We wrote about the issuance of the notices, and the impact on the sector as a result of the new tax-related developments all through the week.

To understand where this is headed, it is important to take a look at how we got here.

For the online gaming sector, run-ins with tax authorities and subsequent legal disputes are not new. And the latest move of imposing 28% GST on full face value, while also back calculating it on previous years’ dues has resulted in a new flashpoint between the firms and tax authorities.

Back to basics

For years, online real money games have operated in a grey area, as the placing of wagers in the games – the most popular being fantasy sports, and card games such as rummy and poker – have often been interpreted as equivalent to gambling by various state governments and regulatory authorities.

The question of some of these being either games of skill or chance has itself frequented several courts of law in the country.

The essential purpose of dealing with this question was that the GST authorities considered games of chance to be akin to betting, and therefore were subjected to a 28% tax on the transaction value of bets placed.

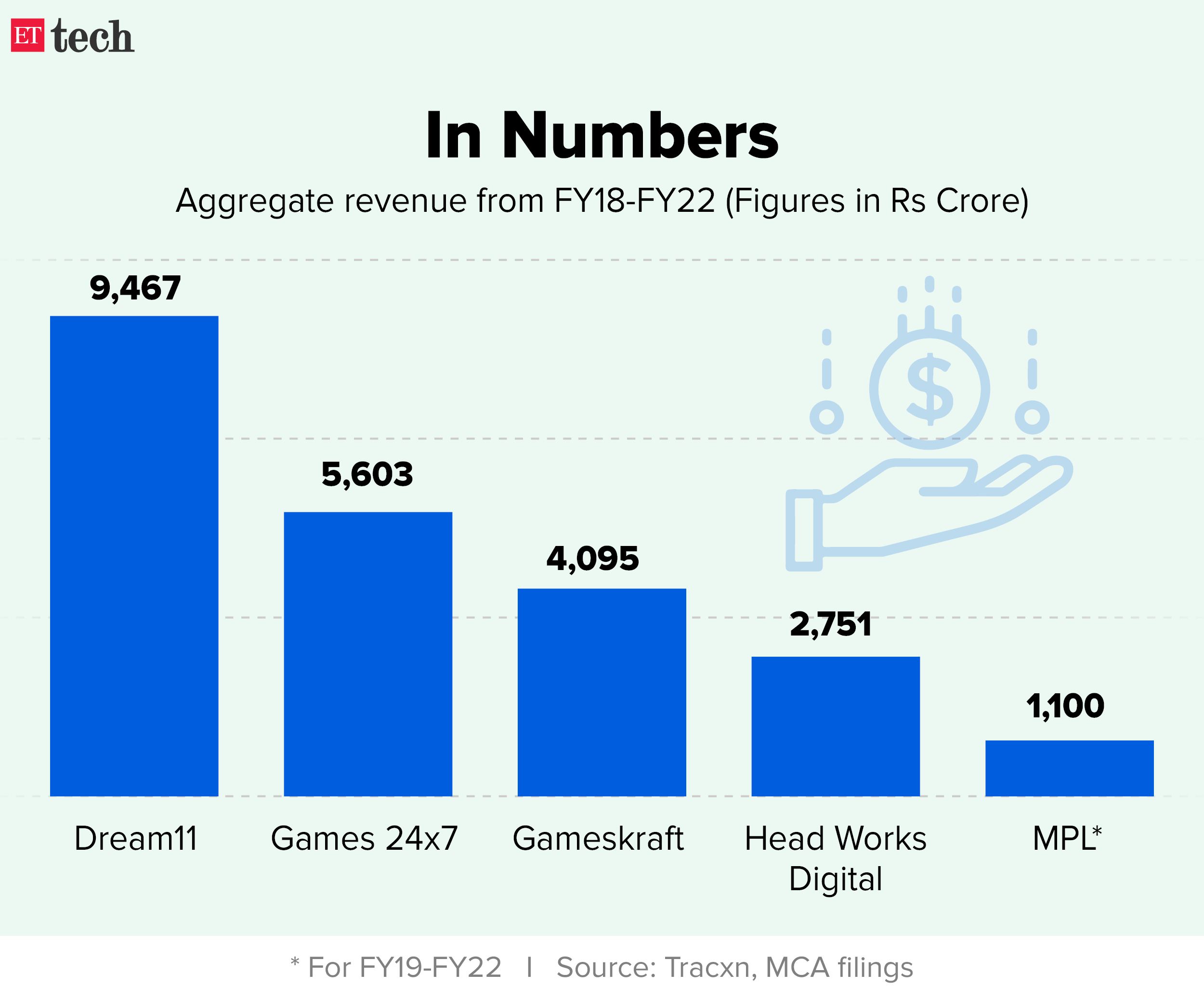

On the same principle, the government issued a tax demand to Bengaluru-based Gameskraft for a whopping Rs 21,000 crore, asking it to pay taxes on previous years’ revenue in addition to interest and penalties. The company moved the Karnataka High Court against the notice, and obtained relief there in May this year. The GST authorities then appealed against the Karnataka High Court order in the Supreme Court.

In July, the country’s GST Council decided that online gaming companies should pay 28% tax on the full face value of bets placed. The case for why the GST Council decided to go for the highest bracket of tax on the contest entry amount rested on two legs – a question of morality, and high profitability.

Now, after the GST Council’s decision and the consequently amended GST laws, the GST authorities got a stay on the Karnataka High Court order from the Supreme Court, paving the way to issue more tax notices. The government’s counsel told the apex court that about 35 similar notices for unpaid taxes were ready to be sent out to other firms in the sector.

Knock, knock, knockin

Shortly after the pre-show cause notices went out, Dream11 approached the Bombay High Court, questioning the legality of the notices that sought back taxes for an amendment that is to become effective from October 1.

The government has argued that while the prevailing practice in the gaming industry was to pay tax on the gross gaming revenue (GGR), or the aggregate of commission charged to players, it was always of the opinion that online gaming is to be taxed on the contest entry amount – and the GST Council decision was only a clarification.

In addition to Gameskraft, and now Dream11, there have been other cases of GST notices being challenged too. In January this year, the Rajasthan High Court asked the GST department to not take any action against Jaipur-based MyTeam11 on the basis of a notice issued to the company for allegedly miscalculating tax.

ETtech reported on September 27 that more companies are expected to take legal recourse against these notices – saying it is the only option against demands that are in multiples of their past revenues.

Government’s stance

In its September 29 edition, ET reported that Central Board of Indirect Taxes and Customs (CBIC) chairman Sanjay Kumar Agarwal said the GST notices to online gaming companies were in accordance with legal provisions, and ruled out any immediate review.

On August 2, following a GST Council meeting, finance minister Nirmala Sitharaman had also elaborated how the tax collection from online gaming companies, which is happening on the basis of 18% on GGR, was “far lesser than the tax that is levied on some of the essential goods for households”.

“The current reality is 18% GGR, and we are talking approximate numbers. 18% on GGR results in only a net 7-8% of revenue. People are saying we don’t mind 18% going to 28%, but let it be on GGR. 18% going to 28% on GGR will still only give me 12%, and not more. So, your original 18% is still not realised,” she had pointed out.

With the government’s insistence on sticking to the stance it has taken, industry executives said there are now two things to do.

“Firstly, we have to wait and see what the outcome of the Gameskraft case in the Supreme Court will be. That will set the tone of our next moves. Secondly, the attempt would be to have the demands for back taxes declared as retrospective in courts, and have the notices quashed,” a senior gaming industry executive said.

The Supreme Court will conduct further hearings in the Gameskraft matter on October 10. Until then, the gaming companies will be lawyering up.

Online Gaming Firms Face Tax Woes

DGGI raises Rs 55,000-crore tax demand from Dream11, other online gaming companies: The DGGI sent out a dozen pre-show cause notices to online real money gaming companies over goods and services tax (GST) dues of about Rs 55,000 crore. These include a GST notice of over Rs 25,000 crore to fantasy sports platform Dream11, possibly the largest indirect tax notice served in the country.

Online gaming companies term GST demand “retrospective”: The companies have sought or are planning to seek redressal from the courts after they were served pre-show cause notices in the last week, multiple people aware of the matter told ET. Industry executives termed this as a big blow to the industry, as it grapples with the risk of bankruptcies.

‘Online gaming companies tax demand in line with legal stand’ | However, Central Board of Indirect Taxes and Customs chairman Sanjay Kumar Agarwal on Thursday ruled out any immediate review of the decision, saying that the GST tax notices are in accordance with legal provisions.

MeitY defers plans to form gaming self regulator, seeks common ground: The Ministry of Electronics and IT (MeitY) has also deferred plans to form a self-regulatory body (SRB) for the gaming sector for now, waiting for “harmonisation” of the views of various ministries — MeitY, law, finance and home — on the industry.

Top Stories This Week

Byju’s new India CEO Arjun Mohan to cut more than 4,500 jobs: Arjun Mohan, who took charge as the new chief executive of the India business at Byju’s last week, is set to unveil a series of changes at the financially troubled edtech firm, including cutting the headcount by a third or about 4,000-4,500 people to further tighten costs, people aware of the matter said.

Now, Tesla rival VinFast looks to make in India: Vietnamese electric vehicle maker VinFast Auto – a deemed Tesla rival that emerged as the world’s third most valuable carmaker in August – is mulling setting up a manufacturing unit in India, multiple people aware of the development told ET. The plant is likely to come up in either Tamil Nadu or Gujarat, they said.

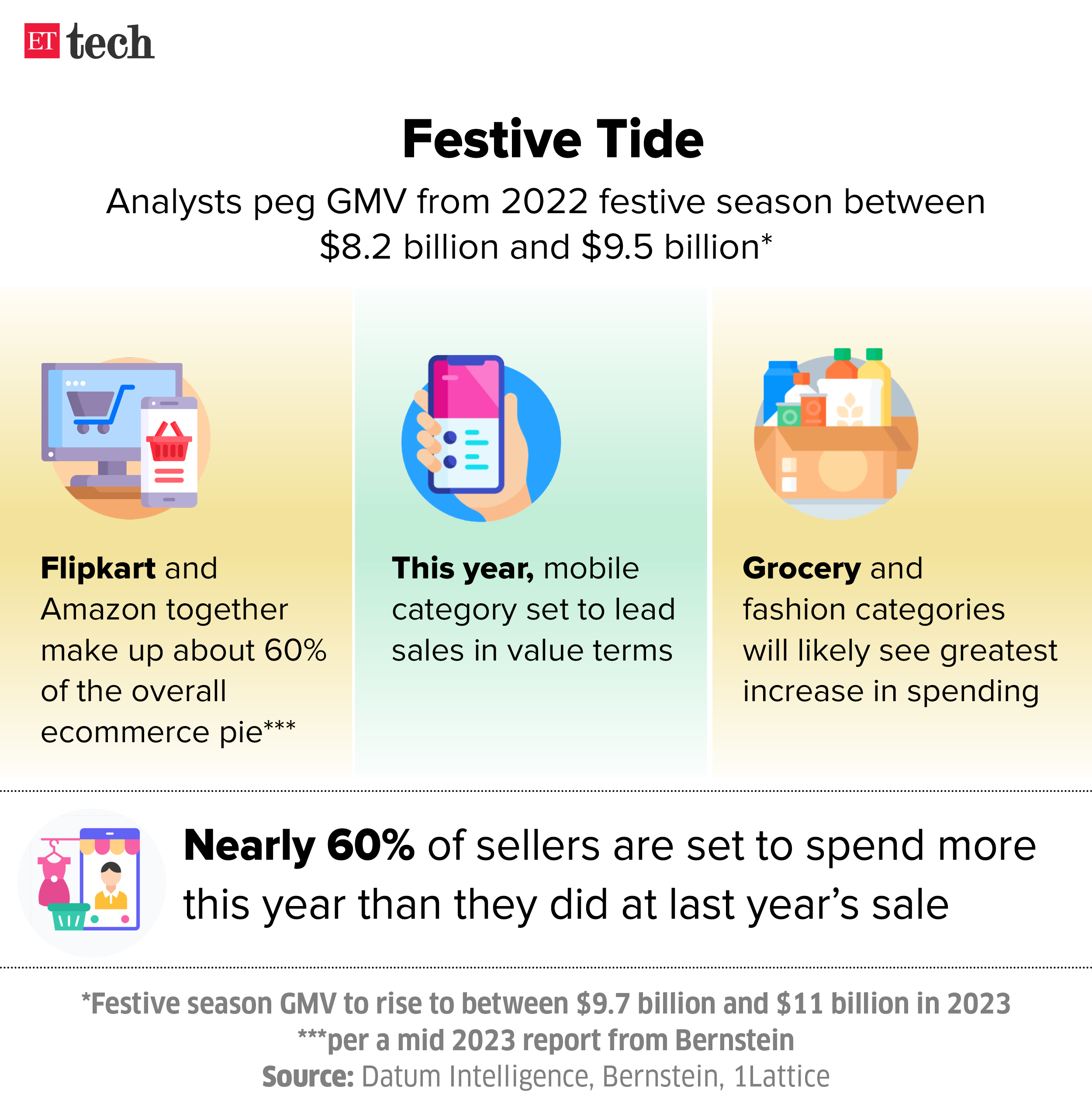

Amazon, Flipkart, Meesho, other ecommerce companies may rack up $11 billion festive sales: report | Online sellers, major brands and ecommerce platforms are gearing up for robust sales through the festive season, as the online shopping ecosystem shakes off a relatively muted first half of the year, industry executives said.

Sales in terms of gross merchandise value are likely to be between $9.7 billion and $11 billion this festive season, rising roughly 15-16% from a year earlier, according to data.

Also read | Flipkart merges tech and product ops of travel and epharmacy biz

Dunzo may get $30-35 million lifeline from Reliance, Google, others: Reliance Retail-backed Dunzo, the troubled quick commerce startup, may be able to secure only $30-35 million in new funding, but with strings attached, people aware of the matter said. The funding will have onerous liquidity preference terms for existing investors, the people cited above said.

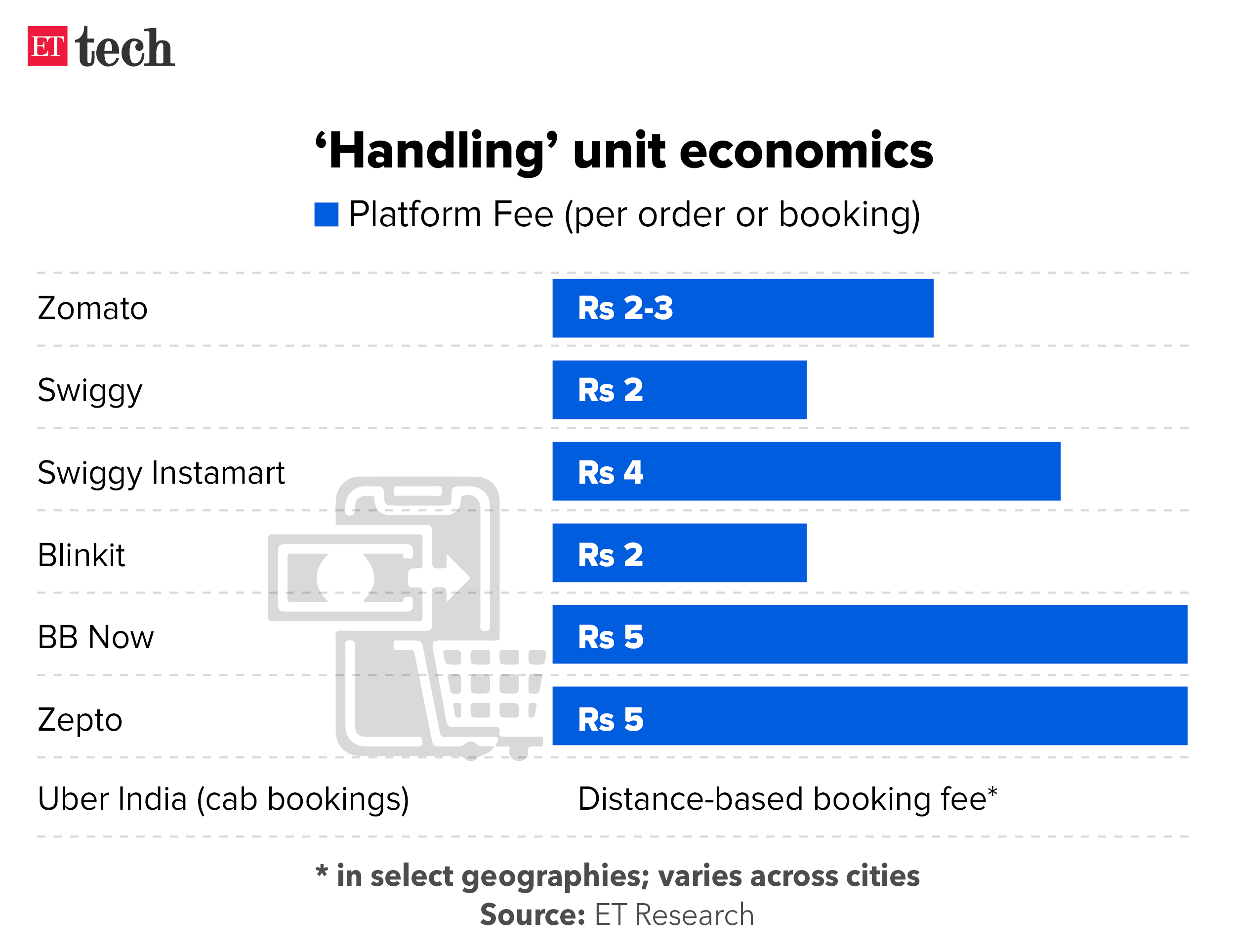

Consumer internet companies levy per-order charges to up margins: Consumer internet platforms have started levying per order charges on customers – akin to convenience fees charged by companies such as BookMyShow and MakeMyTrip – as they seek to optimise unit economics and boost margins.

Unicorns, other large unlisted companies may be regulated: A key Ministry of Corporate Affairs (MCA) panel is considering devising a regulatory framework for large unlisted companies, including unicorns, to ensure better adoption and tighter scrutiny of corporate governance standards by them, a person aware of the details said.

Under the proposed framework, such entities could be mandated to submit quarterly filings of financial statements with the MCA, among others, said the person, who did not wish to be identified.

The Economic Times Startup Awards 2023

ET Startup Awards 2023: Winners to be Felicitated on October 7 | The ninth edition of The Economic Times Startup Awards (ETSA) will be held on Saturday, October 7, in Bengaluru to honour this year’s winners across eight categories in what will be a star-studded gathering of the who’s who of India’s new economy.

Read about this year’s winners in all eight categories here.

Space company Digantara has enough in the tank to soar higher: “Founding a space startup on a university campus has been an incredible adventure,” said Anirudh Sharma, CEO of Digantara, which won Best on Campus award at ETSA 2023. Having no prior experience of the complexities of building a startup in a sector like this in fact turned out to be a blessing in disguise.

HUFT’s Rishi Narang up for global market entry next year | Petcare brand Heads Up for Tails is looking to chart newer domains of growth and plans to take its private-label portfolio across nutrition, grooming and lifestyle products to the global market in 2024, founder Rashi Narang told ET. She bagged the Woman Ahead prize at ETSA 2023.

Financial security for the poor the next step: Fia Global founder | Fia Global, the winner of the Social Enterprise category in ETSA 2023, is venturing into lending, insurance and investments after offering basic account opening and payment services. Fia Global has more than 82 million customers today, and founder Seema Prem wants that number to touch 100 million by 2025.

‘We work for user validation, not investor approval’: Govind Agarwal and Afsar Ahmad, cofounders of online gaming firm Gameberry Labs that won the Bootstrap Champ category in ETSA 2023, said the company is focussed on growing steadily without any external funding. The Bengaluru-based startup, in fact, is considering acquisitions as profit piles up.

Also read | ET Startup Awards 2023: a winter’s tale of grit, guts and glory

Fintech News

(L-R) Groww founders Lalit Keshre, Harsh Jain, Neeraj Singh and Ishan Bansal

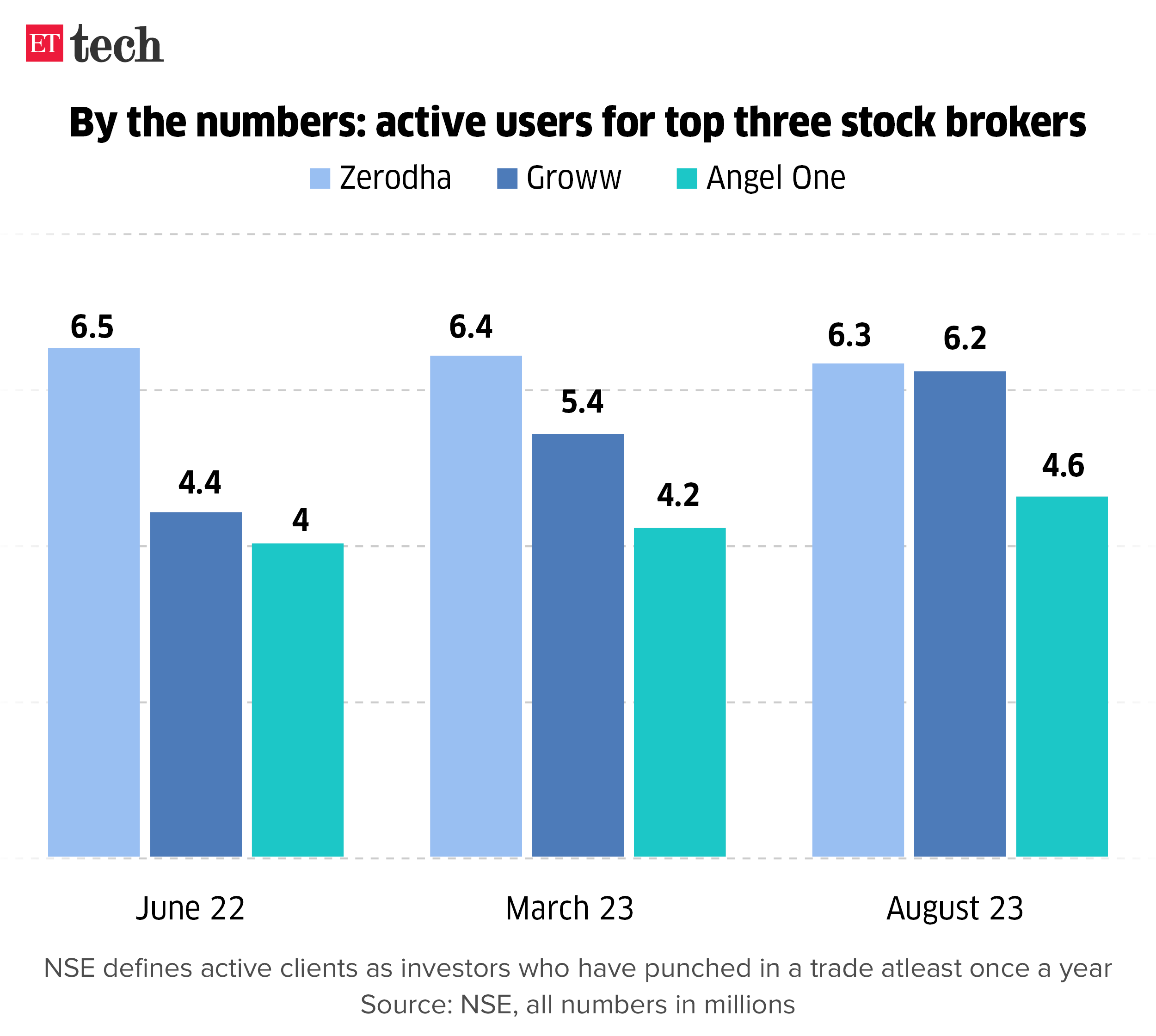

Groww likely to pip Zerodha in active investor count this month: Financial services startup Groww is set to overtake India’s largest stockbroking company, Zerodha in September in terms of the number of active investors on the platform, according to three people in the know. As of August, Groww had 6.2 million active investors compared with 6.3 million for Zerodha.

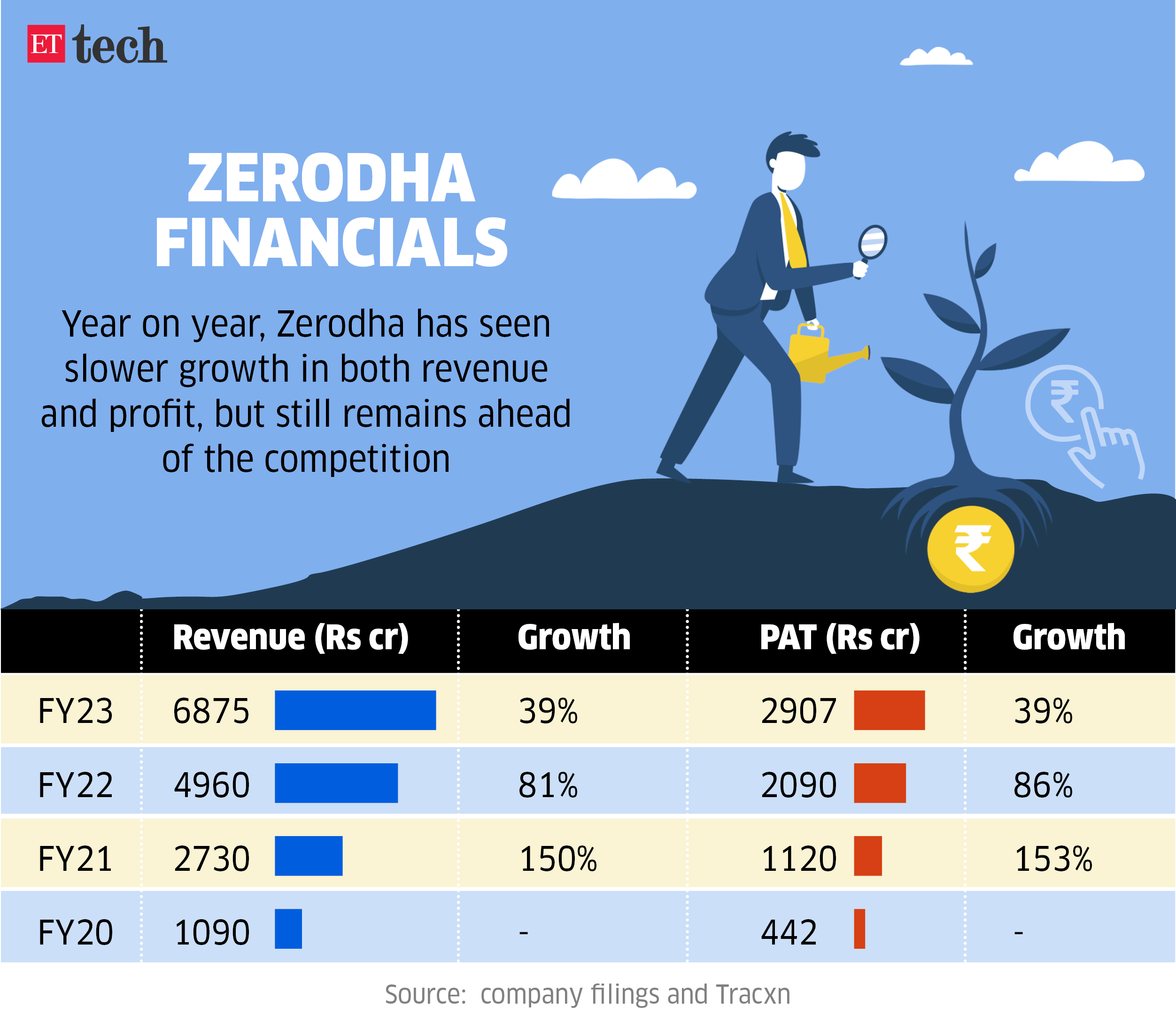

Zerodha’s FY23 revenue jumps 38% to Rs 6,500 crore: Stockbroking major Zerodha clocked overall revenue of around Rs 6,875 crore in fiscal year 2023 and a profit after tax of Rs 2,900 crore. Meanwhile, cofounder and chief executive Nithin Kamath said the firm values itself at about Rs 30,000 crore, or about $3.6 billion.

Fintechs scramble to tweak systems as DPDP Act looms: Meetings with lawyers, detailed impact assessment of every step of a customer journey and redrawing of contractual agreements with business partners — all these are keeping fintech founders on their toes as they race against time to build systems compliant with the Digital Personal Data Protection Act, 2023.

Tech Policy

Digital India Bill out for discussion soon, says official: The draft of the Digital India (DIA) Bill is ready, and will be released for consultation soon, a top official told ET. The Bill, which will replace the 23-year-old IT Act, is likely to be tabled in the Parliament during the later part of the winter session, the official said. The DIA draft is also expected to have provisions to govern emerging technologies such as artificial intelligence and quantum computing, ET reported in June.

Also read | Digital India Bill set to add myriad online offence laws under ‘user harm’

Digital India Bill may help users seek algorithmic accountability: The government is likely to introduce provisions in the Digital India Bill empowering users to seek algorithmic accountability from internet intermediaries and social media companies, sources told ET.

Companies panic, want clarity on data rules, seek more time: Several companies are preparing to submit formal representations to the government to seek clarification on the new Data Act and an extension of its implementation deadline, company executives, policy experts and lawyers told ET. There is a “sense of panic” among companies with respect to the timelines of the legislation, they said.

Also read | Big Tech gets a chance to show age-gating plans

Global hardware firms talk to local companies on PLI longlist: Top global technology hardware brands have intensified talks with local companies that applied for the revised production-linked incentive scheme to set up an ecosystem for making notebooks, desktops, and servers in India – and helping achieve the federal goal of 70% local output in three years for these items.

ETtech Deals Digest: September brings some cheer as funding more than doubles sequentially

Even as funding challenges persist among India-based technology upstarts, September logged a huge uptick in overall deal sizes with $960.5 million deployed across 75 funding rounds.

In terms of value, the month outperformed August’s tally of $436 million by about 120%, as per Tracxn.

As the sequential rise provided a respite during a funding decline, September fared relatively better in terms of year-over-year comparison, down only about 8% from the total deal value in September 2022. It is, however, important to note that the funding winter started showing signs of setting in from September last year.