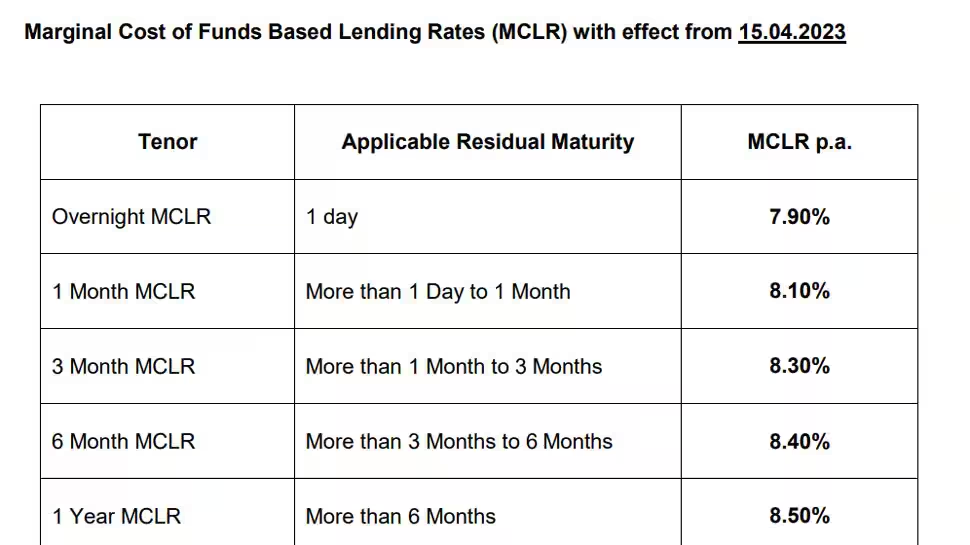

New Delhi: The Marginal Cost of Funds based Lending Rate (MCLR) for all tenors will increase by 10 basis points, according to the state-owned Bank of Maharashtra (BoM). According to the bank, the change to MCLR will take effect on April 15, 2023.

As per the assertion gave by Bank of Maharashtra, the benchmark one-year MCLR is presently 8.50%, up 10 premise focuses. The majority of consumer loans, including personal, auto, and home loans, have a fixed interest rate for one year.

The half year development can moved to 8.40%, while the short-term and one-month MCLRs expanded by 0.10 percent each to 7.90% and 8.10%.

Following the Reserve Bank of India (RBI)’s announcement of its key policy rates on April 6, a number of banks have recently increased their MCLR rates. After their largest public sector rival, SBI, raised interest rates on loans and deposits, Bank of Baroda and Indian Overseas Bank raised their marginal cost of fund-based lending rates (MCLR).

Canara Bank raised its marginal cost of funding-based lending rate (MCLR) for all tenors this past week. The new MCLR rates are pertinent from 12 April 2023, Canara Bank said.

Canara Bank added that existing borrowers will be able to switch to MCLR-linked interest rates (in addition to Fixed Rate Loans). Borrowers able to switch over to the MCLR based loan cost might contact the branch, the bank said.

The Reserve Bank of India (RBI) decided to pause and keep its crucial benchmark policy rate at 6.5 percent on April 6, despite the fact that inflation is approaching the threshold for acceptable levels.

The rate hike was put on hold after six rate increases in a row totaling 250 basis points since May 2022.

According to RBI Governor Shaktikanta Das, the Monetary Policy Committee (MPC) will not hesitate to act when announcing the bimonthly monetary policy in the future.