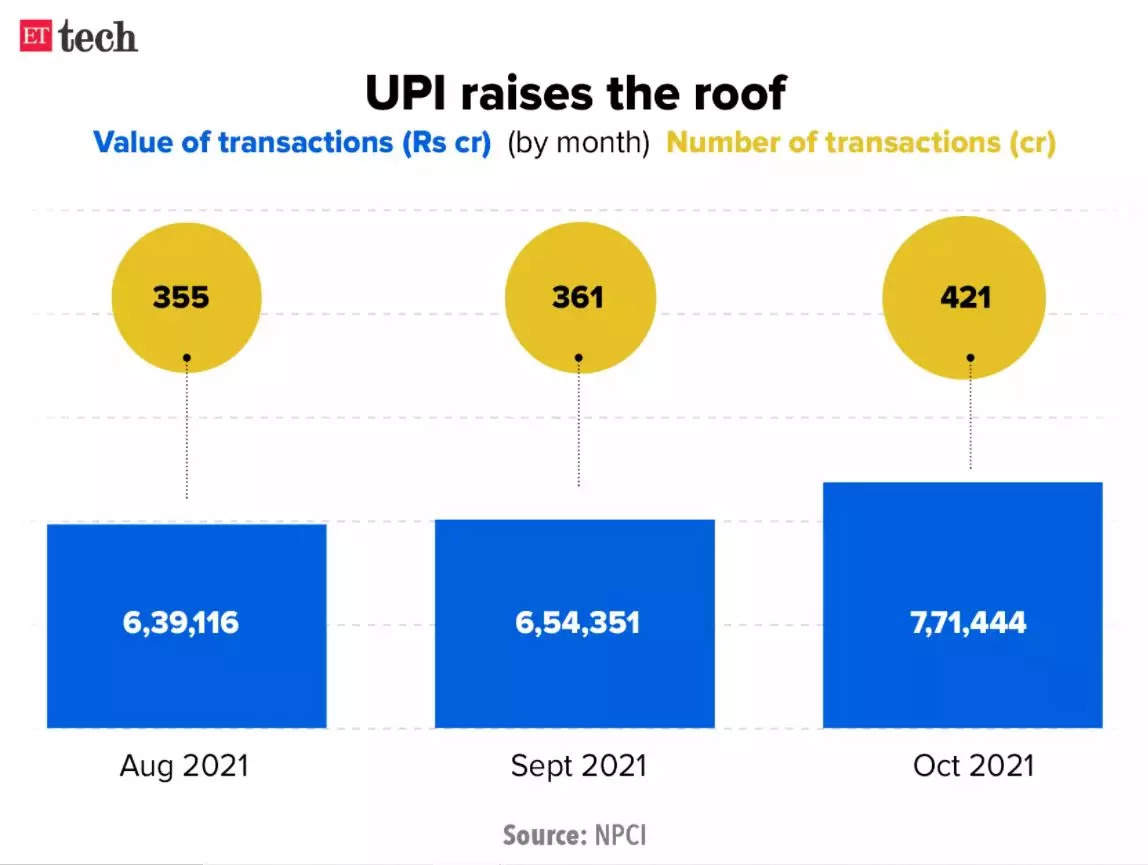

So, what’s changed in the past five years? A lot, as far as India’s fintech ecosystem is concerned. Just last month, a whopping 4.2 billion UPI transactions amounting to over $100 billion were recorded. Global investors are pouring cash into the nation’s fintech startups at an unprecedented pace. And China’s ongoing fintech crackdown is only adding to India’s appeal.

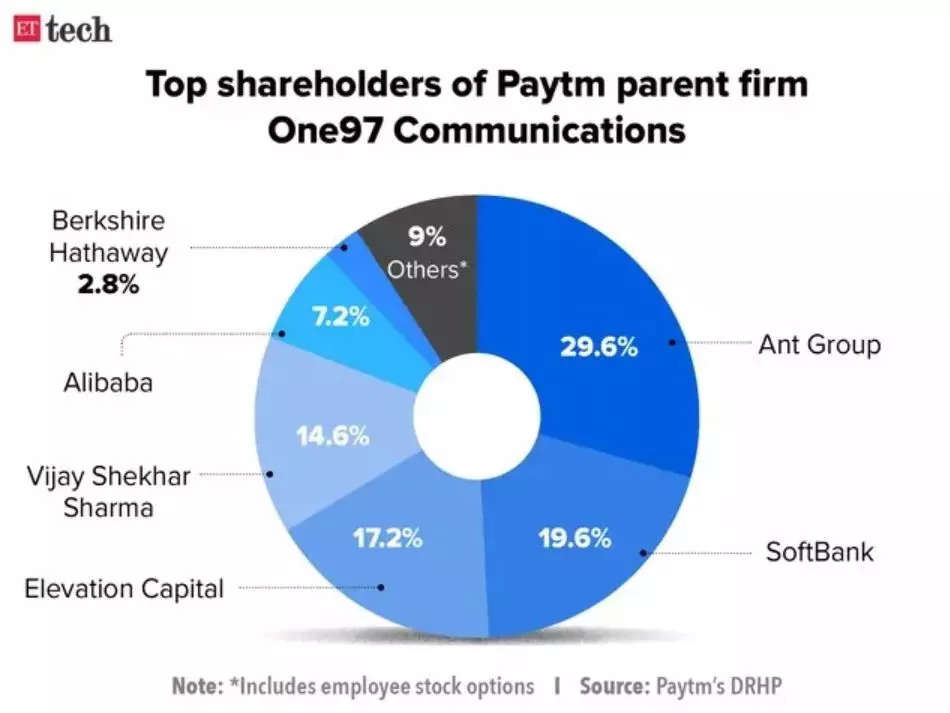

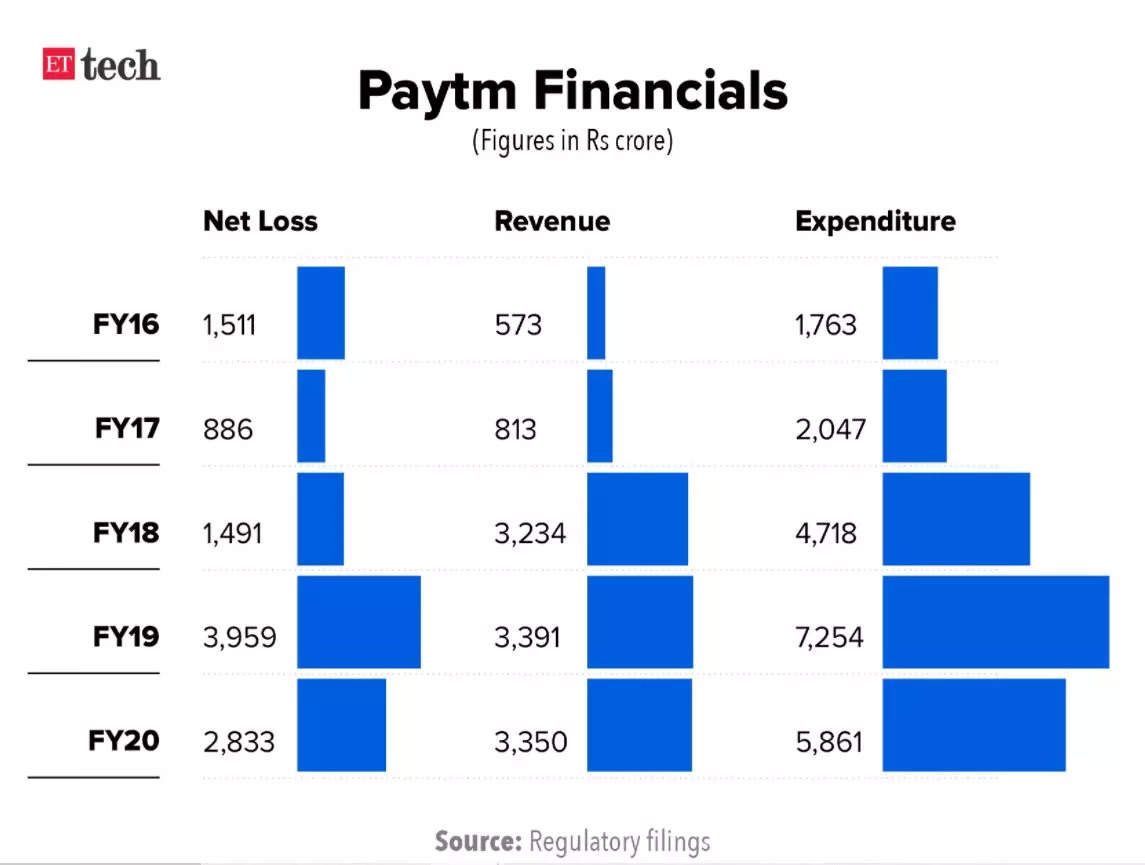

India has about 825 million people online via their smartphones, with hundreds of millions new to the internet. The biggest players in digital payments want to expand into banking services, which have the potential to earn them bigger profits. Paytm already offers these financial services, through its app and payments bank. The company, which aims to raise at least $2.5 billion from its IPO, has already secured nearly 45% of this amount from its anchor investors.

Paytm IPO details

- Dates: Nov. 8-10, 2021

- Face value: Rs 1 per equity share

- IPO price: Rs 2,080-2,150 per equity share

- Lot size: 6 shares and multiples thereof

The IPO proceeds will be used for growing and strengthening Paytm ecosystem, including through M&As, investing in new business initiatives and general corporate purposes.

Also Read: Why initial reviews are negative on Paytm IPO

OTHER BIG STORIES BY OUR REPORTERS

The latest on startup IPOs

■ Delhivery: The new-age logistics startup filed its draft IPO papers with the Securities and Exchange Board of India (Sebi) on Nov. 2, joining a growing list of top-tier startups that have filed for listing after Zomato’s stellar debut on the bourses in July.

Some key takeaways from Delhivery’s filing:

- It plans to raise Rs 7,460 from its IPO, including Rs 5,000 crore through fresh issue of shares and the remaining via an offer for sale.

- It reported consolidated revenue of Rs 4,644.38 crore and a loss of Rs 595.3 crore in the fiscal ended March 31, 2021.

- The IPO proceeds will be used to fund organic growth, acquisitions and general corporate purposes, according to the DRHP.

- The company is seeking a valuation of around $6-6.5 billion for the IPO.

Also Read: ETtech IPO Watch: A decade of Delhivery

Ola founder Bhavish Aggarwal

■ Ola: The ride-hailing firm, backed by Japan’s SoftBank Group Corp., has posted the first operating profit for its mobility business since beginning operations a decade ago.

The Bhavish Aggarwal-led company, which is readying documents for an IPO in early 2022, clocked a standalone operating profit of Rs 89.82 crore in FY21. That compares with an operating loss of Rs 610 crore in the previous financial year.

■ Policybazaar: The initial public offering of PB Fintech Ltd, which operates online insurance platform Policybazaar and financial services portal Paisabazaar, was subscribed 16.59 times on the third day of subscription on Wednesday.

The issue received bids for 57.24 crore equity shares against an offer size of 3.45 crore shares. The portion of shares reserved for qualified institutional investors was subscribed 24.89 times while non-institutional investors or high networth individuals put in bids 7.82 times the amount set aside for them. The retail portion was subscribed 3.31 times.

Pharmeasy CEO Siddharth Shah

■ PharmEasy: API Holdings, the parent entity of India’s largest e-pharmacy PharmEasy, is set to file a draft red herring prospectus (DRHP) in the next 7-10 days for a Rs 6,000-7,000 crore IPO, people aware of the matter told us. It is expected to be a fully primary share sale.

IT Rules seriously undermine privacy, IFF says in rebuttal to FAQs

The Internet Freedom Foundation (IFF) published a 12-point fact-check of the government’s FAQs on Part II of the Information Technology Rules, 2021, which it released on Monday. The rules themselves were notified in February and came into effect on May 26. Part II of the IT Rules deal with due diligence by an intermediary and the government’s grievance redressal mechanism.

Record attrition rates amid huge demand for techies

How many candidates does it take to fill one tech position? The answer is: at least five, if it’s an Indian company trying to hire.

The dream run for tech talent in India has led to record attrition rates and the buoyant market is keeping recruiters on their toes. They are being forced to keep a shortlist of at least five candidates for one job posting, experts told us. Attrition in the IT domain is at 24.4%, the highest in a decade, according to data from Aon, shared exclusively with us.

Also Read: Roadblocks ahead as Indian IT moves into high gear

ETtech DEALS DIGEST

■ Zetwerk Manufacturing is putting together a $250-million funding round led by US-based Iconiq Capital and Greenoaks, valuing the contract manufacturer of consumer and capital goods at nearly $2.5 billion, pre-money.

■ Neobank Jupiter is in talks with US-based venture fund QED Investors to co-lead a new $100-million funding round along with its existing investor Sequoia Capital India. If the deal goes through, Jupiter’s valuation will more than double to around $700 million.

■ Absolute Foods is putting together a $75-90 million funding round led by global investors Falcon Edge and Tiger Global, valuing the five-year-old farming and supply chain startup at $250-300 million.

For more funding news, click here.

Apple, Google report huge rise in profits from India

■ Apple India: Net profit of the iPhone maker rose 32% while revenue from operations surged 68% in the fiscal year ended March 31. Apple India clocked actual sales of Rs 22,845 crore, crossing the $3 billion mark, for the year. The growth was the fastest in five years.

■ Google India: Google India’s profit increased 38% to Rs 808 crore for the year ended March 31, regulatory documents sourced from Tofler showed. Revenue rose 14% to Rs 6,386 crore from the previous financial year.

The rise of cloud kitchens

The number of delivery-only food businesses has ballooned in the past 18-24 months as they’ve emerged as a cost-efficient way to maintain business continuity and expand customer reach in an industry that was decimated by the pandemic. Although businesses are reopening as the pandemic eases its grip, delivery-only brands ensure a solid revenue stream, catering to people who would rather order in than eat out.

UPI transactions crossed $100 billion in October

The value of transactions made using the Unified Payments Interface (UPI) crossed $100 billion in a month for the first time in October, according to data from the National Payments Corporation of India (NPCI). A whopping 4.2 billion UPI transactions amounting to Rs 7.71 lakh crore (about $103 billion) were clocked last month, marking all-time highs on both counts for the payments channel.

Experts sound alarm on claims in some crypto ads

Financial and legal experts are sounding an alarm over some crypto ads that are towing a fine line between “puffery” and “misrepresentation”.

There are no formal guidelines governing the advertisement of crypto in India, unlike other financial products such as mutual funds — which are a lot less volatile than crypto — and online brokerages that fall under the purview of the market regulators.

Explained: How DeFi could one day liberate finance

Decentralised finance, or DeFi for short, is a system in which customers can access financial products directly on a decentralised blockchain network, without the need for middlemen such as banks and brokerages. The aim is to democratise finance by replacing centralised institutions such as banks with direct, peer-to-peer relationships. Every financial service we use today — savings, loans, insurance and much more — could one day exist on a blockchain, not in a bank.

That’s about it from us this week. Stay safe and get that jab.