.

IT corner

More than half of IT companies struggle to get employees back to the office: report

Three in four employees working at IT companies in India are not coming to office even once a week despite their organisations resuming work from office (WFO) according to a survey conducted by CIEL HR.

TCS eyes non-metro offices to move closer to tech talent: Tata Consultancy Services (TCS) will set up offices in small cities and non-metro regions including Guwahati, Nagpur and Goa to get employees back into offices. This is aimed at encouraging collaboration among staff members as many are reluctant to go back to their base locations after working out of home, mostly in their native towns, following the Covid-19 pandemic, executives said.

Karnataka labour office summons Infosys over non-compete clause on July 4: The tussle between information technology (IT) major Infosys and Pune-based labour union Nascent IT Employees Senate regarding the non-compete clauses in the employment contracts will now be fought on a different turf – the Karnataka Labour Department.

That’s all from us this week. Stay safe.