Citibank

Citibank raised interest rates on fixed deposits of a few developments powerful July 15. A few private and public banks have brought interest rates up in the outcome of RBI bringing repo rates up in two progressive strategy meets.

A few private and public banks have raised interest rates on fixed deposits after RBI brought repo rates up in June. Citibank India likewise raised FD rates on deposits of not as much as Rs 2 crore. As per the bank’s site, the progressions in FD interest rates became successful from July 15.

After the new material rates, the bank gives an interest rate of 1.85-3.50% on a FD tenor going from 7 days to 1096 days, while senior residents are given 2.35% to 4% for a similar period.

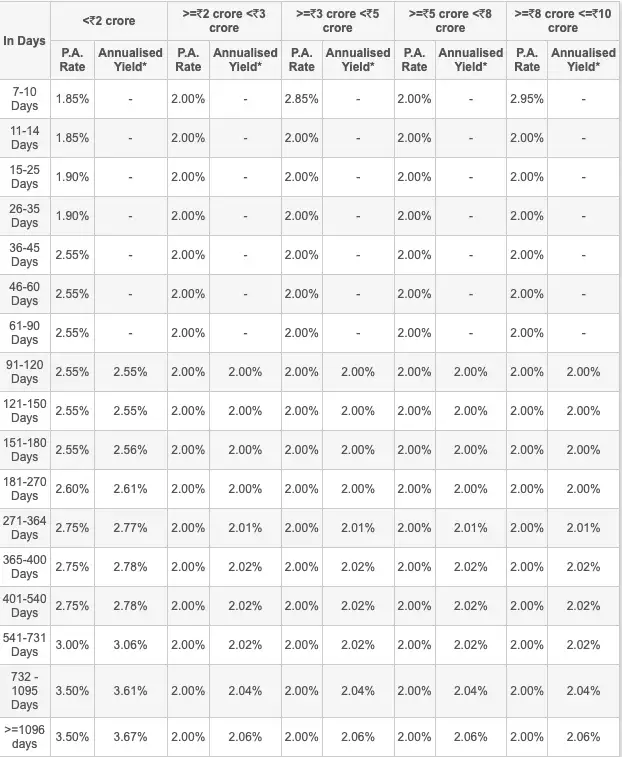

Citibank FD rates

The confidential bank presently gives a premium of 1.85% on deposits that experienced in 7 to 14 days and 1.90% on term deposits that matured in 15 to 35 days. Term deposits maturing in 181-270 days will acquire 2.60% interest, while FD maturing in 181-270 days will get 2.60%. Term deposits maturing in 36 days to 180 days will presently pay 2.55%. Deposits maturing in 271 to 540 days will give 2.75%, those with a maturity of 541 to 731 days will give 3% and term deposits of 732 days to 1096 days will give 3.5%.

Since the RBI climbed repo rates by 90 premise focuses in May 2022 in a bid to tame expansion, fixed deposit interest rates have been rising. Subsequent to offering decadal low rates during the pandemic years, banks and NBFCs have begun climbing interest rates on FDs. Among the banks that have expanded FD rates for deposits underneath Rs 2 crore are the State Bank of India, ICICI Bank and HDFC Bank.