The six chosen projects meet at least one of the following criteria:

- The central bank has already issued a CBDC: Central Bank of The Bahamas

- A CBDC has been or is being tested with actual households and firms: People’s Bank of China (PBUC), Eastern Caribbean Central Bank (ECCB), and Banco Central de Uruguay (BCDU)

- A CBDC project has been brought onto the country’s political agenda and is being analysed by government or parliamentary bodies outside of the central bank: Sveriges Riksbank

- The central bank has conducted a CBDC project and decided against issuing a CBDC for now: Bank of Canada

Goals dictate guidelines: The report noted that central banks’ policy goals help set guidelines for more detailed choices. These goals include:

- Financial inclusion: In the Bahamas, Uruguay and ECCU member nations, financial institutions have found it unprofitable to operate in certain locations, leaving swathes of the population unbanked. In China, while the PBOC has sought to promote digital payments and financial inclusion for two decades, it estimates that around 10% of the population still lack access to basic financial services.

- Access to payments: This remains a problem even in countries with high financial inclusion, the report said. For example, the Riksbank highlighted lack of accessibility for elderly and disabled people amid a trend toward cashless payments.

- Efficiency: In countries where existing digital payments are relatively expensive, such as the Bahamas and the ECCU, CBDC is a potential policy tool to offer a cheaper alternative. “The non-profit nature of central banks means that they could potentially offer low-cost payments as a public good, potentially subject to the need to eventually recover costs,” it noted.

- Resilience: The urgency of this policy goal is especially high in disaster-prone nations such the Bahamas and ECCU member states, the report said.

- Curbing illicit use: The report noted that the Bahamas is the only country that has made combating illicit use of its CBDC a top policy goal. “Some features of cash, including anonymity and the lack of an audit trail,19 make it attractive for illicit transactions (for example, tax evasion, money laundering, and terrorist financing). CBDC could potentially reduce this problem,” the IMF said.

Design differences: The report details a range of design choices by the six central banks, including:

- No interest payouts: One of the biggest concerns around CBDCs is that they could lead to bank runs. To limit competition between their CBDCs and existing bank deposits, the CBOB, PBOC, and ECCU don’t offer interest on their digital money.

- Holding limits: Putting a cap on the amount of CBDC people can hold is another technique central banks use to stave off competition with commercial banks. The ECCB, for example, has an aggregate creation limit for DCash, and the Bahamas’ CBDC will soon have a feature that directs Sand Dollars over a certain limit to people’s regular bank accounts.

- Offline payments: Offline functionality – a big part of ensuring the widest possible access to CBDCs – has turned out to be technologically complicated, the report said. “The Bahamas considers off-line functionality to be vitally important but has encountered difficulties in achieving it. The pilot revealed that the planned solution of local off-line networks—built on introducing local redundancies to the main telecommunication system—did not fully achieve the policy goal,” it said.

Written by Zaheer Merchant in Mumbai.

TOP STORIES BY OUR REPORTERS

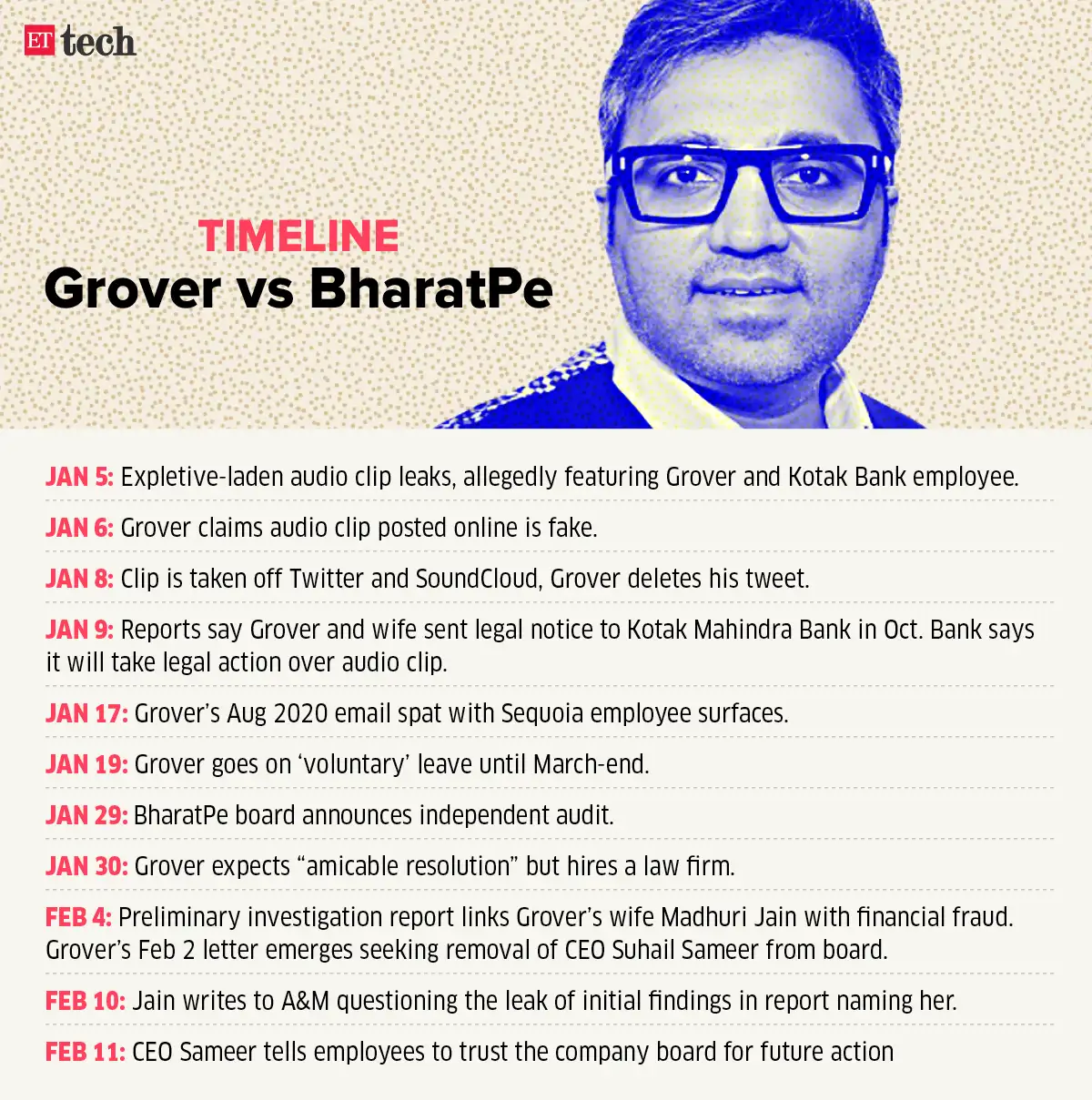

BharatPe’s cup of woes

BharatPe CEO Suhail Sameer and cofounder Ashneer Grover

In the latest development in the BharatPe saga, its chief executive Suhail Sameer wrote a letter to its employees on Friday morning saying the company is “under constant scrutiny and spotlight” and “what is being written is nothing but unsubstantiated rumours”.

BharatPe chief’s missive to employees comes at a time when tensions between cofounder Ashneer Grover and the company board are mounting.

Also Read: BharatPe Board to take right call after audit, says Rajnish Kumar

Row over media leaks: Madhuri Jain, controller at BharatPe and wife of the company’s cofounder Ashneer Grover, wrote to Alvarez & Marsal (A&M) on Thursday, questioning the consulting firm about recent media leaks. A&M’s initial investigation showed that Jain and other family members were allegedly involved in financial irregularities at BharatPe, ET reported on February 4.

Lawyer joins board: Earlier, we reported that John Weinstein, deputy general counsel at US-based venture capital firm Insight Partners, had joined the board of BharatPe. Weinstein joined the board as an additional director on February 1, according to regulatory filings sourced from business intelligence platform Tofler.

Meanwhile, BharatPe cofounder Ashneer Grover held early talks with investors to sell his 9.5% stake in the fintech startup, potentially paving the way for his full exit from the company, two people aware of the matter said.

Taxing crypto doesn’t make it legal, says finance minister

On Friday, finance minister Nirmala Sitharaman said that the government has imposed a tax on cryptocurrency transactions and not done anything to legalise, ban or regulate it.

Fine tuning: Earlier, sources told us the government may broaden the definition of “virtual digital assets” to cover any new assets that may emerge in this space. It could also fine-tune the rules proposed in the budget to tax virtual digital assets after holding discussions with industry representatives and to account for the dynamic nature of the sector, officials told ET.

Impending tax complication: The government’s decision to tax cryptocurrency transactions by levying tax deducted at source is set to trigger another tax complication in the form of an equalisation levy for crypto exchanges, tax experts said.

Also read: Global exchanges await clarity on India’s crypto rules

This is because in most cases, crypto-assets bought by Indian residents through exchanges are from people not based in the country, they said.

In other crypto news:

Infosys cofounder Nandan Nilekani said India’s proposed digital rupee should be “anonymous” as concerns about surveillance will arise if all payment transactions are recorded and are visible.

The newly introduced law aimed at taxing cryptocurrencies is all set to impact reward points and other in-app purchases offered by social media companies, dating and gaming apps, say tax experts. Social media giants such as Meta, dating apps like Gleeden and even gaming apps could face a 1% tax deducted at source as these would be covered under the government’s broad definition of virtual digital assets.

ETtech Deals Digest

Zomato’s Deepinder Goyal invests in Amit Lakhotia’s Park+

Zomato founder and chief executive Deepinder Goyal has invested in Park+, an app for car users. Gurugram-based Park+ said Goyal is also joined by his core team members at Zomato, who have also invested in the startup, founded in 2019 by Amit Lakhotia.

Manish Maheshwari’s Invact Metaversity raises funds at $33 million valuation

Invact Metaversity, a startup at the intersection of education and metaverse, on Monday said that it has raised funds from more than 70 global corporate leaders and founders of unicorns. The funding round values the Manish Maheshwari-led edtech startup at $33 million

Polygon raises $450 million from Sequoia Capital India, others

Polygon, a secondary scaling solution founded by three Indians for the Ethereum blockchain, has raised $450 million in a round led by Sequoia Capital India. The fund was raised through a private sale of Polygon’s native Matic token. SoftBank Vision Fund II was among the 40 marquee venture capital firms, including Tiger Global, Elevation Capital, Accel Partners and Steadview Capital, that participated in the fundraising.

SoftBank-led funding more than triples ElasticRun’s valuation to $1.5 billion

ElasticRun, a kirana-focused business-to-business ecommerce firm, raised $300 million in a new funding round led by SoftBank Vision Fund II. Goldman Sachs has joined as a new investor in the fundraising that trebles the Pune-based company’s valuation to $1.5 billion, according to regulatory filings and people aware of the transaction. The company had last raised $75 million in April 2021 at a valuation of more than $400 million.

Oyo may reduce IPO size amid tough market condition

Oyo Hotels & Homes plans to substantially cut the size of its IPO, several sources told us. The planned reduction is due to adverse conditions in the secondary market and a crash in stock prices of new-age companies, the sources said. The issue size is expected to be much lower than $1 billion, they said. In its draft IPO papers filed with the markets regulator in October 2021, Oyo had said it planned to raise $1.2 billion.

Navi IPO: Meanwhile, Sachin Bansal’s financial services company Navi Technologies is gearing up to list on the Indian exchanges, having converted itself into a public company, according to regulatory filings shared by business intelligence platform Tofler.

Zomato to invest $400 million more in quick commerce

On Thursday, Zomato reiterated its focus on the quick-commerce segment and added that it would invest an additional $400 million in the space in the next two years. The company also outlined its lending ambition with an announcement to set up a non-banking financial company that would allow it to extend short-term credit to its restaurant partners, delivery partners and even customers.

Zomato Q3 Results: Zomato on Thursday reported a December quarter consolidated net loss at Rs 67.2 crore, narrowing it from Rs 352.6 crore reported in the same quarter last year. Revenue from operations came in at Rs 1,112 crore, up 82.47% against Rs 609.4 crore in the year-ago quarter.

Meanwhile, Swiggy’s consolidated revenue from operations decreased by 26.6% yoy to Rs 2,547 crore in FY2021, while net losses shrunk by almost 59% from the previous fiscal to Rs 1,616 crore, according to a regulatory filing sourced from Tofler.

Freshworks’ revenue spike: Software-as-a-Service (SaaS) company Freshworks Inc on Friday said its total revenue surged 44% for the quarter ended December 31 to touch $105.5 million, as opposed to the same period last year.

Focus is on fundamentals, not valuation, says Nykaa CEO Falguni Nayar

FSN E-Commerce Ventures, the parent entity of omnichannel beauty retailer Nykaa, reported a 59% drop in net profit to Rs 29 crore for the quarter ended Dec. 31 from the same period last year. The company’s revenue from operations came in at Rs 1,098.36 crore, up 36% from Rs 808 crore in Q3 of FY21.

ETtech caught up with Falguni Nayar, founder and CEO of Nykaa, and Anchit Nayar, CEO for beauty ecommerce, for an exclusive interview after the company announced its earnings on Wednesday.

What’s powering Good Glamm Group’s buying spree?

The Good Glamm Group, a direct-to-consumer beauty and personal care company, has emerged as one of the most valued businesses in the buzzing segment — after two timely pivots and 10 quick acquisitions. In the last 12 months alone, it has mopped up almost Rs 1,885 crore across three funding rounds and acquired nine brands, including Baby Chakra, The Moms Co, St Botanica, Organic Harvest, Sirona Hygiene, Miss Malini Entertainment and ScoopWhoop, to turn itself into a house of brands.

Polygon tapped Tiger, SoftBank for ‘institutional legitimacy, firepower’

%20Anurag%20Arjun,%20Jaynti%20Kanani%20and%20Sandeep%20Nailwal.jpg)

These were the two key reasons why Sandeep Nailwal, co-founder of Ethereum scaling and infrastructure development platform Polygon, decided along with his co-founders to sell its native tokens worth $450 million to 40 marquee venture firms, including the likes of Tiger Global, SoftBank Vision Fund II and Sequoia Capital India.

Startups in the Web3 space typically prefer to take funds from crypto native VCs as they can provide technical knowledge and infrastructure. Capital is a commodity in the space as startups have the ability to go public on day one, multiple experts have told ET. This round signals the growing appetite among traditional funds to invest in crypto and blockchain startups, even if it means opting for non-traditional ways to invest in these companies.

Flipkart hops on live commerce bandwagon

Flipkart has hopped on the live commerce bandwagon, making it one of the largest ecommerce firms to experiment with the new sales format. The platform now conducts live shopping streams on its app with social media influencers. It has also created a feed similar to Instagram’s, where prominent influencers showcase fashion wear that can be bought directly from the feed.

Curated by Judy Franko in Delhi. Graphics and illustrations by Rahul Awasthi.

That’s all from us this week. Stay safe.